4 Stocks to Be Added To Buy On Pullback Model Portfolio #4 This Week [GeoWire Weekly No. 102]

Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

Investing in the footsteps of legends like Peter Lynch, Warren Buffett, and John Templeton involves a unique approach: going against the crowd. These iconic investors thrived by seizing opportunities in stocks that the masses avoided or where there was panic selling. This week, we delve into the concept of capitalizing on stock price pullbacks, often referred to as contrarian opportunities, and a strategy we have used to enhance long-term investment returns with shorter to mid-term gains in the microcap space. In fact, it has produced consistent returns, delivering an average return of 49.72% since 2016.

What Is A Buy On Pullback Model Portfolio

In January 2016, GeoInvesting introduced the “Buy on Pullback” (BOP) Model Portfolios, aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.

Since 2016, GeoInvesting successfully launched and closed ten BOP model portfolios that typically consisted of 5 to 7 stocks unfairly punished by the market.

How It Works

- Step One: We search through our coverage universe of over 1500 stocks for BOP opportunities. This includes reading earnings press releases, conference call transcripts, and SEC filings.

- Step Two: We tell you which stocks we are adding to the portfolio and why. The portfolios are published and accessible at our Pro Portal.

- Step Three (NEW feature): We calculate and display the returns that we expect the model portfolio to achieve.

- Step Four: We tell you when we are closing a particular position in the portfolio

- Step Five: We let know when all positions in the portfolio have been closed, at which time we close the entire portfolio, and get ready for the next one.

Performance

Nothing better illustrates our success in the Buy on Pullback strategy than its returns.

9 out of 10 of our portfolios posted solid upticks at their close dates, while 1 just about broke even when we closed it. We admittedly had it open for far too long going into the 2022 market shakedown, even though it reached an interim peak high return of 49.72%

Buy On Pullback (BOP) Average & Peak Returns

| Portfolio | Average Peak Return | Average Closed Return | Duration (Months) |

|---|---|---|---|

| BOP #1 | 36.15% | 16.99% | 5 |

| BOP #2 | 30.33% | 19.16% | 4 |

| BOP #3 | 130.40% | 122.83% | 37 |

| BOP #4 | 66.48% | 55.54% | 7 |

| BOP #5 | 50.55% | 10.57% | 10 |

| BOP #6 | 117.99% | 77.05% | 8 |

| BOP #7 | 69.77% | 28.87% | 14 |

| BOP #8 | 184.08% | 85.75% | 5 |

| BOP #9 | 60.60% | 17.53% | 10 |

| BOP #10 | 49.72% | -0.16% | 16 |

Our Buy on Pullback Model Portfolio 11

We are finally launching our 11th BOP Portfolio. The first four companies are being added to the model portfolio, and we plan to add 1 to 3 more. The expected return we believe these for stocks can achieve within 4 months to a year translates to an expected portfolio return of 80.58%.

Why Now?

The market environment since 2022, which includes higher interest rates and inflation, has created extreme fear among investors. This can cause investors to panic sell stocks during market volatility and in reaction to weaker than expected earnings releases.

For example, we are currently seeing a lot of scenarios where a company may have reported great growth in sales and earnings for a particular quarter, and slightly missed analyst estimates, causing investors to panic sell. This is very common with the microcaps we invest in.

One of the strategic moves that we make during earnings season is to read conference call transcripts so that we can determine if management addresses any issues that popped up in the related earnings press release, conveying a message that certain negative events might be temporary or one-time in nature.

Another one of our favorite BOP strategies is to buy stocks that fall sharply when a company initiates a non-dilutive secondary stock offering. This may occur when a large institutional shareholder needs to sell its stock, but can’t do it on the open market because the stock may be too illiquid.

In these situations, the secondary offering is often completed at a stock price significantly lower than the current share price, sending the price much lower. If this situation occurs with a solid undervalued company that has great growth prospects, the stock can often recover quickly.

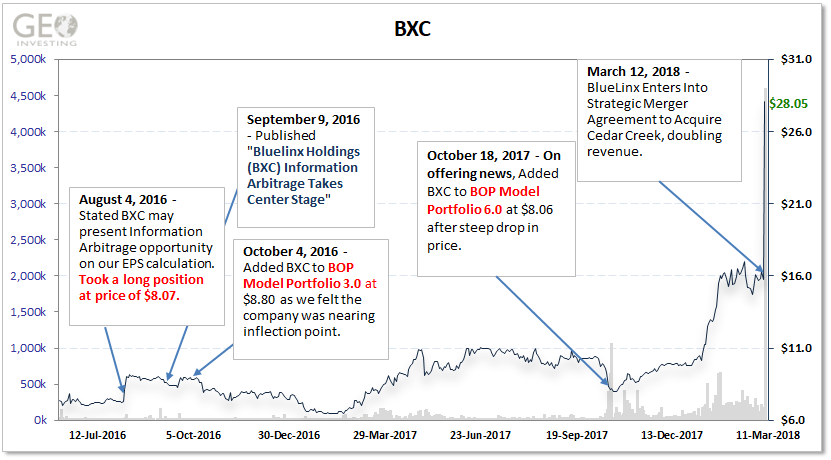

The key point to a non-dilutive secondary offering is that there are no extra shares being offered in the offering. One of my favorite case studies on one of our past high conviction model portfolio holdings portraying this scenario was with Bluelinx Holdings Inc. (NYSE:BXC). On October 10, 2017, the company announced a secondary offering at $7.00 per share. In this scenario, an institutional holder of 51% of the stock wanted to sell its position. Within two months of the offering, the stock doubled and within 7 months after the offering, the stock surged to over $40.

Subscribe To Receive Our Buy on Pullback Model Portfolio #11 Being release This Week part of this post is for paying subscribers

Already a paying member? Log in and come back to this page. If not, Join Today.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Subscribe Now Tweets and Reposts From Maj’s Feed

This passage from “There’s Always Something To Do” (The Peter Cundill Investment Approach) – Chapter 4, page 33… parallels what we see going on in smaller cap stocks & why we’re incredibly excited to be searching for opportunities in this universe. @smallcapdisc @PaulAndreola pic.twitter.com/sFreZa8Xtc

— GeoInvesting, LLC. (@GeoInvesting) September 18, 2023

Iec Electronics Corp. (NASDAQ:IEC) 155% return and acquired: @Geoinvesting video case study #2 checked off 4 multi-bagger markers.

Classic set-up of betting on the jockey. I met the CEO at an @theLDMicro event and walked away incredibly impressed.https://t.co/2vtlkaz2g6

— Maj Soueidan (@majgeoinvesting) September 18, 2023

The post 4 Stocks to Be Added To Buy On Pullback Model Portfolio #4 This Week [GeoWire Weekly No. 102] appeared first on GeoInvesting.

Source: https://geoinvesting.com/4-stocks-to-be-added-to-buy-on-pullback-model-portfolio-4-this-week/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).