Oil Market–Tightness vs Strength There’s A Difference

Oil bears? Anyone?

Maybe it’s just my feed, but the energy around energy on Twitter (excuse me, “X”) is as bulled up as I’ve seen since, well, the last oil run.

Of course, that run was all about “the war”, whereas this run is all about supply.

The lack there of.

Just last week we had J.P Morgan come out with the obligatory sell side piece titled: “Super Cycle Returns”. Their case is all about supply, and the problems ahead.

J.P Morgan believes that there is upside for $150/bbl WTI over the medium term. Their reasoning is 3-fold:

- Higher for longer rates driving up cost of funding for new projects.

- Companies returning cash to shareholders instead of investing in the ground.

- Peak demand and government policy discouraging investment.

These points all have a common theme: less investment leading to less supply. Higher rates, reluctant boards and unfavorable macro will all contribute.

It is hard to argue with any of the points. But all of these points were true when oil was languishing at $65/bbl back in June.

I am long oil (in a small way) but after such a big move in crude over a very short time, I feel the need to look at the other side. We’re all bulled up. A super-cycle beckons. What is the bear case?

KEEP ON DRIVING

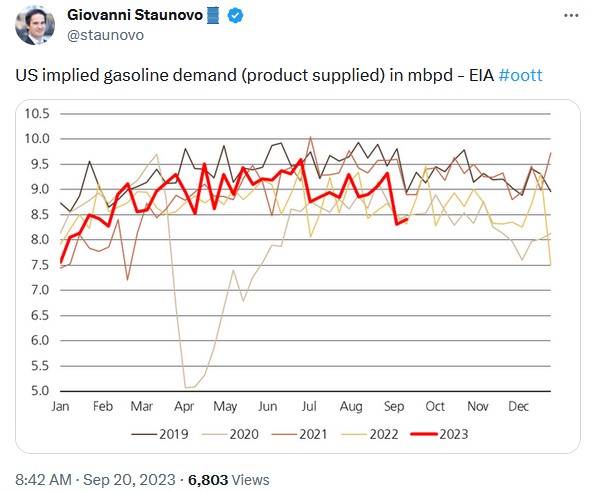

To me, the single, best summary of the bear case comes (unintentionally) from a tweet from Giovanni Staunovo (@staunovo on X). Giovanni is a great follow on X for anyone looking for oil market information. In the tweet below he’s not saying anything bearish, just giving us a chart that states the facts:

Source: X.com

When I look at this chart of US gasoline demand I’ll tell you what I don’t see. Growth.

Forget the last data-point (there is some debate whether its accurate and may still be revised up). Instead, look at the trend. In the first 8 months of 2023 we are still below 2019 levels, still below 2021 levels, and barely treading water with 2022.

But the US economy isn’t just strong, it’s on steroids. We just heard that from Fed Chairman Jay Powell last week. US GDP was 2% in Q1, 2.2% in Q2 and Q3 looks like it could be a barn-burner – with estimates of between 3% and 5%!

A walk around your local mall or a dinner out is all you need to see that the streets are bustling and people are spending. There is no recession in sight.

Yet the US still can’t break out to new highs on gasoline demand. Now of course, the US isn’t ALL of global demand, but I’ll touch on the international side in a minute.

THE CRACK BETWEEN THE SPREADS

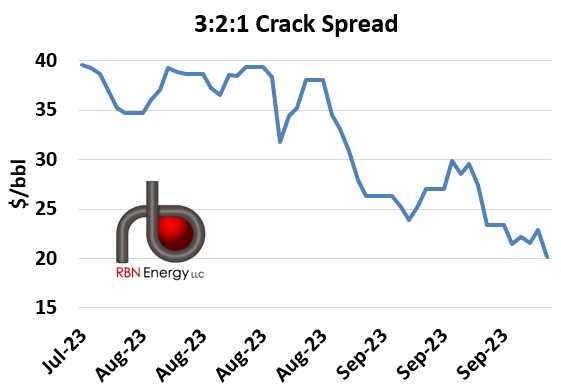

There is a hint of this divergence in the crack spreads. Crack spreads are what refiners pay for turning oil into gasoline, diesel, and jet fuel. Spreads soared in late August and early September, taking most of the refining complex with it. The crack spread got has high at $40/bbl.

But those spreads have come back down to earth.

Source: RBN Energy

But that’s not the real story. The story here has to do with the details.

