China Unveils A Housing Market Bailout: Here’s What’s In It, And Why It Is Still Not Enough

More than four years ago, when China first launched its latest “deleveraging” campaign targeted at bursting the country’s housing bubble in a controlled fashion, which coincidentally was the single largest asset for China’s massive middle class, we – and many others – said that this experiment was doomed and that all China is doing is delaying the inevitable bailout of the property sector with another metric asston of new debt. Well, as the news overnight confirmed, we were right… but not before China saw all of its largest domestic real estate developers collapse, push its housing market into a deflationary tailspin from which the country has not yet recovered, and suffered five years where its economy stagnated and pushed social tension to the edge.

So what happened?

On Friday, Chinese policymakers unveiled a fresh batch of easing measures for the housing market, including:

- clear top-down guidance for local governments to purchase existing housing inventory for public housing provision,

- an RMB300bn relending quota for destocking the housing market,

- reductions in downpayment ratios and mortgage rates,

- more policy support to secure the delivery of pre-sold homes.

Needless to say, local government (which is really just an extension of the central government) purchases of existing housing inventory is for lack of a better word, nationalization, and as Goldman writes in its post-mortem (pdf available to pro subs), if implemented at scale, can help stabilize home sales, prices and completions, but the boost to new starts and land purchase would be limited.

And while lower downpayment ratios and mortgage rates may boost home sales to some degree, the magnitude of downpayment ratio reductions was relatively small this time, and the pace of cuts to effective mortgage rates could be somewhat constrained by bank net interest margins.

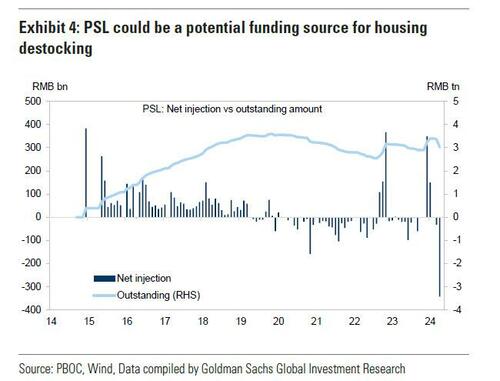

In total, Goldman expects more housing easing efforts down the road — especially on the demand-side — and view funding and implementation as key for the effectiveness of any property market rescue plan. Besides the RMB300bn relending quota, the PBOC’s pledged supplementary lending (PSL), local government special bonds (LGSB), policy bank bonds and commercial bank loans could be potential funding sources for housing destocking. Upcoming policy events will be worth monitoring closely, especially on solutions to address funding and implementation bottlenecks.

1. What’s new today? Following the April Politburo meeting, Chinese policymakers have significantly stepped up their easing efforts to help stabilize the property sector, on both funding and policy solutions. There were a batch of fresh housing easing measures unveiled today (17 May):

- At a video conference today on securing home completions, Vice Premier He Lifeng required to clearly understand the people nature (“人民性”) and political nature (“政治性”) of real estate work, and called for more forceful policy measures to secure the delivery of pre-sold homes and digest unsold commodity housing. He specifically mentioned that for cities with high housing inventory, local governments can purchase part of commodity housing to convert into public housing, based on the local situation and at reasonable prices. He required continued policy efforts on the risk disposal of property developer debt, and the “Three Major Projects” for the property sector (i.e., urban village renovation, public housing provision, and emergency public facilities).

- At the State Council press conference this afternoon, a PBOC spokesman announced an RMB300bn relending program to support local government purchase of existing housing inventory and converting into public housing (“保障性住房再贷款”). The relending interest rate will be set at 1.75%, and the tenor will be 1yr, eligible for rolling over four times if necessary. As banks will receive relending funds amounting to 60% of the principal of their loans to qualified projects, PBOC expects the RMB300bn relending quota to support RMB500bn in bank lending for housing destocking. On the implementation, PBOC highlighted that local governments should appoint local SOEs as agents to purchase housing inventory, but these agents should not engage in local government implicit debt (LGFVs are not qualified). Housing inventory purchase eligible for the relending support should be completed but unsold commodity housing, per the PBOC’s requirement.

