Markets Chop As Wall Street Awaits Apple Earnings After Bell, NFP Friday For Market Direction

US equities ended their two-day slide as tech companies surged late in the session. The trading day has been choppy, with Wall Street now turning its attention to Apple’s earnings after the bell. Some analysts anticipate Apple will reveal a major buyback program to offset potentially disappointing earnings amid countless reports from research firms in recent months about slumping iPhone sales overseas.

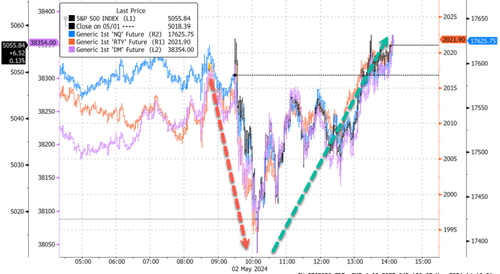

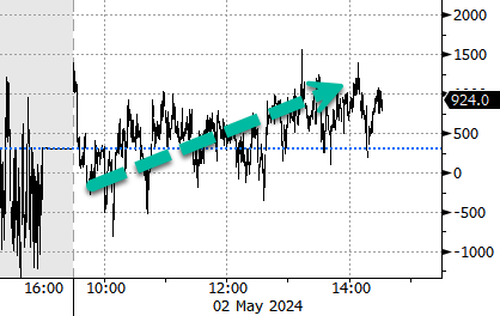

Let’s begin with the choppy session in main equity index futures. Futs tumbled at the start of the cash session and caught a bid about 30 minutes later, or around 1000 ET. Since then, price action has been mostly higher into the late afternoon trade.

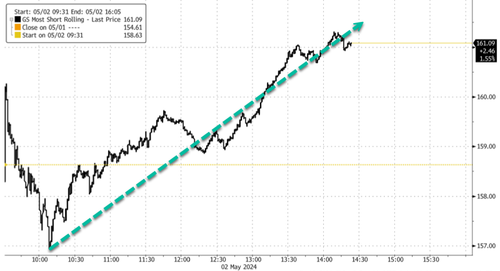

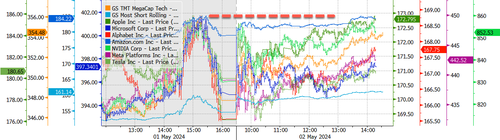

Despite the chop, Goldman’s Most Shorted index (GSCBMAL) surged higher, up 4% on the session. Names like Carvana Co. were up 32% late in the session after a better-than-expected first-quarter earnings release. The company is heavily shorted, with about 27.6% of the float short, contributing to the surge in price.

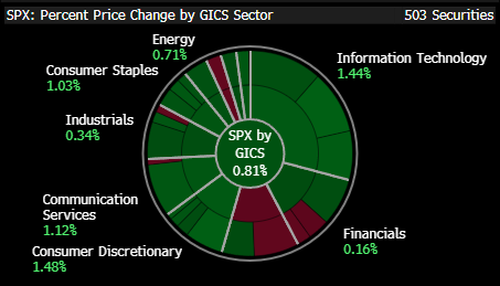

Within the S&P500, consumer discretionary and technology stocks were up 1.49% and 1.39%, respectively. Almost green across the board.

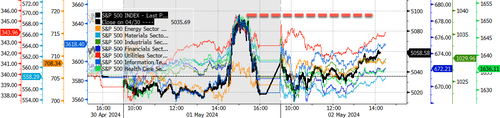

Regarding the chop, most S&P500 sectors are still below levels after Wednesday’s late session pump and dump.

NYSE TICK data shows that most buy programs were out ahead of Apple’s earnings.

Again, more chop with individual names in the tech sector & Mag7.

Ahead of Apple earnings, here’s Goldman’s preview:

All eyes on AAPL tonight. We have positioning at a 7 out of 10, with a recent uptick in interest in the name (altho remains a BM underweight). Focus commentary 1) China trends in March qtr (cons has China revs -11% y/y in March vs the -13% y/y last qtr) .. 2) commentary on AI.. 3) Services visibility (including TAC + App Store)

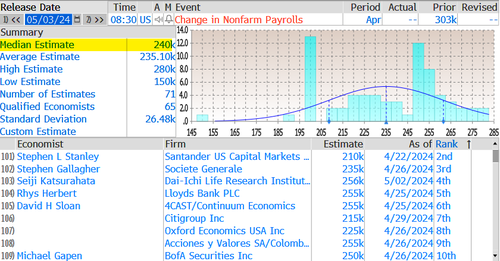

In the macro world, Wall Street traders are preparing for Friday’s announcement of March non-farm payrolls data. The median estimate tracked by Bloomberg is 240k.

22V Research polled investors and found that 30% of respondents believe Friday’s jobs report will be “risk-on,” 27% expect a “risk-off” reaction, and 43% said “mixed/negligible.”

