Is a Greater Than 400% Return In The Cards For Semler Scientific, Inc?

NOTICE: New Information is presented through an Audio PodClip at the conclusion of this report on how the developments covered in this report will affect revenue and potentially share price. The clip includes a detailed conversation between Maj and his analyst, Jan Svenda.

Semler Scientific, Inc. (NASDAQ:SMLR), a medical device company, is down over 80% off of its all-time high of $153 attained in October 2021. The drop in share price is partly due to a change in the Medicare and Medicaid reimbursement rate schedule pertaining to the company’s medical device that tests for pulmonary artery disease (PAD)

Now, we are on a quest to determine if SMLR’s pullback is presenting a golden opportunity to revisit the stock and see if it can get back to its highs, which would represent returns of over 400%!

Due to our success in experiencing nice returns through buying stocks that pull back hard, we have outlined a 7-step due diligence process to help us understand if the market is overreacting to some seemingly negative news that sent SMLR spiraling downwards.

Premium Members sign in To Continue

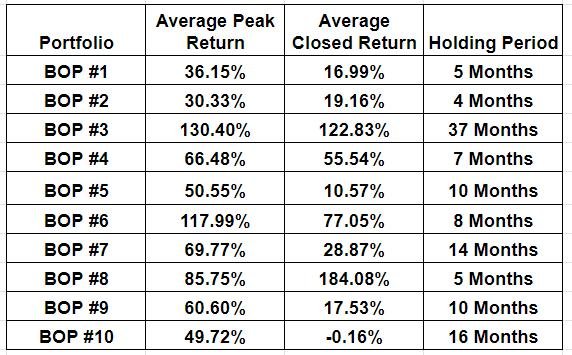

As a refresher, our string of 10 Buy On Pullback (BOP) Model Portfolios produced returns that would dictate a release of another one very soon.

Last 10 BOP Model Portfolios

We’re banking on #11 being right around the corner, and we might even consider SMLR as the first stock to add to it. 😉

Beyond this, we have also made it a point to answer a question from an individual in our investor network about one of our 7 due diligence

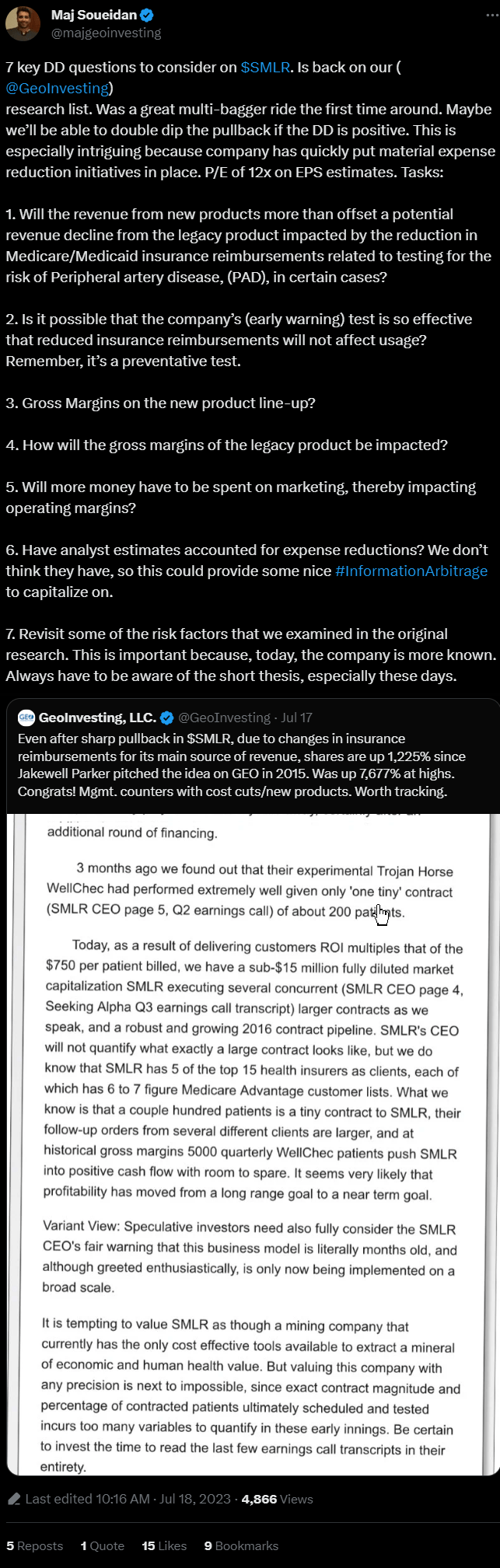

In response to a Tweet that GeoInvesting originally posted,, Maj posted a Tweet on July 18, 2023 in which he deemed to be seven reasonable research tasks for GeoInvesting with respect to healthcare technologies solutions company SMLR, previously a great multi-bagger we captured in our Model Portfolio. (click image to go to Tweet)

