Analysts Are So Off The Mark On This Microcap Stock With Big Cap Revenue

We are about to publish a research report on a stock which we predict will be one of our best ideas since we founded GeoInvesting in 2007. We also plan to host a Skull Session Fireside Chat with the management team.

What is even better about this idea is that Wall Street analysts have totally ignored the company’s growth trajectory in constructing sales and earnings per share estimates published on all sites like Yahoo finance.

Our calculations result in financial estimates well above analyst earnings per share estimates which could result in the stock exceeding $100 per share vs. its current share price of comfortably under $20, translating into a return of over 500%.

Rinse and Repeat

A past 2-time Model Portfolio Holding is once again in our crosshairs. We classify it as a BigCapMicro, or a microcap stock that produces large cap revenues, allowing it to gain more respect from investors. Our first two rounds with the stock in 2015 and 2019 yielded final returns of 185.91% and 33.71%, respectively.

This go-around, we see a return of at least 70% in the near term, and over 500% within 3 years, fueled by the company’s new growth trends, amid a new CEO’s decisions to concentrate on market segments that are less cyclical and carry higher margins.

Furthermore, the stock meets a huge factor from our 8 (and expanding) multibagger checklist: cross selling products across its customer base that resulted from a key acquisition of a company that has industry leading products that competitors just don’t have.

We are most excited to revisit this company because Wall Street analysts are so off the mark with their estimates. We predict the stock will start to rise, once analysts start revising their estimates upward. To put this into perspective, according to our calculation, the company is closing in on $200 million in revenue and $4.20 in earnings per share. This compares to analyst revenue and EPS estimates of $140 million and around $1.50!

The company sells safety products to industrial and government customers in the U.S and across the globe, serving nearly 20 commercial and government markets.

One of the reasons we like this company is that one of its key strategic advantages lies in owning and operating manufacturing facilities in several different countries. Not only does this vertical integration position the company favorably during supply chain challenges, but it also enhances its pricing competitiveness compared to rivals reliant on external contractors. Moreover, it allows for rapid production scaling in response to local market emergencies, aligning with the global trend of protectionism (aka not outsourcing to foreign countries)..

Our BigCapMicro classification of the company is supported by several key points.

Key Highlights

- Strong Financial Foundation: The company boasts a cash balance of over $20 million, earmarked for strategic acquisitions and capital return initiatives, such as actively repurchasing shares. The company also maintains a clean balance sheet with zero debt and possesses 20 patents.

- Targeting Stable Markets: The company is shifting its focus towards less cyclical markets, such as Biopharma and EV batteries manufacturing.

- Operational Efficiency: Its long-term plan includes increasing operating leverage, which could lead to improved profitability.

What operating leverage looks like with a multibagger

Source: Rand Worldwide: Not A Microcap Anymore

Operating Leverage Case For Company in Focus:

- Global Expansion: The company has outlined plans to increase its presence in global markets, which are currently less than 10% of its revenue.

- Acquisitions: Last year, the company made an acquisition to execute its new global market focus, acquiring a company that will help extend its reach as well as introduce a competitive “moat” type product line.

- Earnings Growth: The company is entering a phase of strong earnings growth, where we expect five out of the next six quarters to be favorable.

Valuation

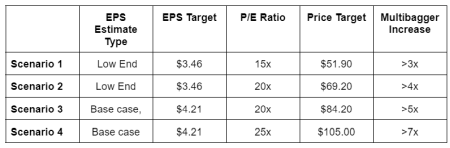

While the company’s current trailing P/E ratio of approximately 20x might seem a little expensive, we see potential for substantial upside. Looking at the valuation on a trailing basis is like looking in the rearview mirror, as many investors are doing. This is what is giving us an opportunity ahead of what we think is coming.

A reasonable P/E ratio of 15x applied to the low end of our EPS target of $3.46 would imply an eventual price target of $51.90.

However, using a P/E of 20x, the P/E the stock is currently trading at, would imply a target price target of $69.20. Referencing our base case earnings per share estimate of $4.20, we derive a price target of $84.00.

Ultimately, considering the company’s growth trajectory, a multiple of 25x a on base case earnings per share estimate should be in the cards, justifying an eventual price target of $105.00.

Equity.

Price; $10 to $20; Revenue: >$100M

Safety Products

Recent Acquisition; Expanding Into global markets; Strong earnings growth; Gaining more revenue from current customers due to cross selling; Analysts increase their financial estimates.

Along with this idea, you will get all the research we’ve done on the company to date, which includes an archived copy of the Management Briefing containing the arbitrage we’ve identified.

Geoinvesting is a research platform founded in 2007 to publish premium research on microcap stocks that meet a certain set of criteria that we have proven leads to superior returns. Empirical evidence proves that investing in microcap stocks beats the returns of larger cap stocks by 8.24% per year. Even Warren Buffett and Peter Lynch have said that if they were to invest in one type of stock, it would be microcaps. We provide our subscribers with an even bigger edge by combining the microcap investing edge with our own tested strategies to find the best stocks that are undervalued relative to their growth prospects or other positive catalysts. Our approach is based on qualitative and quantitative factors that finds stocks a point where they are going through significant changes that the market has yet to identify. This opportunity is only available in the Microcap world, an area ignored by institutions, Wall Street and the financial media.

Over the last 15 years, we have also built a expert Microcap investor network who contribute ideas to our subscriber base.

Our History

1500+ Equities Covered

200+ Multibaggers

30+ Years Of Investing Experience

200+ Management Interview Clips

The post Analysts Are So Off The Mark On This Microcap Stock With Big Cap Revenue appeared first on GeoInvesting.

Source: https://geoinvesting.com/microcap-stock-with-bigcap-revenue-gearing-up-for-european-market-expansion/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).