S&P 500 Sees More Fallout from Delayed Rate Cut Expectations

The repercussions of delayed rate cuts continued to shake out in the U.S. stock market in the past week. Overall, the S&P 500 (Index: SPX) dropped a little over 1.5% from where it ended the previous week to close at 5,123.41 on Friday, 12 April 2024.

Most of that decline came on Friday. Bad news came in the form of diminished earning expectations for big U.S. banks, whose previous outlook had counted on the Federal Reserve delivering rate cuts starting before the end of 2024-Q2.

Speaking of which, with the change in outlook for rate cuts, the CME Group’s FedWatch Tool now projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 31 July 2024. The tool also projects just two rate cuts in 2024, one on 31 July (2024-Q3), the other in December (2024-Q4). And a first rate cut on 31 July 2024 is looking shaky.

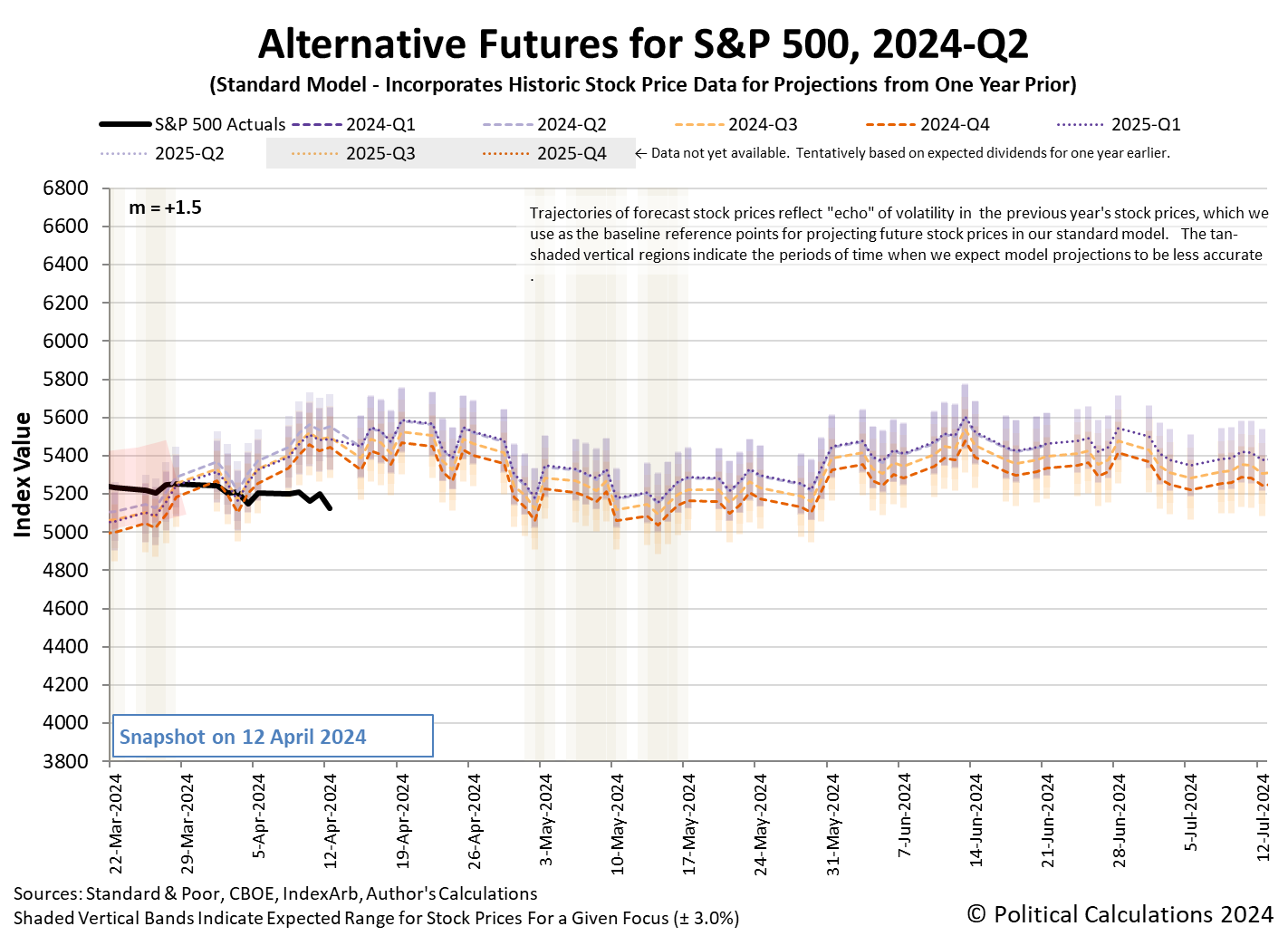

We’ve rolled the alternative futures chart forward to show the dividend futures-based model‘s projections for the S&P 500 through the second quarter of 2024.

