S&P 500 Closes Its Best Quarter Since 2019 at Record High

The S&P 500 (Index: SPX) closed out its best quarter since 2019 at a new record high of 5,254.35.

The index has risen by just over 10% in value since 2023-Q4 ended, largely propelled by expectations the Federal Reserve would be cutting interest rates in 2024. That rise could have been even larger if the Federal Reserve had not doused investor expectations during the quarter. The rise of the S&P 500 during the 2024-Q1 has been restrained as the Fed first sought to first delay expectations for when it would begin cutting interest rates and then as Fed officials dialed back expectations for how much and how often they would act to cut rates during 2024.

As 2024-Q2 begins, the CME Group’s FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2), unchanged over the last few weeks but three months later than investors had anticipated at the end of 2023. The expectation that the Fed will begin a series of quarter point rate cuts starting on that date and continuing at mostly twelve week intervals is also unchanged over the last few weeks but is half as often as investors had expected they would take place in December 2023.

We find the trajectory of the S&P 500 is in the middle of the redzone forecast range we added to the alternative futures chart several weeks ago. Its trajectory continues to be consistent with investors focusing on 2024-Q2 in setting current day stock prices, which makes sense because the Fed’s rate cuts are expected to begin before the end of the quarter. Here’s the latest update of the chart:

Here’s a summary of the market-moving news headlines that investors absorbed during the final week of the first calendar quarter of 2024:

- Monday, 25 March 2024

-

- Signs and portents for the U.S. economy:

- US new home sales fall; median price lowest in more than 2-1/2 years

- Oil settles higher as Russia orders output cuts, geopolitical tensions persist

- Fed minions expected to cut rates, but worry about inflation:

- Fed’s Goolsbee says he sees three rate cuts this year

- Fed officials stil betting on inflation slowdown, but caution rising

- Bigger trouble developing in China:

- Bigger stimulus developing in China:

- BOJ minions have an unexpected problem after ending never-ending stimulus:

- ECB minions excited Eurozone wage growth is slowing, thinking about cutting rates:

- More central banks start pivoting to rate cuts as growth slows:

- Sweden’s Riksbank to hold rates, signal cut in June, poll shows

- Bank of Canada likely to lead the U.S. Fed in rate cuts

- Dow, S&P, and Nasdaq ended lower while yields advanced to start the week

- Tuesday, 26 March 2024

-

- Signs and portents for the U.S. economy:

- US durable goods orders rebound in February

- Oil settles lower as markets weigh Russian supply woes

- Notable US bridge collapses after being hit by a vessel

- Shipping traffic freezes up in port waters after Baltimore bridge collapse

- Timeline: How the Dali container ship crashed into Baltimore bridge

- Fed minions report they’re losing money:

- Bigger trouble, stimulus developing in China:

- BOJ minions may need to get tougher to deal with problems:

- Bank of Japan may be less dovish than markets think

- Japan says it won’t rule out any steps to prop up faltering yen

- ECB minions inching toward cutting Eurozone interest rates:

- Nasdaq, S&P, Dow quickly reverse course near end of trading, end marginally lower

- Wednesday, 27 March 2024

-

- Signs and portents for the U.S. economy:

- Oil prices fall for a second day as US crude inventories increase

- Fast-food companies seeing low-income diners pare orders

- Baltimore bridge collapse to cause logistics headaches, not supply chain crisis

- GM, Ford will reroute Baltimore shipments after bridge collapse

- Insurers could face losses of up to $4 bln after Baltimore bridge tragedy-analyst

- Fed minions try to lower expectations for 2024 rate cuts:

- Signs of recovery developing in China:

- BOJ minions starting to worry they may have a big problem on their hands:

- Japan finance minister issues his strongest warning to date on yen weakness

- BOJ’s Tamura calls for slow but steady policy normalisation

- Japan yen: Authorities hint at intervention option

- Nasdaq, S&P, Dow move sharply higher towards end of trading, close in the green

- Thursday, 28 March 2024

-

- Signs and portents for the U.S. economy:

- US economy continues to shine with help from consumers, labor market

- U.S. pending home sales increase moderately, NAR says

- Firmer oil prices expected as demand builds and supply curbs persist – Reuters poll

- Bigger trouble developing in China, but slower:

- China’s March factory activity likely contracted for sixth month, at slower pace

- China’s Big Five lenders post shrinking margins, warn of property risks

- Top JapanGov minion says BOJ minions should go easy while yen bailout develops:

- Japan PM Kishida says appropriate for BOJ to keep easy policy

- Japan repeats verbal warning to yen bears, BOJ keeps dovish tone

- Explainer: What would Japanese intervention to boost a weak yen look like?

- History of Japan’s intervention in currency markets

- ECB minions getting excited about cutting Eurozone interest rates:

- ECB likely to start with ‘moderate’ rate cut this spring, Villeroy says

- ECB rate cut in June looking more certain, what follows less so – Reuters poll

- S&P 500 delivers best Q1 in five years, driven by rate cut bets and megacap gains

The Atlanta Fed’s GDPNow tool‘s latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) ticked back up to +2.3% after dipping to +2.1% last week. That estimate falls within the upper end of the so-called “Blue Chip Consensus” forecast from early March 2024.

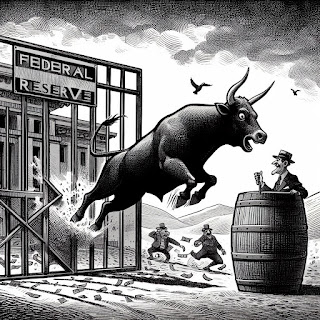

Image credit: Microsoft Bing Image Creator. Prompt: “An editorial cartoon of a bull escaping from a pen after the gate has been opened by a Federal Reserve official.” We originally featured this image on 18 December 2023 and is still our favorite illustration of why the first quarter of 2024 was so good for the S&P 500.

Source: https://politicalcalculations.blogspot.com/2024/04/s-500-closes-its-best-quarter-since.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).