Whatever money can buy, the federal government can do

Whatever money can buy, the U.S. federal government can do. There is no financial problem the federal government cannot solve, and solve without collecting taxes.

Read this short article from the Kaiser Family Foundation:

Annual Family Premiums for Employer Coverage Rise 7% to Nearly $24,000 in 2023

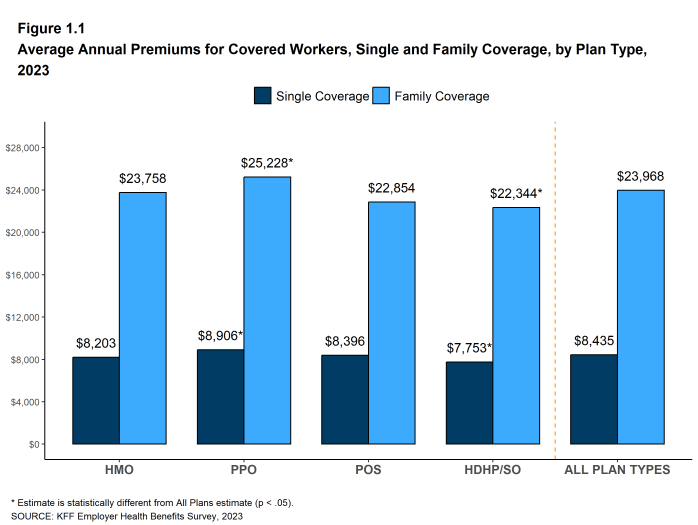

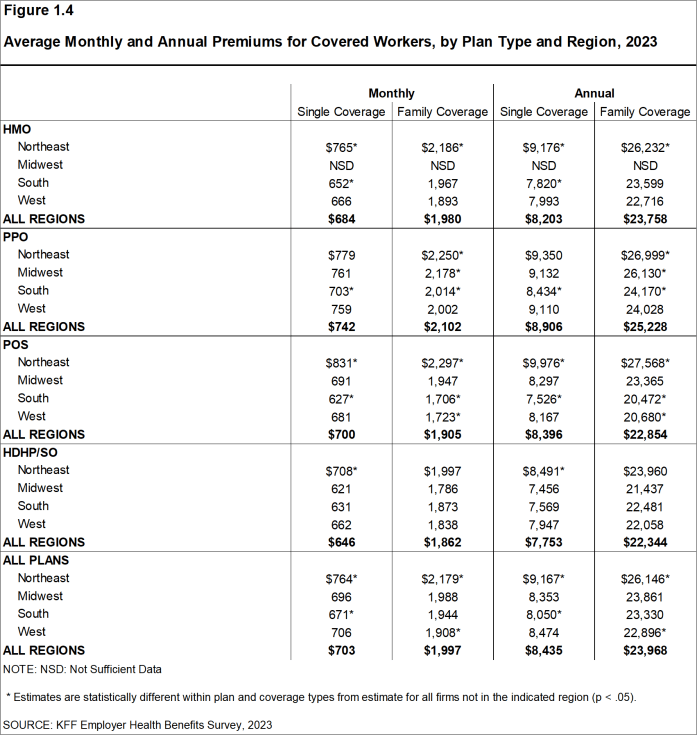

Amid rising inflation, annual family premiums for employer-sponsored health insurance climbed 7% on average this year to reach $23,968, a sharp departure from virtually no growth in premiums last year, the 2023 benchmark KFF Employer Health Benefits Survey finds.

On average, workers this year contribute $6,575 annually toward the cost of family premium, up nearly $500 from 2022, with employers paying the rest.

Future increases may be on the horizon, as nearly a quarter (23%) of employers say they will increase workers’ contributions in the next two years.

The reality is that workers already pay the full $23,968. When employers hire, they figure the overall cost of each worker (including perks) into their payroll decisions.

If employers didn’t have the healthcare expense, they would increase wages as a competitive move. That is how wages are determined.

