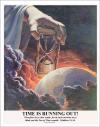

John Williams - We Are Beginning To Approach The End Game

Here is the ominous warning from John Williams of Shadowstats:

Beginning to Approach the End Game. “Nothing is normal: not the economy, not the financial system, not the financial markets and not the political system. The financial system still remains in the throes and aftershocks of the 2008 panic and near-systemic collapse, and from the ongoing responses to same by the Federal Reserve and federal government. Further panic is possible and hyperinflation remains inevitable.

Typical of an approaching, major turning point in the domestic- and global-market perceptions, bouts of extreme volatility and instability have been seen with increasing frequency in the financial markets, including equities, currencies and the monetary precious metals (gold and silver). Consensus market expectations on the economy and Federal Reserve policy also have been in increasing flux. The FOMC and Federal Reserve Chairman Ben Bernanke have put forth a plan for reducing and eventually ending quantitative easing in the form of QE3. The tapering or cessation of QE3 is contingent upon the U.S. economy performing in line with overly-optimistic economic projections provided by the Fed. Initially, market reaction pummeled stocks, bonds and gold.

Underlying economic reality remains much weaker than Fed projections. As actual economic conditions gain broader recognition, market sentiment should shift quickly towards no imminent end to QE3, and then to expansion of QE3. The markets and the Fed are stuck with underlying economic reality, and, eventually, they will have to recognize same. Business activity remains in continued and deepening trouble, and the Federal Reserve—despite currency-market platitudes to the contrary—is locked into quantitative easing by persistent problems now well beyond its control. Specifically, banking-system solvency and liquidity remain the primary concerns for the Fed, driving the quantitative easing. Economic issues are secondary concerns for the Fed; they are used as political cover for QE3. That cover will continue for as long as the Fed needs it.

At the same time, rapidly deteriorating expectations for domestic political stability reflect widening government scandals, in addition to the dominant global-financial-market concern of there being no viable prospect of those controlling the U.S. government addressing the long-range sovereign-solvency issues of the United States government. All these factors, in combination, show the end game to be nearing.

The most visible and vulnerable financial element to suffer early in this crisis likely will be the U.S. dollar in the currency markets (all dollar references here are to the U.S. dollar, unless otherwise stated). Heavy dollar selling should evolve into massive dumping of the dollar and dollar-denominated paper assets. Dollar-based commodity prices, such as oil, should soar, accelerating the pace of domestic inflation. In turn, that circumstance likely will trigger some removal of the U.S. dollar from its present global-reserve-currency status, which would further exacerbate the currency and inflation problems tied to the dollar.

This still-forming great financial tempest has cleared the horizon; its impact on the United States and those living in a dollar-based world will dominate and overtake the continuing economic and systemic-solvency crises of the last eight years. The issues that never were resolved in the 2008 panic and its aftermath are about to be exacerbated. Based on the precedents established in 2008, likely reactions from the government and the Fed would be to throw increasingly worthless money at the intensifying crises. Attempts to save the system all have inflationary implications. A domestic hyperinflationary environment should evolve from something akin to these crises before the end of next year (2014).”

FAIR USE NOTICE: This article may contain copyrighted material. Such material is made available for education purposes only. This constitutes a ‘fair use’ of any such copyrighted material as provided for in Title 17 U.S.C. section 106A-117 of the U.S. Copyright Law.

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).