The US$1.5 BILLION Lottery Ticket in 2024 The US Will Sell CITGO Petroleum and Pay Out Two Canadian Juniors

A US court could give two Canadian junior stocks a total of US$2.5 billion in July 2024, from the sale proceeds of the CITGO gas station chain–which has almost 5000 retail outlets across the USA. CITGO also has three refineries in the US processing more than 800,000 barrels a day of oil.

This court case has been winding through the US justice system for a decade, but on July 15, a multi-billion windfall will be given to a group of companies whos assets were expropriated by ex-strongman Hugo Chavez.

Rusoro Mining (RML-TSXv / RMLFF-OTC)–which USED TO OWN a gold mine in Venezuela–has been a 10-bagger this year as investors started to price in a successful re-imbursement for their mine being expropriated over 10 year ago

Rusoro’s stock–a moribound 5 cent ticker for a decade–could be another 4-bagger from here if they get 100 cents on the dollar from a US court on July 15.

That’s right–a 10 bagger for an asset it doesn’t own anymore. What Rusoro does own are claims for US$1.5 BILLION against the government of Venezuela–for assets that were expropriated over 10 years ago.

A year ago, the market didn’t believe that Rusoro would ever collect on those claims.

But today? It is looking more likely. If Rusoro can collect, the stock has further to go.

Rusoro’s management team is the Russian father-son team of Andre and Vladimir Agapov (Rus=Russian, Oro=Gold). The two have been living in the UK for many years now, but the company is officially based out of Vancouver Canada.

NOW YOU OWN IT, NOW YOU DON’T

Twelve years ago, Venezuela went off-script when then Venezuelan President Hugo Chavez began a campaign targeting the gold mining industry.

Chavez started by going after illegal miners. The scope quickly expanded to any foreign mining interest. From there it evolved into a full-on asset grab, as Chavez stripped mining companies of their exploration and mining rights and turned those rights over to the Venezuelan Government.

This all culminated on August 23rd, 2011, when Chavez approved a decree with the force of law-making exploration and extraction of gold in Venezuela the exclusive right of the Government.

Investors hoped these were just strong-arm tactics to force mining companies into agreements with the government. But as the months dragged on it became clear that this was not about limiting ownership, it was about eliminating ownership.

The posterchild for the expropriation was Crystallex Mining. Crystallex had a contract to develop the Las Cristinas gold mine in Venezuela, which was one of the largest undeveloped gold deposits in the world. With the decree, Chavez cancelled Crystallex’s contract, handed over the mine to the government and left the company with nothing.

Crystallex went bankrupt. Investors lost billions. Life went on.

In the subsequent decade most of us have forgotten about the incident.

But the US Government didn’t forget. And neither did the courts.

I’M STILL STANDING

While Crystallex and many others were not able to withstand billions of dollars of lost assets, other companies were able to muddle through.

Rusoro Mining was one of those.

Rusoro was also caught in the middle of the expropriation nightmare. At the time, Rusoro had two mining operations in Venezuela – the Choco 10 open pit mine and the high-grade underground Isidora mine, which was a 50/50 JV with the Venezuelan government.

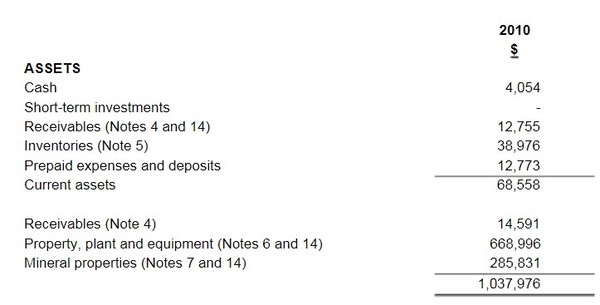

All in Rusoro had about US$1 billion of Venezuelan assets on its balance sheet.

Source: Rusoro Mining 2011 Annual Financial Statements

But unlike Crystallex, Rusoro had very little debt, only a US$30 million convertible loan. Which turned out to be the key to their survival.

In 2012, with their mines now in the hands of the Venezuelan government, Rusoro entered into a standstill agreement with their equity and credit holders. Creditors would hold off on their claims and Rusoro would seek recovery on their assets through the international legal bodies.

Rusoro estimated their claims on Venezuela at $3 billion USD. They took that number to the international courts, asking for reparations from the Venezuelan state.

It took five years, but on April 25th, 2017, an Arbitral Tribunal operating under the World Bank awarded US$1 billion plus interest (which amounted to another US$0.3 billion at the time) to Rusoro as compensation for their loss. In December 2017 the Superior Court of Ontario also ruled in Rusoro’s favor for the same amount.

