The Most Unexpected Breakout of 2024

This post The Most Unexpected Breakout of 2024 appeared first on Daily Reckoning.

The bulls continue their unstoppable run as stocks launch higher once again this week.

The major averages are all fresh off new highs – and the US indexes aren’t the only names on the list.

In fact, 14 of the world’s 20 largest stock markets have recently logged all-time highs, gushed Bloomberg shortly after the Dow Jones Industrial Average closed above 40,000 for the first time Friday afternoon. Other notables on Bloomberg’s new high list: Europe, Canada, Brazil, India, Japan, and Australia.

The bull market party doesn’t end there.

Gold just posted fresh all-time highs above $2,400. Silver has broken above $30 and is hitting prices not seen since early 2013. Copper is squeezing above $5 after gaining more than 30% off its early March lows. And Bitcoin is once again pushing back toward its highs after breaking back above $70K late Monday.

Everywhere you look, you’ll find risk assets either logging fresh highs or extending their respective bull trends.

Well, almost everywhere…

There’s one prominent country that’s lagged woefully behind the US and other nations that are watching their respective indexes fly into the stratosphere. In fact, this country’s biggest indexes were threatening to retest their 2009 lows as recently as January.

But something has changed over the past four months. Instead of breaking down, these stocks are beginning to catch higher. They’ve even outperformed the resilient US averages in April and May.

This could only be the beginning of a much bigger move. Despite this year’s bounce, most investors have little to no exposure to these stocks – a fact that’s quickly changing as the smart money starts to buy into the move, notably Stanley Druckenmiller and David Tepper.

Every major bull run has to start somewhere. As prices rise and the narrative begins to shift, we could be looking at the biggest snapback trade of the year… in China.

A “Good News” Shortage

I don’t talk about Chinese stocks very often. In fact, I couldn’t immediately recall the last time I spent any significant time discussing China at length. So I went through my past columns to try to find out just how often China or Chinese stocks appeared in my notes recently.

A quick search of my personal archives found just a few key mentions over the past five years.

Most of my attention during the first few post-pandemic years focused on China’s hardline lockdown policies and anti-business tactics that weighed heavily on Hong Kong’s Hang Seng, which by late 2022 had cratered to levels last seen during the Great Financial Crisis of 2009.

I also wrote about China’s attempts to squash crypto by banning mining and going after firms that accept crypto payments, and how these actions had failed to produce a sustained selloff (the push to ban crypto seemed to backfire as more wealthy Chinese citizens attempted to protect their assets from the government.)

Finally, I found a short passage where I discussed Xi Jinping securing his third term as China’s leader, stacking the government with loyalists – and subsequently sending Chinese stocks skidding lower.

That was all I could dig up. As you can see, none of my China research was even remotely positive. That’s not surprising if you pull up a long-term look at the Hang Seng or Shanghai indexes. While US stocks enjoyed a post-pandemic boom, the Hang Seng was chopped in half and trading at 31-year lows, while Shanghai suffered a similar fate. Even the most steadfast optimist would have trouble coming up with a positive spin on this ugly bear market.

But a curious thing happened just three short months ago…

Chinese shares stopped going down.

Now, we’re witnessing the beginning stages of what could be a massive reversal in these ignored stocks…

Changing the Narrative

China’s market woes go much deeper than its post-pandemic fallout. While shares have rallied in fits and starts over the past two decades, nothing has come close to matching the performance of BRICs mania that began in the early 2000s and peaked with a parabolic move in late 2007.