Think of it: Healthcare insurance costs the average worker $24,000 annually, about $2,000 monthly. And it could be free.

A more complete version of the study can be found here.

Here are a few excerpts from the study:

Average annual health insurance premiums in 2023 are $8,435 for single coverage and $23,968 for family coverage. These average premiums each increased 7% in 2023. The average family premium has increased 22% since 2018 and 47% since 2013.

And it could be free.

And it could be free.

And it could be free.

Not all insurance is the same. Coverages differ. Generally, better coverages cost more. The more costly coverages have fewer and lower deductibles and cover more medical needs.

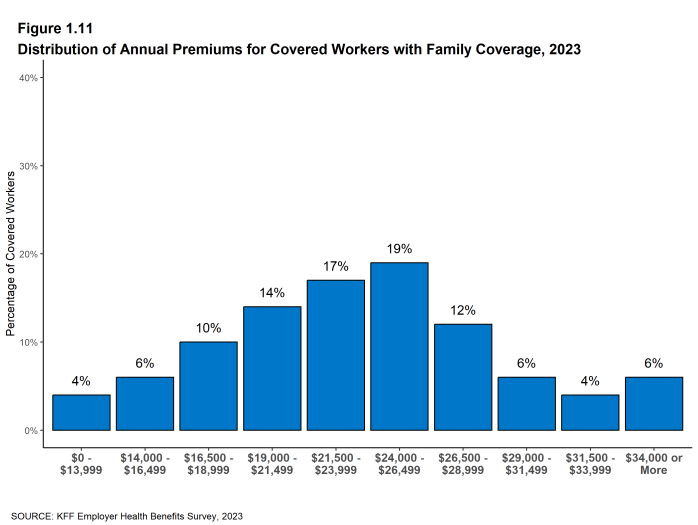

Presumably, those $34,000 plans cover everything you can imagine and possibly some things you can’t imagine. Dental? Certainly. Health clubs and spas? Cosmetic? Travel for health? Weight loss? Hair transplants? Emotional support animals?

You can buy a great deal of health for $34,000+.

But it all could be free.

Workers mistakenly believe that when the company pays, they don’t. But those dollars, whether down at the $14K level or more than the $34K+ level, are part of each company’s cost considerations when deciding how much to pay.

But it all really could be free if the federal government paid for comprehensive, no-deductible Medicare for every man, woman, and child in America.

Three reasons. Because the federal government uniquely is Monetarily Sovereign:

1. The federal government cannot run short of dollars. It creates all the dollars it uses simply by pressing computer keys.

(Alan Greenspan: “There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.”)

2. Your federal taxes do not fund federal spending.

(Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.)

3. Similarly, the federal government never borrows dollars. Accepting dollars for T-bills, T-notes, and T-bonds does not constitute borrowing. The government never uses those dollars. Upon maturity of the T-securities, the government simply returns the dollars in each account to the account owner.

The purpose of T-securities is not to provide spending funds to the federal government. The purpose is to create a safe storage place for unused dollars. This stabilizes and creates demand for the U.S. dollar.

Federal bills, notes and bonds are nothing like state/local government bonds, which are borrowing. State and local governments borrow because they are not Monetarily Sovereign. That is why you, too borrow.

4. Federal spending grows the economy as do federal deficits.

(GDP = Federal Spending + Non-federal Spending + Net Exports)

There is not a single good reason — not one — why the federal government does not pay for America’s health care. But there is a bad reason:

The rich are rich, not because of how much they have, but because of how much MORE they have than what the rest of us have.

“Rich” and “poor” are not absolutes. They are comparatives. You would be rich if you owned $10,000 and everyone else owned only $1,000. You would be poor if everyone else had $100,000.

The two ways to become richer are to get more for yourself, and/or to make everyone else get less.

The rich, who run America, have chosen both routes. They pass laws that give them more and give you less.

To keep you from objecting they indoctrinate you with lies.

