#Housing Report $ITB

|

| Housing Report |

Short-term price fluctuations do not influence long-term trends, cycles, and profitability. The majority, guided by price trends and emotions, concentrate on short-term trading noise rather than cyclical trends of price, time, and energy. This focus creates confusion, frustration, missed chances, and typically leaves them holding the bag during trend shifts. Investors can sidestep this pattern by embracing the Evolution of the Trade and aligning with the minority.

Housing Stocks’ overall trend, revealed by trends of price, leverage, and time, are defined in the Matrix for subscribers.

Subscriber Comments

The Housing Report, a series of videos, discusses advanced cycles of price, time, and energy. The report updated on 04/05/25.

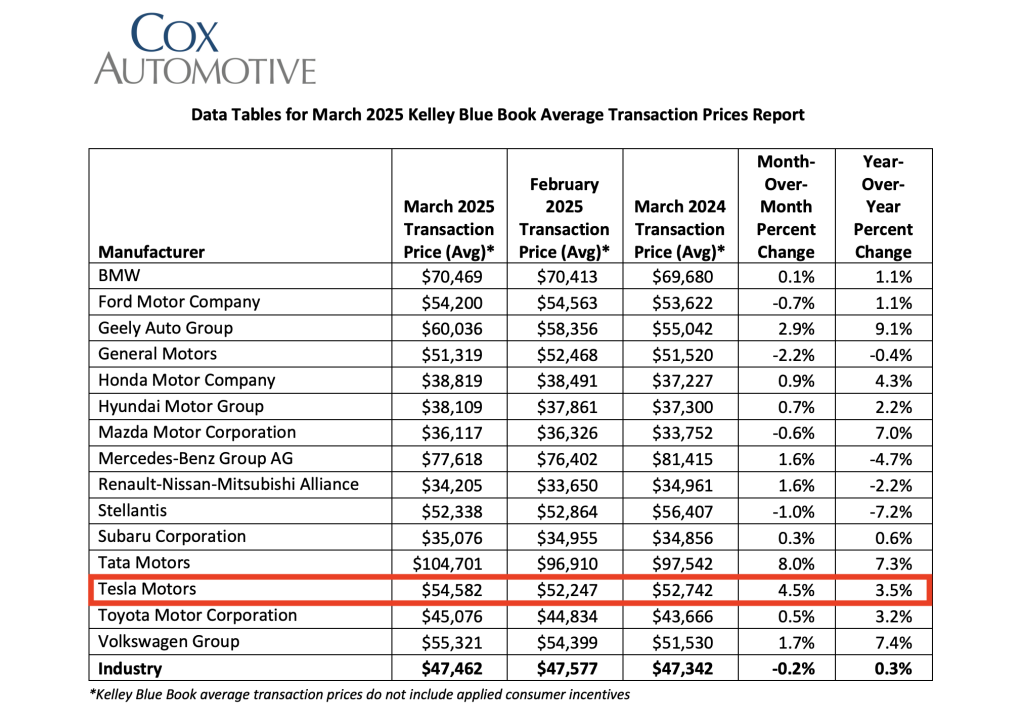

The traditional view of the real estate market is often narrow. Homeownership has consistently been seen as the largest investment Americans make in their lifetimes. Despite soaring housing prices and increased borrowing costs, the market continues to grow. Housing stocks and real estate consistently follow economic and interest rate cycles, as well as the standard of living in different regions of the country. As the economic cycle progresses, 2025 could be a pivotal year, potentially marking an inflection point in the market.

The 04/05/25 Report – Housing Sector Is Leading update has been posted.

Important Updates:

03/14/25 Report – Bulls Better Listen

02/19/25 Report – Pay Attention ASAP

02/05/25 Report – Housing Sector Sees Storm Clouds Coming

Please watch the full update on the Reports Page.

Housing Report Preview

Follow me on ð• or Facebook for further discussion.

———————————-

The Matrix provides market-driven trend, cycles, and intermarket analysis.

Source: http://www.edegrootinsights.com/2025/02/housing-report-itb_5.html

(36).jpg)

(31).jpg)

.jpg)