Small Cap Value Report (Tue 9 April 2024) - GMR, W7L, GHT, SCE, SUS, ORCH, SBDS, IPX

Good morning from Paul amp; Graham!

I’ve got to finish a little earlier today, so I did a section on GMR last night to compensate. Today’s report is now finished due to time constraints. I’ll circle back to a couple of the interesting companies reporting today, later this week.

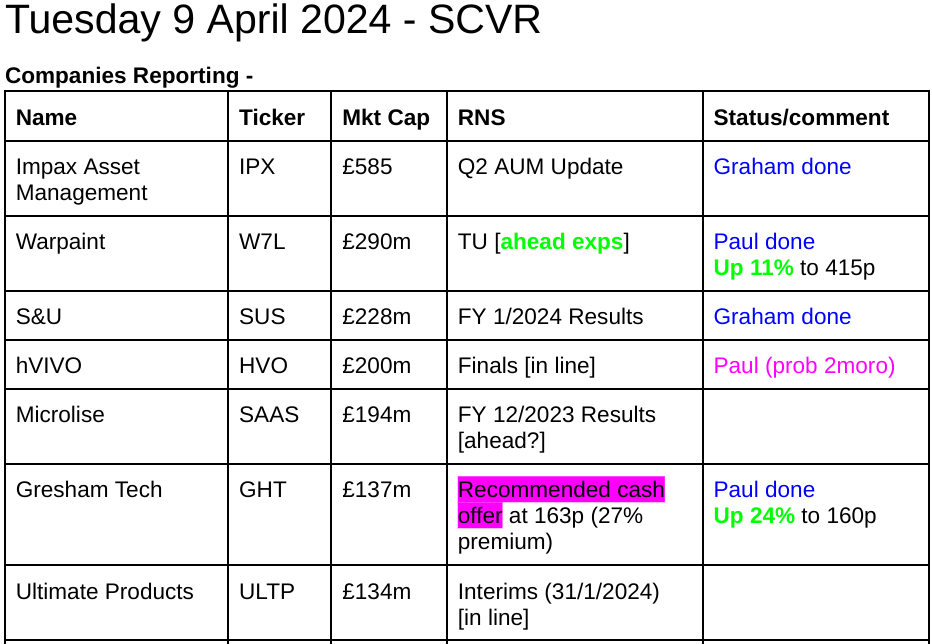

Looks like it should be a good day for my 2024 share ideas, with a takeover bid for Gresham Technologies (LON:GHT) although the premium looks disappointing, and an ahead of exps update from one of our favourites, Warpaint London (LON:W7L) . Can I catch up with Graham?! (EDIT: drat, just realised W7L wasn’t on my 2024 top 20)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates amp; results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it’s anybody’s guess what direction market sentiment will take amp; nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed – please be civil, rational, and include the company name/ticker, otherwise people won’t necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we’re not making any predictions about what share prices will do.

Green (thumbs up) – means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it’s such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber – means we don’t have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) – means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we’re not saying the share price will necessarily under-perform, we’re just flagging the high risk.

Links:

Paul amp; Graham’s 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul’s podcasts (weekly summary of SCVRs amp; macro views) – or search on any podcast provider for “Paul Scott small caps” – eg Apple, Spotify.

Other mid-morning movers (with news) -

Orchard Funding (LON:ORCH) – up 41% to 22.5p (£5m) – H1 Results – Paul – AMBER

Reports £1.1m PBT in H1 – not bad for a £5m mkt cap company.

It says the fraud (I mentioned that here on 1/3/2024) was isolated amp; shouldn’t recur.

Lending related to GAP insurance is falling, as previously indicated.

Notes that shares are c.a quarter of NAV, so they’re looking at options, including potential delisting (which would normally cause the share price to fall), and a possible tender offer.

Paul’s view – I flagged the huge discount to NAV on 1/3/2024, and the dominant major shareholder, and the risk of delisting. Yes there seems to be value here, but the risk of ending up holding shares in a private company puts me off. The commentary today from ORCH makes it sound as if they’ve already decided to delist. Hence why I think it might be a mistake to chase the share price higher, but only time will tell.

Silver Bullet Data Services (LON:SBDS) – down 11% to 105p (£18m) – Board Changes – Paul – AMBER

Group CFO seems to have been dumped amp; replaced with immediate effect, and a new NED also appointed. SBDS looks an interesting company, but I don’t know how to value it, and the share price has been very volatile of late.

