The S&P 500 Rises to Its Highest Point of 2023 as Gloomier Outlook Puts 2024 Rate Cuts in View

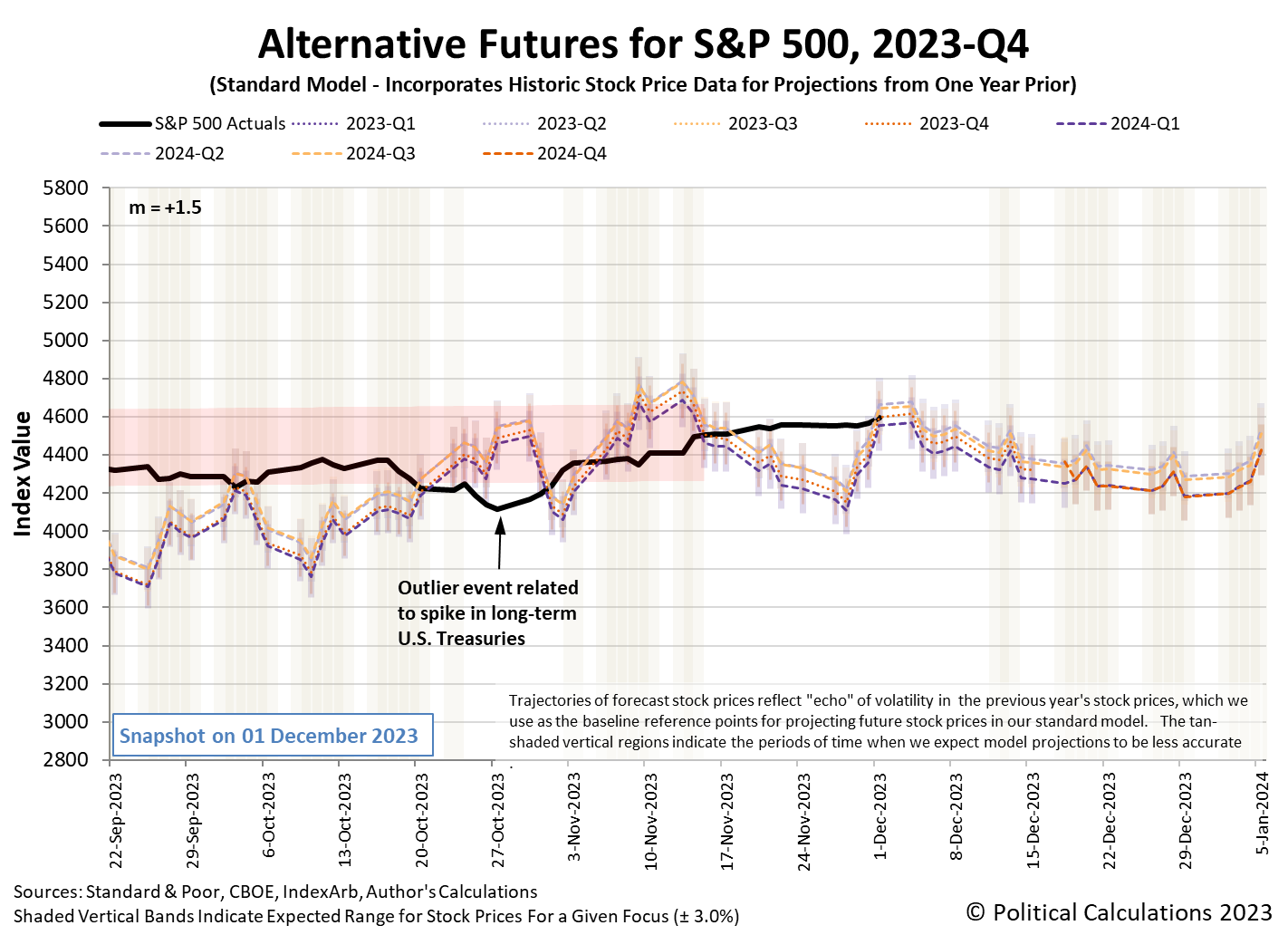

The S&P 500 (Index: SPX) rose nearly 0.8% to close at 4594.63 on Friday, 1 December 2023. That’s the highest close the index has reached during 2023, putting it just 4.2% below its all-time record high close of 4,796.56 from 3 January 2022.

Since the late October 2023 spike in long-term U.S. Treasury yields, stock prices have risen as the outlook for economic growth the U.S. economy shows signs of slowing. In the past week, the Atlanta Fed’s GDPNow tool‘s estimate of real GDP growth for the current quarter of 2023-Q4 dropped to +1.2% from last week’s projected +2.1% annualized growth following gloomy reports on new construction and manufacturing during the week that was.

