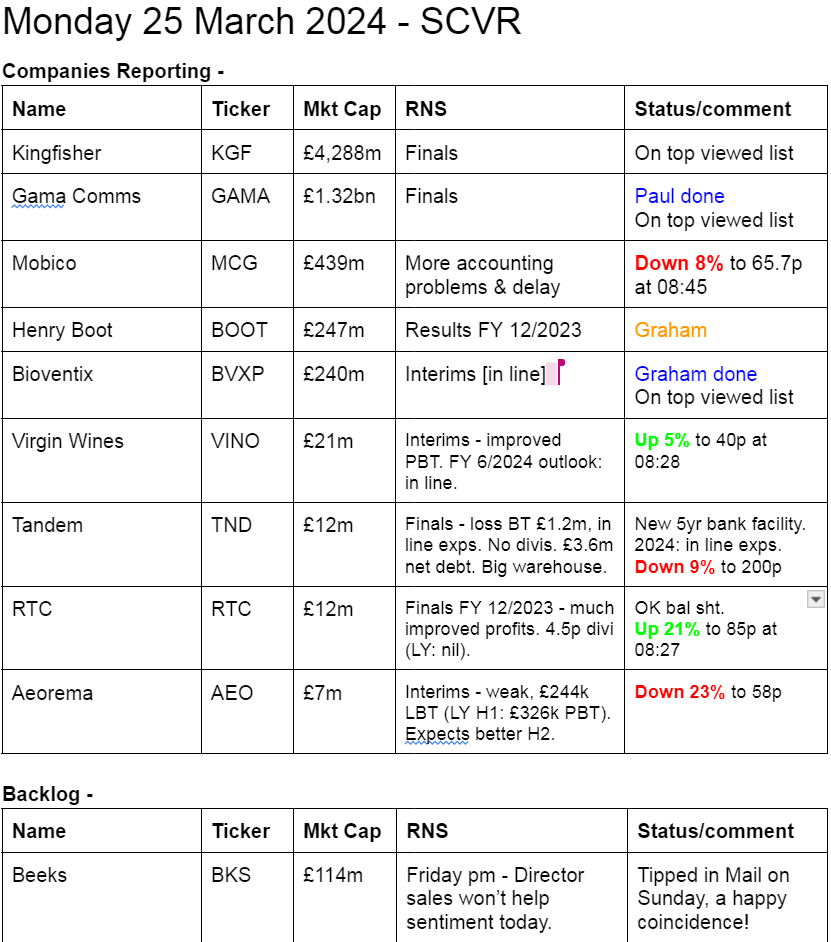

Small Cap Value Report (Mon 25 Mar 2024) - GAMA, BVXP, BOOT, MCG. Quick: DLG, OPTI, BAR, IMM, INC, FDBK

Good morning from Paul amp; Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates amp; results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it’s anybody’s guess what direction market sentiment will take amp; nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed – please be civil, rational, and include the company name/ticker, otherwise people won’t necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we’re not making any predictions about what share prices will do.

Green (thumbs up) – means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it’s such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber – means we don’t have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) – means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we’re not saying the share price will necessarily under-perform, we’re just flagging the high risk.

Links:

Paul amp; Graham’s 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul’s podcasts (weekly summary of SCVRs amp; macro views) – or search on any podcast provider for “Paul Scott small caps” – eg Apple, Spotify.

Other mid-morning movers (with news) -

Direct Line Insurance (LON:DLG) - down 12% to 183p (£2.41bn) – Ageas Insurance announces that its initial, then an improved takeover approach to DLG management were rejected, so it has decided not to proceed with an offer for DLG.

OptiBiotix Health (LON:OPTI) - down 12% to 21p (£21m) on news of a £1.35m equity fundraise at 20p. Dilution is modest, increasing share count by 7.4%. Usual talk of jam tomorrow in the commentary from this serial disappointer.

Brand Architekts (LON:BAR) – down 10% to 21.5p (£6m) – Interim Results show another loss, but reduced vs LY H1 thanks to cost-cutting. Lacklustre outlook. Strong balance sheet is the main attraction, with £7.2m net cash (slightly above mkt cap!). Note small pension deficit. Surely it must be getting near a low?

