Expert Says You May Want To Invest in This Startup

Source: Ron Struthers 05/16/2024

Zefiro has an approved method to monetize methane reduction or abatement in North America that could generate high-margin cash flows for investors. Zefiro just had its first batch of methane abatement credits approved by the American Carbon Registry (ACR), one of the three leading registries worldwide. Ron Struthers of Struthers Resource Stock Report believes the opportunity is huge, with a $25 billion market in Pennsylvania alone, and that Zefiro has a first-mover advantage.

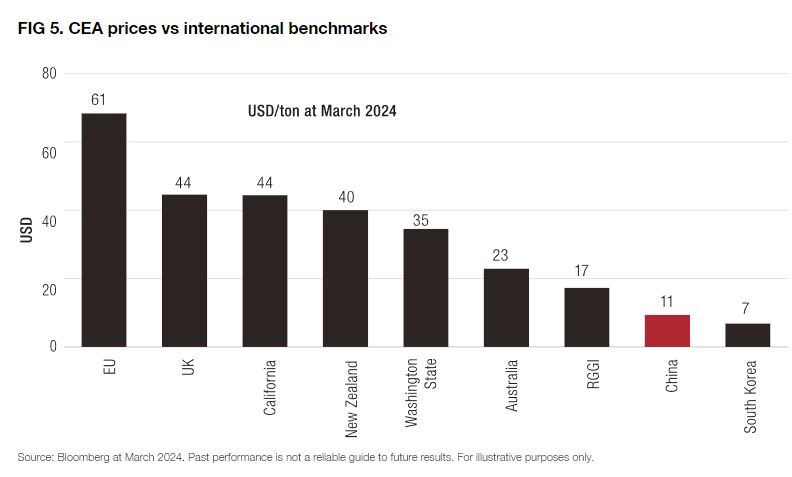

It is a very unique company, and I am adding it to my Disruptive Technology list because it really does not fit with energy despite some relation there. We know that climate change is all about taxes and wealth distribution, and a big part of that equation is carbon pricing and credits, and their price has been rising.

China is potentially a huge carbon market, about three times that of the EU, so it is positive to see the price rise there for the carbon market. In China, since its launch in 2021, it has been trading at around €6 per tonne (CNY45). However, since mid-2023, the China Emission Allowance (CEA) price has doubled. In spring 2024 CEAs have traded close to €13 ($11, or CNY93.75) per tonne. That said, we would need to see a 4 or 5-fold increase to get on par with other markets.

As a greenhouse gas, carbon is nothing compared to methane, which is 25 to 84 times worse, so a focus there is a great benefit to the environment, and that is where Zefiro Methane comes in.

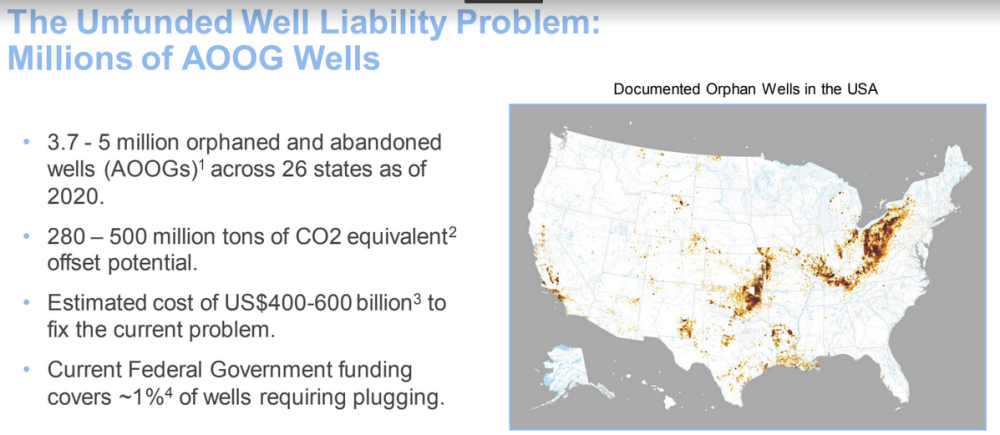

In the past decades, there was much less regulation and focus on properly closing old oil and gas wells. There are millions that need remediation, with estimates of over 5,000,000 people living in the U.S.A. alone. Recognizing this, the U.S. government’s Infrastructure Investment and Jobs Act allocated US$4.7 billion for environmental remediation and restoration activities in 2022. Many states have received grants via The United States Department of the Interior.

Increasing regulation as the methane emission charge will start at US$900/tonne in 2024 and increase to US$1,200 in 2025 and US$1,500 in 2025.

