Easy Money Creates Hard Times

This post Easy Money Creates Hard Times appeared first on Daily Reckoning.

We have yet to reach a full reckoning of the consequences of the era of easy money, but it’s abundantly clear that it ruined us.

The damage was incremental at first, but the perverse incentives and distortions of easy money — zero interest rate policy (ZIRP), credit available without limits to those who are more equal than others — accelerated the institutionalization of these toxic dynamics throughout the economy and society.

Fifteen long years later, the damage cannot be undone because the entire status quo is now dependent on the easy-money bubble for its survival. Should the bubbles inflated by easy money pop, the financial system and the economy will collapse into a putrid heap, undone by the perversions and distortions of endless easy money.

Easy money created destructive, mutually reinforcing distortions on multiple fronts. Let’s examine the primary ways easy money led to ruin.

1. The near-zero rate credit was distributed asymmetrically; only the wealthiest few had access to the open spigot of “free money.” The rest of us saw mortgage rates decline, but we were still paying much higher rates of interest than corporations, banks and financiers.

If we’d all been given the opportunity to borrow a couple million dollars at 1% and put the easy money into bonds yielding 2.5%, skimming a low-risk 1.5% for producing nothing, we’d have jumped on it. But that opportunity was only available to banks, the super-wealthy, corporations and financiers.

Pictures That Tell Thousands of Words

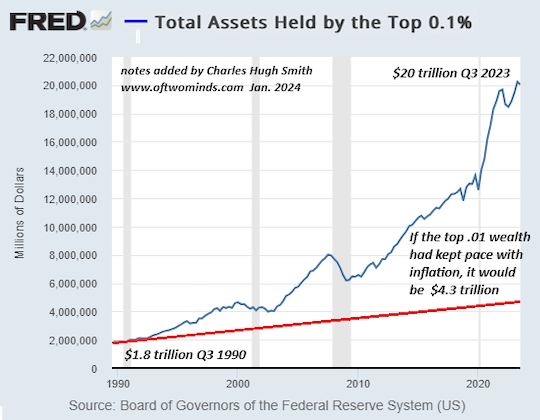

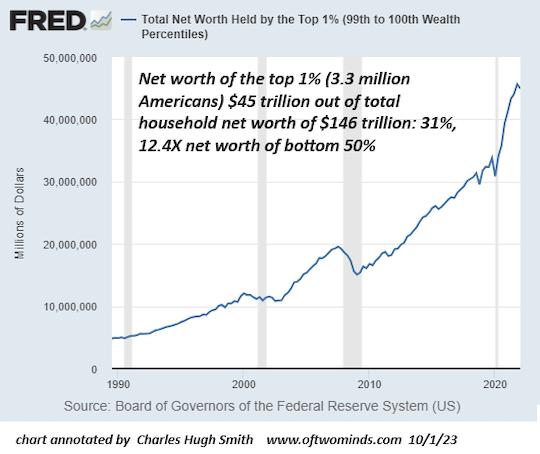

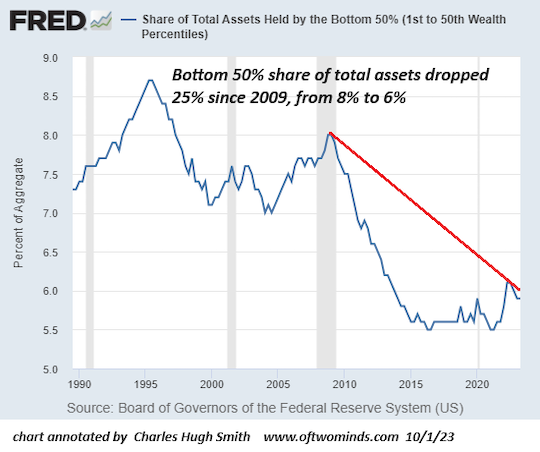

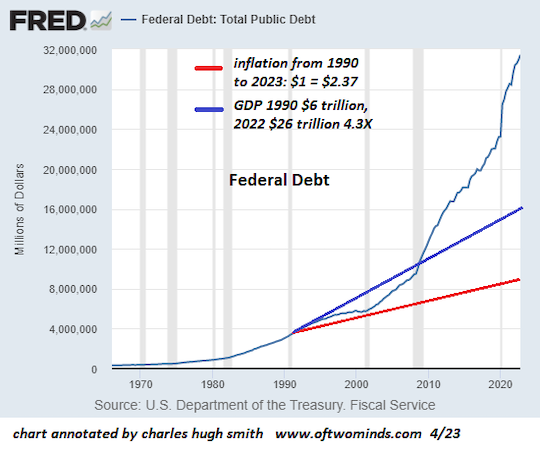

The charts below show the perverse consequences of offering the wealthiest few limitless money at near-zero rates while the rest of us paid much higher interest.

The wealthiest few could buy income-producing assets on the cheap at carrying costs no ordinary investor could match. Since there was so much “free money” sloshing around for financial elites to tap, the demand for income-producing assets soared, pushing prices into the stratosphere. These enormous increases in valuation generated stupendous capital gains for the wealthiest few.