Summaries of main sections

Gaming Realms (LON:GMR) – 33.8p (£100m) – Annual Results 2023 – Paul – GREEN

I look at the rather complicated figures from this gambling software provider. Is it a profit miss? Yes and no – EBITDA is slightly ahead, but a higher depn/amort charge means adj PBT is below expectations. EPS boosted by negative tax charge. Continuing organic growth is expected. Cash position looks fine. Overall, I remain positive, but ask some questions about the business model below.

Warpaint London (LON:W7L) 375p (£290m) – Trading Update – Paul – GREEN

One of our favourite shares delivers the goods once again – with yet another ahead of expectations trading update! Not a big surprise though, as I commented here on 12/1/2024 that the forecasts looked way too low. Expect the shares to resume the upward trajectory, I remain very positive.

Gresham Technologies (LON:GHT) – up 24% to 160.5p (£134m) – Recommended offer - Paul – PINK (takeover bid)

Big shareholders have clearly pressurised the company to put itself up for sale, so they can exit an otherwise illiquid investment. This agreed 163p cash bid from a US private equity firm looks to have been the best deal around. Not an exciting premium of 27%, maybe there’s a possibility someone else might come along and better that price?

Surface Transforms (LON:SCE) – down 27% to 6.75p (£24m) – Q1 2024 Sales amp; Operations Update – Paul – RED

Shareholders take another battering today, as it once again reports more production problems, and a clear need for more funding. Hence I have to move down from amber/red to RED, due to the increased likelihood of yet another discounted placing being needed. The product and order book look exciting, but actually achieving the production ramp up is proving a deeply painful and high risk process.

Samp;U (LON:SUS) – unchanged at 1873p (£228m) – Results to 31 Jan 2024 – Graham – AMBER

These full-year results are impacted by a range of issues including regulatory action, higher rates on borrowings, and a weak consumer. Both Advantage and Aspen remain profitable, but conditions are more difficult than before. I’m neutral until we have regulatory clarity.

Impax Asset Management (LON:IPX) – unchanged at 440.8p (£585m) – Q2 AUM Update – Graham – GREEN

Outflows have unfortunately picked up here, but CEO Ian Simm suggests that broader sentiment has picked up in recent months for environmentally-focused investors. I remain positive on this one as I continue to view it as a quality long-term growth stock.

Paul’s Section: Gaming Realms (LON:GMR)

33.8p (£100m) – Annual Results 2023 – Paul – GREEN

These numbers were published last week, on 2/4/2024.

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile focused gaming content, announces its annual results for the year ended 31 December 2023 and Q1 highlights for 2024.

26% increase in Revenue and 29% increase in Adjusted EBITDA1 in Record Year

I reviewed the FY 12/2023 trading update here on 6/2/2024.

Guidance provided by the company and Canaccord at the time was:

Revenues £23m, adj EBITDA £10m+, adj PBT £5.9m, and 1.6p adj EPS. Net cash of £7.5m.

Actual numbers released today are:

Revenue £23.4m (a 2% beat), adj EBITDA £10.1m (1% beat)

PBT is £5.17m, but I think that’s unadjusted.

Canaccord is now showing £5.4m adj PBT for FY 12/2023, which seems to be a £0.5m profit miss against what was expected previously. By comparing old and new forecasts, I can see the shortfall is caused by the depreciation amp; amortisation charge (actual) being £4.1m, vs a previous forecast charge of £3.0m, which looks like an error in the original forecast, partly offset by a £0.4m gain vs forecast on interest costs.

The way I look at this, the actual 2023 results are an overall £0.5m miss against adj PBT forecast, but due to non-trading items (depreciation, amortisation, and finance costs). So I think we can probably forgive this.

Adj EPS forecast was 1.57p, but actual has come in way above, at 2.02p! This is due to an unusual corporation tax line, which is negative, at a £758k tax credit in 2023, thus boosting EPS artificially. The tax credit is due to recognising deferred tax assets. I think we should probably be normalising the tax charge to say 25%, which would adjust EPS down from c.2.0p to about 1.5p.

It’s rather complicated, but my conclusion is that EPS is being boosted by negative tax, so I wouldn’t want to value this share on the inflated EPS figure of 2.0p, something nearer c.1.5p is more realistic for valuation purposes, so the PER is about 22.5x, which is quite a lot higher than I was expecting.