ImmuPharma (LON:IMM) [Paul holds] – up 36% to 2.6p (£11m) – IMM owns 10.8% of Aquis-listed Incanthera (OFEX:INC) – which says it is about to go from zero revenues to £10m then £33m revenues, and profitability, on the back of a large European order which it hopes will then increase. Is it a tall story from this jam tomorrow stable? Who knows. I’d like to see more evidence first. So IMM shares have gone up in sympathy with the increase in Incanthera shares. For mad punters only (hence why I’m long, but have been top-slicing I should add). I flagged IMM here on 6/3/2024 as a possible speculative trade, which has worked out quite well.

Incanthera (OFEX:INC) – up 74% to 17.0p due to the same announcement that its 10.8% shareholder IMM mentions above. Speculative jam tomorrow junk, or a promising growth company? Time will tell.

Feedback (LON:FDBK) - up 23% to 145p (£19m) – another loss-making nanocap that has seen its shares shoot up recently. Today’s news is a “New tuberculosis partnership in India“, with no financial details. Historical figures for FDBK are lamentable, with losses every year. Although it does have cash remaining at £5.4m (30/11/2023) so it might not need another fundraise until 2025.

Summaries of main sections

Gamma Communications (LON:GAMA) - up 1% to 1366p (£1.33bn) – Final Results amp; Buyback – Paul – AMBER/GREEN

My first look since 2019, and I’m impressed – GAMA has a strong track record of EPS growth, good cash generation, a lovely balance sheet with c.10% of the market cap in cash which I see as surplus. It’s doing a £35m buyback. Modest divis could be increased a lot if management prefer. Doing smallish bolt on acquisitions. I think this looks quite good.

Bioventix (LON:BVXP) – up 2% to £46.90p (£245m) – Interim Results – Graham – AMBER

Maybe I’m a little mean to Bioventix by going neutral on it again, after it posts results in line with expectations. But net income and dividend forecasts are slightly reduced due to corp tax impact, and the PER is c. 28x. The outcome of current trials will determine future success.

Henry Boot (LON:BOOT) – down 0.7% to 182.8p (£245m) – Results for 2023 – Graham – GREEN

This stock delivered a profit warning in January, and today reiterates that it’s expecting a lag between the recovering economy and improvements in the land/property market. I like the risk/reward offered here given the steep (40%) discount to official NAV.

Mobico (LON:MCG) - down 4% to 68.4p (£421m) – Update on timing of results amp; guidance – Paul – BLACK (profit warning) – AMBER on fundamentals.

It’s another mild profit warning today due to continuing audit problems. Overall though it doesn’t sound very significant. I’ve looked back at the H1 numbers, and more recent trading updates, but can’t form a firm view either way. I suspect there might be recovery potential for this share, but it’s a large and complicated business, so needs a lot more work to research it properly.

Paul’s Section: Gamma Communications (LON:GAMA)

Up 1% to 1366p (£1.33bn) – Final Results amp; Buyback – Paul – AMBER/GREEN

Gamma Communications plc (“Gamma” or “the Group”), a leading technology-based provider of communication services across Europe, is pleased to announce its results for the year ended 31 December 2023.

Continued strong financial performance, with growth in line with expectations, delivering considerable cash generation

Revenue £522m (up 8%)

Adjusted PBT £97.9m (up 12%)

Statutory PBT £71.5m (up 10%)

Adjustments look reasonable to me, mostly impairments amp; amortisation of intangibles.

Adj EPS fully diluted 75.1p (up 5%)

Total divis 17.1p, well covered at 4.4x but only a 1.25% yield.

Acquisitions – I can’t find the split between organic and acquisitive growth, but it made 3 smallish acquisitions in 2023.

Note that net finance costs of £0.5m in 2022 greatly improved to net finance income of £4.5m in 2023, giving a £5m boost to PBT.

Outlook - this excerpt sounds moderately positive I’d say, and explains some useful points about the business model -

We saw some evidence of a softer economy in 2023, although early signs in 2024 are that there is some improvement. We believe that our enhanced product set will continue to drive growth but the current economic climate may temper the rate of acceleration. Conversely, the reduction in inflation has reduced pressure on overheads and particularly salaries.

