What is Considered a Great Credit Score?

Getting a loan for your business can be tough, and it requires you to have an impressive credit score. If you don’t know what a credit score is, it’s a number that tells your lender whether you can manage your debt or not. Money lenders check your credit report before issuing you business loans because that’s the only way for them to determine your eligibility. While it might be easier for old businesses to have a long credit history, it can be more challenging for startups because of their lack of experience. If you don’t have a credit history, the lender might consider your personal credit report to check your credit score.

Different types of credit have different criteria for measuring your credit score, and what is considered a good score also depends on the type of credit you are using. You can use multiple credit scores, but the most popular type is FICO. There are also multiple versions of a credit score for each kind; hence, it’s not surprising that new business owners find this process confusing and overwhelming. If you want to have a golden credit score, you first need to understand the type of credit you use; once you have done that, you can start working to achieve a great credit score.

A Good Credit Score

FICO’s credit score ranges from 300 to 850 and has two categories for credit score. Here are the ranges for credit scores.

800+: Exceptional

740 – 799: Very good

670 – 739: Good

580 – 669: Fair

579 or lower: Poor

The average credit score that’s considered good is between 670 – 739. There are chances when you can even have a very good or exceptional credit score. While average credit scores for most business owners are around the range of good, there are things you can do to boost your credit score and achieve the range of exceptional. If you have a score higher than average, you have a better chance of getting a loan with low-interest rates.

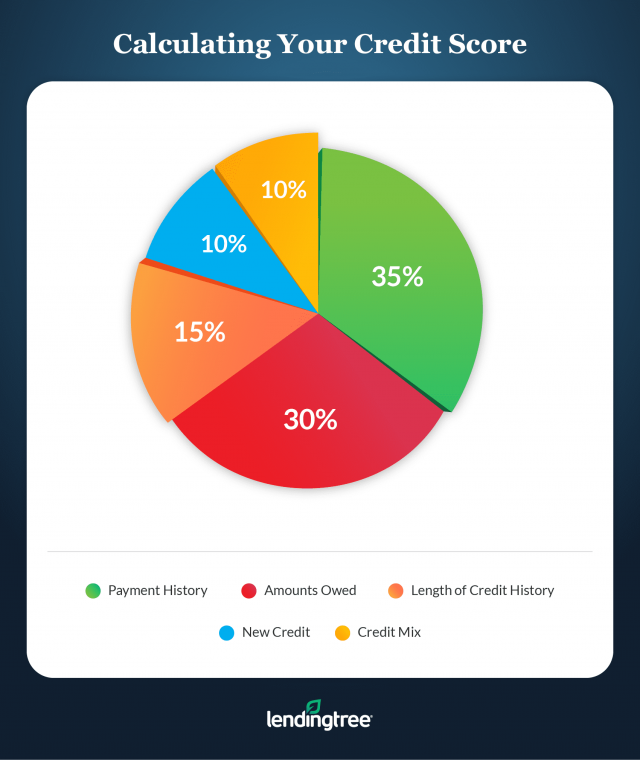

What Impacts Your Credit Score?

Following are some of the factors that affect your credit score.

Payment History

You should ensure that you have a dependable payment history. This will include the repayments of your previous debt or bills. If you are found to be a defaulter, it will affect your credit score, and the lender will have a hard time trusting you with their money.

Length of Credit History

The length of your credit stacking history can also help you build trust with your lender. It will work in your favor if you have been using an account for a long time and have not made that many late payments.

Amounts Owed

Lenders also check your credit utilization ratio to identify how much balance you have as compared to your credit limit; the lower the number is, the better.

New Accounts

You should also ensure that you don’t make several new accounts in a short period of time because that will make you look a bit suspicious, as it implies that you don’t have sufficient cash flow and you are looking for ways to take on more debt.

Benefits of a Good Credit Score

Having a golden credit score has countless benefits for business owners, and some of them are as follows.

● With a good credit score, you can get any credit card that offers high rewards.

● A good credit score enables you to get any loan.

● If you have a credit score above 670, you’re in the prime lending category, which means that you might not be able to get the top rates, but you can surely get many offers.

● In case of emergency, a good credit score helps you in getting a personal loan with lower interest rates.

How to Maintain a Great Credit Score?

Make Payments On-Time

On-time payments can really make a difference in your credit score. If your credit report shows that you pay your bills and debt on time, it will make you more trustworthy for the lenders.

Check the Errors

You should check your credit report regularly to identify any errors. Your goal should be to ensure that there are no errors in your report that can lower your credit score. Reviewing your credit report regularly enables you to identify the errors before it’s too late.

Don’t Apply for Credit Often

When you apply for a loan, the lender does a hard inquiry on your account, which already reduces a few points from your credit report. Making too many credit requests can cause you to have a lower credit score, so make sure your credit applications are at least six months apart so your credit score gets time to bounce back.

If you are looking for a lender who can provide you with a business loan at a low-interest rate, reach out to 0Percent.

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).