- According to the PBOC’s announcements released today, the nationwide floor for mortgage interest rates will be removed, implying local governments have more discretion to lower their local effective mortgage rates if needed. If there is any major change in the supply-demand dynamics of the property market, PBOC would consider resuming the nationwide floor for mortgage rates. PBOC also lowered the minimum down-payment ratio by 5pp, to 15% for first-time buyers and to 25% for second-home buyers. Housing provident fund loan rates will also be lowered by 25bp, effective 18 May.

- National Financial Regulatory Administration (NFRA) pledged to support property projects in the “whitelist” through both new loan issuance and existing loan extensions, with due risk management. Ministry of Housing and Urban-Rural Development (MOHURD) required local governments to push forward the implementation of “whitelist” projects, and commercial banks to increase lending to these projects.

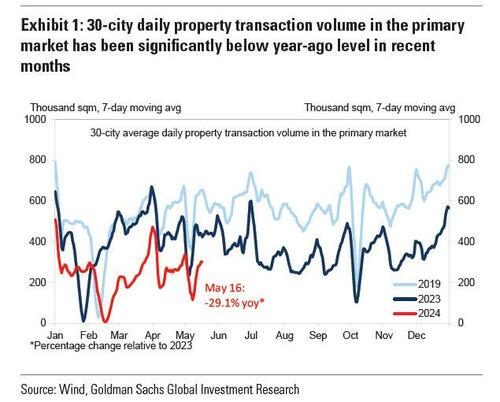

2. Why now? Despite the previous round of housing easing measures, property headwinds are still strong: new home sales have remained around 30% below year-ago levels in recent months…

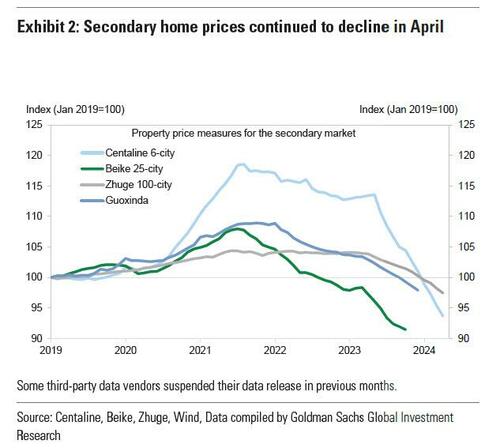

… housing inventory has stayed elevated, secondary home prices declined further in April…

… and some private developers (e.g., Vanke, Agile) continue to face challenging funding conditions. Here, Goldman asserts that “recent developments suggest to us that the prolonged property sector weakness has likely breached policymakers’ pain threshold, pushing them to step up housing easing and to shift the strategic focus towards digesting existing housing inventory.”

3. What’s the likely impact? Local government purchase of existing housing inventory, if implemented at scale, can help stabilize home sales, prices and housing consumer sentiment, improve property developers funding conditions to some degree, and thus facilitate home completions and property sector rebalancing. However, the boost to new starts and investment will likely be limited, as property developers’ funding conditions will remain tight, given falling new home sales, potential price discounts during local government housing purchases, and the policy priority on ensuring completions (implying less funding for land purchases and new starts). Lower downpayment ratios and mortgage rates may also boost home sales to some degree (a 10pps cut to downpayment ratio raises sales by around 7%), although the magnitude of downpayment ratio reductions was relatively small this time, and the pace of cuts to effective mortgage rates could be somewhat constrained by bank net interest margins (NIM). Furthermore, though it’s crucial to prevent significant risk spillovers from the property sector to the banking sector and the real economy, policymakers appear to have no intention to turn the sector from a growth drag to a driver, given the shift in their policy focus towards high-quality growth. PBOC’s highlight on a potential exit mechanism for the effective mortgage rate cuts underpins this view

4. Examples from recent local pilot programs. While some cities (e.g., Chongqing, Jinan) have already experimented pilot programs to clear excess housing inventory with the help of state funding, the amount of previous purchase was at a very small scale. Recent pilot programs, including in Lin’an district of Hangzhou city, indicate local governments appear more willing to purchase small and medium-sized housing units with little completion risk at lower-than-average prices, and mostly in large cities (with net population inflows). Specifically, Lin’an district announced that the total floor space to be purchased this round will be capped at 10,000 sqm; housing units eligible for the purchase include completed housing and uncompleted ones able to be delivered in one year, with floor space no higher than 70 sqm per unit; the purchase price will not exceed comparable market rates; it would purchase housing units and car parking spots on an entire building basis.