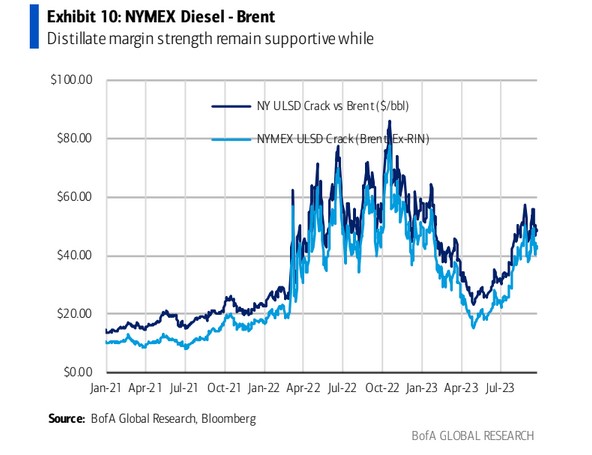

Distillate (mainly diesel) spreads remain extremely healthy – about $46/bbl. Distillate=business.

Source: Bank of America Global Research

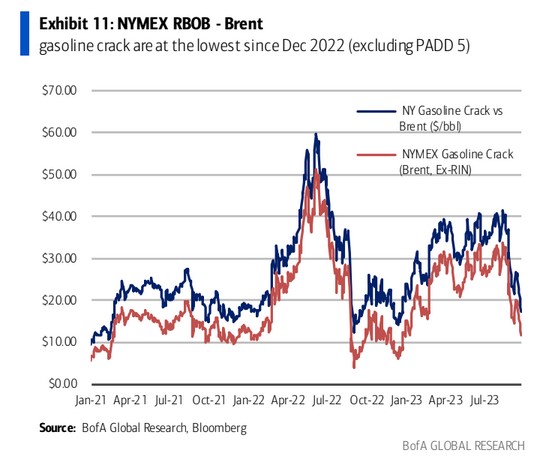

Gasoline spreads? Gasoline=consumer. Not so good.

Source: Bank of America Global Research

Gasoline spreads have dropped precipitously as the summer driving season waned. While some seasonality is expected, what we are seeing here is far more pronounced.

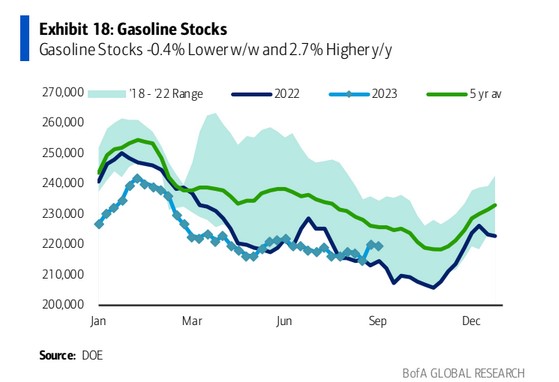

Is this because we are awash in gasoline? Well, no. Actually, the opposite. Gasoline inventory is bouncing along the bottom of its 5-year range.

Source: Bank of America Global Research

What gives? If you have low supply, how come we have low prices?

Look, I don’t know what the market is telling us – or even if it is telling us anything at all. Maybe we are just seeing extreme seasonality.

What I do wonder is–maybe inventories don’t matter as much as they used to–because the trend in US demand is down.

We are so accustomed to growing oil product demand. Every year (when there isn’t a recession) demand goes up.

We are dialed into expecting inventories to trend toward the high end of the 5-year average. You always need more inventory than in the past because demand is always higher.

What if that isn’t the case anymore? It would be okay to bounce along the bottom of gasoline inventories because next year demand is going to be a little bit less. The year after – less again.

“EMERGING” UNSCATHED

The bear case for oil is the developed world; OECD demand. The bull case is emerging markets; non-OECD.

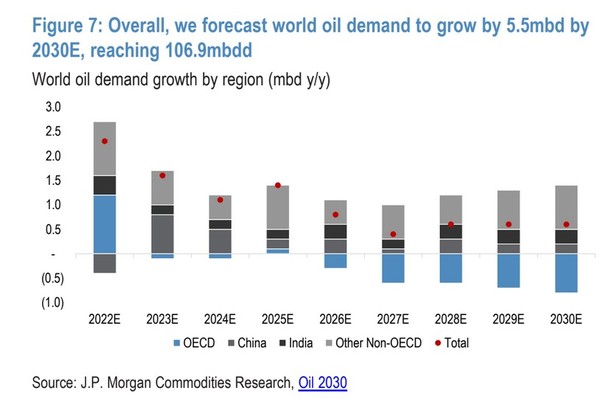

Back to the super-cycle. The second leg of the J.P Morgan forecast is an expectation of an increase in oil demand of 5.5 million bbl/d by 2030. That works out to about 0.8mmbbl/per year of growth.

This is a lot less growth than we have seen in the past. But it is still growth. With supply looking tipsy, that may be all you need for higher prices.

Where is that growth going to come from? Rather risky emerging markets.

Source: J.P Morgan

Emerging markets will account for roughly 2x overall demand growth from 2023-2030 because OECD demand will be falling.

Unfortunately, I have not found a detailed breakdown of that demand growth. What you can see from the report is that two countries, China and India, are expected to account for 65% of demand growth.