It would be worth asking management what, if any, additional tax losses would be available to offset against future profits? The retained Pamp;L is showing a £(26.5)m deficit, so if the tax position is anything close to that, then it might continue benefiting from little to no corporation tax, who knows?

UPDATE: the CFO was asked about tax losses in the webinar today. He replied that they’ve got UK tax losses (I think he said £26m), but pay tax on US earnings. It’s something that gets reassessed each year end. They have anticipated 2 years’ tax losses in 2023, and there could be more in future.

Forecast for 2024 – interestingly, Canaccord’s figures assume a fall in depreciation amp; amortisation charges again, which is the figure that was significantly wrong in the 2023 forecast. Therefore, I suspect its jump from £5.4m adj PBT (2023 actual) to £8.8m forecast 2024 could be too optimistic by about £1m. So I’ll estimate £7.8m adj PBT for 2024, take off a normalised tax charge of 25%, giving £5.85m PAT, divided by 295m shares = 1.98p my estimate for FY 12/2024 adj EPS. That’s a bit below the 2.3p that Canaccord calculates.

At 33.8p EPS, the PER for 2024 is 14.7x for Canaccord, and 17.1x for my estimate.

Neither is expensive to be fair, for a company generating strong organic growth.

Recurring revenues? I’ve never been able to ascertain how much of GMR’s licensing revenues are contractually recurring, and how much are one-offs? The word “licensing” appears 44 times in the results, but I still find myself confused about how exactly the business model works.

UPDATE: I asked this question in today’s webinar, and the CEO gave a very clear reply, saying almost all the licensing revenue is recurring revenue (typically a revenue share paid by the clients). Great news!

Also what IP protection does GMR have over its games? What is to stop competitors launching similar but slightly different games, and undercutting GMR, I wonder?

Social publishing is not doing well, with its EBITDA almost halving to £0.8m. This was more than offset by gains in the all-important high margin licensing revenues. So my question is whether social is a dead end, or can it be returned to growth?

Balance sheet – is healthy with c.£11m NTAV, including £7.5m cash (and no debt). As mentioned before, I think the finances are now healthy enough to commence divis, but the company seems reluctant to do that. So no divis for now.

Cashflow statement – is OK, but note that operating cashflow of £9.3m was more than half consumed by £4.8m investing activities – nearly all of which was capitalised development spend. So actually the business is not as cash generative as I would like for a £100m market cap company. Although further revenue growth expected in 2024 should flow through to improved cashflow.

Also, I should say that GMR’s overall position is absolutely transformed from when I remember reviewing it in 2018-19, when it almost looked a basket case, certainly precarious financially with a weak balance sheet, and loss-making. The position today is unrecognisable from that, and you can tell from the commentary with the 2023 figures that management are justifiably proud of what they’ve achieved.

Consider these graphs, which are remarkable -

Outlook – sounds positive -

…the Board is confident in the Group’s strategy and expectations for the rest of the current year…

“We have had a promising start to 2024…

Paul’s opinion – I’m happy with things overall, having had a good rummage through the numbers. The shareholder register is striking for having little institutional holders. I wonder if the next UK small caps bull market could see this share re-rate from institutional buying, perhaps, once they start to see fund inflows?

I’d like to better understand some specifics of the business model, but there’s no getting away from the fact that performance has been excellent in recent years, and it sounds as if the outlook is also rosy, with continued growth likely.

So it’s another GREEN from me.

There’s an InvestorMeetCompany webinar today at 10am.

Warpaint London (LON:W7L)

375p (£290m) – Trading Update – Paul – GREEN

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands is pleased to provide an update on current trading and confirm the date for release of the Group’s results for the year ended 31 December 2023.

Strong trading continues in Q1 2024

Q1 revenues are up 28% to £23.5m

Margins (gross, presumably) are “robust”, and ahead of 2023.

Cash position is £7.5m (with no debt) is down from £9.0m at Dec 2023, due to…

Increased inventories “to satisfy expected demand later in the year”.

FY 12/2023 results to be published on 24 April 2024.

Overall – it’s ahead! -

Accordingly, given this strong start to the year, the outlook for FY 2024 is now expected to be ahead of the market’s current expectations.

