Small Cap Value Report (Thu 28 Mar 2024) - DPP, SPT, CML, C4XD, PMP, XAR, ZOO, AO., DUKE, JD, LTHM, RBGP

Good morning from Paul amp; Graham!

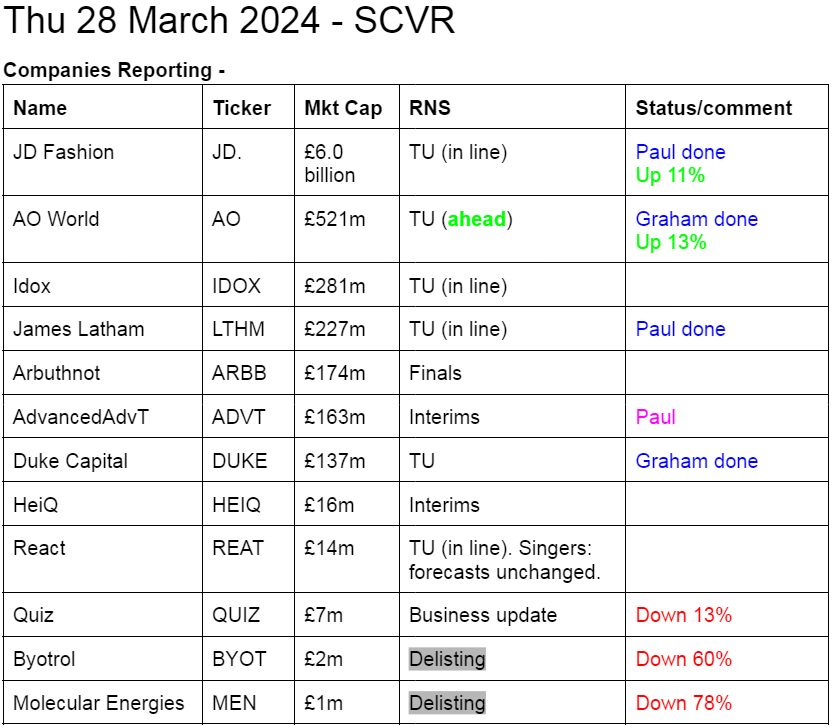

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates amp; results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it’s anybody’s guess what direction market sentiment will take amp; nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed – please be civil, rational, and include the company name/ticker, otherwise people won’t necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we’re not making any predictions about what share prices will do.

Green (thumbs up) – means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it’s such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber – means we don’t have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) – means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we’re not saying the share price will necessarily under-perform, we’re just flagging the high risk.

Links:

Paul amp; Graham’s 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul’s podcasts (weekly summary of SCVRs amp; macro views) – or search on any podcast provider for “Paul Scott small caps” – eg Apple, Spotify.

Other mid-morning movers (with news) -

Northamber (LON:NAR) – down 23% to 35.5p (£10m) – H1 Results – Paul – AMBER/RED

The only attraction to this share is that its NTAV is £22m, more than double the market cap. This is all tied up in inventories and receivables, and the business trades at a small loss.

A totally pointless company, tying up inefficient assets. The 63% major shareholder doesn’t seem to have any idea how to unlock shareholder value, and is impervious to outside pressure with a controlling stake. No point in it having a listing, so why get involved?

Molecular Energies (LON:MEN) – down 78% to 5.4p (£1m) on announcement shares are to de-list – Paul – GREY (delisting)

This explains it well –

Peter Levine, Chairman, comments: “I take no joy in recommending the cancellation of trading in Molecular’s shares on AIM and know that this proposal will impact many shareholders. However the primary benefits of being listed are to avail oneself of access to capital, the ability to utilise one’s shares as currency and enjoying the reputational boost of being on the London Stock Exchange. Molecular no longer receives any of those benefits and so can no longer justify the disproportionately high costs of remaining listed. As a Group its interests are best served by turning to the private arena where Molecular can regenerate away from the microscope and constraints of the public markets yet avail itself of funding and exit opportunities in some ways more flexible and abundant than remaining as a small public company on the London market.

