Why did Fitch downgrade U.S. “Debt”? It’s not what you may think.

The purpose of credit ratings is to assess the likelihood that an issuer of a debt document will adhere to the terms of the document.

The U.S. debt documents consist of Treasury bills, bonds, and notes, including the Federal Reserve Notes you carry in your wallet, aka “money.”

The value of U.S. debt/money is determined by the U.S. government’s full faith and credit, which includes:

A. –The government will accept only U.S. currency in payment of debts to the government

B. –It unfailingly will pay all its dollar debts with U.S. dollars and will not default

C. –It will force all your domestic creditors to accept U.S. dollars if you offer them to satisfy your debt.

D. –It will not require domestic creditors to accept any other money

E. –It will take action to protect the value of the dollar.

F. –It will maintain a market for U.S. currency

G. –It will continue to use U.S. currency and will not change to another currency.

H. –All forms of U.S. currency will be reciprocal; that is, five $1 bills always will equal one $5 bill and vice versa.

The key to the downgrade is item “B,” the “not default” claim.

The following article from Investor News attempts to explain why federal Treasuries were downgraded from AAA to AA+.

Credit Rating Alert: Why Did Fitch Downgrade U.S. Debt?

Story by Josh EnomotoPrimarily, the negative reassessment focuses on “the expected fiscal deterioration over the next three years,” a matter worsened by increasingly bitter political infighting.

The matter was not “worsened” by political infighting. The matter was entirely political infighting.

As you will see, that was the sole reason for the downgrade.

Per the agency’s official statement, a “steady deterioration” in standards of governance during the past two decades imposes a dark cloud as policymakers struggle to navigate the extraordinarily difficult post-pandemic environment.

