Small Cap Value Report (Thu 4 April 2024) - MOTR, CAV, CABP, FUTR, GHH

Good morning from Paul amp; Graham!

Almost tax year end, so we only have today amp; tomorrow to make full use of our ISA allowances, and similar.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates amp; results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it’s anybody’s guess what direction market sentiment will take amp; nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed – please be civil, rational, and include the company name/ticker, otherwise people won’t necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we’re not making any predictions about what share prices will do.

Green (thumbs up) – means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it’s such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber – means we don’t have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) – means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we’re not saying the share price will necessarily under-perform, we’re just flagging the high risk.

Links:

Paul amp; Graham’s 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul’s podcasts (weekly summary of SCVRs amp; macro views) – or search on any podcast provider for “Paul Scott small caps” – eg Apple, Spotify.

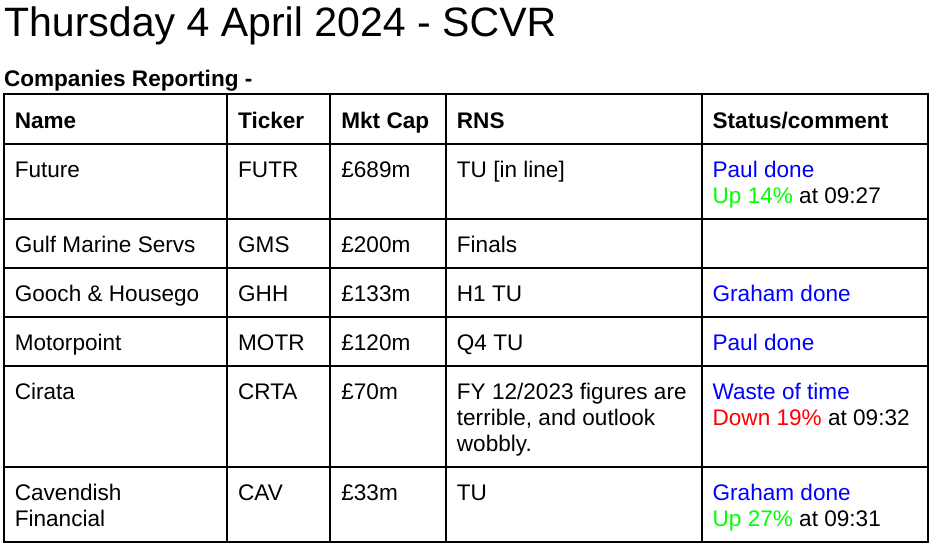

Just a reminder for anyone who has forgotten. This is a list below of companies reporting, and we’ll write up sections on the more interesting ones. It is not a to do list, and we usually cannot cover everything (although it’s quiet today, so we probably can today!)

Other mid-morning movers (with news) -

Cab Payments Holdings (LON:CABP) – up 12% to 123.5p (£315m) – positive market reaction to news of it receiving a European licence -

“CAB Payments announces that its Dutch subsidiary has secured a payment service provider licence with De Nederlandsche Bank N.V. (DNB). This entity will be eligible to provide services across the European Economic Area (EEA) under the passporting regime. This is one of the operational and strategic initiatives that underpin the Group’s growth aspirations for 2024 and beyond. CAB Payments is confident that being able to provide services across the EEA will bring significant opportunity for the business and for the clients and the markets it serves. “

Summaries of main sections

Motorpoint (LON:MOTR) – 134p (pre-market) £121m – Q4 Trading Update – Paul – AMBER

This car supermarket chain has seen an improvement in trading in Q4, although the guidance is still for a hefty £8m loss for FY 3/2024. The sprightly tone of today’s update glosses over the negatives. Broker Shore Capital is hoping it can eke out a £3.0m profit in FY 3/2025. Vehicle stocking loans are now much more expensive, a considerable sector headwind.

Cavendish Financial (LON:CAV) – 10.46p (+21%) (£40m) – Trading Update – Graham – GREEN

A good update as H2 revenues are an impressive £34.5m, up 77% vs. H1. The cash balance bounced higher by £8m over six months to £20m. The Cavendish share price is still lower than it was at the end of 2023 and so there is no reason to change my positive stance.