We find the actual trajectory of the S&P 500 running below the model’s projections, with the deviation taking place entirely during the past week. Right now, it’s too early to tell if that’s a consequence of a regime change in the market, which is on the table because of the change in expectations for the Fed’s rate cuts. A regime change would mean the dividend futures-based model’s multiplier has itself changed from the value of +1.5 it has mostly held since 9 March 2023. We’ll be able to make that determination within the next few weeks.

In the meantime, here are the market-moving headlines from the week that was.

- Monday, 8 April 2024

-

- Signs and portents for the U.S. economy:

- Major food companies offering deals, new sizes as low-income Americans spend less

- Despite $90 crude, US oil output capped by weak natgas prices

- Oil prices dip on Middle East ceasefire talks

- Fed minions worry about “upside inflation”:

- ‘Upside’ inflation risks keep Fed officials wary of turn to rate cuts

- Minneapolis Fed’s Kashkari: Central bank can’t ‘stop short’ on inflation fight

- Fed rate cut expectations for 2024 fall to lowest since October

- More stimulus developing in China:

- BOJ minions shocked their attempt to create inflation is working:

- Interest rate cuts developing in the Eurozone:

- Nasdaq, S&P, and Dow, ended unchanged while yields moved up

- Tuesday, 9 April 2024

-

- Signs and portents for the U.S. economy:

- US small-business sentiment slides to lowest level in more than 11 years

- US Postal Service seeks to hike stamp prices to 73 cents

- US Treasury yield forecasts rise as rate cut calls recede

- US Gulf Coast heavy crude oil prices firm as supplies tighten

- Bigger stimulus gaining traction in China:

- BOJ minions say they’ll keep money spigots open:

- Bigger trouble developing in Eurozone:

- Nasdaq, S&P end higher in late-session recovery, Dow closes little changed ahead of CPI

- Wednesday, 10 April 2024

-

- Signs and portents for the U.S. economy:

- Oil settles higher after Israeli strike overshadows ceasefire talks

- As US bank profits drop, focus shifts to interest income outlook

- Fed seen cutting US interest rates later, and less, as inflation stays hot

- Fed’s ‘confidence’ in disinflation not bolstered by recent data, minutes show

- Fed officials preparing to slow pace of balance sheet runoff

- Fed’s rate-cut confidence wobbles as elevated inflation persists

- Fed looks to slice balance sheet runoff pace by half

- Bigger trouble developing in China:

- Fitch downgrades outlook on China to negative, affirms ‘A+’ rating

- S&P slashes property giant China Vanke’s credit rating to junk

- China has been closing idled auto output capacity, industry body says

- BOJ minions want to avoid hiking interest rates for falling yen bailout:

- Wall St ends sharply lower as sticky inflation dims rate cut hopes

- Thursday, 11 April 2024

-

- Signs and portents for the U.S. economy:

- Focus: Soaring insurance costs hit as US buyers finally get a break on car prices

- July start to Fed rate cuts back in view after data

- Fed minions say they are in no hurry to deliver rate cuts, expect trouble for U.S. banks:

- Fed’s Williams: Banks should be prepared to use discount window if needed

- Bigger trouble, stimulus developing in China:

- China’s Q1 GDP growth set to slow to 4.6%, keeps pressure for more stimulus- Reuters poll

- China’s exports likely swung back to contraction in March

- China’s weak CPI, factory-gate deflation point to more stimulus

- BOJ and JapanGov minions teaming up to ready bailout for falling yen:

- Japan says it won’t rule out any FX action as yen hits 34-year low

- Explainer: Why is the Japanese yen so weak?

- ECB minions getting excited to cut rates in June 2024, claim to be independent from U.S. Federal Reserve, but are they really?

- ECB holds rates at record highs, signals upcoming cut

- ECB puts June rate cut into view, asserts independence from Fed

- Nasdaq, S&P climb, Dow ends flat as investors gear up for earnings season with big banks

- Friday, 12 April 2024

-

- Signs and portents for the U.S. economy:

- Oil settles up on Middle East tensions, posts weekly loss

- US banks’ profit picture less clear with cloudy rates trajectory

- Citi profit falls on severance costs from reorganization while stock slides

- JPMorgan profit beats estimates even as interest income misses predictions

- Wells Fargo profit beats estimates as shares swing on interest outlook

- Fed minions dial back rate cut expectations, worry about bailing out banks:

- Inflation still too high for Fed to cut interest rates, Schmid says

- Exclusive: Fed’s Collins eyes about two rate cuts this year

- Less than half of U.S. banks ready to borrow from Fed in emergency

- Bigger trouble developing in China:

- Nasdaq, S&P, Dow end deep in the red as stocks suffer worst session since late January

Any effect on stock prices from Iran’s attack on Israel from territory it controls in Iraq over the weekend will be seen in the week ahead.

The Atlanta Fed’s GDPNow tool‘s latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) ticked down to +2.4% from the +2.5% growth forecast last week.

Image credit: Microsoft Copilot Designer. Prompt: “An editorial cartoon of a Federal Reserve official trying to pull down a sign while a disappointed bull watches”

Source: https://politicalcalculations.blogspot.com/2024/04/s-500-sees-more-fallout-from-delayed.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).