But all this meant was that Rusoro had a claim. Getting paid was another matter. Until now.

COLLECTING FROM THE STATE

Collecting on a claim from a sovereign state is a tough gig. That’s because, well, the assets of a state are usually within the state. Good luck trying to get the government of Venezuela to give you assets in Venezuela.

The only assets that can realistically be targeted for claims against the state are the ones outside the country.

And about those assets… given the relationship between Venezuela and the United States, is not just a little bit odd that Venezuela is the owner of significant oil and gas assets in the United States. Well, they are!

Venezuela owns Citgo Petroleum. Citgo has been an operator of refineries and gas stations in the United States for over 100 years. This is a big company – the 7th largest refiner in North America.

In 1982, to get a foothold into the US market, the Venezuelan government acquired Citgo. Citgo gave them a buyer of their oil. Today Citgo is owned by PDVSA, which is in turn is owned by the Venezuelan government.

All of Citgo’s refining, transportation and retail assets are in the U.S. Which makes them fair game for a company looking to collect on a court ordered ruling.

THE CITGO FOOTBALL

But wait. Rusoro (and others) were awarded the right to compensation years ago. This is nothing new. Why are we talking about this now?

Politics. Citgo has been a political football for one US administration after another trying to use it as leverage to weaken the Maduro government.

Let’s start with the basics: The US does not recognize the Maduro government as legitimate.

Maduro took over after Hugo Chavez died and he largely continued with the policies that Chavez had started, many of which the US wasn’t thrilled with. When Maduro was re-elected in 2018, the US decided it was not a fair election. They refused to recognize the government.

Soon after the Trump administration cut-off Venezuelan oil from US markets, imposed even more severe sanctions on the country and officially recognized Juan Guaidó, the leader of the Venezuelan National Assembly, as the legitimate interim President of Venezuela.

The Trump administration also stopped money flows from the US to Venezuela. That included payments from Citgo. Those payments were instead directed to the parallel government led by Guaidó. The idea was that the profits from Citgo could be used to fund the opposition so as for them to make inroads against Maduro.

This has continued through the Biden administration. But it hasn’t worked. Maduro remains in power. This year it came to a head when the opposition party dissolved and Guaidó fled to the United States.

Here is where history ties back into our story. In mid-2022 the US Federal judge Leonard Stark put in motion a sales process for Venezuela’s stake in Citgo. There had been previous court rulings that had determined that Citgo’s assets could be seized and used to recoup claims from creditors. A sale was in the hopper.

But it needed Biden approval. Without agreement from the Biden administration the Citgo assets weren’t going any where.

In 2023, when Guaidó fled to the US, the Biden administration had a change of heart. Or just gave up. Whatever the logic, in the middle of this year the administration indicated it would no longer protect Citgo Petroleum from seizure.

That set off a flurry activity. A bidding process was determined in July. Citgo documents were made public to potential bidders in October. And in December, the deadline for submission of interest was passed.

All of this means that Rusoro Mining just might finally get paid. What is left is the submission of bids (January 22nd) and the auction itself (June 10th). On July 15th a hearing will decide the winning bid and distribute the funds to creditors.

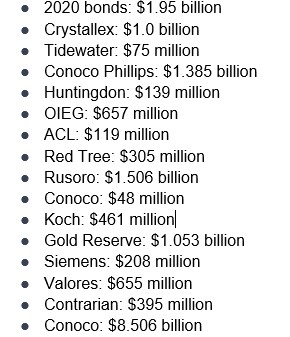

If and when the funds come in, Rusoro will not be at the front of the line. But they are probably close enough.

PAY DAY

The priority of payments for any funds from the sale of Citgo were determined by Stark. First in line are the Citgo bondholders, which amounts to about $2 billion.

This is followed by creditors that have claims against Citgo relating to their claims against the Venezuelan government. The order of ranking is determined by when their claim was filed. Rusoro is 8th in line for payment.

That puts Rusoro about US$5 billion down the creditor stack. Their claim is for US$1.5 billion. That means that if the sale of Citgo happens and if it nets at least US$6.5 billion, Rusoro walks away with a windfall.

WHAT’S A REFINER WORTH?

It is right to be skeptical about just how much a refiner can net in a public sale these days. LyondellBasell (LYB -NYSE) tried to sell their 264,000 b/d refinery in Houston, Texas and couldn’t find a buyer at their preferred price. Irving Oil is trying to sell their refinery in Saint John New Brunswick. Phillips 66 (PSX – NYSE) has also announced an upcoming divestiture of assets.

There are more sellers than buyers in the market.

