How do the rich grow richer at your expense.?

The question is a simple one that few people can answer correctly, mainly because the rich have bribed the media, the economists, and the politicians to promulgate the wrong answer.

The real question, for which the rich know the answer, is: Do federal taxes fund federal spending?

The correct answer is: Unlike state/local governments, the federal government uniquely is Monetarily Sovereign. So, while state/local taxes fund state/local spending, federal taxes do not fund federal spending.

All federal spending is funded by new dollars created ad hoc and totally unrelated to taxes. You can see discussions of that misunderstood fact here.

Even if the federal government collected zero tax dollars, it still could continue spending forever.

The rich try to discourage federal benefits to the poor by claiming that such benefits require tax increases.

That is why you read false articles about how Social Security and Medicare will soon run out of money unless taxes are increased or benefits are reduced.

Consider the absurdity contained in the following article:

A Shock for Many Retirees: Social Security Benefits Can Be Taxed

When older Americans earn above a certain income level, they are often taken aback to find they owe federal income taxes on their benefits. By Brian J. O’Connor, Published Dec. 16, 2023, Updated Dec. 17, 2023Jennie Phipps, a semi-retired writer and editor, had been married to a certified public accountant. When she retired, she thought she was well prepared for any taxes she might face.

Ms. Phipps, 72, said that her annual income consisted of money withdrawn from an individual retirement account, about $50,000 from Social Security and $20,000 from a pension. She also earns some money from part-time work.

But when she first started drawing Social Security benefits, she was shocked: Federal income taxes were due on 85 percent of those benefits.

The absurdity is that FICA tax dollars supposedly are collected to fund Social Security, and then the benefits are taxed supposedly to fund other federal spending.

Thus, you are taxed on the same dollars twice — once supposedly to pay for your benefits and then again when you receive the benefits.

Not only is the double taxation a fraud, but all those tax dollars are destroyed upon receipt. You pay with dollars that are part of what is called “the M2 money supply,” but when those dollars reach the Treasury, they no longer are part of any money supply measure.

They disappear into the bookkeeping totally controlled by the federal government and are effectively destroyed.

If your federal taxes are paid for deposits into Social Security funds, you should not be taxed when you receive Social Security benefits. But when you are taxed on benefits, you should not be taxed to “pay for” those benefits.

Of course, there is no reason for you to be taxed at all.

Former Fed Chairman Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

“Many people are amazed to find out that Social Security benefits can be taxable,” said Luis Rosa, a certified financial planner in Los Angeles.

“Then they have to take more money out of their I.R.A.s to compensate for the difference, and it becomes a never-ending cycle of taking money out to pay taxes and then paying taxes on that money.”

And if you think taxing your income from Social Security is just a regular tax on income, it isn’t. It’s a relatively new scam:

Social Security benefits weren’t taxed at all until 1984. Then, in 1993, Bill Clinton signed legislation that expanded tax thresholds, making up to 85 percent of benefits taxable for recipients with combined incomes of more than $34,000 ($44,000 for joint filers).

Those who earn less could be subject to taxes on up to 50 percent of their benefits. Combined income consists of a filer’s adjusted gross income, untaxed interest (such as from municipal bonds), and half of one’s annual Social Security payments.

The federal government didn’t “need” the money until 1984; then, suddenly, it “needed” more money or, instead, found a way to screw lower-income people by widening the income/wealth/power Gap between the rich and the rest.

Over the past 39 years, both Social Security payments and federal income tax brackets have continually shifted upward to compensate for inflation — but the income thresholds that result in a retiree’s benefits being taxed have not.

And here is the real irony:

Most states do not apply state income taxes to Social Security benefits.

States are monetarily non-sovereign. They use tax dollars to pay their bills but don’t tax Social Security benefits.

Our Monetarily Sovereign government neither needs nor uses tax dollars for anything, but inexcusably, they tax Social Security benefits.

Because the cutoff isn’t benchmarked to inflation, more and more beneficiaries are subject to the tax.

The result is that a single filer collecting the average $1,844.76 monthly benefit could be taxed on up to half of her Social Security benefits if her annual total earned income — from wages, a pension, withdrawals from taxable retirement accounts, interest payments, gambling winnings, or any other taxable source — was just below $14,000.

Add another $9,000 of income, and that filer would face taxes on up to 85 percent of her benefits. For joint filers, the tipping point is about $9,900 to hit the 50 percent tax threshold, and it’s a bit less than $22,000 for the 85 percent threshold.

Why the sliding scale? No good reason. The idea is to project the notion that somehow this benefits the poor while ignoring the fact that taxing Social Security, along with the regressive FICA tax, cheats the lower-income people.

