Small Cap Value Report (Fri 5 April 2024) - PINE, STCM, XSG, RUA

Good morning from Paul!

Last day of the tax year today.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates amp; results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it’s anybody’s guess what direction market sentiment will take amp; nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed – please be civil, rational, and include the company name/ticker, otherwise people won’t necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we’re not making any predictions about what share prices will do.

Green (thumbs up) – means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it’s such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber – means we don’t have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) – means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we’re not saying the share price will necessarily under-perform, we’re just flagging the high risk.

Links:

Paul amp; Graham’s 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul’s podcasts (weekly summary of SCVRs amp; macro views) – or search on any podcast provider for “Paul Scott small caps” – eg Apple, Spotify.

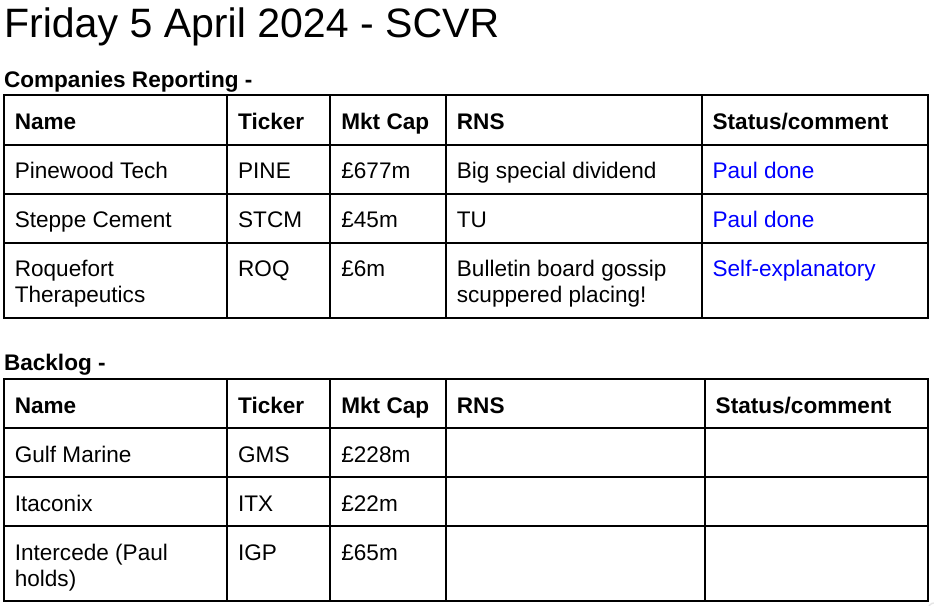

Only 3 companies reporting today, so I’ll be able to cover all of them, plus a couple of backlog items too, hopefully. That’s assuming the RNS hasn’t malfunctioned again – sometimes a second wave of announcements come through about 07:30.

Other mid-morning movers (with news) -

Xeros Technology (LON:XSG) – down 14% to 1.6p (£4m) – conditional fundraising at 1.5p. I was quite surprised that this company is still going, after many years of commercial failure and heavy cash burn. Heavy dilution, with this latest fundraise almost tripling the share count. It’s the washing machine project with beads. Share count c.1m in 2017, c.600m after latest raise.Just passed its 10-year anniversary on AIM.

Rua Life Sciences (LON:RUA) – up 16% to 12.75p (£8m) – Business Update – Paul – AMBER

RUA Life Sciences (AIM: RUA), the holding company of a group of medical device businesses focused on the exploitation of the world’s leading long-term implantable biostable polymer (Elast-Eon™), today provides an update on trading for the financial year ending 31 March 2024 and developments since the successful fundraise in December 2023. [at 11p]

Made up H1 shortfall in H2, with FY 3/2024 revenues in line exps at £2.2m. Gross margin will exceed expectations (not stated). Operating costs £200k below expectations at £3.4m. Cash position of £4.0m – about half the market cap, interesting!

Possible large order? - “succeeded in securing the initial development stages of a significant contract with a global enterprise. This contract represents a major milestone on the route to doubling revenues for the contract manufacturing division once fully operational. Initial development work under this contract has commenced, with an initial purchase order valued at £100,000 already received.”

Paul’s view – this heart valve materials technology sounded vaguely familiar, and it turns out this company used to be called Aortech, which I remember from old. Several generations of investors have become excited, then disappointed, with its failure to commercialise what sounds like interesting technology. It floated on AIM in 1997, amazingly! I wonder how much the listing costs, and Directors fees have been over the past 27 years?

It’s making some positive-sounding noises today, so who knows, maybe it’s making some commercial progress at long last? The recently raised cash pile means that we don’t have to worry about solvency for the time being, with maybe 2 years’ cash in the bank? There does seem to be something interesting hear, but people have been saying the same thing for the last 27 years.

