Why “Bad” Earnings Spark Big Rallies

This post Why “Bad” Earnings Spark Big Rallies appeared first on Daily Reckoning.

We’re smack in the middle of another exciting earnings season.

It’s once again that magical time of the quarter when investors become confused, angry (or both!) when stocks don’t react as they expect after filing their quarterly updates.

Why are earnings so tough on armchair investors?

It might have something to do with all the confusing numbers and analyst estimates floating around. Or maybe it’s because the financial media stirs the pot by quick-calling after-hours reactions, only to update their coverage when a stock abruptly changes direction following the conference call Q&A.

But the most frustrating part about earnings season is that stocks don’t react appropriately once the numbers hit the wire – at least, not in the minds of most investors. More often than not, a stock will behave differently than one might logically expect, even when earnings perfectly adhere to analyst expectations.

Unfortunately, there’s no quick fix that will make earnings season more palatable for the average investor. Companies will continue to dish out fresh reports every three months, and investors and traders will simply have to do their best to navigate the uncertainty.

As long as you’re involved in markets, you’ll have to deal with the occasional earnings shenanigans. So it’s best if you learn to embrace the madness…

Today, I’ll show you that it is possible to ride the earnings wave without losing your mind. The secret to earnings zen doesn’t involve scouring estimates, analyst reports, or insider transactions. You simply need to learn how to put the earnings announcements into context with the forces affecting a stock’s price and trend.

Let’s check out a couple of recent high-profile earnings reactions that have frustrated the investing masses…

A Tale of Two Mega-caps…

Last week, we witnessed Tesla Inc. (TSLA) rally off 52-week lows, closing higher by more than 12% after reporting an earnings miss.

The very next day, investors were forced to watch Meta Platforms Inc. (META) crater more than 15% after beating both top and bottom-line estimates.

Moves like these are why so many people are distrustful of the stock market. They have no idea what to make of price action not matching up with top and bottom-line numbers parroted on the financial news.

The Tesla news alone unleashed more than its fair share of angry comments across social media…

Demand for EVs is falling off a cliff! Tesla’s free cash flow flipped negative! Profits are hitting 3-year lows!

But none of these facts prevented Tesla shares from rocketing off their lows as traders appeared blissfully unaware that anything could be wrong with the company’s business prospects.