That makes sense and gives us some comfort in the forecast. This is another one of those China and India stories—Asian industrialization has been happening for 40 years. We are all familiar with that.

A closer look though leads to some questions.

The contribution from China and India is heavily weighted to 2023 and 2024. In fact, most of the growth from 2025-2030 is from “other non-OECD” countries.

This is demand from the Middle East, from Asia-ex China (Thailand, Vietnam, Indonesia), from Latin America and from Africa.

That is a story I am less familiar with.

I’m not saying that won’t happen. But relying on these emerging markets for the intermediate term bull-case is not without risk.

DIESEL KEEPS BURNING

Look, I am trying to point out the bearish factors that are out there. But I’m not saying that I’m an oil bear.

While gasoline demand and gasoline crack spreads are hinting that some weakness is happening, diesel is roaring ahead.

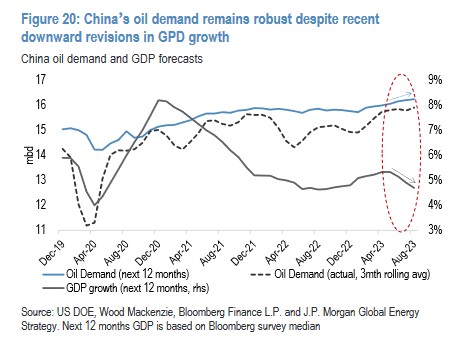

Also, while the Chinese economy has not strengthened as everyone had hoped, oil demand continues to grow.

Source: Morgan Stanley

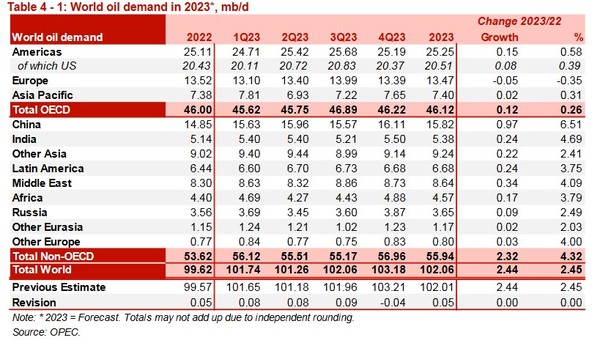

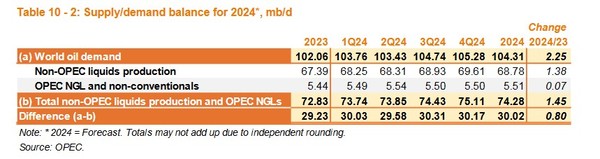

OPEC’s latest estimates for global 2023 oil demand were revised up slightly month-over-month.

Source: OPEC September 2023 Monthly Oil Market Report

OPEC’s own supply/demand balance is forecasting a 2.25 mmbbl/d increase in demand in 2024.

Source: OPEC September 2023 Monthly Oil Market Report

This, while at the same time the cartel enforces reduced production levels and pays lip-service to their worries about demand!

HOPING FOR DISAPPOINTMENT

Which brings us to the last consideration: none of the demand concerns matter if supply disappoints us enough.

OPEC+ is focused on price. Gone are the days where Saudi Arabia “enforced discipline” on the cartel and flooded the market with oil.

Instead, Saudi Arabia seems acutely aware that the good old days are numbered. They need to make hay while they can.

It is all about supply management. Keeping prices high enough for a windfall but low enough to keep demand strong. This is really a bull market in supply management more than oil demand.

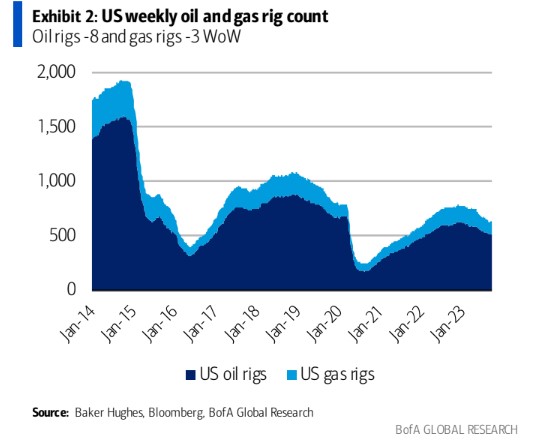

OPEC is helped by the shale struggles.

The EIA recently forecast that shale output may decline again in October – the third month in a row. The US rig count is rolling over again. And the global economy is proving far more resilient—so far—than anyone might have thought.

Source: BofA Global Markets

It is easy to forget how helpful low interest rates were for shale in the late 2010’s. Now interest rates are a headwind to more drilling.

Maybe this dearth of supply that is enough to drive prices higher. A supply-side squeeze super-cycle?

Maybe. Just don’t forget that you still need demand. After all, it is demand that drives the bus.

Source: https://oilandgas-investments.com/2023/latest-reports/tightness-vs-strength-theres-a-difference/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).