SMLR makes medical device diagnostic products focused on the Heart. The one product that really put the company on the map and led to an incredible growth period is its high profit margin Quantaflo product, which monitors blood flow obstructions to aid in the diagnosis of Vascular Disease. The product is being used to test for the risk of pulmonary artery disease (PAD).

A key part of the success in marketing this product for PAD testing has been the favorable Medicare and Medicaid reimbursement rate schedule that reduced the cost for the patient who might be a candidate to use this medical device. It also provided doctors and insurance companies nice reimbursement revenue, a very sell-able concept.

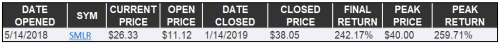

Here’s some background of our coverage history. We wrote a brief report on the stock and included it in our model portfolio in May 2018. The stock reached a high of return of 259.7% and we ended up removing it from the model portfolio at a return of 242.2%

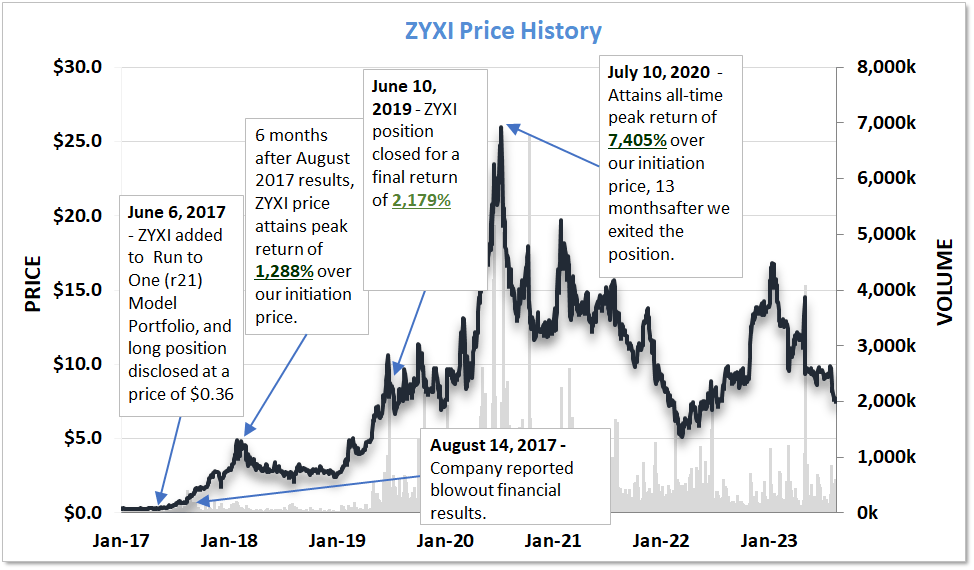

Actually, the company first entered our coverage universe when one of our research contributors published a research report exclusively on Geoinvesting’s pro portal on November 30, 2015. The stock is up 1,348% since he published the report, but was up as much as 7,677%.

However, recently, shares have been facing extreme downward pressure, partly due to changes in the Medicare and Medicaid reimbursement rates with respect to Quantaflo testing for PAD that the market fears will lead to doctors prescribing Quantaflo PAD testing to less patients.

That being the case, we are on a quest to determine if the pullback is an opportunity for us to bring the stock back into our model portfolios. So, we laid out a few due diligence tasks that we need to perform in order to make that call. If our due diligence comes back positive, we could construct a scenario where the stock gets back to the $100 dollar mark. That would imply a 284% return from current prices (as of close 8/17/2023).

User Question on Maj’s Tweet

One person from our investor network asked us how we would go about answering research task #2 of our 7 tasks Maj outlined in his tweet:

Task #2: Is it possible that the company’s (early warning) test is so effective that reduced insurance reimbursements will not affect usage? Remember, it’s a preventative test.

