When facts don’t matter. The right wing’s refusal to understand Monetary Sovereignty

Libertarians are Republicans in disguise.

Both begin with the tacit (or not-so-tacit) assumption that government is harmful, and that people should be allowed to do what they darn well please.

The only significant difference between Libertarians and Republicans is the latter’s belief that only the rich should be allowed to do what they please, the rest of us being too lazy and too ignorant to know what is best.

Well, on reconsideration, that’s what they both believe, so perhaps there’s no difference at all.

Let us explore what the omniscient and omnipotent rich believe:

After Moody’s Warning, Federal Officials Continue to Ignore Fiscal Reality

Moody’s calculates that interest payments on the national debt will consume over a quarter of federal tax revenue by 2033, up from just 9 percent last year. ERIC BOEHM | 11.14.2023 4:15 PM

The “national debt” doesn’t “consume” anything. The so-called “debt” is two things, related by law and size, but not by function, neither of which is debt. The national debt is the:

- Total of federal deficits — the difference between federal tax collections and federal spending, which by law equal the:

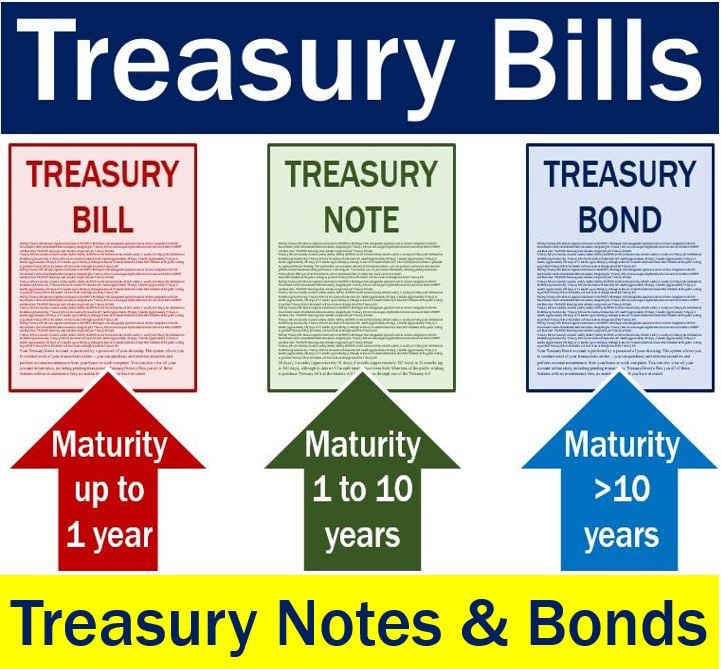

- Net total of deposits into Treasury Security (T-bill, T-note. T-bond) accounts.

The government never touches the dollars in T-security accounts. Those dollars belong to the depositors.

Neither 1. nor 2. consumes federal tax revenue, which is destroyed upon receipt by the Treasury.

Two weeks ago, Treasury Secretary Janet Yellen caused some eyebrows to tilt when she told reporters that rising bond yields were “an important reflection of the stronger economy.”

That’s contrary to the, let’s say, traditional view of how government-issued bonds work.

A bond’s yield—that is, the return an investor expects to be paid at the end of the bond’s term—is the result of buyers pricing their risk into the purchase.

That is true of privately issued bonds, but far less so of federal bonds, which are risk-free (or close to it, depending on what Congress does regarding the useless and infantile “debt ceiling.”)

Interest rates on federal bonds evolve from the basic T-bill interest rate the Federal Reserve creates by fiat in its attempts to fight inflation.

The Fed has no need to make rates attractive because it has no financial need to accept deposits in T-security accounts. The accounts resemble bank safe deposit boxes. The government holds and protects the contents but doesn’t take ownership of them.

Being Monetarily Sovereign, the federal government can create all the dollars it wants simply by stroking computer keys.

Former Fed Chairman Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Contrary to popular wisdom, the federal government does not borrow its own sovereign currency. That confuses people who should (and probably do) know better.

Treasury bonds have historically been some of the most reliable investments out there and, as a result, have typically carried low yields.

In other words: Because you can be very confident that the U.S. government will pay you back at the end of the term, you know that your investment is safe, but you also don’t stand to make much on the risk.

