Don’t let your Congressperson get away with cheating you out of your benefits.

There are two primary ways in which U.S. dollars are created. The rhyming pneumonic is: Bank lending and federal spending.

1. Contrary to popular myth, when a bank lends, it does not lend depositors’ funds. It creates new dollars by increasing the borrower’s bank account balance.

For example, when you take out a mortgage, your bank simply increases the balance in your checking account.

That adds dollars to the M2 money supply measure.

Your bank can’t do this endlessly. It is limited in its ability to create dollars by its reserves and its capital.

The reserve limitation is termed “fractional reserve lending,” which means your bank must keep a fraction of its lending (often 10%) in reserve to handle a bank run.

However, this is not a real limit because banks can borrow reserves from the Federal Reserve.

The real limit to bank lending is its capital. This is discussed in more detail here.

Rather than the common “fractional reserve lending” term, the more correct limit should be called “fractional capital lending.”

2. Contrary to popular myth, the federal government does not spend tax dollars. Instead, it creates new dollars by spending.

Even if the federal government didn’t collect a penny in taxes, it could spend infinite amounts forever.

Most people are amazed to learn that the federal government (unlike state/local governments) destroys all tax dollars upon receipt.

When you pay taxes, you take dollars that are part of the M2 money supply measure and send them to the Treasury, where they instantly become part of no money supply measure.

In effect, they cease to exist.

(Treasury dollar holdings are not part of any money supply measure because the Treasury has the infinite ability to create dollars. It’s supply is endless.)

The sole purposes of federal taxes are not to provide spending money to the federal government but to:

A. Control the economy by taxing what the government wishes to discourage and giving tax breaks to what the government wishes to reward

B. Assure demand for the U.S. dollar by requiring taxes to be paid in dollars.

Unlike state and local government taxes, which do fund state and local government spending, federal taxes do not fund federal spending.

The difference is that state and local governments are monetarily non-sovereign, while the federal government is Monetarily Sovereign.

As the original creator of the U.S. dollar, the federal government rules over all aspects of the dollar, its supply, and its value.

To pay a creditor, the federal government sends instructions (not dollars) to the creditor’s bank, telling the bank to increase the balance in the creditor’s checking account.

When the bank does as instructed, new dollars are created and added to the M2 money supply measure. The bank can do this because it clears that money creation through the Federal Reserve.

In short the federal government approves the bank’s creation of dollars.

All of the above substantiates one simple point: The U.S. federal government has infinite dollars available to spend. If it wished, it could pay a creditor a trillion dollars or a hundred trillion dollars today at the touch of a computer key.

Unlike state and local governments, the federal government is not burdened by debt and cannot be insolvent.

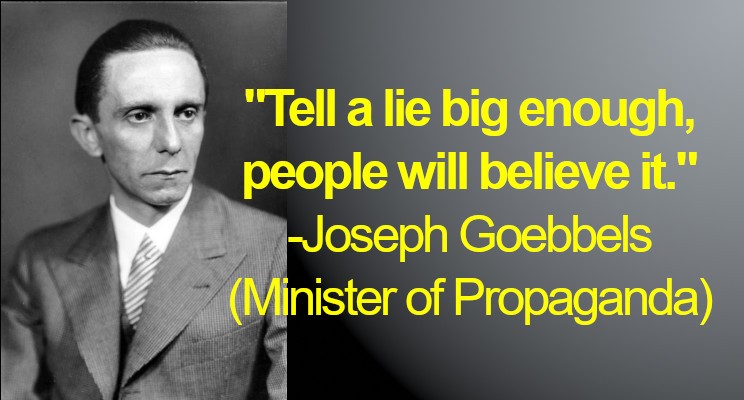

Keep that in mind as you read an example of the Big Lie in economics:

Story by Maurie Backman, The Motley Fool

Social Security is not in the best financial shape. The program gets the bulk of its funding from payroll taxes.

But in the coming years, that revenue stream is expected to shrink as baby boomers exit the workforce in droves.

Wrong.

Payroll tax dollars, which come from the M2 money supply measure, cease to be part of any money supply measure when they reach the U.S. Treasury. Thus, payroll tax dollars are destroyed upon receipt.

The federal government always creates new dollars to pay its financial obligations.

Social Security is an agency of the Monetarily Sovereign U.S. federal government, which has the infinite ability to create its sovereign currency, the U.S. dollar.

It never can run short of dollars. Therefore, no federal government agency can run short of dollars unless Congress and the president want that.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

There is nothing to prevent the U.S. government from creating and adding as many dollars as are needed to keep Social Security Solvent without collecting a penny in taxes:

Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

Social Security can tap its trust funds to keep up with scheduled benefits for a period of time. But once those trust funds run dry, benefit cuts may have to happen. And recent projections call for a trust fund depletion date of 2034, which isn’t so far away.

The so-called “trust funds” are fake. They simply are line items on balance sheets that can be increased or reduced by the federal government whenever it wishes to.

Federal trust funds bear little resemblance to their private-sector counterparts; therefore, the name can be misleading.

