Markets Can Absorb Geopolitic Risks, To A Point

By Michael Msika and Jan-Patrick Barnert, Bloomberg Markets Live reporters and strategists

Geopolitics is having an impact on investment decisions again, and risks are rising as well as equity volatility. Yet under the hood, the stock market is absorbing the shock relatively well so far.

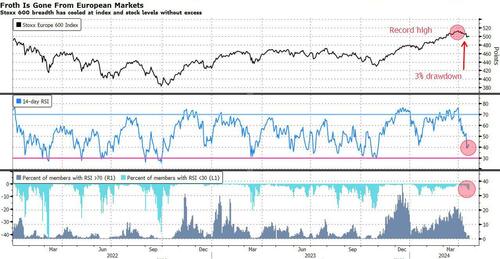

Stress levels have had a steep surge as tensions in the Middle East show no sign of abating. Systematic funds are reducing exposure, technicals are showing some cracks, but the big picture for markets hasn’t changed much. In fact, price action on Friday almost seems mild, with a rise in oil prices reversing. Market breadth has cooled, both at a stock and index level, with just a 3% drop this month.

“This seat has been very busy, but hasn’t seen signs of panic,” says Carl Dooley, head of EMEA trading at TD Cowen. “While optically we see indicators such as the VIX print at similar levels to last October when markets were lower and realized volatility was higher, other indicators we track, such as the demand for crash protection, haven’t moved. It has all felt very orderly and technical.”

After the market was focused on chasing the upside, there is a more balanced approach to volatility. The pressure from funds selling options is now being matched by options demand from investors hedging positioning. This is “keeping the risk environment far more two-way than anytime in recent history,” says Nomura’s Charlie McElligott.

US stocks are down about 4.5% over six trading days. That’s a relatively chilled decline given the severity of headlines coming from the Middle East, especially compared to some of the sudden, more elevator-like moves in 2022 and in the summer of 2020. Even Nvidia, the biggest bullish bet in this market, is just down 20% after a 600% gain.

There’s no talk about emergency meetings to reduce risk and no signs of hasty investment decisions. Commentary from trading desks about hedge funds and other buy-side flows is still carrying a notion of dip buying and is far from a sell everything market. Granted, risk taking is getting a bit of a re-think, positioning is being adjusted along with other thematic indexes that soared in 2024 but now show big 5-day declines.

Trend followers such as CTAs are a potential wild card, with their still elevated exposure. But their reaction depends on stop-loss levels being breached, and so far both the market reaction and the impact on prices have been reassuring.

“Leverage concerns about CTAs are easing,” say Societe Generale Sandrine Ungari, adding that positioning has been reduced, while breakpoints, the percentage move needed on the asset for CTAs to reduce exposure, are now less negative. In addition, CTAs are diversified across asset classes, so losses in equities would have been offset by gains in commodities and FX. “A portfolio that allocates equally across asset classes is flat to slightly up,” she says.

The VIX curve has flipped into concern levels as previously mentioned in this column, and the steep rise is similar to early 2022, when Russia invaded Ukraine. Yet the very low base line of stress is keeping markets well below panic levels at this point.

“Further developments in the Middle East remain subject to increased uncertainty,” says Deka Investment CIO Christoph Witzke. “As a fund manager, I am paying particular attention to the reaction of the oil price and the US dollar. So far, the movement has been muted. If this remains the case, we are currently more likely to see a recovery in equities over the next few days/weeks than the emergence of a new downtrend. The longer-term framework remains quite constructive.”

Tyler Durden Mon, 04/22/2024 – 17:40

Source: https://freedombunker.com/2024/04/22/markets-can-absorb-geopolitic-risks-to-a-point/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).