MEN only recently did a deeply discounted fundraise which I mentioned briefly here on 24/1/2024. Terrible news for shareholders, as this share entered 2024 at 78p, so it’s now lost over 90% in just 3 months.

Summaries

AO World (LON:AO.) - up 7% to 96.5p (£558m) – Trading Statement – Graham – AMBER

An excellent update as FY 2023 adj. profits will be “at least” at the top end of the previously guided range. The company now has a healthy net cash balance (ex. leases) and its core business is starting to grow again. I don’t view it as cheap but am genuinely impressed.

Duke Capital (LON:DUKE) – up 3% to 33.55p (£143m) – Trading and Operational Update – Graham – GREEN

A solid update confirming that Q3 (to Dec) recurring revenues hit a new all-time high. Q4 (to March) recurring revenues have fallen due to disposals; Duke needs to reinvest the proceeds well and without too much of a delay. I continue to like this at a discount to NAV.

Paul’s Section:

DP Poland (LON:DPP) - 12.7p (£92m) – Proposed Fundraising – Paul – AMBER

Yet another equity fundraise from this serial disappointer, the Poland operator of Dominos Pizza. However, this looks different. For a start, the share price has been rising nicely, although the 9.92 placing is at a discount. Secondly this £20.5m fundraise is cornerstoned by larger UK Dom Development SA (WAR:DOM) which is subscribing for just over half the fundraise. I think that turns it from the usual DPP fundraising mode of desperation, to promising.

Also the business model is changing from losing money operating stores, to a franchising model.

Paul’s opinion – heavily biased by years of reporting dismal results. There might be a turnaround here now, but personally I think paying (post dilution) over £100m for it, looks unattractive, so it’s not for me, because they’re asking me to pay too much up-front for future success that has been so elusive to date. Current trading sounds good though, but it always does with this company. Good luck to everyone involved.

Spirent Communications (LON:SPT) – 179p (£1.04bn) – Recommended acquisition by Keysight Tech - Paul – PINK (takeover bid)

RNS this morning confirms Spirent management has agreed a higher cash bid from Keysight Tech at 199p + 2.5p special dividend. This beats the previous bid of 175p from Viavi Solutions.

(This section below written last night)

Never mind checking the RNS every morning at 7am, we now need to check the SNS (Sky News Service) before going to bed every night, as that’s where we repeatedly get inside information early, particularly takeover bids. The Takeover Panel rules demand that companies respond if talks are leaked to the press, which has always struck me as ludicrous. It now seems established practice that deals are leaked to Sky, in order to force an announcement, in what is often a false market where companies themselves hide price sensitive information from investors.

So actually, given we have a lousy system, then all power to Sky News, and I hope they keep pre-announcing as much price sensitive information as possible.

According to Sky, an ideal situation has arisen for Spirent shareholders, where two US bidders are now competing for it.

Checking my previous notes, SPT warned on profits in 2023, pulling it down from c.250-300p range in 2020-22, to a low of c.95p in Oct 2023. Then a good bombshell on 5/3/2024 with a recommended cash offer at 175p from US competitor NASDAQ-listed Viavi. My crystal ball was working quite well, as I did ponder on 5/3/2024 if a higher competing bid might appear, and some subscribers thought the bid from Viavi might be opportunistic due to Spirent seeing a temporary dip in performance?

This is what Sky says now -

Sky News has learnt that Keysight Technologies, which is publicly traded in New York, is preparing to launch a formal offer for Spirent worth roughly 200p-a-share.

That would value the FTSE 250 target at about £1.15bn.Keysight’s bid will trump a 175p-a-share bid unveiled last month by Viavi Solutions, a US-based technology company…

One institutional investor said they expected the higher offer to persuade Spirent’s board to switch its recommendation from Viavi to Keysight…

The emerging bidding war between two American companies for a London-listed technology provider will again raise questions about whether the UK equity markets are mispricing successful businesses with substantial growth prospects.