In October 2024, Gamma will celebrate ten years as a listed company. We have grown revenue, Adjusted EBITDA and Adjusted EPS (fully diluted) in every one of the nine years to date and we expect growth to continue in 2024 as we add more users both in the UK and Europe.

We have a robust business model based on recurring revenue from solutions that are critical to the businesses which use them. Our continued profitability, strength in cash generation and healthy net cash balance leave us well placed to maximise the opportunity even in challenging macro-economic times.

Profit guidance - the detailed guidance below is useful – I really like that they include adj EPS in the guidance section, which saves me lots of time. Let’s hope more companies do this, as EBITDA on its own is not useful guidance at all.

Financial guidance

The Board anticipates Adjusted EBITDA and Adjusted EPS (fully diluted) for the year ending 31 December 2024 will be in the range of current market expectations*.

The Adjusted EBITDA and Adjusted EPS (fully diluted) guidance excludes the one-off incremental costs relating to the implementation of new cloud-based Finance and HR systems, which we intend to treat as an adjusting item and are anticipated to be c.£3m in total and split over 2024 and 2025. UK corporation tax rate is expected to increase from a blended rate of 23.5% to 25%, with expected capital spend of £22m-£25m and Adjusted cash conversion of 90%+.

*Company compiled range is based on known sell side analyst estimates as at 22 March 2024. The ranges are Adjusted EBITDA of £118.3m to £127.4m and Adjusted EPS (fully diluted) of 75.8p to 86.3p.

That gives a PER range of 15.8x to 18.0x, which is consistent with the StockReport which has fwd PER at 16.6x.

Note that the lower end of the forecast range at 75.8p is a negligible increase on the 75.1p actual EPS for FY 12/2023.

I like the history of consistently raising EPS, and a lower valuation, although divis are small -

Balance sheet – I’m pleasantly surprised, this is much better than I expected for an acquisitive group. Intangible assets is mostly goodwill amp; similar, totals £155m.

It’s a capital-light business, with modest fixed assets, and little in inventories. Cash is very healthy at £136.5m, with negligible borrowings of only £1.7m. There’s another £10m in lease liabilities, which is insignificant compared with the cash generation amp; profits.

Overall its finances look very healthy indeed, and I see ample scope to self-fund more acquisitions, or more generous divis? Although it separately announces today a £35m share buyback, to use some of the surplus cash. I think that’s fine, it’s comfortably affordable. All in all, I’m very happy with this balance sheet, which is unusually good for an acquisitive group.

Cashflow statement – looks excellent. Post tax it generated £108m positive cashflow in 2023. That funded capex of £5.6m physical, £17.4m intangible (mainly £14.4m capitalised development spend, which is well above the £5.2m Pamp;L charge, giving a boost to profit).

Acquisitions (of other businesses) cost £22.8m in 2023, £9.8m in 2022, so it seems like the acquisition strategy is small bolt-on deals, rather than anything more significant, which is fine.

Dividends were modest at £15.2m, but its dividend paying capacity is much larger I think.

Those are the main items. Overall cash balances rose a very healthy £42m in 2023, reinforcing that it could have roughly quadrupled the divis instead of accumulating more cash.

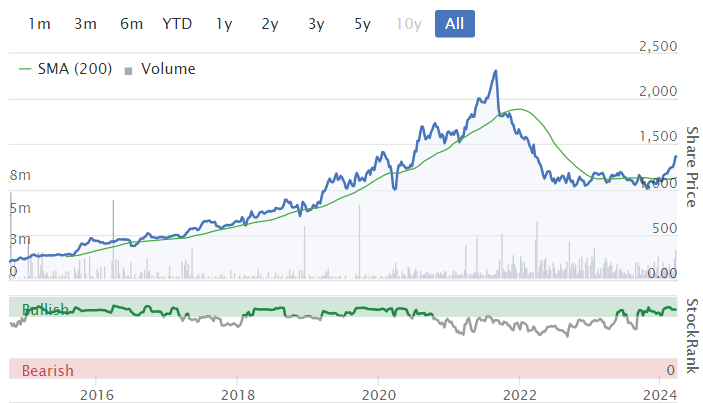

Paul’s opinion - on an initial review, I think this share looks good. The recent strong rally in share price seems justified. The next step would be to properly research the business model – eg what services it provides and how they compare with competitors. Also what went wrong from Sept 2021, when the share price peaked c.2312p, bottoming out around 1000p throughout 2022-23. It’s since put in a nice partial rebound this year to date.