A “trust fund” implies a secure source of funding. However, a federal trust fund is simply an accounting mechanism used to track inflows and outflows for specific programs.

In private-sector trust funds, receipts are deposited, and assets are held and invested by trustees on behalf of the stated beneficiaries. In federal trust funds, the federal government does not set aside the receipts or invest them in private assets.

Rather, the receipts are recorded as accounting credits in the trust funds and then combined with other receipts that the Treasury collects and spends.

Further, the federal government owns the accounts and can, by changing the law, unilaterally alter the purposes of the accounts and raise or lower collections and expenditures.

Of course, it’s in lawmakers’ best interest to try to avoid benefit cuts and the senior poverty crisis they have the potential to cause. To that end, several solutions have been proposed to prevent that unwanted scenario.

If it were in the “lawmakers’ best interest,” there would be no funding crises. Congress would simply vote to add dollars to Social Security.

That is how Congress, the President, and all other federal agencies are funded. Congress votes and dollars are created from thin air.

However, lawmakers have a different “best interest” from the masses. The very rich bribe lawmakers to widen the Gap between the rich and the rest. Since “rich” is a comparative term, widening the Gap makes the rich richer.

Yes, that’s right. Making you poorer actually makes the rich richer.

The “best interest” of the lawmakers is to receive dollars from wealthy supporters.

One idea that’s been gaining traction is increasing Social Security’s full retirement age (FRA), which is the age at which seniors can claim their monthly benefits in full without a reduction.

For workers born in 1960 or later, FRA is 67. However, some lawmakers suggest increasing FRA to 68 to 69 so that Social Security has more time before fully paying those benefits.

This is unnecessary and only makes the people poorer—more years without Social Security support. (Watch for attempts to do the same thing to Medicare—more years without healthcare insurance.)

It’s an idea that could potentially prevent benefit cuts.

But that is precisely what it is — a benefit cut. It’s more years without a benefit.

But it’s also an idea that might hurt workers in a very notable way. Here are some consequences that might ensue if the FRA for Social Security is raised by a year or two.

1. You may have to work longer

It’s possible to claim Social Security before reaching FRA. You can take benefits once you turn 62. But for each month you claim them ahead of FRA, they get reduced permanently.

Due to a lack of retirement savings, you may be unable to afford a cut to your Social Security income.

But if FRA is raised, you’ll have to wait longer to get your full monthly benefit without a reduction. That means you may have to work longer, which you may not want to do—especially if your job is stressful or harmful to your health.

In other words, it’s an unnecessary benefit cut.

2. You may have less opportunity to earn delayed retirement credits

Right now, seniors who postpone their Social Security claims past FRA get to accrue delayed retirement credits.

Those credits boost benefits by 8% a year so that someone with an FRA of 67 who files at 70 gets to snag a permanent 24% increase to their monthly Social Security check.

Currently, delayed retirement credits stop accruing at age 70. However, unless the rules change, if FRA is increased, today’s workers will be left with less opportunity to grow their Social Security benefits.

Another unnecessary benefit cut.

3. You may be subject to an earnings-test limit for longer

You’re allowed to work and collect Social Security at the same time. And once FRA arrives, you can earn any money without risking having benefits withheld.

However, the current rules dictate that Social Security recipients who work and have not reached FRA are subject to an earnings-test limit.

Earnings beyond that limit result in withheld Social Security income. If FRA is raised to help prevent Social Security cuts, workers could be subject to an earnings-test limit for longer.

This unnecessary benefit cut will hurt those who are not rich. Notice there is no call for ending tax breaks given to the rich. The federal government seems to have plenty of money for those tax gifts to the rich but, strangely, not enough to support Social Security and Medicare.

All told, increasing FRA for Social Security has some serious drawbacks. Lawmakers must weigh the pros and cons to determine whether pushing FRA to 68 or 69 is a good idea.

Rather than engaging in theatrical “struggles” to make less money to cover more people, the federal government could and should:

- Eliminate FICA. Those dollars do not increase the government’s ability to fund Social Security (and ability that is infinite)

- Provide Social Security benefits to every man, woman, and child in America, regardless of age, income, or wealth.

The rich bribe the lawmakers to make you believe federal taxes fund federal spending and give you benefits; taxes must be increased. This is the Big Lie in economics.

The federal government has the financial power to provide:

- Social Security payments to you and every man, woman, and child in America.

- Comprehensive, no-deductible Medicare for you and every man, woman, and child in America

- Free college education for you and every American who wanted one.

- An end to poverty and hunger in America.

- An end to homelessness in America

- New roads and bridges wherever needed

- Financial support for every scientific research and development project imaginable.

In short, money is no object for the federal government. We need to understand that fact and then have the imagination and desire to use the money to build a better world.

It you believe it sounds too good to be true, it’s because the rich have been successful in indoctrinating you with the Big Lie.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Source: https://mythfighter.com/2024/04/17/dont-let-your-congressperson-get-away-with-cheating-you-out-of-your-benefits/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).