Combined with more data pointing to slowing demand-driven inflation, the prospects for interest rate reductions in 2024 has increased. The CME Group’s FedWatch Tool now anticipates the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through next February (2024-Q1). Starting from 20 March (2024-Q1), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

In the short term, that’s positive for stock prices because lower interest rates benefit firms that rely on debt to finance their growth and because indications of reduced earnings from slowing economic conditions have yet to register. The latest update for the alternative futures chart shows the trajectory of the S&P 500 is consistent with investors focusing their attention on either the current quarter of 2023-Q4 or the slightly more distant future quarter of 2024-Q1, as the short-term echo event affecting the dividend futures-based model projections that we discussed in last week’s edition has come to an end.

Other stuff happened to influence the trajectory of stock prices, here’s our summary of the past week’s market moving headlines:

- Monday, 27 November 2023

-

- Signs and portents for the U.S. economy:

- Brent falls below $80 ahead of OPEC+ meeting

- More US shoppers tack on buy now, pay later debt for Cyber Monday

- Higher mortgage rates weigh on US new home sales in October

- Fed minions are losing money, are expected to deliver multiple rate cuts in 2024:

- Fed may need four years to recoup income loss, St. Louis Fed study says

- US recession will prompt 175 basis points in Fed cuts next year, DB economists say

- Bigger trouble, stimulus developing in China:

- China’s industrial profits growth slows, keeps stimulus calls alive

- China needs to unblock, sustain financial channels for private firms

- China’s central bank pledges to support domestic demand

- BOJ minions see bigger inflation developing:

- ECB minions claim they’re not done fighting inflation:

- Dow, S&P, Nasdaq end Cyber Monday with marginal losses

- Tuesday, 28 November 2023

-

- Signs and portents for the U.S. economy:

- Some Fed minions claim they’re still thinking about resuming rate hikes, others say probably not:

- Fed’s Bowman says she still expects another interest rate hike

- Fed’s Waller: “Increasingly confident” policy is in the right spot

- More stimulus developing in China:

- BOJ minions get more data telling them to end never-ending stimulus:

- Japan’s price trend gauge hits record, heightens case for BOJ exit

- Japanese firms raise monthly regular pay by record amount this year – government poll

- ECB minions get data showing bigger trouble developing in the Eurozone:

- Nasdaq, S&P, Dow eke out gains on Fed comments, consumer confidence data

- Wednesday, 29 November 2023

-

- Signs and portents for the U.S. economy:

- Contracts to buy existing homes decline to a record-low in October – NAR

- WTI Extends Losses After Across-The-Board Inventory Builds, Record Crude Production

- Fed minions expected to be too slow to prevent recession in 2024:

- Overly cautious Fed could lead to mild US recession next year -Vanguard

- Fed hawks and doves: The latest from US central bankers

- Ackman Flip-Flops, Now Sees First Rate Cut As Soon As March

- BOJ minions not too anxious to end never-ending stimulus:

- BOJ policymaker rules out near-term policy shift, calls for caution

- BOJ policymaker says premature to debate exit from negative rate policy

- Nasdaq, S&P, Dow end mixed, but markets remain on track for big November gains

- Thursday, 30 November 2023

-

- Signs and portents for the U.S. economy:

- Oil falls over 2% after OPEC+ cuts fall short of expectations

- US consumer spending cools; labor market gradually slowing

- US existing home sales to stay subdued next year, along with prices

- Fed minions think they’re done with rate hikes, but aren’t sure yet:

- Bigger trouble, stimulus developing in China:

- China’s factories fall deeper into contraction, more policy support expected

- China factory activity surprisingly expands in November – Caixin PMI

- Contrasting China November factory surveys highlight need for stronger stimulus

- ECB minions not keeping policies up with changes in inflation:

- ECB’s Nagel: inflation trends encouraging but rate cut talk too early

- Euro zone inflation tumble pits ECB against markets

- German inflation eases to 2.3% in November

- ECB Rate-Cut Expectations Soar After EU Inflation Cools More Than Expected

- Nasdaq, S&P rally takes a beat on last day of massive November; Salesforce boosts Dow

- Friday, 1 December 2023

-

- Signs and portents for the U.S. economy:

- Oil prices fall more than 2% as investors wary of OPEC+ cuts

- US manufacturing mired in weakness, economy heading for slowdown

- Fed minions expected to deliver rate cuts in 2024:

- Powell says Fed to move ‘carefully’ on interest rates, ‘soft landing’ taking shape

- US bond investors brace for Fed rate cuts in 2024

- Fed hawks, doves, and centrists: How US central bankers’ views are changing

- Central bank minions expected to start planning rate cuts:

- BoC to cut rates starting in Q2 2024, house prices seen flat in 2024: Reuters poll

- Goldman Sachs now expects ECB’s first rate cut in Q2 2024

- S&P 500 rises to highest close of 2023 amid rate cut optimism

Just a few more weeks to go for 2023!

Image credit: Stable Diffusion DreamStudio Beta. Prompt: “A bull stands at the top of a hill, looking at an even bigger hill. Golden hour, highly detailed, photo, Burrard-Lucas, 4K.”

Source: https://politicalcalculations.blogspot.com/2023/12/the-s-500-rises-to-its-highest-point-of.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).