Future (LON:FUTR) – up 14% to 682p (£783m) – Trading Statement – Paul – GREEN

A sprawling group of websites and magazines issues an in line H1 update. I can’t understand why it’s so cheap, as mentioned in previous reviews here. So well worth readers taking a closer look, I’d say on my initial quick review.

Gooch amp; Housego (LON:GHH) – up 3% to 529.4p (£136m) – Half Year Trading Update – Graham – AMBER

An in line with expectations update, although anything else would have been a shock after it already warned on profits in February. I still find this photonics company interesting but it hasn’t yet demonstrated the quality I think is needed to make it a compelling investment.

Paul’s Section: Motorpoint (LON:MOTR)

134p (pre-market) £121m – Q4 Trading Update – Paul – AMBER

Motorpoint Group PLC, the UK’s leading independent omnichannel vehicle retailer, provides an update on its trading performance for the quarter ended 31 March 2024 (“Q4″) ahead of announcing its Final Results for the year ended 31 March 2024.

MOTR operates 20 large car supermarket sites in the UK, and also sells online, offering mainly nearly new cars. Profitability has collapsed in the last year, due to various factors, including increased online competition, difficulty sourcing vehicles, reduced finance commission, and a sharp fall in used car prices last autumn.

Despite that the share price has put in a decent recovery in recent months, which did surprise me, as it wasn’t driven by any good news from the company.

MOTR issued a nasty profit warning on 30/1/2024, and Zeus slashed forecast losses from £(3.2)m to £(8.7)m, due to falling used car prices, but reading today’s update it’s almost as if that never happened!

H1 results were poor, with a PBT loss of £(3.7)m, on revenues of £607m. A stand-out feature being soaring finance costs (due to higher interest rates) of £5.3m which more than wiped out a small operating profit of £1.6m. This is a big problem for the whole sector, which typically use vehicle stocking loans to finance inventories of cars, which used to be cheap, but are now a lot more expensive.

Today’s update sounds more encouraging, although somewhat vague amp; light on specifics -

Profitability - this all sounds encouraging -

As anticipated in our Q3 Trading Update, the positive momentum experienced at the start of the calendar year continued through February and March, with Q4 retail volume increasing by c.9% year on year. As a consequence, January, February and March were all profitable months. Consumer demand has picked up, and we have benefitted from the numerous enhancements made to our digital presence during the past year which, among other things, is generating strong website traffic. Margins gradually improved through Q4 as we increased stock turn and sold through stock affected by the abrupt Q3 correction in used car values.

Balance sheet – I wouldn’t call it strong. Last reported NTAV was £32m. MOTR conspicuously lacks the big freehold property assets which are typical of traditional car dealers like Vertu Motors (LON:VTU)

Hence it’s rather odd to see the company doing share buybacks, when it’s loaded up with debt to finance its inventories.

Vehicle stocking loans were £102m at 30/9/2023, but it ignores this debt and claims to have net cash of £11.2m in the H1 results headlines, reduced to £9m at 31/3/2024.

Broker update – Shore Capital helps us out with an update note this morning, thanks for that. It says “evidence for a recovery is building”.

Shore says that the range of expectations for FY 3/2024 is a loss of between £8.0m to £8.5m, so I would say being at the “favourable end” of this range is far from a good outcome!

Shore reckons MOTR could bounce back into a modest adj PBT of £3.0m in FY 3/2025. Given the large revenues figure of over £1.1bn, it doesn’t take much of a change in margins to move profit up or down.

Outlook – sounds upbeat -

“I am delighted that the difficult conditions experienced in 2023 have eased in Q4 and, combined with our focus on driving operational excellence through a programme we call Brilliant Basics, has meant that Q4 was characterised by consistent profitability. We are achieving growth, increasing stock turn and improving margins, and this is expected to continue into FY25 as supply improves following recent new car registration growth. I am therefore optimistic for FY25 and look forward to Motorpoint making the most of the growth opportunities ahead.”

Paul’s opinion – I like the concept of car supermarkets, but MOTR has a very unreliable track record of profits – we’ve now had two years of breakeven or losses.