Overall, I’d say this looks a good business, at a valuation that’s fair. The track record looks good, I like the very strong balance sheet with about 10% of the market cap being surplus cash.

The shareholder register is a roll call of typical institutional investors, with no significant founder or individual holders. So it would be fairly easy for a takeover approach to succeed here if a decent premium were offered. I bet the US private equity funds have been checking out these numbers as we speak, so a bid wouldn’t surprise me – an acquirer could strip out the surplus cash, and gear it up with say a couple of hundred million pounds in bank debt, and that’s paid for the takeover premium of c.30%.

I’m happy to go with AMBER/GREEN, leaning towards a positive view.

Looks like a new bull market in this share might be beginning? Decent StockRank of 83 too -

Mobico (LON:MCG)

Down 4% to 68.4p (£421m) – Update on timing of results amp; guidance – Paul – BLACK (profit warning) – AMBER on fundamentals.

This transport group includes US operations, National Express coaches in the UK, ALSA in Spain, and German rail operations.

Mobico Group plc (“Mobico” or “the Group”) today announces an update on the timing of the publication of its audited financial results for the year ended 31 December 2023 (“FY 2023 Results”). As a result of the events set out below the Group now expects to publish its FY2023 Results in the second half of April.

This is the second time accounts have been delayed by audit issues.

A technical issue has arisen in Germany, due to changes in special official inflation statistics that are used by transport operators to determine cost recovery. Something like that anyway! The impact sounds small – currently estimated at £15m in total until 2032, which doesn’t sound much once it’s annualised.

That sounds a plausible reason as to why the accounts have been delayed again.

Updated guidance – is helpful, but why don’t companies also provide the previous guidance, so we can quickly compare them? They’re wasting everyones’ time not doing this, it’s infuriating, we get this from lots of companies.

Luckily I made a note last time, on 20/2/2024 MCG guided adj EBIT would be £175-185m, so it’s today dropped that to £160-175m new range, as below -

· Given the remaining judgemental items to be finalised Adjusted1 EBIT will now be in the range of £160m – £175m although the Group’s expectation is that it should be at the upper end of that range; and

· It expects an increase to the onerous contract provision as at 31 December 2023 of about £70m in addition to a prior year adjustment in relation to the onerous contract provision in FY2022 of an amount in the region of £25m.

Broker updates – nothing detailed is available for the plebs I’m afraid.

However, the broker consensus numbers have been in a relentless downtrend -

Shares are really bombed out, and it only increased the share count by about 20% to 614m shares during the pandemic. So theoretically this share price could be a good recovery candidate, if all the negative issues get resolved -

Paul’s opinion – I don’t have enough information to form a strong view. However, consulting our previous notes here, both Graham and I are intrigued by the possibilities. Despite a series of profit warnings, MCG is a large sprawling transport group that has previously indicated it will be highly cash generative in the post-pandemic era. It successfully refinanced bonds not long ago, at favourable rates, so if the bond lenders don’t perceive much risk, that’s usually positive for equity too.

More than half the H1 operating profit was consumed by finance charges, so I don’t think operating profit is a good metric for it to be quoting in trading updates.

Looking back at its last H1 results, reinforces to me what a large and complicated group this is. Also its NTAV is negative, so it’s heavily reliant on hefty borrowings.

I’m going to sit on the fence until I’ve had a good look through the 2023 results when they eventually appear. AMBER.

Nothing much has changed today, I don’t think a further delay in accounts publication is a particular worry, as the reasons given seem reasonable.

Graham’s Section: Bioventix (LON:BVXP)

Share price: £46.90

Market cap: £245m

Bioventix plc (BVXP)… a UK company specialising in the development and commercial supply of high-affinity monoclonal antibodies for applications in clinical diagnostics, announces its unaudited interim results for the six-month period ended 31 December 2023.

I’ve managed to cover this company from time to time without ever really understanding the science.

