In Focus: Brookfield Infrastructure (BIP / BIPC)

In focus this week is Brookfield Infrastructure (BIP / BIPC), one of the largest owners and operators of critical global infrastructure networks. BIP assets facilitate the movement and storage of energy, water, freight, passengers, and data. It’s part of the Brookfield family of companies.

The company’s stated objectives are to: 1) generate a long-term return of 12 -15% on equity, and 2) provide sustainable distributions for unitholders while targeting annual distribution growth of 5-9%. Brookfield Corporation (BN) owns 27% of Brookfield Infrastructure.

Learn how to create a recession-proof portfolio. Download our free workbook now!

Brookfield infrastructure (BIP / BIPC) business

BIP has built an impressive infrastructure portfolio through four business segments: Utilities contribute about 26% of its funds from operations (FFO), Transport 41%, Midstream 23%, and Data Infrastructure 9%.

Utilities

- 1M electricity and gas connections.

- 4,200 km of natural gas pipelines.

- 2,900km of electricity transmission lines.

- 7M residential energy customers.

Transport

- 37,300 km of rail operations.

- 3,300 km of toll roads.

- 7M twenty-foot equivalent unit intermodal containers.

- 10 terminals and 2 export facilities.

Midstream

- 15,000 km of transmission pipeline.

- 570 billion cubic feet (bcf) of natural gas storage.

- 10,600km of natural gas gathering pipelines.

- 17 natural gas liquids processing plants.

Data Infrastructure

- 228,000 multipurpose towers and active rooftop sites.

- 54,000km of fiber optic cable. 2 semiconductor manufacturing foundries.

- 1,000,000 fiber-to-the-premise connections.

- 135 data centers.

The company is well diversified geographically with operations in the Americas (69% of assets), Asia Pacific (14%), and Europe (17%).

BIP provided extra information on its debt structure in its Q4 2023 presentation in February 2024. BIP has a credit rating of S&P 500 BBB+ with an average debt term maturity of 7 years. The company has $2.8B in liquidity and only 5% of Brookfield Infrastructure’s debt is up for renewal over the next 12 months.

BIP provided extra information on its debt structure in its Q4 2023 presentation in February 2024. BIP has a credit rating of S&P 500 BBB+ with an average debt term maturity of 7 years. The company has $2.8B in liquidity and only 5% of Brookfield Infrastructure’s debt is up for renewal over the next 12 months.

BIP is currently actively investing in its data infrastructure (35% of its CAPEX) and transport business (46%).

BIP investing narrative

A disadvantage most utilities have is a lack of diversification. Many of them excel at a specific type of service (electric transmission, natural gas, etc.) and show a limited geographic footprint. BIP breaks both patterns; it operates in multiple business segments and manages assets across the world. We also like its ability to be proactive with massive investments in data infrastructure.

Brookfield has ample liquidity and no significant debt maturities in the next 5 years; it is also backed by Brookfield Corporation (BN). The company offers a stable business model based on predictable cash flows with inflation-indexed contracts. This is how BIP can report stable growth, even in challenging times.

In 2023, BIP announced the acquisition of Triton International for $13.3B. Triton is the world’s largest owner and lessor of intermodal containers and a critical provider of transportation logistics infrastructure supporting global supply chains.

Secure your retirement. Download our Recession-Proof Portfolio Workbook.

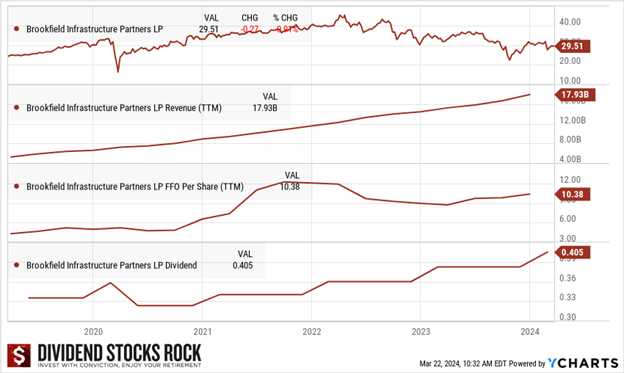

Brookfield infrastructure (BIP / BIPC) dividend triangle

Below is a graph showing BIP’s stock price over the last five years and the evolution of its revenue, Funds from Operations (FFO) per share, and dividend payments.