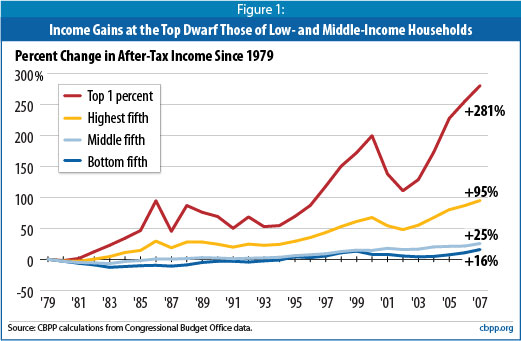

Cheating people who are not rich is no accident. It’s the point of the whole exercise. It dramatically helps widen the Gap between the rich and the rest. And widening the Gap is how the rich become richer.

The wider the Gap, the richer they are. That is the definition of “rich” — having a wide income/wealth/power Gap below you.

Avoiding the tax is possible, but it becomes more challenging once a Social Security recipient turns 73 and must start taking required minimum distributions from I.R.A.s and other tax-deferred accounts.

These IRA distributions are taxed at the highest level. The rich don’t pay at that level. They have trusts and other tax-free devices to insulate them.

The required distribution for a 73-year-old with $370,000 could be enough to activate the tax on 50 percent of her benefits. The interest portions of annuities also are counted in the income calculation.

Like any government program, there’s nothing simple about it. You almost need a 20-page manual to calculate what will be taxable.

The rich have tax advisors who help them pay a lower percentage of their income than you do.

Despite significant changes to retirement accounts in the Secure 2.0 Act, passed last year, there hasn’t been any effort to change the laws governing taxes on Social Security benefits.

There hasn’t been an effort because the rich who run America don’t want changes.

In fact, keeping income limits fixed was part of the original plan, according to the Social Security Administration, to shore up the Social Security Trust Fund against a potential shortfall.

The so-called SS “Trust Fund” isn’t a trust fund. It’s a fake:

As the right-wing Peter G. Peterson Foundation website tells you:

Federal trust funds bear little resemblance to private-sector counterparts; therefore, the name can be misleading.

A “trust fund” implies a secure source of funding. However, a federal trust fund is simply an accounting mechanism that tracks inflows and outflows for specific programs.

In private-sector trust funds, receipts are deposited, and assets are held and invested by trustees on behalf of the stated beneficiaries.

In federal trust funds, the federal government does not set aside the receipts or invest them in private assets.

Instead, the receipts are recorded as accounting credits in the trust funds and combined with other receipts that the Treasury collects and spends.

Further, the federal government owns the accounts and can, by changing the law, unilaterally alter the purposes of the accounts and raise or lower collections and expenditures.

SUMMARY

The federal government has total control over its “trust funds.” It can add to them or subtract from them at will. If Congress and the President wished, they could add $100 trillion to the Social Security “Trust Fund” tomorrow or empty it.

There is no need for FICA or for taxing SS benefits. These taxes hurt the economy by taking dollars out of the private sector.

According to the administration, taxes paid on Social Security benefits go to the fund, making up 4 percent of its 2022 income.

No. Taxes go nowhere. There is no fund. It’s all a charade. The government can set the balance in the fake fund at any level it chooses.

The bottom line is:

>The federal government, being Monetarily Sovereign, cannot run short of U.S. dollars, so

>No federal agency can run short of dollars unless Congress and the President want it to.

>Federal taxes do not support any federal agency — not Social Security, Medicare, Congress, the Supreme Court, the White House, the military nor any other federal agency. All federal agencies receive their money at the whim of Congress and the President.

The purpose of federal taxes is not to fund federal spending but rather to:

>Control the economy by taxing what Congress wishes to discourage and by giving tax breaks to what Congress wishes to reward

>Assure demand for the U.S. dollar by requiring dollars to be used to pay taxes>Help the rich grow richer by widening the Gap between the rich and the rest.

>The rich bribe the thought leaders to brainwash America into believing the government’s finances resemble your finances. They bribe:

-The media via advertising dollars and ownership.

-The economists via contributions to universities and promises of lucrative employment in think tanks.

-The politicians via campaign contributions and promises of lucrative employment.

If all of this does not outrage you enough to contact your Congressperson and demand an end to the Big Lie, you are rich, lazy, or still don’t understand how federal financing works.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The government’s Sole Purpose is to Improve and Protect People’s Lives.

MONETARY SOVEREIGNTY

Source: https://mythfighter.com/2024/01/02/how-do-the-rich-grow-richer-at-your-expense/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).

I Timothy chapter 6 verses 9-10: “But they that will be rich fall into temptation and a snare, and into many foolish and hurtful lusts, which drown men in destruction and perdition. For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.”

Proverbs chapter 19 verse 21: “There are many devices in a man’s heart; nevertheless the counsel of the LORD, that shall stand.”