Paul’s opinion – exciting! The bid(s) for Spirent may be a decent premium to recent bombed out share prices, but if you think Spirent can recover profits back to previous levels, then the bidders may even get a bargain.

Over amp; over again we’re seeing that UK public markets are under-valuing many companies. There are opportunities galore in UK shares, as these bid approaches keep confirming.

CML Microsystems (LON:CML) – 310p (£50m) – Trading Update [26/3/2024] – Paul – BLACK (profit warning) – on fundamentals GREEN

CML Microsystems Plc, which develops mixed-signal, RF and microwave semiconductors for global communications markets, is today issuing a trading update for the year ended 31 March 2024 (“FY24″).

I thought it would be interesting to check out CML, as the shares have dropped a lot recently. This is a hybrid share, which has built up strong surplus assets (cash and freehold property) over the years. So there could be an angle on this share whereby the recent big fall in share price might be letting us own the operating business on the cheap (since the assets might support the share price better now?)

My previous notes indicated that some of the surplus cash pile had been earmarked for a US acquisition.

Summarising the latest update -

Good H1 as previously reported.

H2 has been tougher for various reasons, customer destocking sounds the main problem.

De-stocking expected to continue for a while.

MwT acquisition has gone well.

FY 3/2024 revenues expected “close to £23m” slightly below expectations.

Profit expectations reduced mainly due to sales mix shifting to lower margin products.

Shore capital has kindly updated us, but doesn’t do a before amp; after, so I’ll do it -

New (26/3/2024) forecast FY 3/2024: £3.7m adj PBT, 18.7p adj EPS (down 15% on LY)

Old (5/12/2023) forecast FY 3/2024: £4.4m adj PBT, 22.2p adj EPS.

Ah OK, so it’s worse than the RNS makes out, annoyingly.

Does this (arguably temporary de-stocking issue) justify such a sharp share price reduction as this though? -

Cash – is still highly significant considering the market cap is £50m -

The Company retains a strong balance sheet, with net cash reserves of just under £18m.

Paul’s opinion – as profit warnings go, this looks pretty mild, and seems to be a “good” profit warning – ie fixable, temporary problems, not a structural downturn … hopefully!

There have been several (disastrous) recent floats of chip developers, that seem to run out of money, and have a history of never making any profit, despite which investors seem to become easily excited if they issue contract win announcements. Whereas here with CML we have an established chip business, that has reliably generated cash almost every year, doesn’t need to raise cash from equity holders (indeed it pays divis) and owns a large business park that it’s been trying to redevelop for many years.

From this quick review, I think the plunge to 310p could be providing us with a potential buying opportunity, but you need to do a lot more detailed research for yourself, that’s just my quick initial view.

C4X Discovery Holdings (LON:C4XD) - down 24% y’day to 10.0p (£25m) – Interims amp; Voluntary Delisting – Paul – GREY (delisting)

I’m trying to keep track of delistings on my spreadsheet, so am just flagging this for that purpose. We’ve never covered C4XD here in the SCVRs, because it’s been a serial loss-maker, jam tomorrow and repeat equity issuer.

Today it issues strikingly good interim results, very much a one-off, with a £18m H1 PBT, thanks to 2 large milestone payments from pharmas.

In another RNS it announces it’s flouncing off (delisting) because AIM investors give it such a derisory valuation, compared with the much higher valuations available in the private market. They’ve got a point, that the AIM listing is now an impediment to shareholder value.

The announcement also re-writes history to make out that C4XD has performed well, which of course is nonsense. It’s many years of poor performance which has caused the market cap to get this low.

As I’ve always said, the stock market is completely the wrong place for speculative, loss-making, jam tomorrow companies.

Note the share register is dominated by 3 large investors, who probably don’t see any value in a stock market listing either.