5. What to watch next? Expect more housing easing efforts down the road — especially on the demand side — with funding and implementation as key for the effectiveness of the property rescue plan. On the funding, a recent Goldman analysis suggests any game-changing housing easing measures (including those for housing destocking) would require significantly more funding than available thus far, while many inland local governments remain financially stretched after the three years of zero-Covid policy and amid the prolonged property downturn. This will require a larger top-down funding scheme from the central government, beyond the RMB300bn relending quota. Moreover, strengthened fiscal discipline and financial regulation may dampen some officials’ incentives for more concerted and forceful policy efforts. Upcoming policy events — such as the July Politburo meeting, the Third Plenum, and ad hoc meetings/announcements by major authorities (e.g., the State Council, NDRC, MOF, MOHURD, PBOC, SASAC) — will be worth monitoring closely, especially on solutions to address funding and implementation bottlenecks (Exhibit 3).

6. Other potential funding sources. Besides the RMB300bn relending quota, PBOC’s pledged supplementary lending (PSL), local government special bonds (LGSB), policy bank bonds and commercial bank loans could be potential funding sources for housing destocking:

- PSL is designated to fund property-related stimulus packages, including the large-scale shantytown renovation during 2015-18, and the “Three Major Projects” for the property sector most recently. Goldman assumes PSL net issuance will rise to RMB700bn in 2024 from RMB99bn in 2023, although there are some uncertainties if policymakers prefer to use more relending (funding costs at 1.75% pa) relative to PSL (2.25%) to fund housing destocking.

- LGSB was a funding source for shantytown renovation and land reserves in 2018-19, although there was a temporary ban on LGSB proceeds spending in these areas in late 2019 and early 2020. Local governments have only used ~RMB900bn out of the RMB3.9tn full-year LGSB issuance quota so far this year (as of late May), much slower than previous years. This implies an RMB3tn quota available for the remainder of this year, part of which could be used for supporting the ongoing housing easing package. In early 2024, policymakers allowed LGSB proceeds to be used as equity capital to fund public housing related projects, which suggests a likely larger multiplier effect if implemented well.

- Policy banks were major players in the 2015-18 PSL-backed shantytown renovation, and in theory they have no explicit constraint for external financing. Hence, more policy bank bond issuance and related lending could be possible.

- Commercial banks, especially the large ones, may also provide more funding support if needed. Moreover, there is a possibility for the PBOC to increase the relending quota for housing destocking if needed.

By comparison, the ongoing issuance of ultra-long-term central government special bonds (ULT CGSB; 超长期特别国债), which are designated for funding key projects in strategically important areas (e.g., high-tech manufacturing), may not be a financing tool customized for the property sector. That said, purchasing housing inventory well below market prices and requiring banks to increase lending to projects launched by some troubled POEs could lead to increased burden for banks, which in turn could require the government to enhance support to the banking system.

In a follow up post this weekend, we will look specifically at what it would take to clear China’s housing inventory, and why the proposed program falls short.

More in the full Goldman report available to pro subs.

Tyler Durden Fri, 05/17/2024 – 20:40

Source: https://freedombunker.com/2024/05/17/china-unveils-a-housing-market-bailout-heres-whats-in-it-and-why-it-is-still-not-enough/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Lion’s Mane Mushroom

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, But it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes:

Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity.

Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins.

Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system.

Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome.

Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function.

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules. Today Be 100% Satisfied Or Receive A Full Money Back Guarantee Order Yours Today By Following This Link.