Forecasts – Shore Capital puts out a helpful update note, saying its 18.6p EPS forecast for FY 12/2024 is “at least 10% too low”. That won’t come as a huge surprise, as it didn’t escape our notice previously that rising from 18.0p (forecast) in 2023 to only 18.6p in 2024 seemed unrealistically low, and implied growth was stalling, which it clearly wasn’t in reality.

As I commented here on 12 Jan 2024, my view is that a much higher forecast of c.25p looks realistic for FY 12/2024, and maybe 30-35p EPS in FY 12/2025. Today’s news reinforces that my much more aggressive idea for future profit is looking correct. Which means the shares are still potentially cheap, assuming nothing goes wrong.

Paul’s opinion – the recent dip in share price looks to have provided a nice buying opportunity. I’m working on the assumption that another ahead of expectations update today, the latest in a long series, shows that sitting tight here and enjoying the ride is the best approach. We’re likely to end today back above 400p I’m guessing, and I can see the ground being laid for another push upwards – maybe to 500p+ in due course?

W7L remains one of our favourite shares here, so it’s obviously going to be a continuing GREEN view.

Stockopedia is also very keen, with a high StockRank -

Gresham Technologies (LON:GHT)

Up 24% to 160.5p (£134m) – Recommended offer - Paul – PINK (takeover bid)

Who’s the buyer? A US private equity firm called STG Partners, LLC, via a company called Alliance Bidco Ltd.

Price? 163p in cash, plus a 0.75p dividend.

Premium? Only 26.9% above last night’s closing price, so this looks a disappointingly low bid, hence I wonder if shareholders might reject it? Looking at the chart, I think a bid needs to be 200p+ to look fair.

Recommended – so the Board of GHT has agreed to this bid.

75% vote at a shareholder meeting is required to agree the bid.

Directors only hold 0.5% of the company.

Shareholders holding 45.4%, including the largest shareholder Kestrel (with 23.9%) are supportive of this deal.

On price, GHT says -

…the Cash Offer values Gresham at 12.9 times adjusted EBITDA and 30.8 times adjusted cash EBITDA for the year ended 31 December 2023 as estimated by the Gresham Board and detailed further in paragraph 8 of this Announcement. Having sought to obtain competitive alternative proposals, the Gresham Board considers the above multiples to be attractive.

The rationale mentions low liquidity in GHT shares, and the pressures of being on the public market, as opposed to more generously, privately funded competitors.

Paul’s opinion – this deal is all about providing a liquidity event for large shareholders, who want to exit. Hence why there’s 45% support for this deal, despite it only being at a modest premium.

Surface Transforms (LON:SCE)

Down 27% to 6.75p (£24m) – Q1 2024 Sales amp; Operations Update – Paul – RED

Surface Transforms (AIM:SCE) manufacturer of carbon fibre reinforced ceramic disc brake materials provides the following sales update for the three months to 31 March 2024…

“Reconfirms unchanged sales guidance of £23m for the 2024 financial year.”

Q1 2024 revenues were £3.0m, flat vs the previous quarter.

“Significant improvements” in the previous production problems.

This bit doesn’t exactly fill me with confidence -

The prime remaining operational challenge relates to continuing high levels of scrap from processes that are not yet fully capable. Again we regard these issues as a learning curve and note, that considerable success has been achieved in recent weeks in reducing scrap. We expect to continue these improvements over the coming months unlocking further capacity.

“Customer situation is stable”, with revised delivery schedules.

Outlook – this is the bombshell unfortunately -

We are maintaining sales guidance of £23m for the year ending 31 December 2024. However the scrap problems in particular have absorbed a sizeable amount of working capital and cash.

The Board are assessing options to address this short term issue.

Surely if they’re having to scrap production, then that is a loss - it’s not absorbing working capital, it’s destroying cash. That is unless scrap can be economically recycled into fresh production, I don’t know. The word “scrap” suggests it’s a write-off, rather than just having to re-work faulty production, but I’m guessing there.

Paul’s opinion – yet again, SCE needs more cash. We already knew that the rescue deal late last year wasn’t going to be enough, but I didn’t expect it to be signalling the need for more cash quite so soon. I wonder if there might be some way of getting customers to fund working capital in advance by offering discounts?

It’s painful watching a promising UK company with a large order book struggling to commercialise things – not just a lack of proper funding, but also interminable production problems, which make it sound as if they’re figuring out how to make the products as they go along.

