Cocky Bears Outmatched: Tech Triumphs

This post Cocky Bears Outmatched: Tech Triumphs appeared first on Daily Reckoning.

A dicey April pullback has given way to a fresh rally as the market’s former momentum leaders gain traction.

The bears might have gotten a little too cocky during the April swoon, leaving the door open to an unexpected snapback as investors refuse to sell in May and go away…

Facts are facts… and we can’t deny what’s happening in the markets right now. While we were all expecting a bigger correction in April, stocks have reversed higher and have repaired much of the damage. Barring a massive failure here, we should concentrate our efforts on finding quality long setups, rather than pressing any shorts that have taken a hit over the past two weeks.

Friday’s not-so-hot jobs number has clearly sparked a glimmer of hope amongst the rate-cut crowd. Stocks are now also aided by the hope that perhaps the economy isn’t as strong as many feared early last week.

Yes, I know that sounds a little crazy. But this has been the market’s fixation since the days of the 2022 bear market. And while we don’t know when the bulls will get their precious rate cut, we will have a better idea as to where stocks might be headed in the short term if the averages can continue to bounce after reclaiming key support.

Either way, volatility is down and Friday’s rally has helped push the averages back toward the area of the mid-April breakdown. As always, price trumps narrative. If we continue to see stocks build on this move, we need to go with the flow and flip bullish for trading purposes.

While some weaker groups have found their footing this month, the resilience of the Q1 tech leaders has been the biggest story…

AAPL, TSLA Finally Find Buyers

The unshakable semiconductors are back on the top of the heap as this sector works on its third straight week of gains coming off the April lows. NVIDIA Corp. (NVDA) is now only a 5% rally away from its all-time highs. This is no small feat considering the stock is coming off a 20%-plus correction following a record-setting Q1 performance.

