Whither the Junior Miners?

Source: Michael Ballanger 05/13/2024

Michael Ballanger of GGM Advisory Inc. takes a look at current movements in the market, specifically in the junior miner’s sector. He also shares a few public companies that will be embarking upon drilling campaigns this summer.

During the course of the past week, as copper closed at a 26-month weekly high at $4.65/lb., I came across no fewer than a dozen tweets and retweets of various podcast gurus doing their damnedest to explain the woeful underperformance of the junior miners relative to the recent upward surges in gold, silver, and copper, along with the share prices of the senior producers.

The starter pistol for the current rally in the miners was sounded at the end of February as a sudden explosive move in gold and copper prices interrupted the pre-planned celebrations for the PDAC battery metals lovefest. Attendees came away in early March on the final day of the largest mining conference in the world, staring into space with jaws agape and hearts broken as all of their preparations for the widely-touted uranium gala was upstaged by that ornery old charmer — gold.

In answering the question as to why the juniors are acting so poorly, the paper-hanging charlatans of the junior mining trade would point to a “lag effect” that would explain why they have steered their congregation in the direction of “Foofoo Mines” instead of Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) — that eventually, the juniors will “massively outperform” their senior brethren making them “the far better bet.”

Well, this chart makes no such claim.

Anyone who has been in this sector for more than a coffee break knows that at the onset of every bull market in the resource sector, the generalist money rotates into the high-quality, highly liquid names that dominate the sector in terms of market cap and visibility first and THEN after the big name blue chip miners have moved, they move down the ladder of safety to progressively less-liquid and less-quality names. That is the first lesson in the resource space. After a prolonged bear market, you bottom-fish with the large-cap names first.

When I first turned positive on uranium in 2022, the first name I covered was Cameco Corp. (CCO:TSX; CCJ:NYSE) because it was the biggest and most liquid uranium name around. When I went berserk on the copper-gold tandem as my list of top metals to own in 2024 and beyond, I added Freeport-McMoRan Inc. (FCX:NYSE) because it was (and is) the largest copper producer in the world with a strong gold production component from their ownership of the Grasberg Mine. Names like FCX and CCJ become the core of your allocation to any particular commodity because if you are trying to bottom-fish after a long bear market and it turns out you are either early or wrong (because in this business, “early” IS “wrong”), no one will have you tarred and feathered for owning a blue-chip name.

However, if you try to pick a cyclical or secular bottom in Foofoo Mines and you are wrong, you often get pilloried for owning a speculative name totally unsuitable for the portfolio. In addition, since liquidity is always a problem, many of the micro-cap juniors with aspirations of either discoveries or re-ratings wind up as “owl stocks” — that is, when you try to sell them, the haunting mating call of the Great Horned Owl fills the night air — “to-WHOOOO, to-WHOOO” — the reply often heard when instructions are given to find someone to take you off your million shares of Moose Pasture Metals at thirty cents. Liquidity is important when you are right but lack thereof can be injurious to one’s career if one is wrong/early/stupid.

Back to the question: Why are the juniors not yet responding to $2,400 gold, $29.00 silver, and $4.65 copper?

Shift to the performance of the TSX Venture Exchange — the place where dreams are sold and hearts are broken, the financial industry’s answer to Aqueduct or Hialeah, the place where you dabbled before legalized gambling became a cottage industry for literally every outcome we face in everyday life. Since the peak in 2007 at over 3,300, the TSXV has dropped like a stone with anemic rallies in 2016 (after gold bottomed at $1,045) and in 2020 (after the world dropped trillions in cash bombs from helicopters to combat a nasty little flu bug). Every rally has failed since 2007, only to hit new lows on ever-declining volume (liquidity).

The problem facing the elder statemen (and women) of the mining industry is that nobody under the age of fifty has made any money in owning mining stocks, especially the new generation of investors from the Millennial and Gen-X demographics. It is predominantly a function of Western demographics because while Western “Boomers” still recall the boom times of the 1980s and 1990s when phenomenal discoveries and enrichment were commonplace, no such rapture was happening in the Emerging Markets. So, the new generation of Western and Asian investors have rightly avoided the cesspool of resource purgatory and focused on technology, which includes AI and crypto, and while we gold “afficionados” (as opposed to “bugs”) love to pluck hairs from Michael Saylor’s pitiable stubble, the tech and crypto space has treated investors considerably better since 2007 than has the mining sector.

The graphic shown below is of a waterfall where it cascades down through various layered pools of gathered liquid, each spilling over into the next one below. Imagine the river at the top of the waterfall as the capital liquidity destined for investment in the mining sector. As it enters the falls, it first pools at the top (where the Senior Miners reside), and as it fills up all the nooks and crannies (to full allocation status), it then breaches its banks and then fills the next pool (intermediate miners) until that pool overflows its banks and fills the third pool (junior producers).

