ES Morning Update April 19th 2024

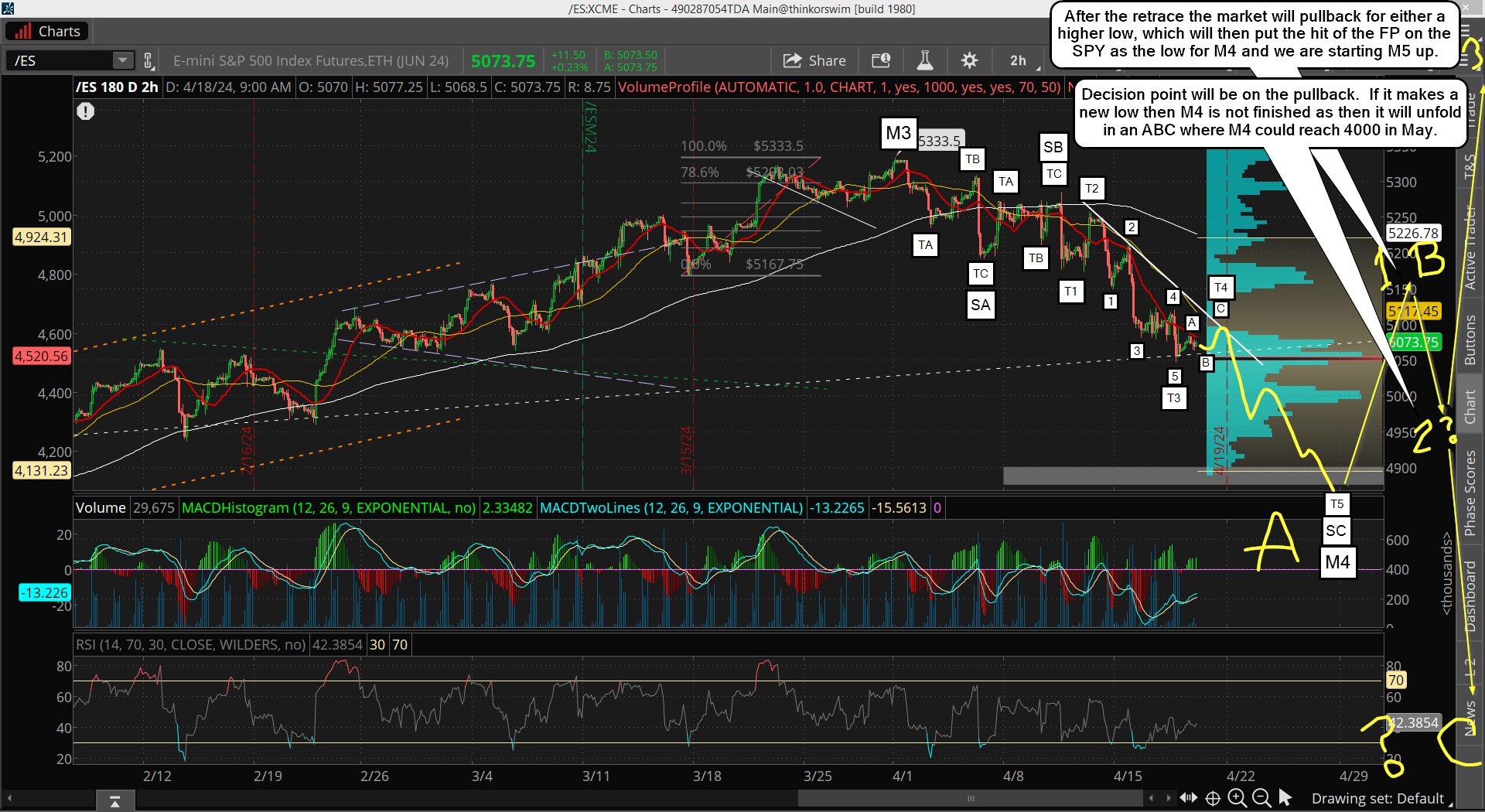

A nothing day yesterday as the chop continued. This 5050 area on the ES is critical support for the bulls, which is why it’s been such a battleground. To me it’s just delaying the move down to the FP, which is coming one way or the other. At this point it’s looking like it will be next week, which is fine with me. Possibly next Monday or Tuesday as we are only about 150 points or so away from it.

On the ES it should be around 4880-4890 and on the SPX around 4850 or so. That could hit even today, but with it being OPEX I have to think they will hold it up to pin it at wherever max pain is for options. That’s all I have for now. Here’s yesterday wave count I posted in the chatroom.

Keep in mind that if we hit the FP today that means they plan on gaping it up on Monday to do the 50% retrace with everyone trapped short over the weekend expecting a crash. It won’t happen. Once the FP is hit the market will reverse. With two FP’s in the 483 zone on the SPY that’s double conformation that it’s real and that we will turn back up from it.

I would fully expect a gap up Monday (big one) and a squeeze all week. I guess it could be over with by Wednesday but it should last the whole week I think. I’ll just be looking for a 50% move up (probably a hair more as it rarely stops right at 50), which is where I’ll exit the long I plan on taking at the FP… if hit today. I’m still short and will exit it when the FP is hit, whether that’s today or Monday. But I get the feeling we will hit it today to get all the bears to stay short over the weekend.

I’ve been down this road many times thinking a crash would happen the following Monday, and it never did. And now I have two FP’s around the same area as well, so I know that once they are hit this market will squeeze back up the next day. It’s the perfect trap to do it over a weekend, so I promise you I will be exiting my short at the FP today and going long.

Have a great weekend.

Source: http://reddragonleo.com/2024/04/19/es-morning-update-april-19th-2024/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).