Summaries of main sections -

Pinewood Technologies (LON:PINE) – up 1% to 39.1p (£680m) – Return of £358m to shareholders – Paul – AMBER

Having demerged its main business (car dealers, formerly called Pendragon), it’s now proceeding to pay a large, planned special dividend with the cash proceeds. A 1 for 20 share consolidation is the next step. This leaves a SaaS software business, which looks good (see Zeus note for details), but I question the valuation, which is looking rather full perhaps?

Steppe Cement (LON:STCM) – down 7% to 19p (£42m) – 1.5p/share cash return, Q1 2024 TU – Paul – AMBER/RED

A convoluted corporate structure involving several countries make it difficult to pay divis, so it’s structured a proposed 1.5p cash return as a capital reduction/distribution. The Q1 2024 trading update doesn’t give any details on profits, so is largely useless, and there are no broker forecasts. 2023 results have not yet been published, and H1 results were poor, at only breakeven. Unsurprisingly therefore I’m leaning towards a negative view.

Paul’s Section: Pinewood Technologies (LON:PINE)

Up 1% to 39.1p (£680m) – Return of £358m to shareholders – Paul – AMBER

Formerly the Pendragon car dealership group, it sold the main operations to Lithia (NYSE:LAD) for cash, with 24.5p per share (£358m) to be paid out to PINE shareholders as a special dividend.

A share consolidation will also happen, on a 1 new for 20 old basis, so the share price will rebase upwards, for a smaller number of shares in issue (Old: 1,742.3m, New: 87.1m).

I’m assuming that when the 24.5p special divi is paid on 7 May (for those holding shares on 22 April), then the share price would gap down to 14.6p. Then it would gap up to 292p when the 1 for 20 consolidation occurs. Hopefully those figures are correct.

I make that a £254m market cap for the Pinewood software business post de-merger, which seems a lot, considering it was little more than an afterthought when part of Pendragon.

We need pro forma numbers and forecasts, which Zeus helpfully provide via Research Tree. Forecast adj PBT is £8.5m for FY 12/2024, rising to £12.1m and £15.4m in the following two years. There are good reasons provided for the forecast growth, eg expansion into the US market, in a JV with Lithia. Also Pinewood can now sell to other car dealers who might have seen it as a competitor (when part of Pendragon).

Paul’s opinion – based purely on a quick review, I think we’re being asked to pay too much for future growth that hasn’t happened yet, so it doesn’t interest me at this stage.

The demerger strategy has clearly worked well, with the idea being that a standalone software business would attract a higher rating than was attributed whilst it was part of a car dealership group. That seems to have gone well -

I can’t remember the exact details, but there was some kind of scandal which left Pendragon looking really dicey when it hit the lows of c.6p, which is why the share price crashed before the pandemic hit. Still, it’s been a superb recovery since, so a very good outcome for holders.

Steppe Cement (LON:STCM)

Down 7% to 19p (£42m) – 1.5p/share cash return, Q1 2024 TU – Paul – AMBER/RED

This producer of cement in Kazakhstan is calling an EGM to authorise a reduction in capital to allow payment of 1.5p per share as a capital return to shareholders. More detail is provided as to why this method is being used, which is more tax efficient than paying divis which could be subject to taxation in multiple countries, due to its complicated corporate structure, which seems to involve Malaysia and the Netherlands, as well as Kazakhstan.

I would normally give anything like this a wide berth, but STCM has a history of being profitable, and generous with divis – something that’s quite rare for overseas companies that usually list on AIM primarily to fleece gullible UK investors. So anything that pays generous divis stands out from the pack of AIM junk.

Various problems were encountered and reported in 2023, but we still haven’t had the financial results. A year-end trading update on 12/1/2024 wasn’t much use, unless you have your own forecast spreadsheet that you can plug the selective numbers into.

H1 2023 results were poor, with a breakeven overall result, down from a $12m H1 PBT in 2022.

Q1 2024 trading update – is similar to previous updates, in that it provides detailed information on production and pricing, but not the number we actually need – has it made any profit?! Given that the variables seem to be worse than 2023, and it only reached breakeven in H1 2023, then I’m assuming this means it’s now loss-making?

Paul’s opinion – this might be of interest to special situation investors. The continuing desire to pay divis is the only saving grace really – if it wasn’t for that, I’d be red on this share. However, previously high profits, and a track record of paying shareholders, means I’ll hold back from going fully red. The lack of proper information on profitability, no broker forecasts, and what seems likely to be a loss-making Q1 of 2024, means I’ll go with AMBER/RED.

Ten year track record (chart below) is volatile – but at least it’s got a 10-year track record! – in fact it’s been UK listed nearly 19 years -

Source: https://www.stockopedia.com/content/small-cap-value-report-fri-5-april-2024-pine-stcm-xsg-rua-993936/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).