It’s tantalisingly close to commercial success, so I think shareholders probably need to be philosophical about the likelihood that another equity raise seems almost inevitable.

Does anyone actually believe that they’ll hit the £23m revenues target for FY 12/2024, given the track record?!

I don’t recall SCE mentioning problems with scrap before. That sounds serious, in that they don’t seem to know how to actually make the product. Surely that’s fundamental?

Previously we were giving it the benefit of the doubt here with amber/red, but I think the clear need for yet more funding, and ongoing production problems, means the risk meter has just gone RED again. I’d rather wait for these problems to be resolved, and buy once the trajectory is more obviously heading for success. Dilution risk strikes me as too high again.

This share must be incredibly frustrating for everyone involved, given that it took so many years to achieve big demand for the products, but actually producing them has proven so difficult. It’s easy to criticise of course, I really do hope this project succeeds, but it’s not something that I would want to be backing at this problematic stage.

Graham’s Section: Samp;U (LON:SUS)

Unchanged at 1873p (£228m) – Results to 31 Jan 2024 – Graham – AMBER

Samp;U plc (LSE: SUS), the motor finance and specialist lender, today announces its preliminary results for the year ended 31 January 2024.

Paul covered Samp;U’s profit warning in February.

The profit warning was attributed to “…poor consumer confidence, continuing high interest rates, cost of living pressures and regulation…”, resulting in a weak H2 repayment performance at the motor finance business (90%).

Headlines in the full year results:

-

Revenue +12% to £115m

-

PBT down 19% to £33.6m.

The impairment charge is up by £10m (to £24m), and is the primary reason for lower profitability.

Final dividend for the year is 50p (last year: 60p). Total dividend is 120p (last year: 133p). Given the increase in corporation tax this seems like quite a generous payout to me. Especially when you consider that earnings per share fell to 209p (last year: 277.5p).

Net borrowings increase by £30m+ to £224m.

Net assets increase by £10m to £234m.

See that net borrowings are now almost as large as the company’s net assets: this is reflected in a “gearing ratio” of nearly 96%: the company calculates its gearing as net borrowings divided by net assets.

Pre-Covid, Samp;U had a gearing ratio of c. 65%. It always impressed me that the company performed so well despite not seeming to borrow as much as it could, or as much as its rivals would be inclined to borrow.

However, in recent years, the company’s risk tolerance has increased. Will they allow the gearing ratio to go over 100%, I wonder? It’s still a modest amount of leverage, but perhaps no longer in the ultra-safe category it previously inhabited.

Chairman comment from Anthony Coombs is typically memorable:

Enthusiastic and supportive customers underpin Samp;U’s long success and guarantee its future. Current trends, both at Advantage and Aspen, prove that Samp;U has an abundance of these and trading since our year-end is encouraging. Of course, challenges remain. As Marcus Aurelius, a second century Roman Emperor and Stoic philosopher once said, “sometimes the art of living is more like wrestling than dancing”. Confident in our people, business philosophy and the markets we serve so well, we wrestle on.

In his longer “Review” section, he goes on to again blame “a combination of prolonged and raised interest rates, a British economy sliding towards recession and, most of all, a flurry of regulatory activity” for the fall-off in profits.

Both customers and investors may be interested in the notice at the top of Advantage’s homepage:

IMPORTANT NOTICE: DISCRETIONARY COMMISSIONS

Advantage Finance can confirm that as a firm we have never used any form of Discretionary Commission Arrangement and has never allowed the broker to influence the interest rate for any potential customer. Therefore, this action being taken by the FCA does not apply to Advantage Finance and any of its past business.

This division is responsible for nearly all of the increased impairment charge, and its PBT fell from £44m to £37m.

There is a sign of Samp;U pulling back on its risk appetite, with annual net advances (i.e. new loans made during the year) falling from £187m to £176m.

However, the total value of the loan portfolio still continued to grow.

Comments by Anthony Coombs highlight the following important points:

-

Higher interest rates have increased the interest payable on Advantage’s borrowings.

-

The FCA has made “inquiries” into Advantage. One of these is around broker commissions.

-

Another inquiry is “focusing on affordability, forbearance and vulnerable customers“. This inquiry “has increased Advantage’s costs and inhibited both the range of products we offer our customers, and our ability to sensibly help them maintain their loan repayments – which bolsters their future credit rating”.