It must be galling to small shareholders though, some of whom might have supported this company for years, to be presented with the first decent set of accounts, which come with news that it intends to delist. I find this disconcerting, as it’s the first situation I can remember where a company which has actually had some success, promptly announces it wants to delist. It’s usually just the complete basket cases that delist. So it’s now looking worryingly, that we might face delisting risk at both good and bad companies. Something to ponder. Checking the shareholder register for one or a few dominant shareholders, also greatly increases the delisting risk. They might want their mistakes taken out of public view, as much as anything, perhaps? I can feel a rant coming on for this weekend’s podcast!

Portmeirion (LON:PMP) - 244p (£34m) – FY 12/2023 Results – Paul – AMBER/RED

Portmeirion Group PLC, the owner, designer, manufacturer and omni-channel retailer of leading homeware brands in global markets, announces its preliminary results for the year ended 31 December 2023.

This ceramics maker has disappointed once too often for me, and I don’t like the way it slipped out profit warnings through broker notes on the quiet.

Although personally I did catch that 60% bounce from 300p to 500p last year, and luckily sold at the top. Who needs US tech shares, when it’s possible to make a 60% profit in a few months from a Stoke-on-Trent teapot maker (as one of our subscribers hilariously quipped when tech stocks were soaring, we were obsessing about teapots here!)

Zooming out on the chart to 5-years, the recent rally has been barely a blip in a very disappointing downtrend -

2023 results look poor, with a modest adj profit, and a hefty statutory loss –

Dividends have been cut from 15.5p in 2022 to 5.5p for 2023, which I think makes sense given the poor profit performance.

Borrowing is under control I think, however there’s a bombshell in the going concern note, saying that a “material uncertainty” exists over Lloyds Bank renewing facilities in Sept 2024. Management think that’s unlikely, but I’ve personally experienced Lloyds pulling the rug out unexpectedly (back in 1996), so I wouldn’t trust them as far as I could throw them. So there’s a risk PMP could need to dilute, with an emergency placing.

The balance sheet overall looks fine, but there’s too much tied up in inventories. PMP needs to greatly reduce inventories, so it doesn’t need to rely on the (uncertain) bank, in my view.

Outlook - little reason to celebrate here -

Paul’s opinion – I’m a bit wary of PMP now, and doubt I’ll be bottom fishing again here. It feels to me as if there could be scope for another profit warning, PMP seems to have developed a liking for missing targets. Although lower costs (especially energy) should be helping somewhat.

I think it’s a good example of a company that is bad at acquisitions, so money was wasted on deals which have not delivered any overall benefit, but have left it financially weaker.

The “material uncertainty” in going concern compels me to flag the higher risk, so my hands are tied, it has to be AMBER/RED.

Xaar (LON:XAR) – 103p (£81m) – FY 12/2023 Results – Paul – AMBER

Xaar plc (“Xaar”, the “Group” or the “Company”), the leading inkjet printing technology group, today announces its full year results for the 12 months ended 31 December 2023.

It says these results are in line with management expectations. I’m pleasantly surprised actually, as Graham had written quite bearishly about XAR in late 2023.

The highlights below shows adj PBT slightly up, but note that’s due to big adjustments, with a statutory loss before tax. Also it’s still got net cash of £7.1m -

Even though the share price has come down a lot, the £81m mkt cap is not exactly a bargain against these numbers above.

So the market is still anticipating increased profits in future.

Note that profit is stated after expensing £5.6m of Ramp;D.

Balance sheet has a couple of unusual items. Inventories of £31m looks far too high, and so there might be write-offs to come maybe? Note £2.1m of deferred consideration is payable in 2024. Also I query the £8.3m in fixed assets called “Financial asset at fair value through profit or loss”, I’m not sure what this is?

Overall, if they can get inventories down, then the balance sheet should be OK.

Outlook – makes generally positive noises, although it also sounds cautious -

Whilst the end of 2023 was challenging, and the current external trading environment remains so…

As previously announced in our November 2023 trading update, due to the current geo-political and macro-economic conditions, bringing some of our customer’s products to market is taking longer than expected, meaning we are cautious on precise timing.

