Know the Risks of an Over-Diversified Portfolio

The risks of an over-diversified portfolio are real. We talk a lot about how diversification protects your portfolio. But some investors overdo it; they buy too many holdings. Diversification can become diworsification. Is that a thing? Yes, it is.

Warren Buffet says that investors should either go with the S&P 500, easily done with ETFs and which is close to full diversification, or just a handful of stocks in which they have a lot of conviction. About 40% of his portfolio is Apple stock; he does okay, right?

It’s true that if you invest only in five high-conviction stocks and they all go crazy runs, you’re a lot better off than you would be with a diversified portfolio. So, what’s the point of diversification?

Listen to Mike’s podcast!

The point is…

When investing, we make mistakes. We analyze company narratives incorrectly, we make wrong assumptions, there are problems in the business or changes in its industry we didn’t see coming, and boom! We get hurt. If we only have five high-conviction stocks and make such a mistake, it hurts a lot!

For these reasons, it’s a good idea to add protection through diversification. However, we see investors go overboard and end up with too many holdings, be they stocks or ETFs.

Get great stock ideas in our Rock Stars list, updated monthly!

Over-diversified portfolio – ETFs and stocks

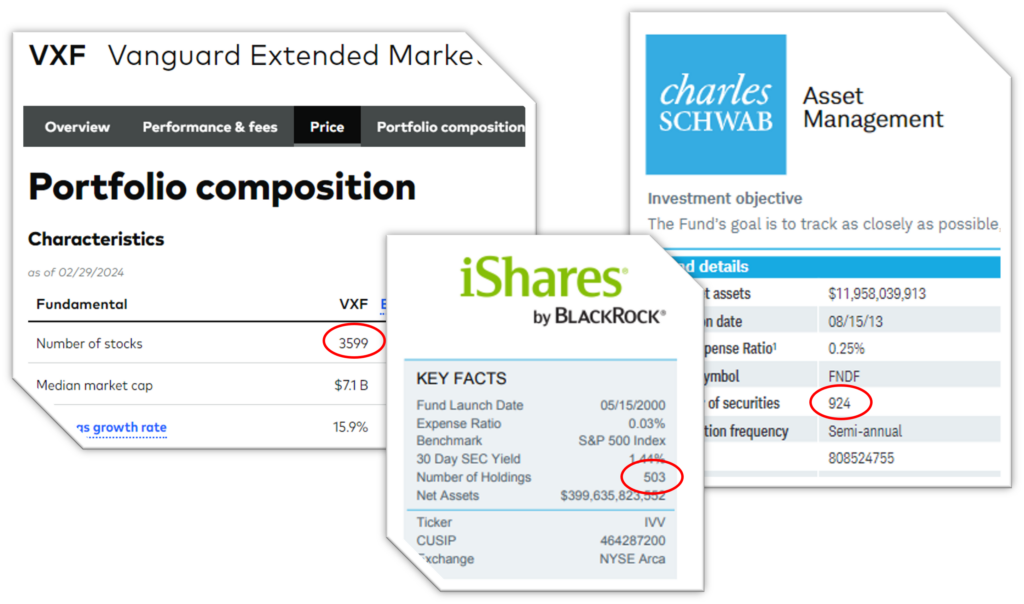

Many investors like that their ETFs give them exposure to 5000+ stocks. They are diversified alright. Over-diversified. Each of the stocks represents a tiny fraction of their portfolio. A single peanut doesn’t give you enough protein for the day; you need more to sustain yourself; a tiny position in a stock is not risky, but it fails to give you value.

Investing in many ETFs also raises the odds that you’ll have stocks from many similar companies; some of them will be leaders in their field, others won’t. This can affect your returns and over-expose you to a sector or industry—which, ironically, is the opposite of diversification.

Exposure to 5000+ different companies through multiple ETFs is just being exposed to the entire market. Your returns will go as the market does. If the market goes down, your portfolio will too; if it goes up, you’ll be happy. But you have no other control. Sometimes, this strategy works out well and can be appropriate for some types of investors.

However, in an ETF investing approach, I’d rather focus on one or two ETFs, not five or ten. This is especially fitting now that we have All-In-One ETFs that cover many markets and provide asset allocation that suits your goals; if you want less volatility, you invest in bonds or fixed-income products and get all of them in a single ETF, a pretty good solution. For more on this, see Why not simply invest in ETFs?

The worst diversification problems occur with investors who handle their own portfolio of stocks. Thinking about diversification or just getting excited by the new shiny thing on the market, some add more and more individual stocks. They become over-diversified.

Get great stock ideas in our Rock Stars list, updated monthly!

Sector allocation

Sector allocation can be a cause of an over-diversified portfolio. There are 11 sectors and 100+ industries within the sectors. Believing you must be exposed to all sectors is incorrect in my opinion, and exposure to all industries is even worse.

Investing in several sectors is essential, but not necessarily all sectors. For example, let’s say you don’t know much about the energy sector or the information technology sector. Perhaps you struggle in analyzing their metrics or have a hard time understanding the business models or what happens in the sector.

Investing in these sectors just for the sake of diversification is a mistake. You won’t gain much from it, except some pain. When the sectors go down, you won’t understand why. Maybe you’ll sell prematurely because of it, or hold on too long, and leave money on the table. In addition to losses, this undermines your confidence in your portfolio and your abilities as an investor.

Going into 11 sectors is fine if you’re comfortable and understand them. Alternatively, choose six to eight different sectors you understand or that interest you enough to study them enough to make the right choices. All sectors offer great opportunities; you can pick winning companies in different industries within a few sectors, and you’ll make money from those, no question.

For more, see How sectors and industries guide investors.

Too many holdings

The second big problem is having stocks from too many companies, causing an over-diversified portfolio. What are the consequences of this?

Too much to monitor

Tracking multiple industries and monitoring 50-60-70 companies takes a lot of time and energy. Most people just won’t read 70 quarterly results press releases, investor presentations, and financial statements every quarter.

If you think you don’t have to monitor your holdings that closely because they’re great companies that will continue to be great, think again. Even an amazing company can hit a wall at any time, and if you don’t monitor your investments, so will you.

Holdings have minimal impact

Having too many holdings lessens the impact each one has on your portfolio. A single stock doing very well or very poorly won’t change a thing for you. A stock price doubling or falling 80% won’t even move the needle when it represents 0.32% of your portfolio. You won’t even feel it. What’s the point?

Too much of the same thing

You’ll probably end up with several companies with the same business model in your portfolio. For example, having four or 5 banks or railroad companies. All your bank stocks are affected by interest rates or a mortgage crisis. All railroad companies react the same way when consumer spending is up and when it dips. Since you won’t have time to monitor all your stocks—you have too many, remember?—you won’t know which of the banks or railroads outperform the others.

That’s not diversification. It’s diworsification; you spend more time, energy, and resources to track the same thing multiple times without gaining anything from it, even possibly losing on returns. The remedy: identify companies in the industry that have the strongest metrics and pick one or two. More than that is too much.

You might struggle to choose between companies in an industry for fear of making a bad decision. Just compare them to see which ones have the strongest dividend triangle, i.e., the strongest revenue growth, strongest earnings per share growth, and strongest dividend growth over the last five years. Use a stock comparison tool or do it manually. Then, read about their business model thoroughly. It’ll be a lot easier to identify those likely to outperform the others.

The post Know the Risks of an Over-Diversified Portfolio appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/risks-of-over-diversified-portfolio/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).