Zefiro Methane

Recent Price – CA$1.70

Shares Outstanding – 65.7 million

Insiders – Own 37%

Zefiro Methane Corp. (ZEFI:NEOE;Y6B:FRA) is an environmental services company specializing in methane abatement. Zefiro strives to be a key commercial force toward active sustainability. Leveraging decades of operational expertise, Zefiro is building a new toolkit to clean up air, land, and water sources directly impacted by methane leaks.

The company has built a fully integrated ground operation driven by an innovative monetization solution for the emerging methane abatement marketplace. Zefiro has an approved method to monetize methane reduction or abatement in North America that could generate high-margin cash flows for investors. Zefiro just had its first batch of methane abatement credits approved by the American Carbon Registry (ACR), one of the three leading registries worldwide.

Management – All the Right Stuff

Zefiro is headed up by a proven team of ex-JP Morgan executives: Talal Debs, Catherine Flax, and Tina Reine.

Talal Debs, Founder, Chairman, and CEO, is an expert in the energy sector.

- Managing Partner at XMC Strategies, an energy sector investment fund

- Former chair of JPMorgan oil price deck committee (among other high-level leadership roles)

- PhD in Modern Physics from Cambridge University with roles at Harvard and LSE

Tina Reine, Chief Commercial Officer, is a preeminent carbon market leader.

- Helped develop several new carbon offset methodologies

- Experience as a carbon market originator and trader

- Helped build out environmental markets divisions at JPMorgan and NextEra

- Led commercialization team at World Kinect Energy Services

Catherine Flax, Board Member, is an energy sector and finance senior executive.

- Led and co-founded the team that represented the first major financial institution in the carbon offset market

- President, Private Markets at XMC Strategies

- Former global CMO, CEO of commodities EMEA, and other very senior roles at JPMorgan and other leading financial institutions

- Board Member at BASE Carbon, a publicly traded Toronto firm specializing in nature-based offsets

Matthew Brooks, Head of Operations, is an energy sector A&D expert.

- Leader in managing acquisitions and divestitures in the domestic upstream oil and gas sector

- Served in senior roles in the Land and Legal Department for Urban Oil & Gas Group, LLC

- Developed Urban’s divestiture program

Luke Plants, CEO, Plants & Goodwin is a third-generation owner of P&G with widespread knowledge in the oil and gas sector.

- He served in various roles, such as operations manager and COO, at P&G before being promoted to CEO

According to a 2021 study by the American Chemistry Society, each site needing remediation leaks 78 cubic meters of methane a year. That is almost 300,000 tonnes of methane into the atmosphere.

There are so many lucrative and easy-to-require opportunities here it’s hard to imagine.

Who would have thought old abandoned wells would be worth anything, as they were considered a liability?

My, my, how times have changed, and for Zefiro’s benefit, nobody tried to accumulate thousands or tens of thousands of sites needing remediation among millions in the U.S. It’s because they didn’t know how to monetize them.

That’s what the Zefiro team does, as the main principals are ex-JP Morgan carbon market specialists. They have spent the last two years creating the methodology — which has now been accepted — to monetize the methane abatement.

Revenue Model

Distinctive strategy with three established revenue streams. Zefiro operates in three business segments – environmental monitoring, asset retirement, and carbon offsets. Environmental monitoring is a service contracted to survey and measure wellhead emissions, while asset retirement is a service contracted for plugging and abandonment work. Both segments are positioned to benefit from a large total market with millions of AOOG wells and increased regulatory pressure to fix the methane emitted from these unplugged wells.

Zefiro has purchased majority interests in two operating subsidiaries which did over US$35 million in methane abatement and environmental remediation in fiscal 2023, so they are already off to a head start. Zefiro has already won state contracts for methane abatement in Pennsylvania.

The third stream and big opportunity is the carbon credits that are sold and delivered to buyers, with increased global demand from corporations and institutions. Zefiro estimates that they can sell their credits up to $20/tonne. I believe this is a very conservative number, given the carbon pricing at the beginning of my report. Using a realistic 50,000 credits per methane abatement at $20 per credit is an even $1 million. Consider just a small number of 25,000 opportunities in Pennsylvania, which gives a potential market of $25B for Pennsylvania alone.

Zefiro is already engaged with Appalachian state governments:

- Pennsylvania Department of Environmental Protection

- New York Department of Environmental Conservation

- Ohio Department of Natural Resources

- West Virginia.

Zefiro has worked through the initial stages of a couple of pilots in Pennsylvania and Louisiana. As above, Zefiro has acquired two companies specializing in methane abatement, and their pipeline of potential projects is now over 500, and growing.

They estimate there are 45,000 immediate opportunities for methane abatement between all these jurisdictions, almost double in the example I give above.

