S&P 500 Falls Short of Reaching New High as 2023 Ends and 2024 Begins

The S&P 500 (Index: SPX) came close to reaching and surpassing its two-year old record high of 4,796.56 from 3 Janary 2022 in the final weeks of 2023. Alas, the index fell short and closed out 2023 at 4,769.83, just 0.56% shy of setting a new record.

That’s close enough for the S&P 500 to reach a new high on absolutely no news with little more than typical day-to-day volatility. Then again, that’s all it took for the 505 component stocks that make up the S&P 500 to top out at its old record on the first trading day of 2022 before beginning its descent into a prolonged bear market on the prospects of rising interest rates.

Stock prices have since nearly recovered to their old record high on the strength of a rally that began in late-October 2023 after investors determined the Federal Reserve had reached the end of the series of rate hikes it began in March 2022. Now, the CME Group’s FedWatch Tool indicates investors are not anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 20 March 2023 (2024-Q1), when the Fed is expected to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

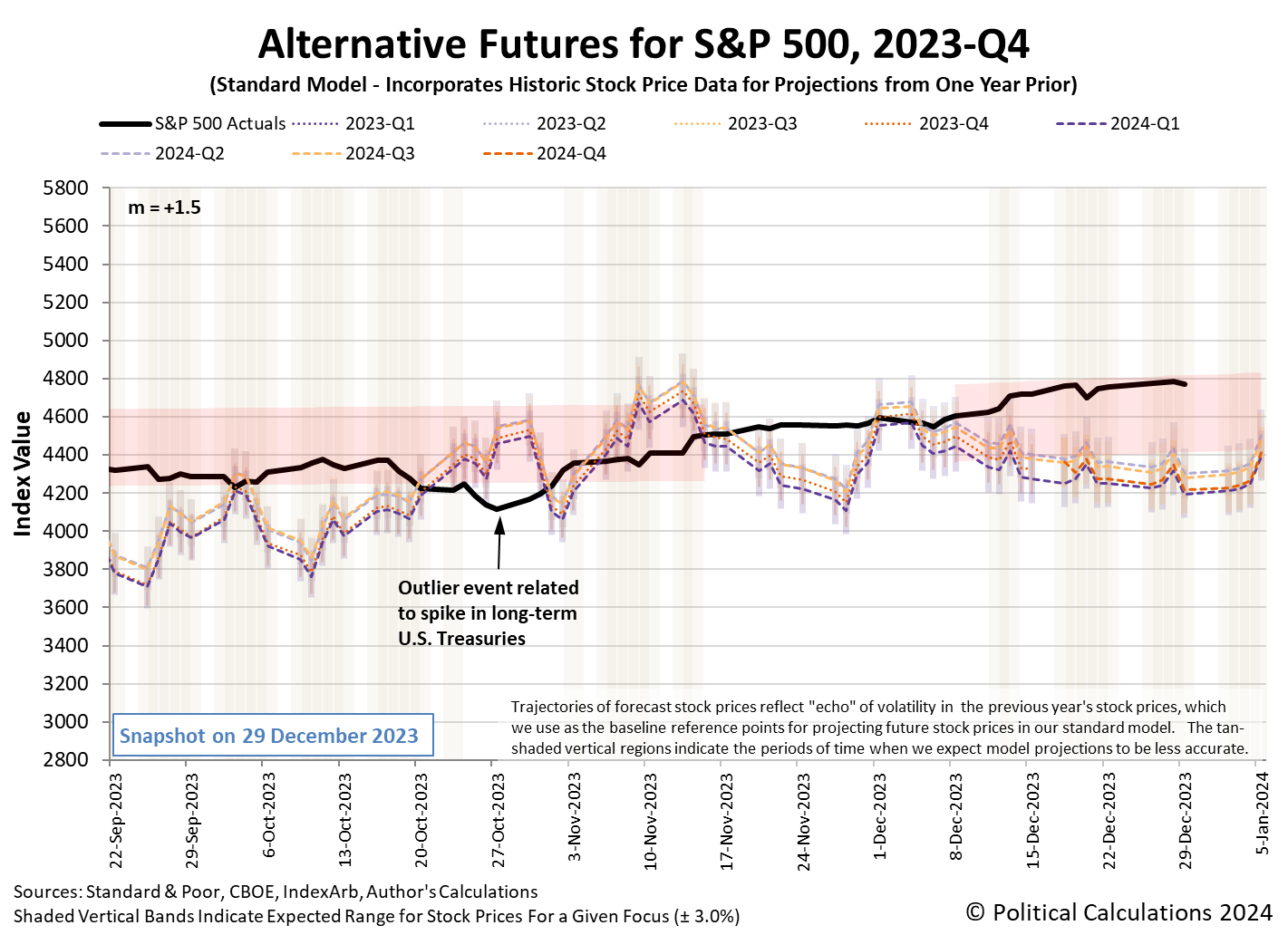

These strengthening future expectations were enough to deliver an old-fashioned Santa Claus rally at the end of 2023, which more or less ran out of steam in the final days of the year. The latest update of the alternative futures chart shows the whole rally through the final trading day of 2023.

There was very little new information for investors to absorb during the final trading weeks of 2023. Here is what passes for the market-moving news headlines during that time.