They tell you the federal government can’t afford to provide comprehensive, no deductible Medicare for everyone. A lie. The federal government cannot run short of dollars. It can afford anything.

They tell you your federal benefits must be paid for by your taxes. A lie. Federal spending is not funded by taxes. Tax dollars are destroyed when they reach the U.S. Treasury.

They tell you inflation is caused by federal deficit spending. A lie. All inflations are caused by shortages of goods and services (oil, food, metals, lumber, computer parts, labor, etc.). The cure for inflations is more, not less, federal spending to increase the availability of scarce goods and services.

They tell you that the federal budget should be balanced. A lie. Deficit reduction always leads to recessions and depressions.

The lies are so devious, that one political party has devoted itself almost exclusively to reducing your federal benefits. They have tried for many years to eliminate ACA (“Obamacare”), Medicare, SNAP (food stamps) school lunch programs, and all other benefits received by the poor.

Both parties created fake “trust funds” for Medicare and Social Security and claim falsely these “trust funds” are running short of money (so you’ll believe benefits must be cut and taxes increased).

The GOP (the party of the rich) wants to cut funding of the IRS, solely to allow the rich to cheat on their taxes. (The middle classes have taxes deducted from their salaries with scant chances to cheat.)

Tax laws are designed by the rich to reduce tax rates on the types of compensation most enjoyed by the rich (long term capital gains, real estate “losses,” trusts, etc.) It’s how a billionaire like Donald Trump pays far less income tax than you do.

WHAT IS THE SOLUTION? EDUCATE YOURSELF

1. Understand that the federal government, being Monetarily Sovereign never can run short of America’s sovereign currency, the U.S. dollar. It neither needs, nor even uses, tax dollars. It destroys all the tax dollars it receives and creates new dollars to pay every bill.

2. Understand that the federal government is run by the rich. The federal politicians have but two goals: Receiving campaign money and being elected. Nothing is done for “good” reasons; everything is done for political reasons.

3. You are not important to them as a person. They want your vote and your money. Period. To attain their goals, the rich bribe politicians, media, and economists to mislead you.

4. The rich and their lackeys, the politicians, do not want you to understand federal finances. They want you to believe the federal government’s finances are like yours or your state’s. They claim poverty for a government that has infinite money.

The goal of the rich is to widen the income/wealth /power Gap between them and you. That is the only reason they want to cut Medicare, Social Security and other benefits. The wider the Gap, the richer they are.

The so-called Social Security and Medicare “trust funds” are fakes. They do not fund anything. They aren’t even trust funds. They merely are balance sheet notations.

SS and Medicare are funded by the federal government, not by FICA, the same way that Congress, the White House, the Supreme Court and all the military branches are funded: By federal money creation.

5. GDP = Federal Spending + Non-federal Spending + Net Exports. Mathematically, the more the federal government spends, the more the economy grows.

The economy cannot grow when the federal government fails to run deficits. The bigger the deficits, the more the economy grows. When deficits fail to grow significantly, we have recessions.

Recessions can be avoided if the federal government continually were to run increasing deficits.

6. Federal spending does not cause inflation. All inflations are caused by shortages.

The current inflation was caused by COVID shortages of oil, food, lumber, metals, computer chips, shipping, labor, etc.

Even the inflation of WWII was not caused by federal spending.

It was caused by the difficulty of importing oil and other goods (those German U-boats) and labor shortages (the men were off to war.)

“Too much money” never is an inflationary issue. The issue always is “too few goods.”

7. Unless you’re rich, vote for the politicians who will:

A. Provide free, comprehensive Medicare for All

B. Provide free Social Security for All

C. Provide free college for all

D. Eliminate federal taxes on all but the rich

E. Provide benefits including school lunch, food stamps, other poverty aids

F. Run significant deficits every year to fund science and research, air and water quality, housing, and everything else that improves the quality of your life in America.

Whatever money can buy, the federal government can do.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Source: https://mythfighter.com/2023/11/05/whatever-money-can-buy-the-federal-government-can-do/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).