It’s difficult to see why this company is valued at £120m, but maybe investors are hoping it can return to pre-pandemic profitability c.£20m pa. That might be a tall order, because interest rates are now so much higher, making it much more expensive to finance the stocking loans required for its inventories of vehicles.

With little asset backing to fall back on, the valuation seems to have got ahead of itself in my opinion. That said, at least current trading is improving from the poor performance in Q1 to Q3. Today’s update strikes me as over-embellished by the PR. It’s after all dressing up a lousy, loss-making result for FY 3/2024 as if it were some kind of triumph. Although it’s fair to say that trading now seems to be on an improving trend.

Note that the share count has actually fallen over this period, so in theory there’s no reason why the share price couldn’t return to previous highs, if profitability returns.

Future (LON:FUTR)

Up 14% to 682p (£783m) – Trading Statement – Paul – GREEN

My preconception of this share is positive, checking my previous notes here -

7/12/2023 – GREEN at 613p – FY 9/2023 results, shares look superb value.

7/2/2024 – GREEN at 718p – AGM TU, slightly below exps first 4 months. Why so cheap? Rapid debt reduction means I’m not worried about weak balance sheet.

Today we get an H1 update -

Future plc (LSE: FUTR; “Future” or “the Group”), the global platform for specialist media, today announces a post-close trading for the six months ended 31 March 2024.

Overall – trading is in line with expectations for FY 9/2024 -

As a result, the Group is on-track to deliver on expectations for FY 2024, subject to impact of foreign exchange translation.

The StockReport is showing consensus of 121p adj EPS (up 9% on LY), which means at today’s increased share price of 682p the PER is only 5.6x – I don’t understand this valuation, why is it so cheap?

Note that forecasts have reduced a lot, so maybe the market was pricing in further weakness?

Returned to organic revenue growth in Q2.

Reorganisation into 3 business units will make it “more agile and less complex” apparently.

More detail – this sounds a bit mixed -

The return to growth has been driven by a strong performance in Go.Compare, alongside good growth in B2B, and a resilient performance in Magazines. This has been offset by a more challenging performance in affiliate products and digital advertising as macroeconomic pressures and low visibility continue to impact the wider sector. Website users’ broad stabilisation has continued in Q2 but remains in year-on-year decline. Importantly, the implementation of the Growth Acceleration Strategy (GAS), as outlined at full-year results in December 2023, is underway, with encouraging progress from the Hero brands, which continue to outperform the wider brand portfolio. This has been combined with a stronger performance in US direct advertising, a key strategic initiative, driven by the continued focus on premiumisation of advertising inventory benefiting from the Group’s scale and first-party data.

Cash – I would have preferred disclosure of what the net debt figure is, rather than general reassurance that cashflow has been good, but this will have to do -

The Group is highly cash generative and cash conversion in the half has been strong.

Paul’s opinion – as before, I’m perplexed as to why this decent, cash generative business is rated so cheaply by the market. Surely we could put it on a PER of say 10x? That would give a target share price of £12/share, giving c.76% upside from the current price.

Maybe the market might be worried that some parts of the business could be in long-term decline, I seem to recall that’s been mentioned as a concern by some readers here in the past. So that would need careful checking.

Overall at this valuation, I think FUTR looks well worth a closer investigation by readers here. Remember we’re only doing quick reviews of the numbers, we’re not digging right down into the business models, and trying to assess what the future holds – that’s your job! But on my basic review, I have to say the valuation looks highly attractive, so I’ll stay at GREEN. If you find anything wrong, let us know in the comments below!

Graham’s Section: Cavendish Financial (LON:CAV)

10.46p (+21%) (£40m) – Trading Update – Graham – GREEN

Cavendish (LON: CAV), a leading UK mid-market investment bank, today issues a trading update for the year ended 31 March 2024.

Any signs of green shoots? Here are the key points:

-

H2 revenues up 77% to £34.5m vs H1 revenues of £19.5m (these are pro forma revenues; Cavendish was created by a merger that took place in September 2023).

-

Full-year revenues on a pro forma basis are up by 7% to £54m.