This continues down through pool after pool and layer after layer until it finally meets the broadest but also the shallowest pool of all — the junior explorers, the “penny dreadful.” Usually, this final pool takes but a few relative minutes to fill, and before one knows it, it has been transformed into a swirling eddy of speculation and excitement and is always the stage of the cycle where most of the new discoveries and enrichment are found. Old-timers like me can usually be found at the top of the waterfalls, watching the upper layers with casual amusement but intensely focused on the bottom layers, where most of the excitement will eventually be found. What becomes the most difficult part of this process is having the patience to wait it out and relating this to 2024, the problem is that the “river” (capital) that in the past would continue to flow until all pools are filled allowing the water to continue downstream has been a mere trickle. If the movement of the underlying commodity markets could be likened to the gushers of water created during the spring melt, this year has ushered in the melt (commodity price surge), but for some reason, it has only just begun to fill the upper pool and very slowly, at that.

So, when, pray tell, will the spring run-off occur, bringing the water coursing through the watershed and thundering over the waterfall?

If you wonder why we have seen outflows in the GLD and SLV ETFs in recent months, even as prices have broken out to new highs, the answer lies in the generational shift in the age of the asset allocators. The new generation, having never made any money in precious metals and only peripheral returns in specialty metals like battery (lithium) and energy (uranium), have maintained their fervent distrust of this advance by reducing their exposure to every rally.

However, the question must be asked: “For all of the selling being done by this largely Western-based group of Millennial and Gen-X allocators, WHO is BUYING that which they are selling?”

The last major bull market in the precious metals market was 2002-2011, a period just before the Millennial and Gen-X crowd found stocks. It was also before a population base of 1.4 billion people found out about stocks. When the Chinese farmers began migrating to the cities, they learned about manufacturing and they learned about money.

Now, as incomes are rising and this new middle class is in need of excitement, they have been speculating in real estate and their stock markets but have been largely exempt from the wonders of the precious metals equities. Last week, I commented about the Indian subcontinent and its 7% growth rate. Between the Indians and the Chinese, this collective group of new-generation investors has never experienced the agony of the precious metals markets plaguing the West since 2011, so that incredibly acetate taste in the mouths of so many Western investors and speculators is absent in the mouths of their Asian counterparts.

This, in my view, is exactly why, despite massive selling by the Western funds, prices continue to rise. The Asian dragon has awoken to the utility of gold and silver and they are flexing their considerable financial muscle as this is happening.

Think this through. It took the largest demographic in world history to discover the precious metals in the 1970s, and that evolved into junior exploration speculation in the 1980s and 1990s despite a cooling in the gold and silver prices. It created a twenty-year period of untold wealth creation through the exploration for and discovery of metals of all shapes and sizes. Here in 2024, a demographic many times the size of the 1970s, boomers are in the process of inhaling every ounce, pound, and wafer of gold and silver (and copper) that is both above ground and known to mankind. In fact, an entire continent of upwardly mobile wealth seekers has discovered that there is actually a “Life After AI” and “Life After Bitcoin” and, in the case of China, “Life After Real Estate” and that new life quest is why all of these metals held by Western funds and in Western vaults and safe houses is rapidly moving to the East. It is being inhaled and stored, never to be returned, by interests in Shanghai, Mumbai, St. Petersburg, and Singapore.

Furthermore, at some point, these voracious interests are going to come after those legacy short positions of the bullion banks and when they do, it will be as if the entire contents of Lake Superior decided to go over Niagara Falls. The sheer volume of demand for “all things metal” will cascade into the equities markets in a manner not seen by any generation ever.

So, as I look down at my desk to the millions of shares that I hold in dozens of “Foofoo Mines” lookalikes, I do not despair for their illiquidity or valuation. As hundreds of Western-based and fuzzy-cheeked asset allocators fumble around with electric cars and new software hybrids in a forlorn exercise in “yesterday’s bubble,” a multitude of Eastern-based and exceedingly deep-pocketed speculators will be discovering the junior explorers and developers. Like the Western boomers 50 years before them, they too will learn of the cascading effect of capital as it trickles down from Seniors to Intermediates to Juniors, but the major difference between 1974 and 2024 will be the sheer volume of capital available for investment in the sector. It is woefully under-owned today, and when that changes, the moves will be life-altering.

Copper

Just so that you all know that I am never 100% certain of anything in the slash-and-burn world of the capital markets, the copper market has me at once totally excited and thoroughly terrified at precisely the same time as it hits multi-year weekly closing highs. I was a “bang-the-table with a sledgehammer” bull in November at $3.60/lb.; I was a “pound-the-table-with-my-fist” bull at $4.00 in March; I was a “rubbing-hands-together” bull at $4.35 in April, and here in May at multi-year highs, I am a “hiding-under-the-desk” bull making little if any noise and gulping down sedatives with mouthfuls of Boone’s Farm elixir.

I would be a total and complete hypocrite if I sat here and repeated my reasons for owning copper, which I identified back in 2022 and early 2023. One reason that I loved copper (amongst many) was that nobody was talking about it. There is no “initiating coverage” from the major money-center banks, no analyst comments with $10,000 per tonne estimates, and most importantly, no armies of Twitter followers all bowing to the east and praising copper for its healing and spiritual qualities and esoteric value. As a quasi-technical analyst (as in the case of the highly-annoying “armchair quarterback), I have long told my subscribers that “whenever a trend in any price movement either up or down moves from “gradual” to “vertical,” it is approaching a terminus for the move” — and therein lies my dilemma.