It gets worse – gross margins are expected to fall -

As we reduce our finished goods inventory during 2024, the lower volumes will impact our ability to recover production overhead costs. Together with the effect of increased input costs, as previously explained, our gross margin will be impacted this year.

Overall though, no change to expectations for 2024 – which according to Progressive is only for breakeven.

We believe the business is well positioned for growth through both new applications and share gains in new and existing markets and our expectations for the full year remain unchanged.

Paul’s opinion – there’s no denying XAR has been a big disappointer for a long time. However, that massive spike in 2013 was when one of its innovative printheads hit the big-time for a while, I think that was when it cornered the market in Chinese tile printing for a little while.

So the company has demonstrated what upside can happen if one of its products really takes off. Trouble is, it wasn’t able to follow up on that success.

With only breakeven forecast for FY 12/2024, and some quite negative things in the outlook section, I can’t get excited about XAR shares. We’re just being asked to have a punt on its new products hopefully taking off. I have no idea how likely that is, so can’t really work out how much this share is worth. I’ll be a bit kinder than Graham last time, I’ll go with AMBER.

Zoo Digital (LON:ZOO) - 36.4p (up c.67% this week) £36m – Trading Update – Paul – AMBER/RED

ZOO Digital Group plc (AIM: ZOO), a leading provider of end-to-end cloud-based localisation and media services to the global entertainment industry, today provides an update on trading.

This share has been an unmitigated disaster in the last 12 months, losing c.90% from peak c.200p to low last week just above 20p. It’s put in an impressive 67% rise this week, although percentages from a low base look better than reality of it only being a small blip in a big downtrend -

What went wrong? Hollywood strikes, and streaming services retrenching. Even so, the rapid descent into large losses took us all by surprise, even commentators like me who were not keen even before all the problems emerged.

Has it turned the corner? The current financial year is FY 3/2024. Tuesday’s update this week said -

“the Company is beginning to see an acceleration of its pipeline with work expanding in March and April 2024…”

It now expects to beat market expectations, but is coy about saying how much of a beat, and see the footnote which shows the expectations are dismally low, for a large loss -

As a result, the Company expects to beat revised market guidance for FY24* with revenues of at least $40 million. Consequently, the anticipated EBITDA loss will be reduced.

Net cash on 31 March 2024 is expected to be at least $3 million, also higher than revised market expectations, and although the Company has no debt it intends to renew its current undrawn facilities when they fall due.

* The Company understands market consensus for FY24 to be revenue of $37.6 million, EBITDA adjusted for share based payments loss of $14.0 million and net cash of $1.6 million.

My question would be whether the bank is happy to renew facilities for such a heavily loss-making company? If not, then it’s almost out of cash, and could need another equity raise.

Broker updates – many thanks to Singers for making its updated forecasts available to us.

The FY 3/2024 figures look seriously grim. Adj EBITDA has only been improved by $0.5m, to a $(13.5)m loss. That translates into a $(20.8)m adj PBT loss. Horrendous, in other words.

FY 3/2025 forecast is for a +50% recovery in revenues to $60m, and adj PBT slightly loss-making at $(0.8)m.

Outlook - the company makes positive noises here, but remember that according to Singers, it has to increase revenues by 50% just to get close to breakeven. Also I imagine such a big increase in revenues, even if it’s achieved, would suck cash into working capital. So the cash position looks precarious to me.

My opinion – I’m highly sceptical. ZOO has incurred such large losses in FY 3/2024, that I’m struggling to imagine that it could recover sufficiently quickly to avoid another likely year of losses in FY 3/2025, albeit hopefully reduced losses.

It’s burned through a cash pile in FY 3/2024, and I reckon it will need another fundraise.

This update does its best to sound positive, but with things looking finely balanced, I’m not tempted to punt on this share. I’d rather sit on the sidelines and wait to see if trading actually does rapidly rebound. Even if +50% revenue growth is achieved, it would still be a modestly loss-making business, so where’s the attraction of taking all the risk of a possible fundraise, when the upside is only that it might get to breakeven? Risk:reward looks weak to me, so I’ll go with AMBER/RED.