Expanding on this later, he says “imposing restrictions on customers’ ability to address their arrears, in pursuit of comprehensive and sometimes intrusive affordability assessments, may inadvertently lead to a preventable worsening of their credit scores”.

This sounds particularly important:

In response to ongoing concerns regarding the cost of living and its declared objective to “deliver quantifiable consumer benefits,” the FCA has launched comprehensive inquiries across the industry, affecting approximately two-thirds of non-prime motor finance companies. In anticipation of the findings, Advantage has consented to specific limitations on its repayment processes. These modifications have temporarily influenced monthly repayments and recovery efforts.

The long-standing CEO at Advantage has retired and is replaced by a new CEO with experience at MotoNovo and Aldermore.

This division slowed down its aggressive growth: the loan portfolio only grew from £114m to £130m.

PBT was flat at c. £5m, despite an increase in finance costs of £3.6m.

Samp;U is optimistic on the outlook for house prices this year, seeing a rise of up to 5%, and possibly more in the South East (where most of the bridging loans are made).

Graham’s view

I’m a long-term fan of this family business, and a former shareholder.

But I switched to an “AMBER” stance on it late last year, due to the Chairman’s bearish language and my concerns over the possible consequences of the FCA inquiries.

The FCA’s actions are now having a real impact on the business, even if it’s true (as I believe) that Advantage has done nothing wrong.

Of course even without the FCA’s actions, the company would still need to grapple with interest rates staying higher for longer, and more customers experiencing difficulty with their repayments than had previously been the case.

It has taken the shine off the stock’s valuation, which tends to trade at a big premium to other lenders and at a premium to book value.

It now only trades around book value.

I calculate that Samp;U’s return on equity for FY Jan 2024 was 11%, an unusually poor result.

But my instincts are that in the long run, Samp;U will achieve the ROE of 15%-16% that it has in the past. This depends on a normal regulatory setup and economic backdrop. I have more faith in the latter than I do in the former.

For now I’ll remain neutral, but I’ll be very happy to give this one the thumbs up again when there is some clarity from the FCA.

Impax Asset Management (LON:IPX)

Unchanged at 440.8p (£585m) – Q2 AUM Update – Graham – GREEN

We looked at the Q1 AUM update from this fund manager in January.

Net outflows have increased to £1.7 billion (Q1: £1 billion).

But once again, market movements have saved the day, more than fully offsetting the negative flows.

The result is a small increase in AUM, from £39.1 billion to £39.6 billion (+1.3% quarter-on-quarter).

Here are the thoughts of CEO Ian Simm, who describes the outflows as follows:

“I am pleased to be able to report another quarter of rising AUM in the context of sustained positive market sentiment. Although our net flows were moderately negative, the outflows were overwhelmingly from a small number of intermediary clients largely representing European private wealth, and we again recorded an increase in the number of institutional clients, and no segregated mandate terminations.”

Despite the relative weakness in the last couple of years, he says “asset owner sentiment around the transition to a more sustainable economy and associated areas of Impax expertise has improved in recent months”.

Clearly this is not yet reflected in the flow data, but maybe Q3 will be better?

Estimates: thanks to Paul Bryant at Equity Development for providing some estimates. These are:

-

AUM £41.1 billion at the end of this year (FY Sep 2024), rising to £46.1 billion (FY Sep 2024).

-

EPS 31.3p this year (FY Sep 2024), rising to 37.8p (FY Sep 2025).

It is forecast that the dividend will remain flat at 27.6p (yield 6.2%).

Valuation: PER is 14.5x.

At the current share price, investors get £68 of AUM for every £1 invested in Impax stock.

Graham’s view

I’ve been positive on this one and I’m inclined to remain that way today as I see this as a long-term growth stock going through some temporary challenges.

A reminder of the deflation experienced by this stock:

Up at the more testing valuations, I always thought it was a fine company, but was too expensive.

Now it trades at a fraction of its former levels, because it’s experiencing some outflows – this is when value investors should be interested in it, in my view. And I’m looking forward to seeing how it fares as it expands its offering, particularly in fixed income.

Source: https://www.stockopedia.com/content/small-cap-value-report-tue-9-april-2024-gmr-w7l-ght-sce-sus-orch-sbds-ipx-994176/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).