Here is our answer:

To fully understand, we need to point out that SMLR’s stock price recently tanked due to news that their early warning test related to PAD is going to be pulled from the Medicare and Medicaid reimbursement rate schedule, or at least reimbursements will be significantly reduced and limited to certain types of high risk patients. This means doctors might prescribe fewer SMLR tests as they and private insurance companies would need to absorb the cost of the test. Furthermore, it’s uncertain if patients would accept sharing in covering the costs.

Extra Background

Here’s some color on how Semler is impacted by the change in the Medicare and Medicaid reimbursement rates, as it pertains to the coverage eligibility Quantaflo.

The Centers for Medicare & Medicaid Services (CMS) is the federal agency within the United States Department of Health and Human Services that oversees and administers programs like Medicare, which provides health coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities, and Medicaid, which offers health coverage to low-income individuals and families.

A large part of SMLR revenues (likely most) have come from people covered by Medicare Advantage (private insurance companies offering Medicare insurance), where the scenarios that qualified Quantaflo to be covered under the insurance were favorable to the company.

Thus, there was a large incentive for doctors to prescribe the use of Quantaflo to diagnose PAD and for insurance companies to want doctors to take this route, as the reimbursement fees administered by the CMS for the Medicare Advantage program is split between doctors, insurance companies, and of course, SMLR.

The way the program was structured also seemed to create a competitive advantage for SMLR. If a patient was diagnosed with PAD through a cheaper and faster test like Quantaflo, compared to other types of tests such as the ankle brachial index (ABI), the doctors/medical facilities could get “bonus”payments.

Now, the CMS has changed the circumstances that will qualify Quantaflo PAD testing to be covered under the Medicare Advantage Program to only cover the test when there are complications associated with PAD (we assume patients suffering from later stages of PAD or already have symptoms). We are still unclear on how the CMS will carry out this change in terms of billing codes that will qualify Quantaflo PAD testing to be covered.

The current reimbursement schedule is expected to be phased out over 3 years.

What We Need To Do

We certainly need to determine why the CMS changed the reimbursement qualification standards. Is this public information? Maybe the reasons are not widely available, but we believe they could be.

The reasons for the changes made by the CMS could stem from bureaucratic or budgetary issues, but maybe the CMS also believes the usefulness of the test is not as great (or not as needed) as SMLRbelieves it to be. This was one of the risk factors and unknowns that we brought up in our original research report.

At the very least, some people following the stock closely could have an idea why this is the case, so we will reach out to our investor network. We also intend to talk to insurance companies, doctors and “experts,” maybe by using expert market platforms like Tegus. It might also be interesting to take a look at other medical device companies that may have gone through similar types of insurance reimbursement issues. For example, Zynex, Inc. (NASDAQ:ZYXI) faced insurance related issues more than once, yet managed to be a huge multibagger for GeoInvesting.

SMLR suggests that the reimbursement phasing out period (3 years) will provide enough data to continue to demonstrate the necessity of using Quantaflo to test for PAD, regardless of whether or not insurance covers its use. Thus, we will need to track any papers mentioning SMLR’s test and its effectiveness.

Some interesting topics we are pondering include:

- Will more private insurance companies eventually/potentially cover the test if they determine that early detection of PAD reduces healthcare costs? In fact, some already have been.

- For the private insurance companies that may decide to cover SMLR’s PAD test, will they follow the more restrictive CMS guidelines?

- Will other SMLR heart related diagnostic testing solutions in the pipeline that are not affected by the new CMS adjustments be able to more than compensate for any potential revenue loss from the decrease of Quantaflo to test for PAD. In the company’s latest Q2 2023 conference call, Renae Cormier, the company’s CFO is noted as saying “There are CPT reimbursement codes for echocardiography and HCC diagnosis codes for heart dysfunction that were not affected by this year’s CMS updates.“

- Will some patients who do not qualify under the new CMS guidelines opt to use and pay for Quantaflo, out of pocket?

- This is a big one: Since Medicare only covers people 65 or older, yet SMLR recommends that people over the age of 50 should test for PAD:

- What does the opportunity to capture market share in the 50 and to 65 years old target market look like?

- How much of SMLR’s current revenue is generated from people in this age range? (we assume very little)

Another big thing that we need to probe into is the impact extra marketing costs will have on the company. When the reimbursement was in place, there was an incentive for doctors to push SMLR’s test. Therefore, the company did not have to spend an exorbitant amount of dollars on marketing, which is partly why the company has huge pre-tax margins of about 40%.