Meanwhile, the S&P500 is wedged between the 100-day Simple Moving Average (4979) and the 50-day Simple Moving Average (5129). A combination of Apple earnings (after the bell) and jobs data (Friday) could determine the next direction in price action.

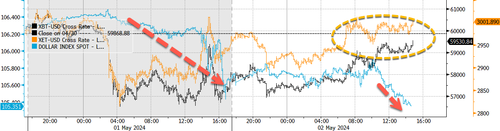

One day after the Federal Reserve kept the target range for the benchmark rate at 5.25% to 5.5%—after serious concern that the US is headed for stagflation—bond yields across the curve leaked lower late in the session.

In FX, the greenback is on pace for its biggest drop this year as yields continue sliding. Cryptos, such as Bitcoin and Ethereum, trade mainly in chop. BTC/USD is trying to recover the $60k handle late in the cash session.

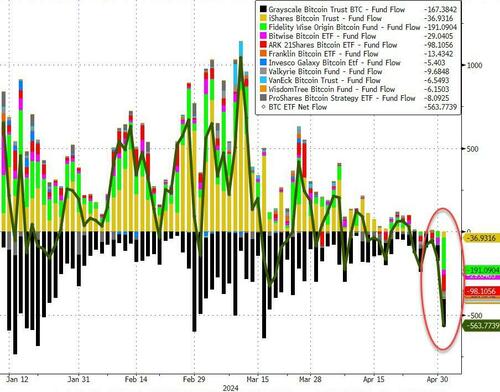

We noted early that BlackRock’s ETF saw around $37 million in outflows for the first time, while the remaining spot Bitcoin ETFs collectively notched over $526.8 million in outflows.

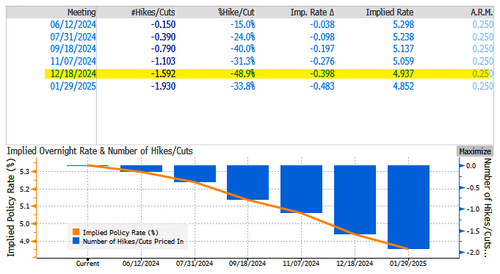

Rate traders have priced in about 1.6 cuts this year—up from 1.15 yesterday—but down from nearly 7 earlier this year. There has been dramatic repricing in Fed cuts due to sticky inflation.

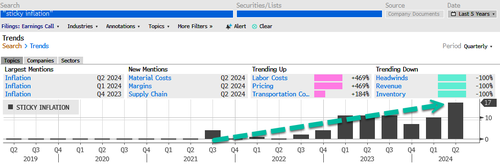

On inflation, using Bloomberg data, the number of mentions in earnings calls for ”sticky inflation“ surged to record highs in this earnings season. Several mega-corporations like Starbucks and McDonald’s have warned about struggling working poor consumers.

Here’s the recap of some of today’s top corporate news (courtesy of Bloomberg):

-

Peloton Interactive Inc. said Chief Executive Officer Barry McCarthy is stepping down as the company undergoes a major restructuring that will reduce its global workforce by 15% in an effort to slash costs.

-

MGM Resorts International reported first-quarter sales and earnings that beat analysts’ projections, benefiting from the post-pandemic recovery in Macau and a new partnership with Marriott International Inc. that helped fill hotel rooms.

-

Carvana Co. reported stronger earnings with revenue topping expectations as the company digs into its restructuring plan and regains sales momentum.

-

DoorDash Inc., the largest food delivery service in the US, offered a disappointing profit forecast for the current quarter as the company invests in expanding its list of non-restaurant partners and improving efficiency.

-

Moderna Inc. reported a narrower first-quarter loss than Wall Street had expected, as the biotech giant’s cost-cutting helped offset a steep decline in its Covid business.

-

Apollo Global Management Inc. reported higher first-quarter profit as the firm raked in more management fees and originated a record $40 billion of private credit, a key area of growth.

By the way, Boeing shares continued to surge even after another Boeing whistleblower died.

no whistleblowers left. buy buy buy pic.twitter.com/BMOFzsvOi8

— BuccoCapital Bloke (@buccocapital) May 2, 2024

A recap of this morning’s macro data:

-

Unit Labor Costs Soar In Q1 As ‘AI Productivity Boom’ Fails To Show Up

-

US Factory Orders Rise In March… But February Saw Yet Another Downward Revision

…. and it’s an election year – remember that… We cited a note from Goldman’s Adam Crook that points out the Fed and US Treasury are in ‘full-blown stock support mode’… Powell can’t let Biden’s stock market crash… Pro subs read here.

Anyways, all eyes are on Apple after the bell.

Tyler Durden Thu, 05/02/2024 – 16:00

Source: https://freedombunker.com/2024/05/02/markets-chop-as-wall-street-awaits-apple-earnings-after-bell-nfp-friday-for-market-direction/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.