First Mover Advantage It is not easy or simple to get into this market, so Zefiro has a big advantage as first to market and the expertise and resources to do the steps:

- Identifying sites that are emitting methane

- Have a qualified team to measure and quantify each site (the economics)

- Get one of the three major carbon registries to accept your methodology

Conclusion

Zefiro is amazing because they created the opportunity of methane carbon credits, have the team. and the business model, and now the public trading vehicle to leverage it all. And now it’s going to start rolling out. Zefiro has already pre-sold tens of thousands of tons of emission reduction tons of its methane emissions offset portfolio to Mercuria Energy America LLC.

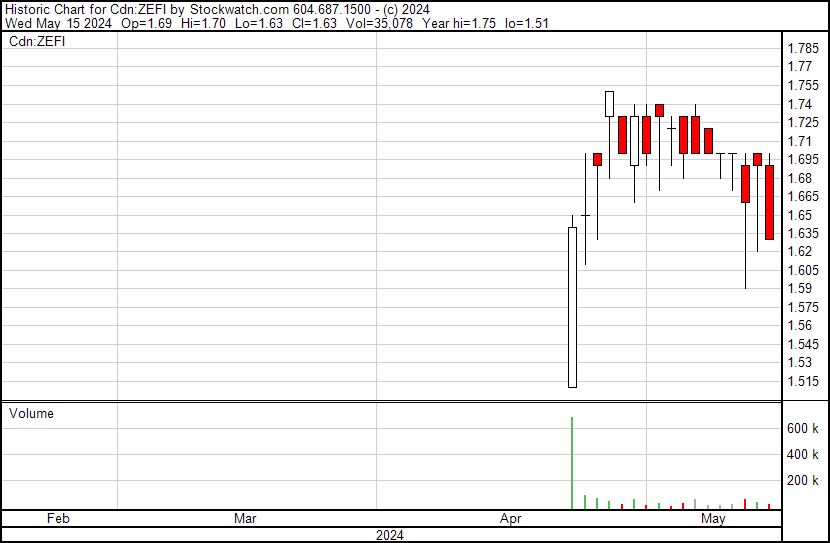

Right now, the stock is just a junior listing with little liquidity, and the plan is to go straight up to a senior listing on NASDAQ or New York. However, if we wait until then to buy, it will be at least two or three times the current price.

The majority of shares are under lock up, with about 5.5 million founder shares becoming free trading with the listing date of April 23. On that date, Zefiro completed its IPO, raising $3.45 million at $1.50 per share. Next to become free trading will be 2.1 million shares from $1.00 seed financing on August 24 and then 12 million shares free trading from $0.50 seed financing on October 23.

I doubt there will be much, if any, insider seller and seed round selling until much higher prices. An indication is Dr. Talal Debs, an insider of Zefiro, participated in the $1.50 IPO offering, acquiring an aggregate of 420,200 shares under the offering through X Machina Capital Strategies Fund I LP. Important is strong and aligned management and Board, including former members of the carbon market team at J.P. Morgan, with a track record of success in financing and risk management of deals in the oil and gas sector as well as creating carbon offset projects that generate high-quality offsets.

Zefiro will benefit from a large total addressable market with 3.7-5.0 million AOOG wells across 26 states in the U.S. as of 2020, representing 280-500 million tons of CO2e offset potential. A robust project pipeline is ahead with AOOG wells sourced from a proprietary network of oil field services firms, landmen, oil and gas operators, and energy investors with locations across the U.S. Zefiro is in preliminary discussion with multiple government agencies and departments regarding collaboration on several possibilities. These states have upwards of 45,000 documented orphaned wells. The Company’s majority stake in P&G expands the deal pipeline further.

Additionally, the company has an active M&A strategy with recently acquired Plant & Goodwin (“P&G”) and Appalachian Well Surveys. We have a unique opportunity here to invest with JP Morgan executives as a first-mover player in methane abatement carbon credits. Most investors do not even know something like this exists, but when they do, we could be sitting on a 10-bagger from current prices. A perfect fit for my disruptive technology sector.

Leaking methane gas is nasty for the environment in many aspects and many many times worse than the carbon from it when burned. Investing in Zefiro is also helping the environment and I like that. I strongly suggest watching this 3-minute video with the CEO to get a good grasp of this opportunity. There is only 170 views so little exposure so far.

I waited a while to see how the stock would trade, and it has been in a $1.65 to $1.75 range with only about 50,000 shares per day. I would accumulate up to $2.00 for now.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Zefiro Methane Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

( Companies Mentioned: ZEFI:NEOE;Y6B:FRA, )

Source: https://www.streetwisereports.com/article/2024/05/16/expert-says-you-may-want-to-invest-in-this-startup.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Lion’s Mane Mushroom

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, But it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes:

Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity.

Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins.

Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system.

Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome.

Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function.

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules. Today Be 100% Satisfied Or Receive A Full Money Back Guarantee Order Yours Today By Following This Link.