- Monday, 18 December 2023

-

- Signs and portents for the U.S. economy:

- Fed minions admit they’re confused, will be cutting rates in 2024:

- Goolsbee ‘confused’ by market reaction to Fed chief’s rate-cut remarks

- Fed’s Mester says next phase is to see how long its policy needs to remain ‘restrictive’ – FT

- Fed’s Daly: rate cuts may be needed next year to prevent overtightening -WSJ

- Bigger stimulus developing in China:

- China’s weak property sector, retail sales keep stimulus calls alive

- Exclusive: China to run budget gap of 3% of GDP in 2024, issue special debt

- China banks step up sales of bad loans as consumer defaults rise

- ECB minions thinking about cutting rates in June 2024:

- Nasdaq, S&P extend seven-week bull run, Dow ends flat as year-end comes into view

- Tuesday, 19 December 2023

-

- Signs and portents for the U.S. economy:

- US single-family housing starts scale more than 1-1/2-year high

- High US interest rates add to headwinds for small businesses

- Fed minions claim they are “nicely positioned” for inflation, claim no urgent need to cut rates:

- Fed’s Barkin: Central bank ‘nicely positioned’ amid inflation retreat

- Fed’s Bostic: No ‘urgency’ for rate cuts

- Inflation, not politics or markets, will determine Fed’s next move -Goolsbee

- BOJ minions keep never-ending stimulus alive, for now:

- Wall Street ends higher as rate-cut fever lingers

- Wednesday, 20 December 2023

-

- Signs and portents for the U.S. economy:

- Oil settles up on Red Sea tensions; gains capped by US stock builds

- US existing home sales unexpectedly rise in November

- US 30-year mortgage rate drops to 6.83%, its lowest since June

- Fed minions try playing coy over coming interest rate cuts:

- Fed’s Harker open to lowering interest rates, but not imminently

- Fed hawks, doves, and centrists: Tracking US central bankers’ views

- Wall Street tumbles to sharply lower close as abrupt sell-off snaps rally

- Thursday, 21 December 2023

-

- Signs and portents for the U.S. economy:

- Speculations about what Fed minions will do in 2024:

- Is the ‘Big Ease’ coming in 2024 or will rate-cut hopes get dashed?

- Why Traders Are Refusing To Give Up On The Idea Of A March Fed Rate-Cut

- BOJ minions get reason to keep never-ending stimulus alive a little longer:

- Wall St ends sharply higher, rebounding with a boost from chips

- Friday, 22 December 2023

-

- Signs and portents for the U.S. economy:

- Oil eases ahead of Christmas break on possible future Angola output increase

- US inflation decelerating in boost to economy

- US durable goods orders surge in November on aircraft

- US new home sales fall to one-year low in November

- Fed rate cuts firmly in view for 2024, even as rate-setters shift

- S&P 500 posts best weekly win streak in over six years as Wall Street rally powers on

- Tuesday, 26 December 2023

-

- Signs and portents for the U.S. economy:

- Oil jumps over 2% amid Red Sea vessel attacks, rate cut hopes

- Home prices continued climb in October, surveys show

- BOJ minions creep closer to ending never-ending stimulus, dissent over messaging:

- BOJ’s Ueda signals chance of policy shift, progress on price goal

- Ex-BOJ board member criticises governor Ueda’s market messaging

- Nasdaq, S&P, Dow kick-off final week of 2023 with gains, as Wall Street eyes record close

- Wednesday, 27 December 2023

-

- Signs and portents for the U.S. economy:

- Home prices continued climb in October, surveys show

- Bigger stimulus developing in China:

- Signs of stimulus gaining traction in China:

- BOJ minions want to think more about ending never-ending stimulus:

- Wall St ekes out modest gains as S&P 500 hovers near all-time closing high

- Thursday, 28 December 2023

-

- Signs and portents for the U.S. economy:

- Bigger trouble, stimulus developing in China:

- China’s Dec factory activity likely contracted for third month – Reuters poll

- China aims to expand domestic demand, ensure speedy recovery

- BOJ minions get reason to keep never-ending stimulus alive:

- ECB minions claim they may not cut rates in 2024:

- S&P 500 ekes out meager gains, flirts with bull market confirmation

- Friday, 29 December 2023

-

- Signs and portents for the U.S. economy:

- Mortgage rates slide to lowest since May – Freddie Mac

- Oil prices set to end year 10% lower as demand concerns snap winning streak

- 2023 is in the books as the Dow, S&P, and Nasdaq slide on the last trading day of the year

Starting from a projected +2.6% annualized growth rate on 15 December 2023, the Atlanta Fed’s GDPNow tool‘s estimate of real GDP growth for the current quarter of 2023-Q4 dipped to +2.3%, where it held throughout the Christmas-through-New Year’s holidays. The Atlanta Fed’s projections for GDP growth in the final quarter of 2023 will continue until they are replaced by the BEA’s initial estimate of that growth at the end of January 2024.

In the next edition of the S&P 500 chaos series, we’ll roll the alternative futures chart forward to provide a glimpse of what to expect for stock prices throughout the first quarter of 2024.

Image credit: Stable Diffusion Dreamstudio Beta. Prompt: “A bull runs toward a finish line ribbon, but doesn’t reach the end. Digital art concept, 4k.”

Source: https://politicalcalculations.blogspot.com/2024/01/s-500-falls-short-of-reaching-new-high.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).