Thinking aloud about bank margins - Part 1

Also I will be on the road for six weeks. Expect the posts to be sporadic at best.

—

The most interesting thing I have seen in the past three months was an interview on Real Vision by Shannon McConaghy of Horseman Capital entitled “Prepare for a Japanese Banking Meltdown?“.

The title on the interview has a question mark. I am not sure that Shannon would include the question mark.

But the argument is pretty simple really. Japanese regional banks have – for decades – had excess funds. They have found it extremely hard to lend at adequate rates as excess funds is the Japanese condition. Rates the banks can achieve on loans are very low.

The result is that Japanese banks (especially regional banks) have very low returns on equity and generally trade below book.

As an extreme example about fifteen years ago I asked Bank of Kagoshima why they could not achieve their four percent ROE target and they said that it would “put too much strain on the local community.” That bank is gone now – but the problem remains right across Japanese banking.

Shannon McConaghy’s thesis is that “Abenomics” has made the problem much worse. He states that the average interest rate achieved on a loan by a Japanese regional bank in the first half of this year was about 79 basis points. The rate was 62 basis points in May but there may be some seasonality.* He thinks it costs about a percent to run the bank. There are staff and systems to pay and the like. So he thinks that Japanese regional banks will be loss making before they have any credit losses. Then of course they have been rolling credit losses in zombie businesses for decades and so after the credit losses settle there won’t be any equity left to earn any return on anyway.

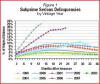

Shannon thinks the problem has been masked because the banks have typically invested their excess funds in Japanese Government Bonds (JGBs) and the yield on JGBs has gone pretty sharply negative. The banks this decade have sold significant amounts of these JGBs and reflected the gains on these sales as one-off income. They then shifted much of their securities holdings into a unique type of investment trust, largely invested in domestic equities, which under unusual accounting conventions allowed the banks to report capital gains as interest income. This means they are still showing positive ROEs but earnings are highly reliant on a constantly rising domestic equity market to generate gains, which is problematic as the Japanese equity market is still down by more than 10% from its peak last year. The situation is unlikely to improve as the underlying margins are already near zero and incremental loans actually lose money after costs.

[Shannon runs a Japan fund. This talk was so interesting I wrote to Shannon and got on his mailing list. I recommend readers do the same. There is plenty there that is interesting.]

Anyway all this accords a little with my view of bank margins and crises. The determining factor of how well your banks recovered from the financial crisis by-and-large wasn’t how many or few losses your banks took (Iceland excepted), rather it was what was the underlying pre-tax, pre-provision profitability of your banking sector.

The US banking sector has pretty decent margins – and pre-tax, pre-provision profits were about $300 billion per year. In three and a bit years they had covered a trillion dollars in losses. The banks are mostly okay now.

German banks have very thin margins and whilst they had less credit losses they had considerably less income to offset them. The German banks (notably Deutsche and Commerzbank) look deeply problematic. Italian banks are also very low margin and slightly higher credit losses and they have been catastrophic investments.

Bank margins are really important

Bank margins were once a concern to bank investors and not really to the general public. After all low margins generally meant cheaper finance. High margin banks (like Australian banks) leave you with the uneasy feeling you are being ripped off.

But the world has changed. Abenomics – which includes the deliberate pushing of interest rates to very low or negative levels may suppress bank margins. And if you suppress bank margins enough your banks go bust. And if your banks are stressed they stop lending and your economy slows down.

In this view of the world monetary policy (cutting rates when you need a stimulus) not only stops working but becomes counter-productive. It blows up your bank and causes an economic crisis.

The Raoul Pal view of the world

Raul Pal runs real vision and has a twitter account that is absolutely worth following. He has been harping on about a single chart – the Eurostoxx Bank Index going back for thirty years.

This index is bouncing along its thirty year low. [No dear Americans, stocks do not always go up over a generation.]

Raoul rather grandly says that “this level in the Eurostoxx Banks Index is probably THE most important level of ANY chart pattern in the history of equity markets”. [Emphasis is in the original.]

And to some extend I think he is right. What the Bank of Japan is doing to Japanese regional banks the European Central Bank is doing to European banks. The possibilities are that:

1. The ECB cuts rates further, blowing up the banking sector and causing the mother of all recessions starting with the weakest banks outwards (ie starting in Germany) or

2. At some point they can’t cut rates and you get a recession anyway and as the banks have almost no margin left the credit losses leave them pretty darn impaired.

And the stakes couldn’t be higher. A generalised collapse of the European banks would be a pretty big risk to the European experiment. It won’t have been caused by Europe per-se, the English banks look pretty dire too, but it will be blamed on Europe, and the resultant unemployment will have large political consequences. When Raoul suggests that “this level in the Eurostoxx Banks Index is probably the most important level of any chart pattern in the history of equity markets” he is being appropriately alarmist – at least if the Eurocrats do not act accordingly.

Whatever – the Raoul Pal view of the world is unremittingly bearish. The usual central banks will bail us out narrative gets exposed as impossible. It gets ugly from here.

My view

I am not sure it is that simple always – but the reason Shannon McConaghy thinks that Japanese regional banks are uninvestable is the same reason European mega-banks and the Eurostoxx Bank Index is uninvestable. The European banks are deeply problematic.

But it doesn’t have to be that way and it isn’t irrevocably that way for the whole sector. And the ECB isn’t totally trapped either.

But those are really the subject of the next few blog posts.

John

PS. I have mostly equity market readers. For this series I probably should have a few readers in the central banks too. Pass it on if you can.

J

*I asked Shannon for the source of this data – he sent me this link.

Source: http://brontecapital.blogspot.com/2019/08/thinking-aloud-about-bank-margins-part-1.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).