JD Sports Fashion (LON:JD.) up 11% to 129p (£6.7bn) – Trading Update FY 1/2024 – Paul – GREEN

This is a large, international fashion sportswear retailer. Shares have been looking cheap for a while, so I’m interested in reporting on this mid-cap.

Key points -

FY 1/2024 adj PBT in line with guidance of £915-935m.

Initial guidance for FY 1/2025 PBT £900-980m (before accounting policy changes, which will boost this range by c.£55m).

First 7 weeks of new year trading has been in line.

Outlook - a bit mixed I’d say -

The market remains challenging due to less product innovation and elevated promotional activity in key markets, particularly online. We anticipate trading conditions will improve as we move through the year, helped by a busy sporting summer, softer comparatives with last year from Q2 and an improving product pipeline towards the end of the year. Given this, Q1 is likely to be the softest LFL period of the year and H2 is likely to be stronger than H1. In addition, cost inflation remains elevated, particularly labour, and we will continue to invest in our infrastructure in FY25 to deliver our long-term growth plan.

Paul’s view – I remain of the view that this share seems modestly valued on a PER basis, for a group with a stunningly good long-term track record.

Even after today’s rise, the PER would only be about 10. So I’d say it’s worth readers taking a more detailed look yourselves. There was a profit warning on 4/1/2024 which I reviewed at the time – it wasn’t too serious, just soft Xmas trading.

James Latham (LON:LTHM) - Unch at 1,120p (£227m) – Trading Update FY 3/2024 – Paul – GREEN

We like this company, a family-controlled timber merchants. It had a profits bonanza during the pandemic, when limited supply met with excess demand, causing profit to soar. Conditions are now normalising, and it’s good to hear that trading is in line with expectations (which already factor in a big reduction in profits from the pandemic boom) -

The Board of James Latham provides the following trading statement ahead of the Company’s results for the year ended 31 March 2024.

Revenue for the year to 31 March 2024 remains in line with market expectations. Cost prices of both timber and panels are relatively stable. The ongoing issues affecting shipping in the Red Sea have caused some delays and increased costs for some of our imported products, although this is currently not causing concern. Sales volumes are very similar to the previous year.

Overheads have been well controlled but are slightly higher due to inflationary increases and our continuing investment in our depots to improve service levels. We anticipate that our profit before tax will be in line with market expectations. The Company’s balance sheet and cash balances remain strong.

The Board plans to report the Company’s preliminary results for the year ended 31 March 2024 on 27 June 2024.

The StockReport here is showing 96p forecast for FY 3/2024, which is still about 50% higher than pre-pandemic, so I am still a little worried that normalising supply could result in selling prices falling in future maybe? The PER is 11.7x

Why would profit be permanently 50% higher than pre-pandemic in future?

For that reason, I’m a little sceptical that high profits are necessarily sustainable, but so far it’s doing OK.

The last H1 balance sheet isn’t just strong, it’s groaning with surplus liquid capital – look at the middle section (below), and bear in mind there are no significant long-term creditors -

The mkt cap of £227m is only a bit higher than the last balance sheet NTAV of £202m. So at some point LTHM shareholders should receive a bonus from special divis, buybacks, etc.

It’s difficult to think of any other small cap with a balance sheet this ridiculously strong, so LTHM shares are absolutely copper-bottomed, for investors who want to sleep at night.

I have to stay at GREEN, due to this immense financial strength, and reasonable valuation (providing future profits don’t slip) -

RBG Holdings (LON:RBGP) – up 10% to 9.5p (£12m) – Disposal of Convex – Paul – AMBER/GREEN

This accident-prone legal services group seems to have resolved another of its problem areas – selling its Mamp;A division Convex to a management buyout team for £2.0m initial cash, with a possible £0.6m earn-out, linked to 4 specific deals. This 2019 acquisition has been a bad one, and will incur a £13.5m non-cash write off (of goodwill I assume).