According to Wikipedia, this is the definition of a monoclonal antibody:

A monoclonal antibody (mAb, more rarely called moAb) is an antibody produced from a cell lineage made by cloning a unique white blood cell. All subsequent antibodies derived this way trace back to a unique parent cell.

And this is how they are used:

It is possible to produce monoclonal antibodies that specifically bind to almost any suitable substance; they can then serve to detect or purify it. This capability has become an investigative tool in biochemistry, molecular biology, and medicine. Monoclonal antibodies are used in the diagnosis of illnesses such as cancer and infections and are used therapeutically in the treatment of e.g. cancer and inflammatory diseases.

Bioventix has been one of the best-performing shares in the small-cap market:

Here are the latest interim results:

-

Revenue +13% to £6.7m (2022:£5.9m), in line with expectations.

-

PBT +16% to £5.2m (2022: £4.5m)

-

Small increase in the cash balance to £5.5m, after making a large dividend payment.

-

First interim dividend up 10% to 68p. Corporation tax has held back the growth of after-tax net income growth.

Troponin tests: “temporary operational issues experienced by our partner customers have slowed the rollout of their improved troponin assays” and this “has inhibited growth short-term”, but longer-term forecasts for troponin revenues are unchanged.

Ramp;D: this is difficult to follow without any biotech expertise but the company is working on a prototype assay for early detection of Alzheimer’s disease, and another for monitoring of patients later in the disease. The company acknowledges that there is competition from multiple sources in this field.

Bioventix is also working on assays for industrial pollution exposure, and is waiting on results from two other development projects. So there is lots of product development happening behind the scenes, but I consider it very difficult or perhaps impossible to predict the outcomes of these projects.

The short interim report concludes as follows:

In conclusion, our core business has performed in line with expectations with growth in China being a key feature. Troponin revenues did not accelerate quite as expected but we continue to believe that the headwinds are temporary and operational in nature. We remain excited as the scientific output of our Gothenburg Alzheimer’s collaboration slowly translates into commercial potential. We look forward to further progress in the second half of the year and beyond.

Estimates: with thanks to Cavendish for refreshing their estimates today. They have slightly (by 1%) reduced their profit forecasts for this year and next year, taking into account the impact of the corporate tax rate. They also reduced their dividend forecasts to a more conservative level.

-

New EPS forecasts: 164.6p this year, 177.9p next year.

-

New dividend forecasts: 161p this year, 172p next year.

As you can see, EPS is nearly entirely paid out in the form of dividends.

One of the key reasons the company can do this is because its accounts are so clean. It capitalises barely any expenditure. So you get a clean conversion from net income, to cash flow from operations, to free cash flow.

Balance sheet: net assets are £11.4m. It’s one of the simplest balance sheets you are ever likely to find in a company of this size, with only five line items for assets and two line items for liabilities! Remarkable.

Graham’s view

The archives show Paul and I taking slightly different approaches to this one, although for good reasons:

In March 2023, when last year’s interim results were released, I took a neutral stance (share price at the time: £39), on the grounds that I find its technology difficult to understand and that the valuation was full.

In October 2023, when the full-year results were released, Paul took a positive stance, considering the incredibly powerful long-term financial performance of the company. He also noted that the share price had fallen modestly since I’d covered it (to £36) and that brokers had upgraded forecasts.

Today, at a share price of nearly £47, I am struggling to maintain the enthusiasm for a GREEN stance. The PE Ratio is in the region of 28x. Admittedly the stock has traded higher than this from time to time:

I’m on the borderline but I think I’ll return to my AMBER stance. When the PER gets closer to 20x, I can justify a positive stance on this one, taking into account the company’s wonderful, pretty much unrivalled track record for shareholder returns.

But with a PER closer to 30x, I’m just not comfortable enough backing this horse when I have no way of predicting whether or not the current pipeline is going to result in successful product launches.

History does suggest that it will succeed:

Henry Boot (LON:BOOT)

Share price: 182.8p (-0.7%)

Market cap: £245m

Henry Boot PLC, a Company engaged in land promotion, property investment and development, and construction, announces its unaudited results for the year ended 31 December 2023.

