Do Down Markets Affect Retirement?

Do down markets affect retirement? To the majority of people, the answer is obvious…an emphatic “Yes!”. However, this might be the wrong answer. I can see you raising your eyebrows right now. How can you not be affected by a 20% market drop in your portfolio at retirement? Keep reading…

Let’s be honest, if you experience a down market in retirement, it’s not your first, nor will it be your last. Each time, it feels like it’s the end of capitalism, yet companies and governments find ways to adapt and thrive.

Let’s go back to 2008. Back then, the market took about four to five years to fully recover. If you retired in early summer of 2008, right before Lehman Brothers went bankrupt, you went through a terrible four years. While you were withdrawing money from your portfolio monthly, its value was falling faster and faster.

Now, remember two things. First, if you retired in 2008, you were investing for at least 30 years before that. Second, you were between 55 and 65 in 2008, which gives you another 30 years or so of investing, assuming your life expectancy is somewhere between 85 and 95. Now, let’s put this in perspective.

Learn how to build a strong portfolio, download our Recession-Proof Portfolio Workbook!

Investment years prior to down market

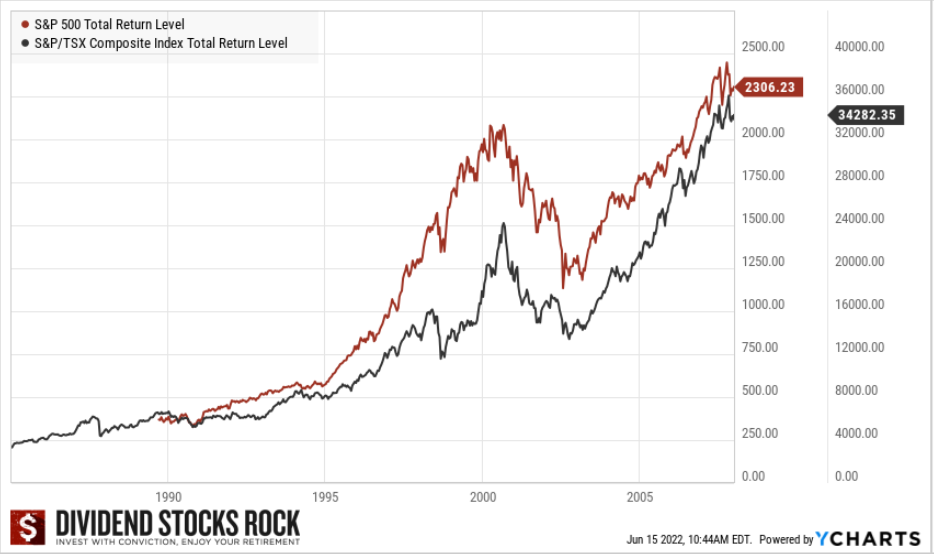

Here is what the market looked like over the 30-year investment period before you retired and before the 2008 crash:

Lesson #1: You enjoyed strong bull markets in the past that helped you build this retirement nest egg!

Being invested between 1978 and 2008 was a blessing. It’s the same story I’ll be telling my children and grandchildren in 2041 about investing in 2003. I was fortunate to start investing young (my children have started at an even younger age). What’s so special about 1978 or 2003? Absolutely nothing. They are just the dates when you started investing. It could be 1995, 2015, or 2030, the story will be the same 30 years later.