And while U.S. Treasury bonds remain very safe investments, the traditional view would say that the recent uptick in yields means investors are pricing just a bit more risk into those purchases.

It really means:

- The Fed arbitrarily has raised the prime interest rate and/or

- Other investments carry low enough risk and/or are profitable enough to warrant switching over and/or

- A potential investor wishes to make a sale and retrieve so many dollars the private markets couldn’t handle without causing significant price movement (This can be true of government purchases).

- Or, a significant depositor (like China et al.) has decided to switch investments.

For example, the yield on 10-year Treasury bonds—a key benchmark that helps determine the rates of mortgages, student loans, and more—hit a 16-year-high of 5 percent late in October, though it has fallen a bit since then.

By no coincidence, the prime rate was last reconsidered on November 1, 2023. The Federal Open Market Committee voted to keep the target range for the fed funds rate at 5.25% – 5.50%. Therefore, the United States Prime Rate remains at 8.50%.

In short: Buyers will demand higher yields to make riskier investments.

That’s why the 10-year U.S. Treasury bond yield peaked at 5 percent, while a 10-year Russian bond comes with a yield north of 12 percent. (As an aside, there’s something cool and quite libertarian about all this: Governments must answer to the market.

It costs the Russian government more to borrow funds simply because investors are less confident that Russia won’t stiff them a decade from now.)

The U.S. government does not “answer to the market” the way a private bond issuer must.

The government arbitrarily sets the prime rate at any place it pleases, usually with an eye toward inflation.

Because the federal government is Monetarily Sovereign, it doesn’t need to set interest rates for its own financial reasons. It can pay any interest rate with equal ease.

Eric Boehm, the author of the article, seems ignorant of a Monetarily Sovereign government’s bonds from a private sector bond issuer.

Sadly, you can go on government websites that will tell you the government borrows and taxes to fund spending. This is wrong and results from ignorance and/or intent to deceive. Unlike you and me, the federal government has no need for any sort of income.

Why would a government, that has the infinite ability to create dollars, borrow dollars? It wouldn’t. As for taxes, the federal purpose is not to acquire spending funds but to:

- Control the economy by taxing what the government wishes to discourage and by giving tax breaks to whom the government wishes to reward

- Create assured demand by requiring taxes to be paid in dollars.

- At the direction of the rich, to fool the populace into accepting cuts to benefits and tax increases. both of which widen the income/wealth/power Gap between the rich and the rest. This is one way the rich become richer.

Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

So, what could be causing investors to price higher risk into U.S. Treasury bonds right now? Yellen says it results from a strong economy and the sense that interest rates will remain higher for a longer-than-expected period.

But that seems to ignore the 300-pound gorilla in the room—or, rather, the $33 trillion mountain of IOUs threatening to bury the Treasury building and the U.S. economy.

Nonsense. That $33 Trillion is the most recent culmination of 84 years’ worth of deficits, beginning with a federal “debt” of $40 Billion in 1939.

Not once, in all those 84 years, has the misnamed “debt” buried the Treasury building or the U.S. economy.

On the contrary, deficits add growth dollars to the economy while the lack of deficits leads to recessions.

It seems more likely that investors are looking at the trajectory of federal budget deficits and the national debt and are now hedging their bets ever so slightly to account for the possibility of a first-ever federal default.

If there ever is a default, it will not be because the infinitely survivable federal “debt” is so large, but rather because an infinitely ignorant Congress arbitrarily has decided to enforce the infinitely stupid debt ceiling.

Moody’s, one of the world’s “big three” credit rating services, added a significant data point in favor of that conclusion on Friday when it lowered the federal government’s credit outlook from “stable” to “negative.”

As long as boobs like Marjorie Taylor Greene and Mike Johnson run the House of Representatives, I would put the risk of something stupid at nearly 100%

The change reflects Moody’s belief that “downside risks to the nation’s fiscal strength have increased ‘and may no longer be fully offset by the sovereign’s unique credit strengths,’” The Wall Street Journal reported.

Moody’s calculates that interest payments on the national debt will consume over a quarter of federal tax revenue by 2033, up from just 9 percent last year.

The “national debt” consumes nothing.

Unlike private sector (including state/local government) interest payments, federal interest payments do not burden our Monetarily Sovereign government. It could pay any amount of interest simply by tapping computer keys.

Need to make a $1 Billion interest payment? No problem for the federal government. What about a $100 Trillion payment? Still no problem.

