"No Rate Cut" Bear Scares S&P 500 Into Retreat

The S&P 500 (Index: SPX) fell again durin ghte third week of April 2024. The index closed out the week at 4,967.23, a little over three percent below the level it closed the second week. The index has dropped 5.5% below its record peak closing value from 28 March 2024.

The main driving force behind the falling level of stock prices are slipping expectations for when and by how much the Federal Reserve will cut interest rates during 2024. The CME Group’s FedWatch Tool anticipates the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3) when a quarter point reduction is expected, some twelve weeks longer than expected just a week earlier. The tool also projects only one rate cut in 2024, the timing of which is looking uncertain.

As we illustrated in a separate analysis, that slipping timing is reducing the expected level of dividends in future quarters. Right now, we think investors have been scared by the “no rate cut” bear into shifting their forward-looking focus to either 2024-Q3 or 2024-Q4, with their investment time horizon being affected by the sliding expectations for when the Fed might alter the level of short term interest rates in the U.S.

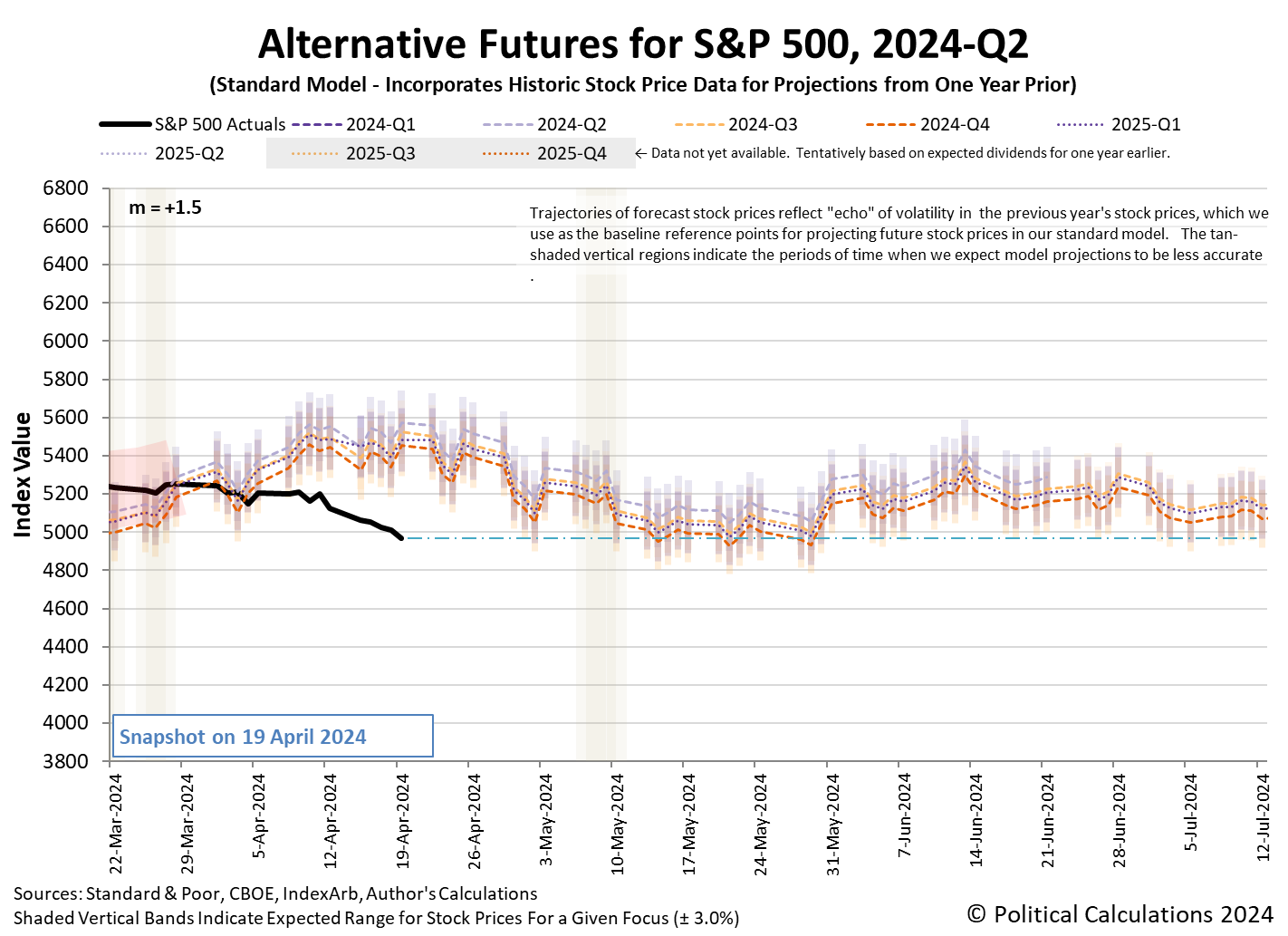

We’re basing that hypothesis on the level the dividend futures-based model is projecting the potential level of the S&P 500 will be a month from now as we’re within the month-long window in which its projections have “locked in”. The latest update for the alternative futures chart shows the current level of the index is consistent with the model’s still-dynamic projections outside of the locked-in period:

An alternate explanation is the stock market is experiencing a regime change, in which the dividend futures-based model’s basic multiplier has changed, but we would need several more weeks of data to confirm if that is the case. We’re weighing these scenarios behind the scenes, where we haven’t yet seen sufficient data to determine the established value of the multiplier has definitively broken from the level it has held since 9 March 2023.