Retiring in a down market

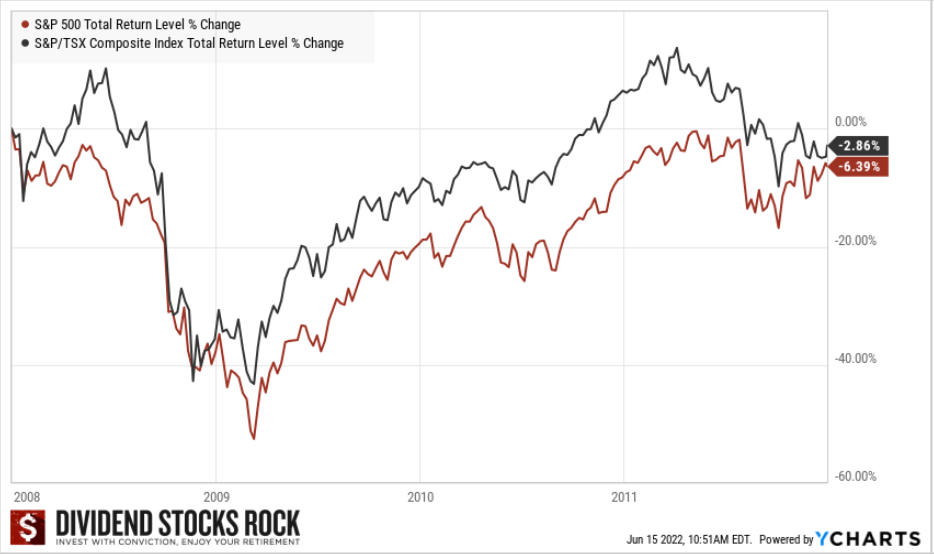

Ok Mike, but how do you feel when you retire in 2008 and four years later, you are still in the red?

Fair point. If you retired in 2008 and you started withdrawing 2% of your portfolio by making your “own dividend” by selling shares here and then, you were in the red at the start of 2012. That is not a good feeling, I get that.

However, the possibility of such an event should have been factored into your investment plan using strategies like one explained in Retirement Cash Reserve: Surf the Market’s Waves.

As financial planner in early 2008, I remember all my investment products showing double-digit returns over the previous five years. Many investors thought that was the norm. While we were all showing double-digit returns over 5 years, some of us still do  , a double-digit return portfolio is not sustainable over a 30-year period such as your entire retirement.

, a double-digit return portfolio is not sustainable over a 30-year period such as your entire retirement.

After a down market

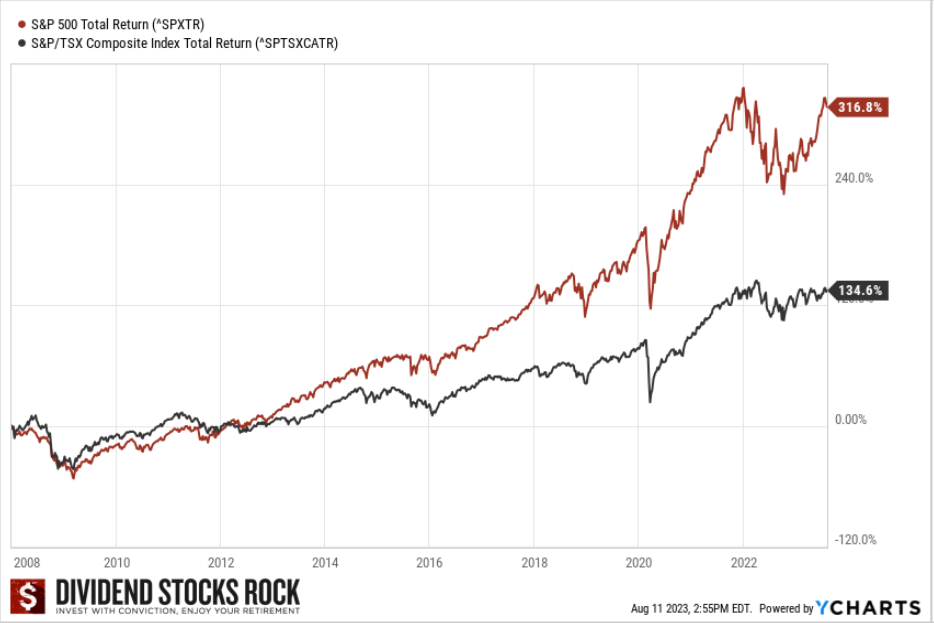

Enough dwelling over the bad stuff, what happened after that four-year dark period? Here’s how the market evolved from 2008 until the end of 2022:

You can see that even if you retired just before the toughest bear market of the past 20 years, your portfolio more than recovered over the following 15 years. It has more than doubled, even tripled for the U.S. market, providing you with more money than ever to keep-up with a comfortable retirement lifestyle.

Lesson #2: Staying true to your investment strategy during a bear market will reward you in the long term.

If we had a crystal ball, we all would have cashed in all our investments in 2008, reinvested it all in March of 2009, then sold everything in 2015 only to buy back at the end of that year, and repeat this strategy in 2018, 2020 and 2022.

Main takeaway

When you consider your retirement plan, it should include a ~30-year period of accumulation and a ~30-year period of decumulation. Through roughly 60 years of investing, you will go through many market cycles.

Do down markets affect retirement? Not if you stick to your strategy. The keys are always the same: good sector diversification, a solid investment thesis for all your holdings, and a focus on dividend growers.

The post Do Down Markets Affect Retirement? appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/do-down-markets-affect-retirement/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).