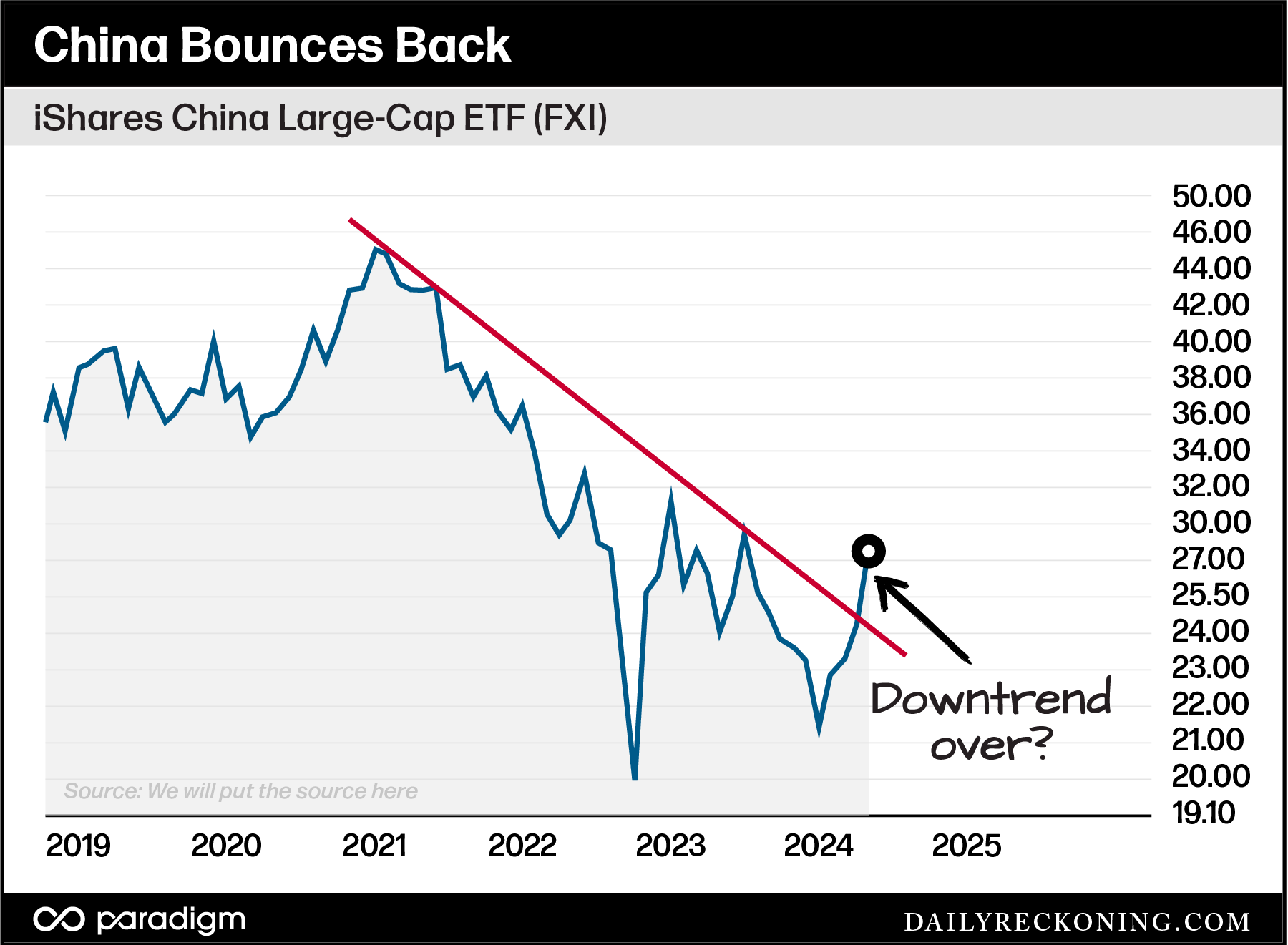

The iShares China Large-Cap ETF (FXI) finally fought back to those highs in 2021, only to get rejected and fall into a nasty three-year bear market that sent shares lower by nearly 60%. This downtrend remained intact until earlier this month, when FXI finally exploded higher, breaking above the Oct.- Nov. swing highs near $26.

FXI is now up nearly 14% on the month, nearly doubling the performance of the Nasdaq Composite (+7.25%). And while the stories surrounding China and its economy remain overwhelmingly negative, we’re beginning to see a few glimmers of hope and a few brave fund managers swooping in to buy shares of their favorite Chinese names.

Remember, price moves first – not the stories told in the financial media!

Most of the stories you’ll dig up on China right now involve the property crisis, snowball derivatives, and a general lack of confidence in its economic prospects. The situation had gotten so bleak that foreign investors reportedly pulled out almost 90% of the money they put into Chinese stocks in 2023, according to the Financial Times.

Even as Chinese stocks have started to bounce, the only positive stories you’ll find related to China right now are about how stocks are currently a value play as world markets extend their respective rallies.

This will change once some FOMO kicks in. If Chinese shares continue to push higher, we’ll witness a drastic narrative shift as the herd begins to buy into the move.

For now, we’re still in the early innings. There’s still time to take a shot at these “cheap” stocks – before the rest of the world catches on.

The post The Most Unexpected Breakout of 2024 appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/the-most-unexpected-breakout-of-2024/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.