We covered Henry Boot’s profit warning in January. The company was forced to concede that the macro outlook was not improving quickly enough to enable much of a recovery in residential property sales in 2024.

I remained positive on it due to a high net asset value, a good long-term track record, and a cheap earnings multiple against what I believe it could earn in a “good” year.

Here are the 2023 results:

-

Revenue +5.3% to £359m “driven by land disposals, property development and housing completions”.

-

PBT £37.3m (2022: £45.6m)

-

ROCE 9.9% (2022: 12%), “at the lower end of our medium-term target of 10-15%” (not enough companies tell us what their ROCE target is, if any!)

Other key items:

Net debt has increased to £78m, at the high end of (but still within) the company’s target range.

NAV per share increases slightly to 306p, much higher than the company’s share price (it’s trading at a 40% discount). It’s almost 100% tangible.

Dividend increases 10%, so the total dividend for the year is 7.33p. BOOT pays a useful yield:

I covered the various parts of the company in January in relation to their 2023 performance, but here’s a brief recap. As you can see there are multiple activities within the group:

Land promotion: fewer plots sold in 2023, but at higher margins. Land bank nearly 101,000 plots.

Property investment and development: a huge £1.5bn development pipeline (up from £1.3bn last year). This includes joint ventures, i.e. only a fraction of this value is attributable to Boot.

Boot’s own private Investment portfolio saw its value increase to £113m.

Stonebridge homes (a unit within property development): still quite small, but “scaling up in line with its growth aspirations”. 251 homes completed in 2023.

Construction: turnover fell by about 30% “in a challenging market”; it remained in the black with an operating profit of £6.5m (2022: £12.1m).

To help make sense of all the segments, here’s a table showing the contribution of each to the overall result.

Out of £40m total operating profit (before central costs), property investment/development and land promotion were about equally important, contributing £20m+ each:

In 2022, operating profit was over £46m, with much bigger contributions from property investment/development and from construction.

The big picture is that 2023 saw “a slowing economy, facing stubbornly high inflation and rising interest rates”. While the economy may now have turned a corner, there will be a delay before profitability picks up again due to higher activity in Boot’s “rate sensitive markets”. As such, the company remains cautious in the short-term. This leads us to the outlook:

Outlook

It’s a very mixed outlook statement from my point of view, with the company on the one hand arguing that the economy is improving, but at the same time unable to offer much clarity on when its financial performance will rebound. Here’s an excerpt:

…planning uncertainties and delays will continue to be a problem and we also face the uncertainty of a General Election during 2024.

Not surprisingly, we do not have clear visibility on how all of this will unfold and, with key transactions to execute and complete this year in both land promotion and development, we expect 2024 results will be heavily second half weighted

The planning system is described as “increasingly dysfunctional and under resourced”. As the company has many thousands of plots and is always seeking to increase the number of those with planning permission, I would imagine that it knows what it’s talking about – and of course is highly motivated to see the planning system speed up.

Graham’s view

I remain a fan of this business. It has a great tendency to generate profits, even in tough years like 2023. I also like the way it set out its stall with a 10-15% ROCE target and with a range of other medium-term targets such as:

-

Capital employed (wants to grow from £417m to £500m+)

-

Plot sales (from 1,900 in 2023 to c. 3,500 p.a.)

-

Development completions

-

Investment portfolio

-

Stonebridge Homes Sales

etc. etc.

It’s a very clear medium-term strategy providing investors with simple ways to track the company’s progress against its targets. And the targets themselves seem quite reasonable and realistic to me, while also providing for good growth.

The growing net debt position is a slight concern but at a 40% discount to NAV I think many investor concerns should be priced in here.

The difficulty is that it’s not “just a homebuilder” or “just a development company”. With so many different (but related) activities, investors have lots to keep track of, though the KPIs do help in that regard.

This is not a high-conviction stock for me but I do remain positive on it at this level. I think that a stronger economy with lower interest rates would see it back around its 300p NAV. Of course how long it might take to get there (if ever) is the difficulty. But the risk/reward seems favourable to me:

Source: https://www.stockopedia.com/content/small-cap-value-report-mon-25-mar-2024-gama-bvxp-boot-mcg-quick-dlg-opti-bar-imm-inc-fdbk-993070/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).