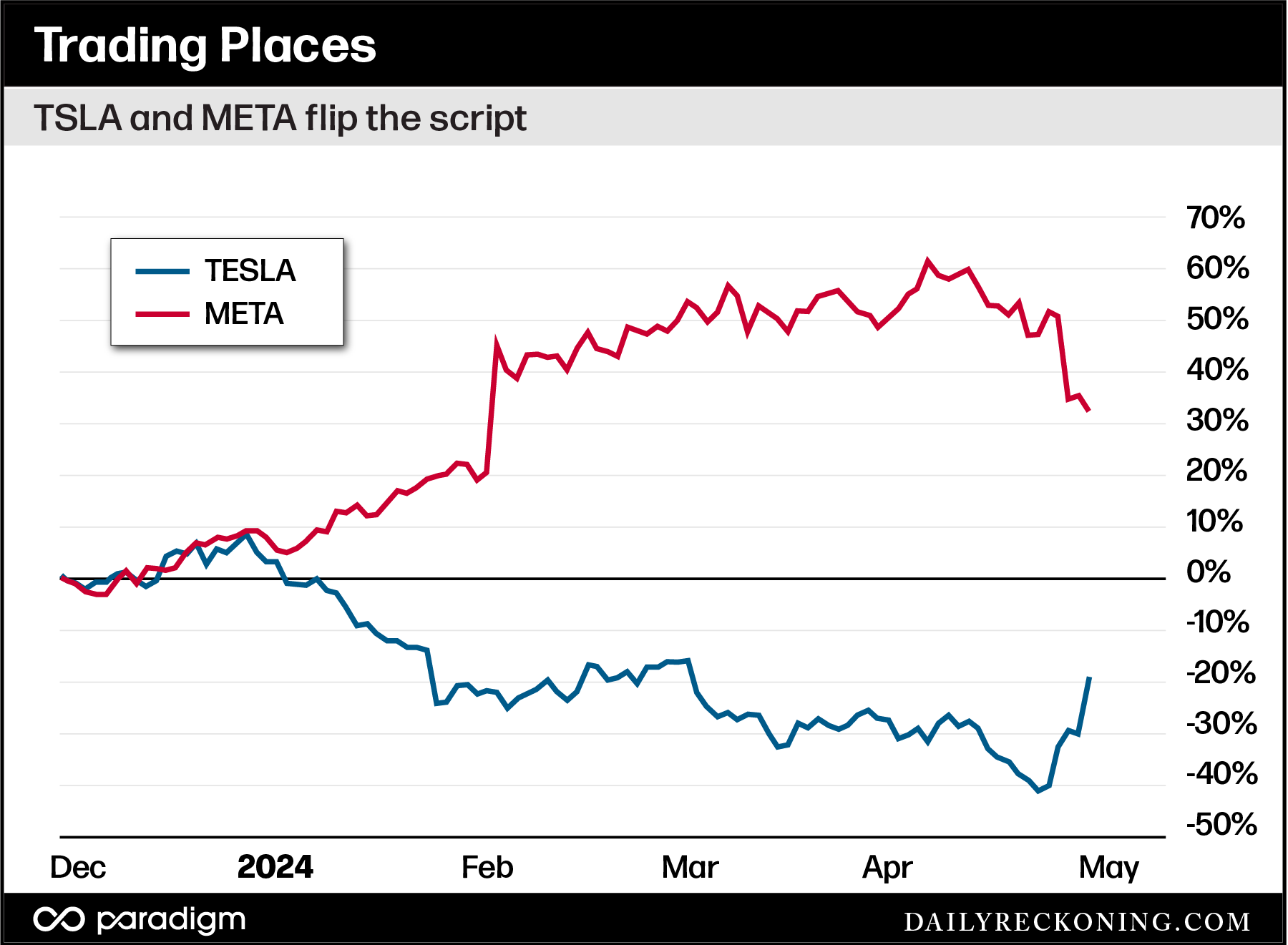

Meanwhile, Meta has been a Wall Street darling since it bottomed in early 2023. Shares were up 450% from their 2022 lows ahead of its earnings announcement last week. The stock was also up 40% year-to-date ahead of earnings — the opposite action we had seen from Tesla during the first quarter.

While Tesla’s financials were a mess, Meta actually posted some impressive numbers. The company beat earnings and revenue expectations for the quarter, extending its fiscal comeback from the dark days of its metaverse pivot in late 2021 – early 2022.

But slightly lower second-quarter expectations stuck out to investors despite the strong Q1 showing. After a perfect start to the year, sellers came out in full force and sent the stock lower by double-digits to its worst showing in 18 months.

What Did You Expect?

To truly understand why the market reacted as it did, we have to zoom out and place the earnings into the context of the bigger price trends shaping these two popular stocks.

On one hand, we have sputtering TSLA shares that have already coughed up more than 40% year-to-date. TSLA broke from its Magnificent Seven brethren in late December and spent most of the first quarter digging itself into a deep hole.

Most investors expected the worst. In fact, sentiment couldn’t have been more bearish heading into last week’s announcement. Combine that with the strong downtrend and breakdown to fresh lows, and you have a recipe for a big bounce on mediocre results. Tesla only needed a report that was slightly better than apocalyptic to spark a short covering rally. And that’s exactly what happened!

The opposite was true for Meta. The stock was on a historic run, posting one of the best-looking charts amongst the mega-caps extending back to the 2022 bear market lows. This strong uptrend plus the fact that Meta shares extended to new all-time highs following its previous earnings beat left little room for error.

Anything less than a “perfect” earnings report would of course entice investors to take profits — which is exactly what happened. Tesla just needed to prove the wheels weren’t falling off their cars to attract buyers, while Meta needed to dazzle analysts and investors to maintain its

Heck, even if this premarket drop holds, META shares won’t completely fill the earnings gap higher from early February (the stock jumped 20%-plus following its last quarterly earnings release).

Bottom line: earnings reactions are all about expectations — just not the expectations everyone talks about. You have to separate the financials from how the herd feels about a stock. The best way to do that is to analyze prices and trends.

The post Why “Bad” Earnings Spark Big Rallies appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/why-bad-earnings-spark-big-rallies/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).