The Disposal is in line with the Group’s strategy to reduce its risk profile and to refocus on and invest in RBG’s established legal services businesses – Rosenblatt and Memery Crystal – where the Board believes it can best maximise profits. Similarly in 2023, the Group disposed of LionFish Litigation Finance Limited (“LionFish”).

Paul’s opinion – I wonder if there’s turnaround potential here? Old management’s disastrous diversification strategy has now been unwound, leaving behind what should be 2 decent legal firms. Although I’ve never liked the conflict of interest that staff and Directors have, when legal firms become stock market listed.

With the market cap now only at £12m, and the main problem divisions apparently resolved, along with a small placing (at 9p) done and proceeds from the sale of Convex, I’m starting to wonder if this might be worth a little punt for a possible recovery in share price?

Debt is now the biggest risk. HSBC renewed facilities in Dec 2023, and there should have been some progress in paying down some of the debt. So I’m leaning towards seeing this positively as a risky, but interesting recovery punt.

Not the best of track records -

Graham’s Section:

AO World (LON:AO.)

- Share price: 96.5p (+7%)

- Market cap: £558m

AO World plc… the UK’s most trusted electricals retailer, today issues the following pre-close update for the 12 months to 31 March 2024.

This stock is a good example of “when the facts change, I change my mind”. A long-term bear of this company – even going so far as to short it at one point – I switched to neutral on it when it started to focus on profitability over empty revenue growth. I covered last year’s results here.

Paul took a look at it in November, expressing concern over the exposure to production protection plans and mobile phone connections.

Today we do get some good news for AO shareholders. Key bullet points from this full-year update:

Revenues c. £1.04 billion.

The company leaves out a comparison with last year – but it’s another annual decline in revenues. FY March 2022: £1.14 billion. FY March 2021: £1.37 billion.

Given the historic lack of profitability at AO, I view its decline in revenues as a good thing. Remember the phrase – revenue is vanity!

Adjusted PBT at least at top end of previous guidance £28-33m.

Great news! It goes to show what’s possible when a company is run for profits rather than for revenues.

Net funds of over £30m.

One of the features of this stock that attracted shorters over the years was the net debt position, but the company has fixed the problem (albeit at the cost of some dilution).

CEO John Roberts comment:

“I’m pleased with the clear progress that we’re making after pivoting our focus to profit and cash generation during the 2023 financial year. As we expected at our half year results, we returned to revenue growth in our core business during Q4 and, as a result, we’re entering the new financial year with good momentum. With net funds on our balance sheet and a clear plan, we remain confident in our ability to deliver on our ambition for 10-20% revenue growth in the year ahead and medium-term profit guidance of 5% adjusted PBT margin.”

Graham’s view

I still can’t believe that this is the real John Roberts! The old John Roberts loved buzzwords and dreamy aspirations, whereas the new John Roberts is a calculating, cold-hearted businessman.

Ever since it ran into some difficulty in 2022, and raised new equity, this company has been telling us the things that most value investors would want to hear: that it’s being run for profit and cash generation, instead of unprofitable revenues.

Revenues have collapsed all the way from a high of £1.7 billion in the Covid-influenced year of 2021, but according to today’s update, the core business is now able to start growing again – from the stable footing of profitability.

Could I even consider taking a positive stance on these shares? I may be forced to at some point, but my sense is that the shares are fairly valued at the current level (PER 20x according to Stocko). For an online retailer that doesn’t own any of the brands it sells, that does seem quite high enough.

But I am definitely more optimistic about this company than I have ever been before:

Paul is right to point out that there are risks related to the company’s reliance on warranty sales. Of course the same could be said of many retailers in this space.

Duke Capital (LON:DUKE)

- Share price: 33.55p (+3%)

- Market cap: £143m

This is “a leading provider of hybrid capital solutions for SME business owners in Europe and North America”.

