Is the cost of the White House unsustainable?

The federal government has more than a thousand departments and agencies, including The White House, the House of Representatives, the Senate, the Supreme Court, the Central Intelligence Agency (CIA), Medicare (CMS), and the Social Security Administration (SSA).

Contrary to popular myth, all federal agencies and departments are funded in precisely the same way: Congress votes, and dollars are created from thin air.

A few agencies are associated with so-called “trust funds.” According to the Peter G. Peterson Foundation:

A federal trust fund is an accounting mechanism the federal government uses to track earmarked receipts (money designated for a specific purpose or program) and corresponding expenditures.

The largest and best-known trust funds finance Social Security, portions of Medicare, highways and mass transit, and pensions for government employees.

Federal trust funds bear little resemblance to private-sector counterparts; therefore, the name can be misleading.

A “trust fund” implies a secure source of funding. However, a federal trust fund is simply an accounting mechanism that tracks inflows and outflows for specific programs.

In private-sector trust funds, receipts are deposited, and assets are held and invested by trustees on behalf of the stated beneficiaries.

In federal trust funds, the federal government does not set aside the receipts or invest them in private assets.

Instead, the receipts are recorded as accounting credits in the trust funds and combined with other receipts that the Treasury collects and spends.

Further, the federal government owns the accounts and can, by changing the law, unilaterally alter their purposes and raise or lower collections and expenditures.

Read that last sentence carefully, for it is the heart of this discussion. It consists of four truths:

- The federal government owns the accounts

- The government can change the law and unilaterally change the purposes of the accounts.

- The government unilaterally can raise or lower collections and expenditures.

This all adds up to a powerful but little-understood fact. The so-called federal “trust funds” operate entirely at the whim of Congress and the President.

These “trust funds were created and operated according to the laws the Congress and the President control. By adjusting laws, Congress and the President can determine how much money each “trust fund” collects, has, and spends.

Congress and the President arbitrarily can decide that any trust fund has $1, or $1 trillion, or $1,000 trillion, merely by passing laws. There is no limit to what laws Congress and the President pass, nor what those laws say regarding money in the “trust funds.”

Keep this total control in mind as you read excerpts from this article, also by the Peter G. Peterson Foundation:

SOCIAL SECURITY REFORM: SHOULD WE RAISE THE RETIREMENT AGE?

In their 2022 Annual Report, the Social Security trustees estimate that the program’s primary trust fund — Old Age and Survivors Insurance (OASI) — will spend more on payments to beneficiaries than it collects yearly until it is depleted in 2034.At that time, an estimated 70 million beneficiaries would see a substantial reduction in their benefits. OASI would only be able to distribute as much in benefits as it collects in annual revenues.

Driving that impending depletion are the dual demographic trends of retiring baby boomers and lengthening life expectancies, which together have placed considerable strain on Social Security’s finances.

Many options exist to shore up OASI’s solvency, including increasing revenues dedicated to the program, raising the full retirement age, and decreasing the program’s benefits.

A balanced approach that combined components from each option would likely provide the fairest, most lasting, and least painful adjustment for the future.

Translation: The primary “trust fund” will spend more than it collects –according to current law, which Congress and the President can change at will, but the only law changes being considered are:

- Higher taxes

- Raising the retirement age, and

- Reduced dollar benefits

But here is another, even better approach: Congress and the President should simply vote to give Social Security more money, precisely as they do for the other thousand federal departments and agencies.

There is no need to increase taxes. In fact, FICA should be eliminated. It is unnecessary and a double tax in that it is not deductible, but part of Social Security is taxed. It also punishes lower-income people.

There also is no need to raise the retirement age. Social Security payments can and should be given to every man, woman, and child in America,

Finally, there is no need to reduce dollar benefits. We should even end the faux “trust funds” and simply pay for Social Security the same way the federal government pays for nearly all of its other agencies: By recreating dollars from thin air.

The U.S. federal government is Monetarily Sovereign. It cannot run short of its own sovereign currency.

To pay for your Social Security benefits, the federal government sends instructions (in the form of a wire or check) to your bank or you, instructing your bank to increase the dollar balance in your checking account.

When your bank does as instructed, the balance in your account increases, creating new dollars and adding them to the M2 money supply measure, growing the economy.

Sending instructions to banks is the primary way the federal government creates dollars. The federal government, being Monetarily Sovereign, has the infinite ability to send and clear instructions, thus, the endless ability to create dollars.

(By contrast, everyone who writes a check or sends a wire can send instructions but not clear them. Checks that don’t clear are said to “bounce.”)

Your bank then clears the transaction through the Federal Reserve, another federal agency. Thus, the federal government clears its own money-creation transactions, giving it the infinite power to create dollars.

The government also has the infinite power to change Social Security laws, as demonstrated by the 12 benefit changes shown in this chart.