In the meantime, the context provided by the market-moving headlines of the week points to that market regime still holding. The week’s headlines point to the rapidly slipping expected timing of rate cuts in 2024, which continued in the past week, as the continuing culprit in the decline of stock prices during the last several weeks.

- Monday, 15 April 2024

-

- Signs and portents for the U.S. economy:

- US growth may be a global boon, but inflation could derail the train

- Oil slips as risk premium eases after Iran attack

- Fed minions say they won’t rush to cut rates until they need to see data pointing to wage inflation:

- Fed should not act urgently to cut rates unless required, Daly says

- US workers seeking record wages to consider new jobs, New York Fed says

- Fed’s reverse repo facility plummets to lowest level in nearly three years

- Bigger trouble, stimulus developing in China:

- China’s Q1 GDP growth likely to slow, more stimulus on the cards

- China c.bank keeps policy rate unchanged, drains cash from banking system

- Economic growth signs in Japan:

- Nasdaq, S&P, and Dow ended notably lower while yields rallied once again

- Tuesday, 16 April 2024

-

- Signs and portents for the U.S. economy:

- US single-family housing starts plunge in March

- Oil slips as concern eases about Middle East supply risk

- US manufacturing output increases in March; February data revised higher

- In reversal, Fed minions claim they need more time to combat inflation before they can cut rates:

- Federal Reserve’s restrictive policy needs more time to work, Jerome Powell says

- Fed could keep monetary policy tight for longer if needed, Jefferson says

- Bigger trouble, stimulus developing in China as Q1 growth better than expected:

- China’s Q1 GDP grows 5.3% y/y, well above forecast

- China’s cycle of dollar hoarding and weakening yuan gets vicious

- China’s new home prices decline at fastest pace since 2015

- Chinese city Zhengzhou tells state-owned company to buy second-hand homes to reduce new housing inventories

- Nasdaq, S&P, Dow end mixed after hawkish Powell further clouds rate cut expectations

- Wednesday, 17 April 2024

-

- Signs and portents for the U.S. economy:

- US regional banks seen booking more commercial property losses, loan sales

- Oil dips as demand worries outweigh Middle East supply risks

- US wheat farmers face bleak crop economics as grain oversupply hits

- Fed minions say they’re in “no hurry” to cut interest rates:

- Bigger trouble, stimulus developing in China:

- ECB minions looking forward to cutting Eurozone interest rates, don’t want to review their inflation target anytime soon:

- ECB’s Vasle sees rates much closer to 3% at year-end

- ECB’s Centeno says policy would be tight even after two rate cuts

- ECB’s Lagarde hints it is too early to review inflation target

- Nasdaq sheds more than 1%, S&P posts four-day losing streak, Dow slips slightly

- Thursday, 18 April 2024

-

- Signs and portents for the U.S. economy:

- Oil extends losses on easing Middle East tension, demand concerns

- Mortgage rates top 7% for the first time this year, Freddie Mac says

- Fed minions now saying they’re in no “mad dash hurry” to cut interest rates:

- Fed’s Williams doesn’t see urgent need to cut interest rates

- BOJ minions promise future rate hikes will be slow:

- BOJ’s Noguchi says future rate hikes likely to be slow

- BOJ’s Ueda signals possible rate hike if weak yen boosts inflation

- ECB minions say they’re “crystal clear” on cutting Eurozone interest rates in June:

- ECB ‘crystal clear’ on June rate cut, de Guindos says

- German home building permits tumble 18% in February, extending rout

- S&P posts five-day loss for first time since Oct, Nasdaq & Dow end mixed; eyes on Netflix

- Friday, 19 April 2024

-

- Signs and portents for the U.S. economy:

- Oil settles slightly higher as Iran plays down reported Israeli attack

- Fed says 1,804 banks and other institutions tapped emergency lending facility

- IMF minions getting mad at Fed minions; Fed minions say they’re doing nothing because Bidenflation not going away:

- Fed’s rate-cut foot-dragging grates on global peers at IMF meetings

- Fed policy on hold because of ‘stalled’ progress on inflation, Goolsbee says

- Bigger trouble, stimulus developing in China:

- BOJ minions say rate hikes are coming:

- ECB minions say inflation could go either way:

- Wall Street’s April pullback intensifies as S&P 500 notches worst week in over a year

The Atlanta Fed’s GDPNow tool‘s latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) rose to +2.9% from the +2.4% growth forecast last week.

Image credit: Microsoft Bing Image Creator. Prompt: “An editorial cartoon of a bear with a sign that says ‘NO RATE CUTS’ scaring Wall Street traders”

Source: https://politicalcalculations.blogspot.com/2024/04/no-rate-cut-bear-scares-s-500-into.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).