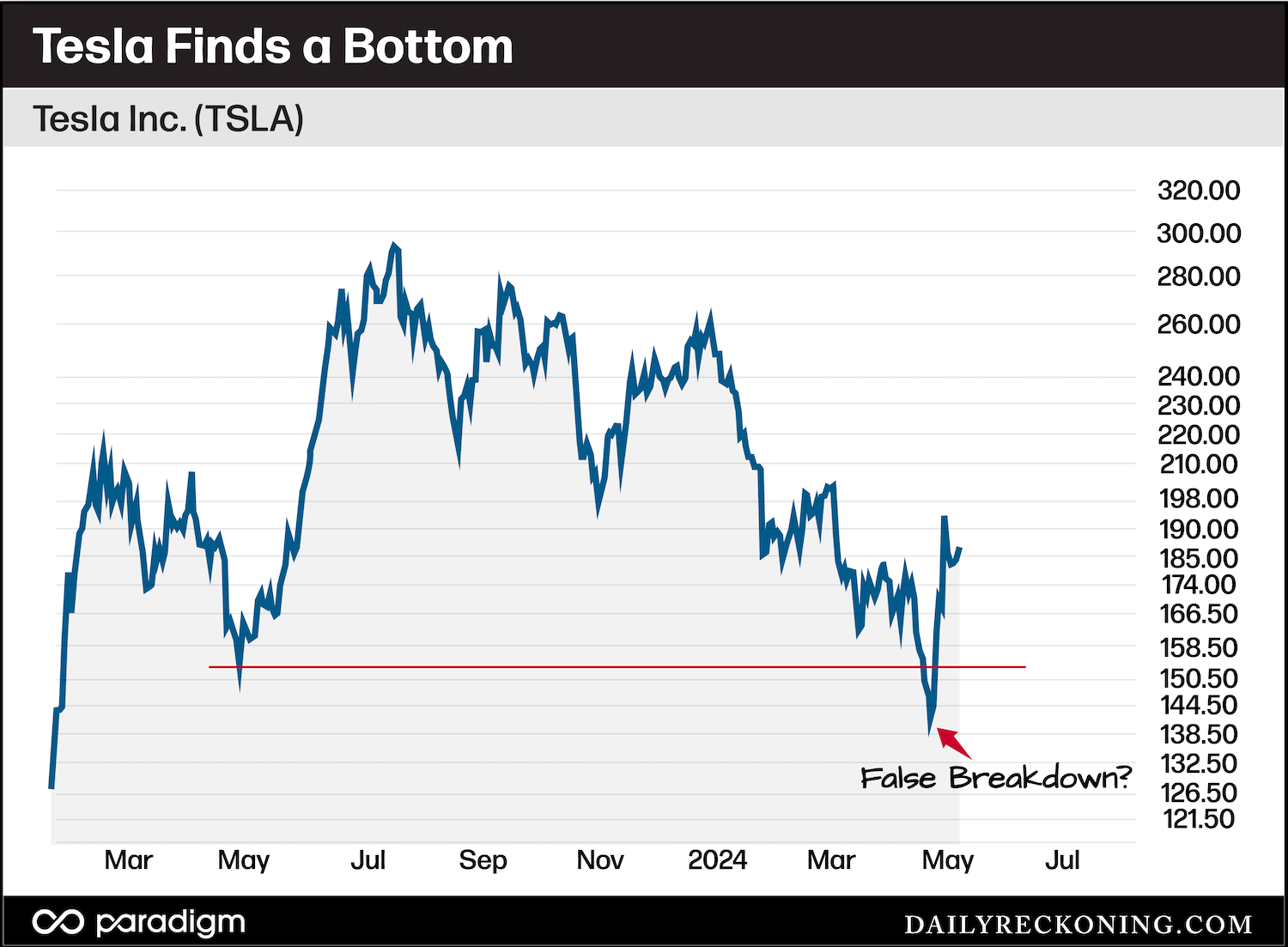

In fact, the Magnificent Seven are (almost) all piecing together significant rallies now that the bulk of quarterly earnings have hit the wire. Two notable laggards – Apple Inc. (AAPL) and Tesla Inc. (TSLA) – finally found traction and pushed higher after failing to participate in the first quarter melt-up rally.

Perhaps more importantly, both stocks rallied on “bad” earnings, according to the financial media and Wall Street analysts. Apple beat top and bottom line estimates, yet reported a 10% year-over-year drop in iPhone sales and offered lackluster guidance. Meanwhile, Tesla reported quarterly profits sinking to 3-year lows, and a slew of other concerns we covered in last week’s note.

One of our main concerns heading into spring trading was how some mega-caps like AAPL and TSLA were decoupling from the melt-up. But I think it’s time to cross that worry off the list. Unless we see these two names completely fill those earnings gaps and move lower, our bias should remain to the upside.

2 More Earnings Winners

Alphabet Inc. (GOOG) is another important earnings winner to watch as the rally continues to unfold. GOOG launched to new highs, jumping almost 10% after reporting an unexpected earnings beat.

You might recall that GOOG wasn’t looking too hot back in March as it corrected 15% off its January highs. But a strong snapback and subsequent earnings explosion have vaulted this stock back to top-performer status as it builds on its 20%-plus year-to-date gain.

One of the prime drivers of GOOG’s strong earnings reaction was a 20% pop in YouTube ad revenue, demonstrating that the advertising rut from the previous bear market is now firmly in the rearview.

“Advertising is so back,” a recent CNBC piece declares. “After a brutal 2022, when brands reeled in spending to cope with inflation, and 2023 defined by layoffs and cost cuts, the top digital advertising companies have started growing again at a healthy clip.”

GOOG isn’t hogging all the ad money, either. In fact, we’re seeing signs of a bigger turnaround amongst the social media also-rans.

Snap Inc. (SNAP) was the first of these names to come back from the dead after beating earnings estimates in late April. If you have any familiarity at all with this name, you might remember that many analysts were quick to bury it after a miserable earnings report back in early February that sparked an instant 35% selloff.

Somehow, SNAP managed to flip the script this go-round, posting its strongest growth in two years. Shares continue to drift higher into May, with the stock now approaching a bigger base breakout.