It doesn’t help that Citgo is BIG. Citgo’s 3 primary refineries add up to 800,000 barrels per day. They own 38 terminals and a network of 4,200 gas stations. They will require a large player to swallow it up.

Source: Argus

Nevertheless, Citgo will find a buyer. Be it a Valero (VLO – NYSE) or a private equity group, someone is going to want this mountain of cash flow.

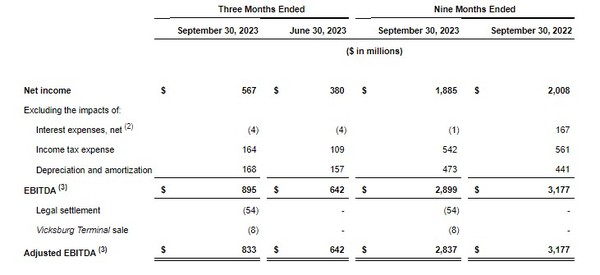

In the first nine months of this year Citgo generated $2.8 billion of aEBITDA.

Source: Citgo Q3 Results

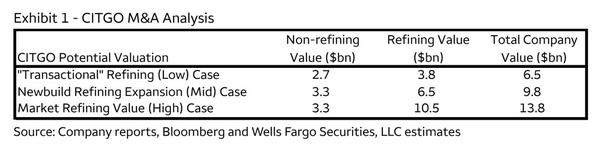

The question is the price. I’ve seen estimates for Citgo ranging from as little as $6.5 billion to as much as $40 billion. Given that there are likely only going to be a few bidders and that there is a muted market for refining assets, a sale might be closer to the low end.

That very low-end number comes from Wells Fargo (WFC – NYSE), which estimated Citgo assets at between US$6.5 billion and US$13.8 billion.

Source: Wells Fargo

Still, even that would be enough to pay off Rusoro in full – but barely.

WHAT IT WOULD MEAN TO RUSORO

Rusoro has 575 million shares outstanding and another 80 million of warrants and stock options that will be well into the money if the sale proceeds.

At the current price 50c give or take, that gives Rusoro a market cap of C$327 million or about US$250 million.

Rusoro has another US$400 million of debt. That includes on balance sheet debt of US$265 million and litigation and success related fees of ~US$135 million. They would have to pay another US$50 million in taxes.

Subtracting all that from the US$1.5 billion they would get, at 100 cents on the dollar recovery Rusoro becomes a 4-bagger.

It is getting from here to there where it could be bumpy. What could go wrong? Plenty.

We KNOW that Venezuela does not like this deal at all. Maduro has called the sale “the biggest lootings that has ever taken place against any nation in the world”. They are certainly going to do everything they can to stop it.

Some efforts have been made to derail the process. In the summer, PDSVA claimed to have lost their share certificates, which would have held up proceedings until new certificates are issued (Citgo was saying this could take a year or more). But Stark squashed that and issued new certificates on the spot.

We also have to hope that the interests of the Biden administration are actually to sell these assets. You can never be sure of their ultimate aim, is this is just more brinkmanship to squeeze concessions out of Maduro?

On the other hand, this sale has been in the courts for years. A lot of tricks have already been used.

There is also the risk of what Citgo fetches at sale. While the low-end estimate is still enough to cover Rusoro, it does it just barely. We can’t be sure how the bidding process will play out. Marathon (MRO – NYSE) and PBF Energy (PBF – NYSE) have already hinted that they aren’t planning to bid. Valero has only said they are reviewing it.

Maybe is simply the price of oil. A lot can happen between now and June. At $70 WTI Citgo sounds attractive. But if the economy goes south or the Saudi’s blink, it is not hard to imagine oil prices dropping and refinery assets along with them.

Rusoro may also look to limit their own risk by making an early sale. There are funds circling these claims, looking to buy them at a discount before the sale is complete. Rusoro could sell some of their claims at a discount to get the sure win up front rather than hold all the risk and the chance that Venezuela pulls a rabbit out.

While I’d love to give a green light on idea, this is a VERY complicated situation and I think it is a call that everyone needs to make on their own.

The upside is obvious – if Rusoro is paid at 100 cents on the dollar the stock is 4-bagger in a little over 6 months. But if not… well, before the Citgo sale had life Rusoro was a 5-cent stock with a lot of debt. Any glitch in the process and it is going right back down.

All or nothing. But even on the side lines, it will be interesting to watch this play out.

Source: https://oilandgas-investments.com/2023/latest-reports/the-us1-5-billion-lottery-ticket-in-2024-the-us-will-sell-citgo-petroleum-and-pay-out-two-canadian-juniors/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).