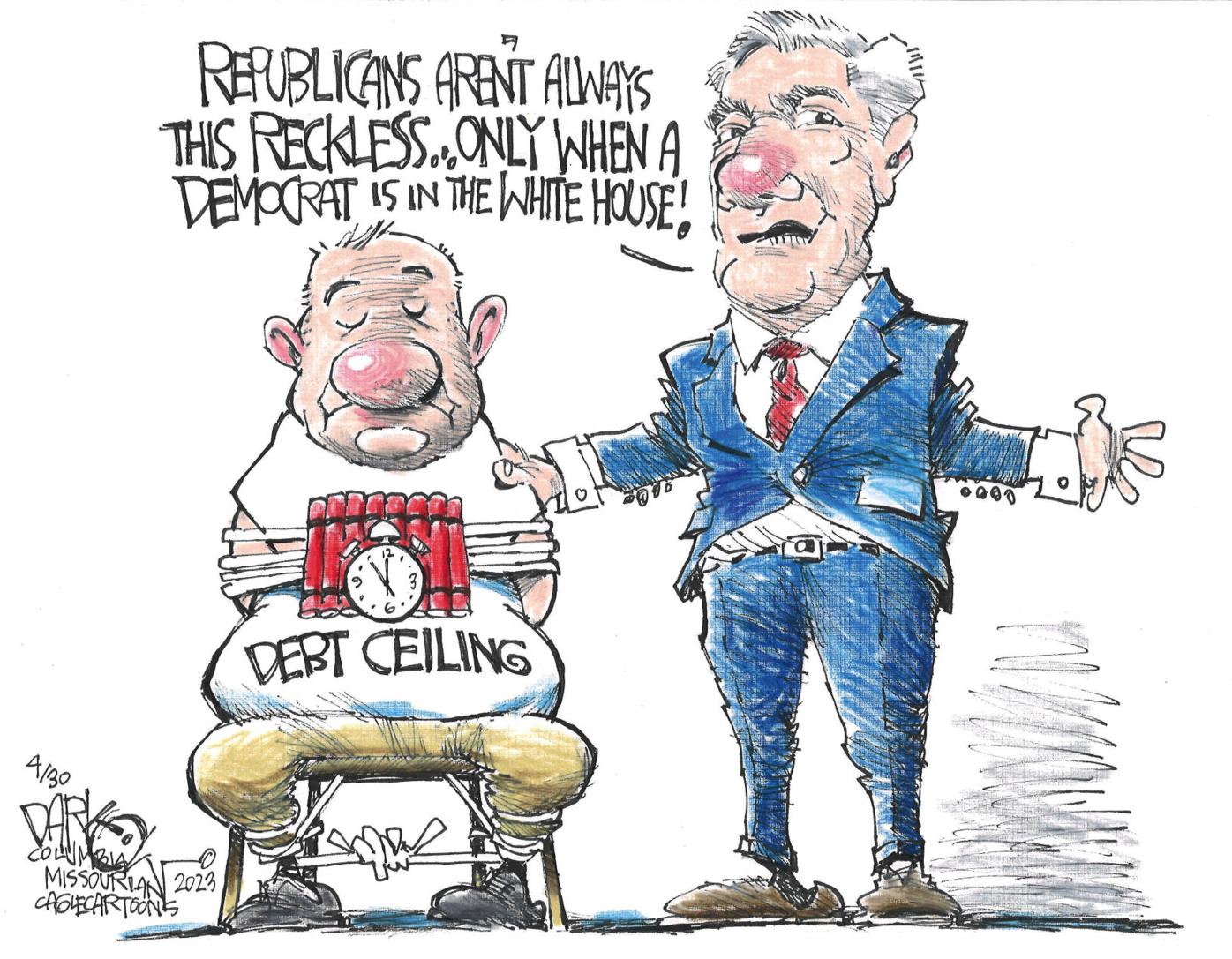

Specifically, “[t]he repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.”

“Standards of governance” is the polite way to say that the GOP has become Trump-nuts, with such stellar brains as Matt Gaetz, Marjorie Taylor Greene, Lauren Boebert, Marsha Blackburn, et al leading the way.

Really, would you lend to those people?

The debt limit is 100% political. It is how the party not holding the Presidency exerts political power over the competing party. It has no other purpose.

As well, the combination of economic shocks and initiatives involving tax cuts and spending programs spiked the overall debt load.

Tax cuts and spending programs are irrelevant to the federal government’s ability to pay all its dollar debts.

Even if the total “debt,” which stands at about $30 trillion, were instead only $1, that would have no effect on the federal government’s ability to pay.

As the creator and issuer of the U.S. dollar (aka Monetarily Sovereign), the government has the infinite ability to create enough dollars to pay all its dollar-denominated debts.

If, for instance, you sent a $50 trillion, or $100 trillion, invoice to the U.S. government today, it could pay that invoice today simply by passing laws and pressing computer keys.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Alan Greenspan: “There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.”

Alan Greenspan: “The United States can pay any debt it has because we can always print the money to do that.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

Statement from the St. Louis Fed:

“As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

This infinite power is true not only of the U.S. federal government but also other Monetarily Sovereign entities. Consider the European Union, which is monetarily sovereign over the euro:

Question: I am wondering: can the ECB ever run out of money?

Mario Draghi: Technically, no. We cannot run out of money.

No Monetarily Sovereign entity can run short of its sovereign currency unless it wishes to.

Some elements of today’s Republican Party would like to see the U.S. economy fail, so they can claim, before elections, that the economic failure is the Democrat’s fault.

In addition, Fitch took into account the Federal Reserve’s efforts in combating historically high inflation into account regarding its latest credit rating decision.

“While headline inflation fell to 3% in June, core PCE inflation, the Fed’s key price index, remained stubbornly high at 4.1% yoy,” wrote the agency. As a result, this framework will likely preclude benchmark interest rate cuts until March of next year.

All inflations are caused by shortages of crucial goods and services, most often oil and food. So-called “core inflation” refers to this:

“Inflation is based on the consumer price index (CPI), covering the inflation of all the goods and services except the volatile food & fuel prices, excise duties, income tax, and other financial investments.