Every time I scroll through Twitter, the same names that were expounding the virtues of lithium, nickel, and cobalt back in 2022-2023 are now front-and-entre, cymbals-and-pompom-carrying members of the “Copper Moonshot Club” with tweet after tweet after tweet of the “Ten Reasons to Own Copper” which they now have memorized and can recite to the local Uber driver on command.

Make no mistake; the copper story is only just beginning, and I am a committed bull with large positions in a number of junior copper explorer-developers, but also a large leveraged position in the mighty Freeport-McMoRan from under $40 as well as trading positions in the FCX calls which have thus far treated me magnificently.

However, copper prices have indeed moved from “gradual” to “vertical,” much in the same manner as uranium during its recent foray, which has been over $100/lb.

Last January. After a somewhat “gradual” move from 2020 to Q3/2023, U3O8 suddenly went “vertical” as if shot out of a cannon to over $100 by New Year’s Day, accompanied by tweet after tweet and podcast after podcast, all rhyming off the same story in a Reditt-style social media bombardment effect designed to trap the big bad short sellers in the style and flair of GME or AMC.

Most importantly, this had nothing to do whatsoever with the fundamentals for U3O8, which remain almost as positively bullish as copper, but the problem, as always, lies in the “crowded trade” theory whereby trader positioning had everyone piling onto either the starboard or port side of the vessel which ultimately capsizes the vessel.

Now, these gargantuan passive funds are only just starting into the “reflation trade” that favors cyclicals like copper, so it is going to be agonizing watching the retail trade pile on to the copper trade, which is what we are witnessing these past few weeks. Finally, as a trader, the most difficult part of cashing in on a truly big score is staying with the trade. It is a lot easier when you are early and own a large position because you can trim it if you think it is getting overbought, unlike the late-arrival traders who can only tiptoe in with small starter positions that get turfed at the slightest hint of correction.

For now, I stay with the copper trade, but if it were not for the liberal application of liquid and tablet forms of suitable medication, it would be excruciating.

Stocks

After a very modest 5.7% correction in the DIA during April, the SPDR Dow Jones Industrial Average ETF (DIA:NYSE) is within 3.64 points (377 Dow points) of the all-time high.

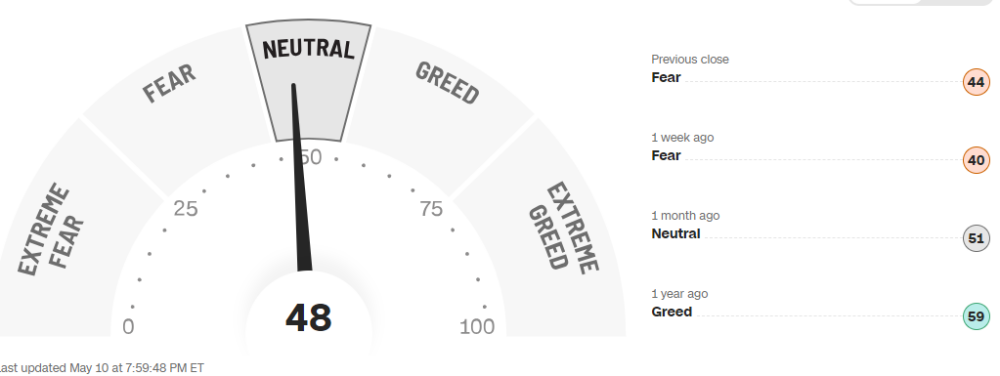

The correction lasted from March 21 until April 17 for the market to experience a pullback, but what was surprising is that the CNBC Fear-Greed index is still only in the

I exited the volatility trade with a small haircut and am now looking for a re-entry point.

As the summer wears on, a number of the junior copper names will be embarking upon drilling campaigns with the first being Vortex Metals Inc. (VMSSF:OTCMKTS;VMS:TSX;DM8:FSE) followed by American Eagle Gold Corp. (AE:TSXV), and then Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) in that exact order.

Hopefully, by the time results begin to filter in, the trickle-down effect will have increased capital flows moving to the junior space. Evidence of that is that an eventual outcome occurred in the recent bid by BHP to acquire Anglo American, which will make BHP the world’s largest copper producer.

M&A activity is always a precursor for a broadening of capital flows to the sector, so this is indeed very good news for all juniors lucky enough to be fully funded and ready to drill.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp., Agnico Eagle Ltd., Vortex Metals Inc., and American Eagle Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Source: https://www.streetwisereports.com/article/2024/05/13/whither-the-junior-miners.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Lion’s Mane Mushroom

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, But it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes:

Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity.

Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins.

Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system.

Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome.

Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function.

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules. Today Be 100% Satisfied Or Receive A Full Money Back Guarantee Order Yours Today By Following This Link.