As the reimbursement structure changes, the burden to market Quantaflow will likely mostly fall on SMLR. We would like to know how big of an impact this could have on SMLR’s margins and earnings per share. However, if the test is as good as the company claims it is, is it possible that doctors will still want to push the product, lessening that marketing burden on SMLR?

An initial step in this process could be to look at marketing spends as a percent of sales of certain companies across the medical device space and apply that to SMLR.

Stay tuned for more updates as we continue down this path or research. This is a potentially sticky situation, where we need to determine if Quantaflo really is as good as advertised, or if the success the company achieved in growing its revenue mainly arose from a favorable insurance reimbursement schedule, which incentivized doctors to prescribe the test.

We have already reached out to the company to see if they would entertain our request for an interview with management and maybe even invite them to one of our Skulls Session Fireside Chat live events so we can learn more about the company and the new business model.

Quick Look At Financials

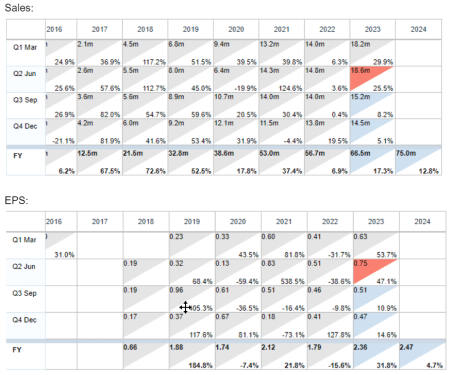

As far as financials go, since the company entered into our coverage universe, they’ve clearly been on an upward trajectory. Revenues have increased over 800% to roughly $65 million since the publication of our premium subscriber’s initial bullish report, while earnings per share have gone from a large loss of over $1 per share to a current EPS of $2.25:

On August 10, 2023 the company posted strong Q2 2023 results:

- Sales of $18.6 million vs $14.8 million in the prior year and ahead of analyst estimates of $16.0 million

- EPS of $0.75 vs $0.51 in the prior year and ahead of analyst estimates of $0.56

Here’s a snapshot of the company’s financial history:

*Areas shaded in blue represent analyst estimates; Areas in red indicate last quarter reported.

Current estimates still call for some growth for the rest of 2023 and into 2024. We will obviously need to look into these estimates to see if they have been adjusted for the reimbursement issue.

Also, with $51 million in cash and nearly no long term debt, the company’s balance sheet is in great shape.

Furthermore, remember that the reimbursement phaseout will occur over the next three years, so we need to have an idea of what 2025/26 financials will look like on a normalized basis.

Finally, keep in mind that the company should have sufficient time to launch and generate revenue from other products that are not affected by the reimbursement issue. This is the most interesting topic for us to explore and what the market really might be underrepresenting.

If the market becomes convinced that the company can get past its current challenges, we think the stock can easily eventually trade at price to earnings multiple north of 30x on 2024 estimates. This would translate into a price target of $62.76, or upside potential of 142%. Now, we have to remember that SMLR could be the dominant player in its target market with the solutions it offers. This might be the reason why it carried a price to earnings multiple of around 70x at the stock’s high of $150 in October of 2021.

So, it may not be out of the question for SMLR to eventually trade at a price to earnings multiple greater than 50x, which would put the stock well over $100.

Of course, we are going to need to perform more due diligence to understand the type of market dominance the company might have past its current product pipeline, as well as understand the size of its target market. Also, will the company expand outside solutions related to the heart?

We think the most likely scenario will be that the stock won’t do much until some more pieces of the puzzle fall into place, but the story is certainly worth watching. On the same token, it is likely that short “activists” are also probing into SMLR.

Uncovering the pieces of the SMLR puzzle will be challenging, but should be a lot of fun and extremely rewarding IF our findings come back positive.

On that note, we do have a research update on SMLR that revolves around trying to gain more of an understanding on how the unfavorable changes in Medicare and Medicaid reimbursement for the company’s medical device that tests for pulmonary disease (PAD) will impact future revenues.

The update is through an informative and must-listen PodClip exchange between Maj Soueidan and Jan Svenda that you can listen to below.

new research Available Below After This Article Was Posted, maj and His Analyst Jan Svenda Engaged in a PodClip Exchange Discussing Revenue and Share Price Implications for SMLR.

Listen To The PodClip

The post Is a Greater Than 400% Return In The Cards For Semler Scientific, Inc? appeared first on GeoInvesting.

Source: https://geoinvesting.com/is-a-greater-than-400-return-in-the-cards-for-semler-scientific-inc/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).