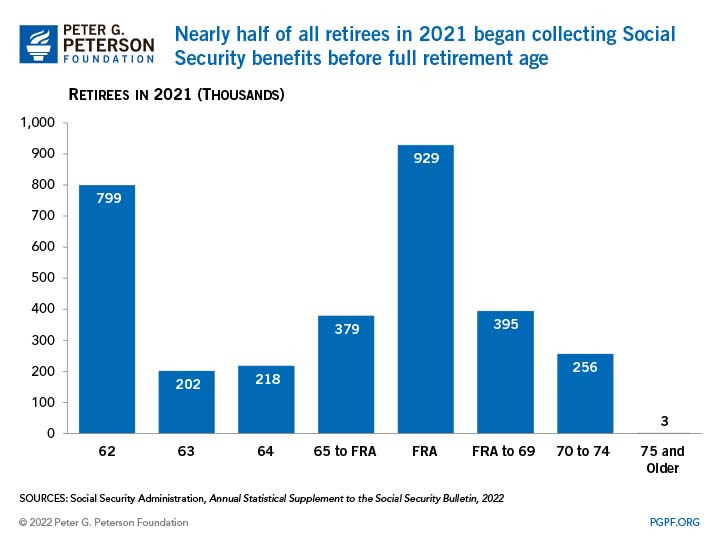

More than half of all Social Security recipients take benefits before the official retirement age when benefits are reduced.

This demonstrates an early need for benefits by those in lower-income groups.

WHAT EFFECT COULD RAISING THE FULL RETIREMENT AGE HAVE ON SOCIAL SECURITY’S LONG-TERM SOLVENCY?

Given that more retirees are beginning to collect Social Security benefits earlier in their retirement and that overall life expectancy continues to increase, many policymakers have called for a modification to the program, wherein the full retirement age is gradually raised and ultimately pegged to average life expectancy.According to an analysis from the Committee for a Responsible Federal Budget (CRFB), gradually increasing the full retirement age by two months per year until it reaches 69 and then indexing it for changes in overall life expectancy would save $90 billion over 10 years, but much more in future decades; CRFB estimates that the change would close over half of the structural mismatch between Social Security’s revenues and spending in the long run.

The above two paragraphs indicate ignorance of the difference between Monetary Sovereignty and monetary non-sovereignty.

If Social Security were private insurance (i.e., monetarily non-sovereign), pegging benefits to life expectancy would be appropriate, even necessary. However, there are zero reasons for the federal government to do this.

There is no fiscal reason why the federal government should try to extract $90 billion from the private sector. If one wishes to grow the U.S. economy, it is the worst possible course of action.

This is what happens when the federal government “closes the mismatch between revenues and spending“(i.e., runs a surplus). Federal surpluses extract dollars from the economy, causing depression or recessions:

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Even without surpluses, just reducing federal deficits leads to recessions:

Economic growth requires the federal government to spend more dollars into the economy than it extracts via taxes and fees (i.e., run deficits). Without federal deficits, we have depressions and recessions.

Those who argue against federal deficit spending may admit it grows the economy but sometimes claim it causes inflation. However, as the above graph indicates, the economy grows, even when adjusted for inflation.

All evidence indicates that inflation is caused not by federal spending but by scarcities of critical goods and services.

Inflation usually is cured by federal spending to obtain and distribute the scarcities that caused the inflation.

Federal taxes reduce non-federal spending (mostly private sector spending). Thus, no matter how one calculates it, increasing FICA and/or decreasing Social Security benefits will reduce economic growth.

And it’s all unnecessary; the federal government has infinite money. It cannot become insolvent.

Not understanding the differences between a Monetarily Sovereign government and the monetarily non-sovereign state/local governments, businesses and individuals is the single most significant cause of economic misery and self-defeating government spending decisions.

In summary, if the White House, Congress, the Supreme Court, and hundreds of other federal agencies and departments are financially sustainable, so is Social Security and Medicare. There is no need for benefit cuts. There is no need for FICA tax increases. There is no need for FICA at all.

The federal government can provide all its agencies and departments with every dollar they need at the touch of a computer key.

Why Don’t They?

Question: If the government can fund all its agencies and departments without taxes, why doesn’t it just do it?

Answer: The very rich, who run the government, want you to believe the government can’t afford to give you benefits.

“Rich” is a comparative term. A person having $1,000 would be rich if everyone else had only $100. But that person would be poor if everyone else had $10,000.

You can grow richer if the income/wealth/power Gap below you widens and the Gap above you narrows. So, the goal of the rich is to narrow the Gap below them, which requires limiting the benefits you receive from the government.

To keep you from screaming about that, the rich bribe your sources of information — the media, the politicians, and the university economists — to convince you of the Big Lie that federal spending is funded by federal taxes.

It’s a Big Lie because the federal government, being Monetarily Sovereign, creates all the money it uses. The only true purposes of federal taxes are to:

- Control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward and

- Assure demand for the U.S. dollar by requiring taxes to be paid in dollars.

That’s it. Federal taxes don’t fund anything. In fact, your precious tax dollars are destroyed the moment they are received by the U.S. Treasury. (You pay with dollars that are part of the M2 money-supply measure.

When they reach the Treasury, they cease to be part of any money-supply measure and are effectively destroyed.

Suppose you are made to believe the federal government is like monetarily non-sovereign state governments, relying on taxes. In that case, you won’t complain when your Social Security, Medicare, poverty aids, college tuition aids, etc. are cut.

The less you receive from the government, the richer are the rich. The rich still receive their federal benefits in the form of tax breaks. There never is a complaint about benefits for the rich being “unsustainable,” “unaffordable,” etc. Those terms are reserved for your benefits.

When you read articles telling you the Social Security age requirement must be raised, benefits must be decreased, or the FICA tax must increase, know this: It’s all part of the Big Lie fostered by the rich to make themselves richer.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Source: https://mythfighter.com/2024/04/14/is-the-cost-of-the-white-house-unsustainable/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).