I think of it as providing a corporate mortgage to small businesses. The key feature of the product is that payments to Duke are adjusted, depending on the revenue growth at the borrower. In this way, Duke gets to participate in the growth of the companies it has invested in.

Today we have a Q3 update (to December) and guidance for Q4 (to March).

Q3 update: Recurring revenue up 12% year-on-year to £6.3m

Q4 guidance: Total cash revenue £10.2m, breaking £10m in a quarter for the first time.

It’s important to note that “total cash revenue” includes non-recurring items such as:

-

Profits when companies buy back their mortgage (i.e. pay it off early) at a premium.

-

Profits from the sale of equity investments.

-

One-off fee income.

Therefore, while the £10.2m figure is a useful measure of profits, it’s not a measure of the stable quarterly income that is Duke’s bread and butter.

Q4 saw two profitable buyouts of their investments, resulting in total income of £19m.

Checking recent RNS announcements, one of these was a UK manufacturer in which Duke had invested £6.2m. The IRR (internal rate of return) on the investment was 36%, enjoyed over a three-year period.

The other investment was a Swiss pharmaceutical company (“Fairmed”). The IRR of this investment wasn’t given but Duke did say that the recently agreed sale was “at the upper end of the expected rate of return for Duke with no equity participation”. €11.4m was the agreed price of the disposal.

I’ve quickly checked the background to the deal; it was originally described as a €10m royalty, and it started in mid-2021. So to receive €11.4m in 2024 is not going to provide an amazing return, but perhaps not bad. Maybe c. 4.5% annualised? And that does not include the income received from Fairmed over the years, which would massively boost the IRR when you take them into account.

Overall, these two buyouts seem to be good news for Duke, providing decent returns although at the same time each buyout brings a challenge to reinvest the funds in a timely and attractive way. This is reflected in the following bullet point:

Duke expects to achieve recurring cash revenue of £5.8 million in Q4 FY24, a small decrease versus the previous quarter. While the recent buyouts have resulted in increased total cash revenue, until this capital is redeployed, there is a temporary impact of reduced recurring cash revenue.

Other highlights include:

-

£2.9m purchase of shares in United Glass Group to bring Duke’s equity stake from 30% to 74%.

I’ve been nervous about Duke’s equity investments, seeing them as a risky venture that could distract from the core royalty product. Duke says that the equity investment in United Glass “is in line with Duke Capital’s vision to deepen its engagement with its high performing partners”.

CEO comment:

“We are delighted to show a record quarter of total cash revenue following the successful exits of two of our investments. Fabrikat particularly highlighted the value of Duke’s capital, having financed an MBO by three executives in 2021, facilitating an exit three years later at a 36% IRR. We look forward to redeploying the capital from these exits into our pipeline of immediate and longer-term opportunities, driving a return in the short-term to delivering record quarterly recurring cash revenues.

Graham’s view

As a former shareholder, I remain a fan of this company, and I’ve been positive on it for some time now.

The share price has been struggling to get back to book value, and remains at a discount. Net assets were £162.5m as of the interim results, versus a market cap of £143m:

I imagine that the company would probably like to raise money, in order to continue growing and diversifying its portfolio.

However, with the share price sitting at a discount to book value, and with general investor appetite being what it is, raising new money right now is probably not very easy or very appetising.

But until it raises new money, investors might (with some justification) worry that the portfolio still isn’t diversified enough yet. And this in turn justifies a share price discount to NAV! So we have a chicken and egg-type of situation.

For me, the shares at this level do continue to represent decent value. The company has only had one unprofitable exit so far, and even that exit was very impressive (it failed to lose much money despite investing in a riverboat cruise operator prior to Covid).

At a yield of 9% and with the company still not having put a foot wrong, it gets the thumbs up from me.

Source: https://www.stockopedia.com/content/small-cap-value-report-thu-28-mar-2024-dpp-spt-cml-c4xd-pmp-xar-zoo-ao-duke-jd-lthm-rbgp-993411/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).