It guides the government in forecasting long-term inflation trends for a country.

Using “core inflation” as a forecasting tool is nonsensical because the primary causes of inflation are those “food & fuel prices, excise duties, income tax, and other financial investments.”

It’s like predicting a baseball team’s wins while omitting runs-scored-and-allowed to get “core victories.”

In a possible reality check, the Fitch downgrade also incorporated recession risks. Based on the aforementioned tighter credit condition and a projected consumer spending slowdown, the U.S. economy may slip into a mild recession in the fourth quarter of 2023 and Q1 of 2024.

The predicted “mild recession and consumer spending slowdown have absolutely nothing to do with the federal government’s ability to service its Treasury paper. Zero.

The only thing that affects debt service is the federal government’s willingness to service its debt.

As The Wall Street Journal pointed out, the Fitch downgrade represents the first by a major credit rating agency in more than a decade. In theory, the unfavorable reassessment clouds the outlook for the global market for Treasurys, which stands at $25 trillion.

Indeed, the WSJ states that “America’s reputation for reliably making good on its IOUs has cast Treasury bonds in an indispensable role in global markets: a safe-haven security offering nearly risk-free returns.”

The U.S. dollar is a safe-haven security only if the government wants it to be a safe-haven security. All those other factors — total debt, spending, inflation, taxes, etc. — are meaningless to that safe haven.

There is but one question: Will the Republican party refuse, for political reasons, en masse, to authorize future payment. Period.

Treasury Secretary Janet Yellen blasted the Fitch downgrade as “arbitrary.” Yellen noted that the agency demonstrated deteriorating U.S. governance since 2018 but didn’t say anything until now. “The American economy is fundamentally strong,” she emphasized.

The downgrade was not arbitrary. The crazies have taken over the GOP, and Fitch merely is allowing for that craziness by, in effect, saying, “You have a political party that cares nothing about America’s credit rating, and instead, will do everything it can to destroy it.

If I were Fitch, I too would have downgraded the U.S. credit rating, not because of any economic problems but solely because of the political situation, notably the craziness of the Trump-led GOP.

The New York Times op-ed writer and Nobel laureate Paul Krugman chimed in, calling the credit rating decision “bizarre.” Also, former Secretary of the Treasury Larry Summers, in an interview with Bloomberg, stated, “I can’t imagine any serious credit analyst is going to give this weight.”

Sorry, guys, it’s not bizarre. It’s legitimate and will continue to be legitimate so long as the Republicans are enslaved to their MAGA wing.

On paper, the credit rating falling appears rather ominous. However, Axios — while not dismissing the relevant concerns leading to the decision — stated that the Fitch downgrade is “largely symbolic.”

It’s symbolic but also a warning. If you invest in a T-bill, T-note, or T-bond, buy U.S. dollars, or sell something to the U.S., and will be paid in dollars — and if the crazies decide not to raise the so-called “debt ceiling” — you will lose money.

Also, it’s important to remember that credit rating agencies don’t always issue accurate prognostications. For instance, in October of last year, Fitch stated that it expected a mild recession to materialize in Q2 2023.

However, CNN recently reported that the economy picked up steam in Q2 “despite punishing rate hikes and still-high inflation.”

The wrong prediction of a mild recession may have been based on “core inflation,” which is irrelevant. If it was based on predicted shortages of oil and food, and those didn’t materialize, Fitch should have stated that.

Bottom line: People are discouraged from buying the obligations of a crazy debtor. Wouldn’t you be?

That unpredictable craziness, and not the size of the so-called “debt,” “core inflation,” or any other factor, are solely responsible for the value loss of the federal government’s full faith and credit.

Eliminate the useless — no, harmful — debt limit, and/or get rid of the crazies, and the U.S. credit rating instantly will be AAA again.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Source: https://mythfighter.com/2023/08/03/why-did-fitch-downgrade-u-s-debt-its-not-what-you-may-think/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).