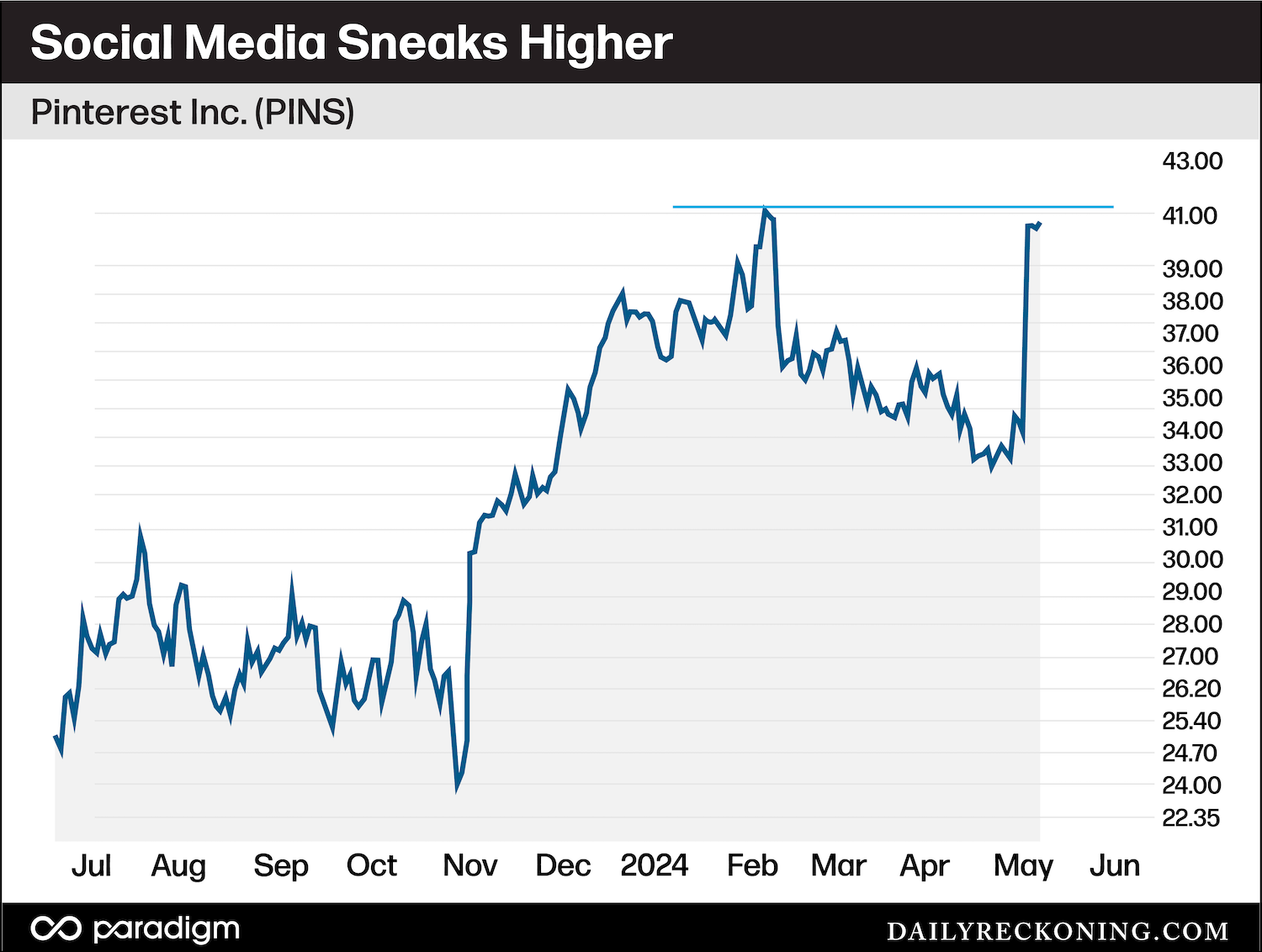

Pinterest Inc. (PINS) was the next social media name to break its losing streak following a stronger-than-expected earnings report. PINS shares kicked off the new trading month with a big earnings beat, launching a 20% rally back toward year-to-date highs. Like SNAP, the stock was caught in a 3-month slump following a previous earnings miss. Now, it’s working on its own breakout as it pushes toward levels we’ve not seen since late 2021.

I like SNAP and PINS here as they consolidate near breakout levels.

Both stocks remain well off their all-time highs and are on the edge of coming back into favor with investors following some pleasant earnings surprises. If market conditions continue to improve, I suspect we’ll see speculators trickle down the cap scale into names like these that are showing strong upside reversals.

By no means are market conditions perfect (they rarely are!). But now is not the time to press your shorts. Instead, I’m looking for unloved trade candidates like SNAP and PINS that are beginning to turn around and change the narrative.

The post Cocky Bears Outmatched: Tech Triumphs appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/cocky-bears-outmatched-tech-triumphs/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).