The 2024 Trade That Will Keep Giving All Year

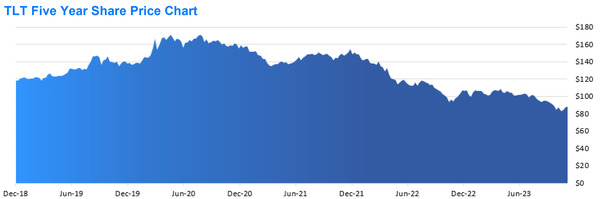

If you think interest rates don’t have much farther to fall (after a fast 20% jump in TLT-NYSE), have a look at the last decade of REAL interest rates in this chart:

REAL interest rates are as high as they have ever been–even after the Street has started pricing in lower intersest rates for the last 5 weeks!

To me and my colleague Nathan Weiss, that makes the 20+ Year Treasury Bond ETF (TLT-NYSE) an InTheMoney bank trade–likely for most of 2024 as well.

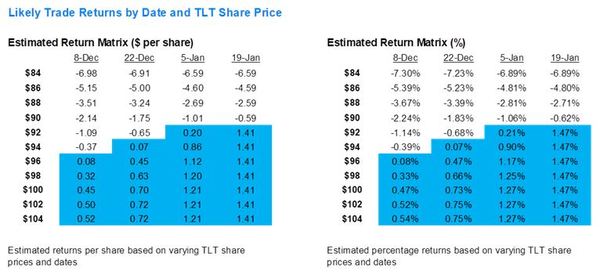

This is the second options trade on TLT for Nathan Weiss and myself in the last month. The first trade–on Nov 18–we advised our readers to write December 15th, $85.00 covered calls on TLT shares, earning a 1.46% return as long as TLT shares are trading at or above $85.00 when the options expire–a 17.5% annualized return.

Nathan Weiss and I have teamed up to create a new research service – InTheMoney – which seeks to earn low-risk, consistent 1.5% to 2.0% (or more) monthly returns with covered calls and puts. We generally publish trades monthly, and you see our first trade above. (You can read this story on our website, inthemoney.capital)

We believe Treasury prices have made/are making a cycle low and owning the TLT outright and writing calls against a portion of our position gives us 1) medium/long term upside and 2) 1-2% per month extra income.

TLT is once again functioning as a hedge against the economy. So if you were concerned about a major economic contraction, the TLT is a good strategic way to express that view.

That idea is getting popular and TLT is running up lately, so if our shares get called away–we can buy more and write more calls almost immediately! We do see TLT potentially at $120 a year from now—BUT—if the economy heats up again or if war causes oil to go to $120/b and TLT ends up mostly unchanged, our InTheMoney covered call strategy can still generate up to 20% returns. THAT is the primary benefit of writing covered calls!

Here’s the December trade, with more colour commentary below:

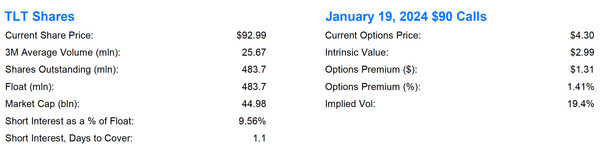

Buy the iShares 20+ Year Treasury Bond ETF (TLT), Sell January 19th, $92.00 Calls against the long position

Company Overview

The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury Bonds with remaining maturities greater than twenty years. The TLT holds 40 different Treasury Bonds and has an average coupon of 2.52% and an effective duration of 16.37 years. The ETF currently trades at a .08% premium to NAV.

Potential Events and Newsflow

CPI: Monthly CPI reports will be released before the open on December 12th and January 11th

U.S. Government Funding: Updates relating to government spending or receipts will impact Treasuries, as will announcements regarding the relative issuance of U.S. debt in December and January (Treasury Refunding)

Speeches: Remarks from FOMC officials have been impacting yields: The market REALLY wants rate cuts

Economic Data: ‘Bad’ economic data is good for Treasury prices (and TLT shares), although REALLY ‘bad’ economic data is bad for Treasury prices (and TLT shares)

Market Exposure/Risk of a 10% Change in Equity Prices (S&P 500)

With a beta of .47, we would expect TLT shares to decline 4.7% if the S&P 500 declined 10.0%, sending the shares to $91.14. This would result in an anticipated gain of $.55 on the covered call position at expiration – net of the $.29 dividend. If the S&P 500 rallied 10.0%, TLT shares would likely rally 4.7% (to $100.12) and the covered call trade would realize the maximum gain of $1.41 per share including the dividend, or 1.47%.

How We Like To Execute These InTheMoney Options Trades

Be a little patient – TLT shares have followed a pattern of bigger up days then a smaller down day (or two).

When we write a covered call, we’re buying the security–so obviously we want to buy at lower prices rather than high, but the implied volatility of the option we are selling also matters. Higher implied volatility = a higher premium for the options we are selling.

Volatility is price-down action–so when a stock goes down, volatility tends to go up, so covered call writers win two ways: You get to buy the stock at a lower price and write the option for a few cents more. At InTheMoney, we’re looking to make 2% monthly return, so if we give up 10 or 20 basis points by buying on the wrong day, that’s a meaningful part of our total return.

Finally, we NEVER execute our options trades in the first hour of trading–the spreads are ridiculous, the prices don’t follow models, and the market makers are working hard to capture quarters and dimes from people that unwittingly place market orders.

Forward This Email

Sign Up For Our Next Trade–HERE

Source: https://oilandgas-investments.com/2023/latest-reports/the-2024-trade-that-will-keep-giving-all-year/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).