We show the FFO per share rather than earnings per share (EPS) because BIP has massive capital expenditures (CAPEX) and large assets. This means that its financial statements are always affected by large non-cash charges such as amortization and fair value modifications (up or down). Non-cash charges affect earnings per share, but not the company’s cash flow. Funds from operations (FFO) calculations add these non-charges back, giving a more accurate picture of the company’s cash situation. That’s the case with many other companies, including Brookfield Renewable Partners (BEP).

Seeing BIP with negative EPS while it’s raising its dividend is confusing, to say the least; why would a company increase its dividends when it is losing money? Because BIP generates constant cash flow from its assets; this is visible in the funds from operations, but not in EPS which has all non-cash charges subtracted.

The cash flow from the assets is well protected against inflation. In Q1’24, BIP confirmed 11% FFO growth, of which 7% was organic growth and an 8.3% increase in its FFO per share. Growth was driven by the Transport segment, with contributions from the Triton acquisition, inflationary tariff increases, and higher volumes.

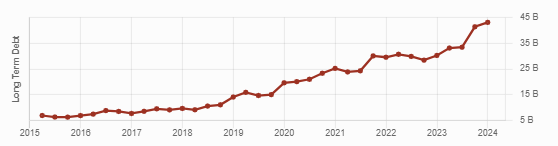

Potential risks

BIP continues to show interest in new projects that require billions. It is taking on a lot of debt to finance them. The company now has a total long-term debt of $43B USD, up from $10B in 2018. Total long-term debt remained stable in 2022 but increased again since mid-2023. This could become a problem with current high interest rates not likely to go down a lot any time soon.

Another source of concern is its diversification. Diversification is often positive, but BIP is managing a wide range of varied business types; there are few similarities between data centers and railroads. Could BIP lose itself in this maze of disparate ventures?

BIP’s financial structure makes it difficult to analyze. There are blind spots as we can’t review each business operated by BIP. We must trust management in thief FFO calculation since it’s not a GAAP measure.

Partner, trusts, and corporate shares?

In 2020, Brookfield created new types of shares in BIP. Historically, it was trading under a Trust in Canada or a Limited Partnership (LP) in the U.S. We’ll skip the tax implications here because a) I hate taxes and b) I leave this field of knowledge to accountants and tax experts.

In short, Trust and LP distributions are taxed differently in a taxable account than corporate shares. Therefore, they are usually less popular among retail investors, ETFs, and mutual funds due to their tax complexity. To ensure more flexibility and liquidity, and appeal to U.S. investors, Brookfield created corporate This created much confusion at first because Brookfield Infrastructure now has 3-4 different tickers per company:

| Share Type | Ticker Symbol |

| Limited Partnership (LP) | BIP |

| Corp. (U.S.) | BIPC |

| Trust (CDN) | BIP.UN.TO |

| Corp. (CDN) | BIPC.TO |

All entities are economically equivalent. However, there was an important difference between the performance of the new “C” shares vs the old tickers following their inception. The difference is explained by the unexpected level of interest in the corporate shares, particularly from institutional investors who usually don’t buy limited partners or trust units for tax purposes. As demand increased for the corporate shares, C shares appreciated faster than the trust and LP units. Now that the initial hype is gone, both tickers (which pay the same dividend) seem to move similarly. However, chances are if there is another influx of funds to buy BIPC shares, the corporate class may get more of that influx.

In closing

BIP is a mixed bag of various utility businesses; it’s almost a utility ETF! It can count on projects across the world, with rock-solid contracts that perpetuate their growth.

Brookfield Infrastructure has a strong dividend history over the past decade. I appreciate their FFO payout ratio target of 60-70%, leaving lots of room for business growth on top of dividend growth. Combine this with management’s confidence in being able to maintain a 5%-9% distribution increase policy for years, this is clearly a “go-to” stock if an investor is looking for income.

The post In Focus: Brookfield Infrastructure (BIP / BIPC) appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/in-focus-brookfield-infrastructure/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Lion’s Mane Mushroom

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, But it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes:

Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity.

Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins.

Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system.

Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome.

Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function.

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules. Today Be 100% Satisfied Or Receive A Full Money Back Guarantee Order Yours Today By Following This Link.