Look at 2009 as the starting point in these charts, as that’s when the Federal Reserve instituted ZIRP and opened the spigots of easy money to “those with first access,” i.e. banks, corporations and financiers.

Here we see how the assets of the top 0.1% more than tripled since 2009, far outpacing inflation.

The net worth of the top 1% went ballistic as well. Nearly free credit is rocket fuel if you’re first in line and nobody else gets the same interest rate.

The bottom 50% of American households lost ground in the era of easy money. This is not coincidence, it’s direct causation: Give the lowest interest rates and unlimited credit to the wealthy, and they will buy up the most productive assets, leaving crumbs for the rest of the American citizenry.

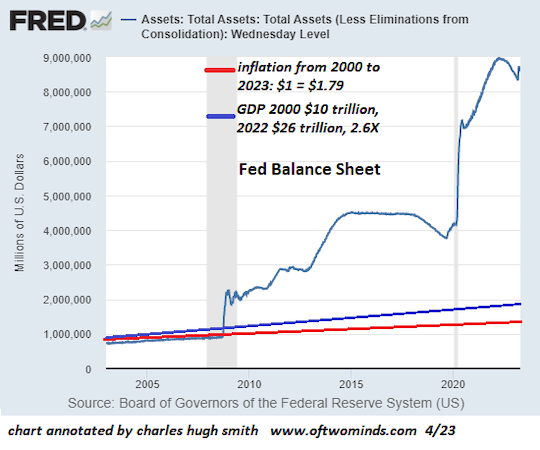

Here’s the Fed balance sheet, the money they created out of thin air and injected into the cheap-unlimited-credit-for-the-wealthy machine.

Note how the easy money sparked federal borrowing. Federal debt was under the line of GDP expansion until 2009, at which point it took off in a parabolic ascent.

Now that interest rates have finally normalized a bit, the gargantuan interest on this debt will be extracted from the citizenry via higher taxes and/or reduced federal spending. (Giveaways to wealthy political donors will of course remain untouched, along with tax havens for the super-wealthy.)

The Social Perversions of Easy Money

The social perversions of easy money are equally destructive. When it’s cheap and easy to borrow more money, that becomes the “obvious” way to deal with challenges. This incentivizes enterprises and institutions to advance those with skills in finance and PR rather than in management.

With the discipline imposed by the cost of money gone and the expansion of opportunities to reap fortunes by pyramiding credit and leverage, competency was redefined from management focused on increasing productivity and cutting costs through efficiencies to extracting the soaring value of existing assets: Nothing new was produced but yowza, a lot of people sure got rich.

The rot created by easy money has seeped into every fiber of our social, political and economic orders. Correspondent D.T. drew a direct line between easy money and the decline of competence in The Powers That Be:

Nepo[tism] babies selected by accident of birth without any tempering in flames… cocooned in their own reality, disdainful of the unselected, coddled and hothoused, ignorant of history and, worst of all, supremely confident in the superiority of their own righteous abilities… because when you get first dibs on the free money there are no consequences you can’t buy your way out of.

Is there any doubt that what some are calling The Disconnected Elite (DE) have fortified their Ivy League-luxe-enclave bubbles and unearned privileges with the easy money that comes with their position atop the heap?

The cost of this elevation of incompetence, the complete disconnection from the realities of everyday Americans and the hubristic confidence in their own talent — i.e., believing your own PR — has hollowed out the nation’s institutions in ways those outside the institution cannot yet observe.

The rot caused by easy money will only become fully visible when the hollowed-out institutions start collapsing under the weight of incompetence, debt and hubris.

Obsolete System

Though few want to admit it, our system is obsolete. And obsolete systems are much more difficult to replace, for everyone being enriched by these arrangements will move heaven and Earth to keep them firmly in place, lest their share of the gravy train diminish.

The maximization of self-interest comes at the cost of system stability. Put another way, the system can either be optimized for self-enrichment or for dynamic stability, but it cannot be optimized for both, as self-enrichment is best served by monopoly — the destruction of the dynamic stability created by competition — or by reducing adaptability as a means of locking in private gains.

And so various policies are ramped up to keep all the machinery in its current configuration. These policies may be for show, accomplishing little, or they may reach extremes, as only extremes can keep the machinery duct-taped together as obsolescence decays the system’s functionality.

We can anticipate the uneven unraveling of systems which no longer respond to extreme policy “saves.” I expect health care, higher education, commercial real estate and banking and the financial system based on extremes of debt and speculative leverage to all unravel, despite the hasty passage of ever more extreme policies.

In my view, there is no way the status quo can chug along virtually unchanged for decades to come. There are two basic reasons: 1) Do the math: The limits of the real world cannot be dissolved by trickery, and…

2) The core systems of the status quo are obsolete. They are being defended not because they work but because those being enriched by the systems want to maintain their power and perquisites.

Another way of saying this is that the forces that have been tailwinds — hyper-globalization, hyper-financialization and stable global arrangements — have shifted into headwinds.

What were deemed solutions have become problems, and doing more of what worked in the past only accelerates the unwinding.

Like what you’ve read? Go here for more.

The post Easy Money Creates Hard Times appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/easy-money-creates-hard-times/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).