The pro forma figures are what really matter here, to avoid any distortions caused by the merger.

And then I would say it’s the full-year revenues that really matter, not a comparison of H2 vs H1. The timing of large deals can cause a bounce in a 6-month period, but I wouldn’t say that this is particularly meaningful unless there is good progress over a full year..

Cash at the end of March 2024 was £20m, covering nearly two thirds of last night’s market cap and up from £12m at the end of H1.

Outlook

Whilst the interest rate cycle appears to have peaked, conditions continue to impact demand for UK equities, making deal execution in ECM (GN note: equity capital markets) challenging across all market participants. However, private and public Mamp;A has remained buoyant in H2 and our pipeline across both ECM and Mamp;A remains good.

Graham’s view

While it was an excellent H2, and it does bode well for FY 2025, personally I’d still like to see another 6-12 months of better performance before getting too excited about a sustained recovery.

The positive market reaction to this update could be a reflection of the fact that the cash balance shot up to £20m; it doesn’t make a lot of sense for this company to have an enterprise value of only c. £13m, which is what it would have today if the share price hadn’t moved.

Also, the Cavendish share price has been quite weak in recent months, as if the market was pricing in very bad news into today’s update. That bad news hasn’t materialised:

I’m remaining positive on this share as it is still cheaper than it was at the end of 2023, when I put it on my best ideas list for 2024. All of my reasons for putting it on that list are still intact: a strong balance sheet with a meaningful amount of net cash vs. the market cap, good prospects for recovery if/when the UK small-cap market rebounds, and weakened competition as Cenkos and finnCap executives work together instead of being rivals!

Gooch amp; Housego (LON:GHH)

Up 3% to 529.4p (£136m) – Half Year Trading Update – Graham – AMBER

This is an in line update for H1 (the full year ends in September, H1 in March)..

Gooch amp; Housego PLC (AIM: GHH), the specialist manufacturer of photonic components and systems, provides an update on trading for the six months ended 31 March 2024.

Note that GHH had a profit warning in February, covered by Paul here. The all-too-familiar word “destocking” was used then.

Key points from today’s update:

-

As previously reported, they have seen customers in some markets have “normalise their inventory holdings resulting in lower levels of demand for some of the Group’s products”.

-

Destocking is expected to end by the end of 2024.

-

H1 revenue down 5% to £67.5m and this includes the positive effect of acquisitions, i.e. the organic performance will be worse than this.

Order book is down 7% year-on-year, but GHH says it has grown “on an organic constant currency basis”, and “provides good coverage for our expected second half revenues”.

GHH sold a business last month (for £9m), and this would explain why its order book could be up on an organic basis, while actually falling.

Net debt (including leases) has grown a little in recent months, and now sits at £32m.

Strategy: manufacturing is being selectively outsourced, while the recent disposal “allows the Group to focus its resources on those parts of its Aamp;D (GN note: aerospace and defence) portfolio where it can differentiate itself and achieve acceptable returns.”

The sold business made a loss in the most recent financial year.

CEO comment excerpts:

…we have further improved our operational performance reducing our overdue backlog and lead times.

Following the strategic addition of the GS Optics and Artemis Optical businesses in FY2023, we have already been rewarded with new customer orders as a result of the Group’s enhanced portfolio.

“The divestment of our EM4 business in March this year represented an important milestone on our journey to focus our Aamp;D business on those areas where we can secure acceptable returns, supporting the Group’s path to mid-teens profitability.”

Estimates: Cavendish see FY 2024 adj. PBT of £9.6m, rising to £13.3m in FY 2025. However I’d watch out for some large adjustments so that actual PBT is likely to be very different, based on the track record here (and the likely impact of the recent acquisitions/disposal).

Graham’s view

I’ve always thought this stock was worth keeping an eye on, but it has unfortunately never matched my enthusiasm with a really strong financial performance.

Maybe margins can improve with the outsourcing strategy? It certainly needs some kind of catalyst to improve its metrics.

Source: https://www.stockopedia.com/content/small-cap-value-report-thu-4-april-2024-motr-cav-cabp-futr-ghh-993813/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).