The only thing that exceeds the government’s infinite ability to pay any financial obligation is the infinite ignorance of those who don’t understand Monetary Sovereignty.

The announcement from Moody’s comes just three months after another of the primary credit rating services downgraded the federal government’s rating from “AAA” to “AA+” in August.

The change made Friday by Moody’s is not a rating downgrade but signals that one could be coming soon.

Rating downgrades never came during significant deficit growth but only when Congress politically debated whether it wished to pay its bills.

The political party that doesn’t hold the Presidency always tries to prevent economic growth by cutting the federal spending that grows the economy, all in the name of “fiscal prudence.”

That way, they can criticize the President for lack of economic growth and hope to fool a naive voting public.

Moody’s could hardly be clearer in saying how America’s mix of political dysfunction and its increasingly unwieldy debt could trigger that future downgrade.

Forget the “unwieldy pile of debt. The downgrade is 100% based on the debt ceiling and Congress’s willingness (not ability) to pay.

“Without effective fiscal policy measures to reduce government spending or increase revenues, Moody’s expects that the US’s fiscal deficits will remain very large, significantly weakening debt affordability,” Moody’s said in Friday’s announcement.

The above sentence is wrong. The so-called “debt” (that is not a debt of the U.S. government) is infinitely affordable.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

“Continued political polarization within U.S. Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability.”

The polarization is entirely political. It has nothing to do with “debt affordability.” I suspect Eric Boehm knows this and simply is being paid to spread the bullsh*t.

Yet, in Washington, that announcement was greeted by a chorus of federal officials (and their mouthpieces) denying reality yet again.

White House Press Secretary Karine Jean-Pierre said in a statement that the outlook change from Moody’s was “yet another consequence of congressional Republican extremism and dysfunction.”

True.

Yellen, on Monday, said she “disagrees” with Moody’s decision and claimed the Biden administration is “completely committed to a credible and sustainable fiscal path.”

I don’t know what “credible” means in this context, but the fiscal path is infinitely sustainable.

That’s even though the federal budget deficit doubled over the past year. That’s despite the White House’s request for more spending—which would require more borrowing—in ongoing budget negotiations.

More bullsh*t from Boehm. The federal government, unlike state/local governments, never borrows dollars. It creates all its spending dollars, ad hoc.

Alan Greenspan: “There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.”

And now, we finally come to the real reason for all the lies.

And that’s despite President Joe Biden’s utter unwillingness to engage with the problems facing America’s entitlement programs, drive much of the unsustainable future deficits.

There it is, where the Libertarians and the Republicans agree: Cut benefits to those who are not rich.

Both parties have sold their souls to the rich. You’ll notice no mention of raising taxes on the rich and no mention of eliminating the tax loopholes that allow billionaires like Donald Trump to pay less in taxes than you do.

No, the Libertarians and the Republicans want the money to come from the elderly on Social Security and from the sick on Medicare and Medicaid.

They claim it’s those poor lazy freeloaders who are taking all the money.

In Yellen’s view, then, increased bond yields do not reflect increasing concern from investors about the fiscal state of the federal government, and growing federal budget deficits are a “sustainable fiscal path.”

Neither claim makes much sense.

Wrong, Eric. Both claims are correct.

She may turn out to be right, but this comes off as a lot of politically motivated gaslighting.

Huh? “Neither claim makes much sense,” but “She may turn out to be right”?

Poor Eric, he stands firmly with his legs planted on both sides of the fence.

Americans would be wise to keep in mind that the sky is still blue and gravity still pulls you toward the center of the Earth, no matter how many federal officials might claim otherwise.

Americans would be wiser to keep in mind that 84 years of politically motivated bullsh*t warnings about our “unsustainable” federal debt, have proven wrong, wrong, wrong.

Sadly, that has not stopped Boehm et al from taking paychecks to spread it thick and wide.

If you wish to contact Boehm, you can write to his employer at: Reason Foundation, 1630 Connecticut Ave NW, Suite 600, Washington, DC 20009, or call them at (202) 986-0916, or even tweet him at @EricBoehm87.

Couldn’t hurt. Might help.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Source: https://mythfighter.com/2023/11/17/when-facts-dont-matter-the-right-wings-refusal-to-understand-monetary-sovereignty/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).