Big Stores, Bigger Brand—and a Dividend That Gets the Job Done

This is one of those businesses you probably visit regularly, and it represents one of the most efficient and profitable retail operations in North America.

It sells hammers, lumber, light fixtures, and the systems that power them. It supports DIYers and professional contractors alike. And behind it all? A cash-generating engine that quietly delivers dividend growth, even when home sales stall.

Building Blocks: The Retail Model that Powers the Paycheck

With over 2,300 stores across the United States, Canada, and Mexico, Home Depot (HD) offers a diverse range of products, including mulch, plumbing parts, high-end flooring, and commercial HVAC systems. Its customer base is split into:

-

DIY customers tackling their home projects

-

Professional contractors (PROs) working on everything from flips to new construction

Revenue also flows from its fast-growing digital channel, now fully integrated with in-store pickup, as well as its fulfillment and distribution network, which has become a competitive advantage.

Over 1 million items are available online, but the real edge is in the store itself: each location functions as a mini logistics hub, allowing fast delivery with low fulfillment costs.

Bull and Bear Breakdown: Built to Last, but Not Immune Bull Case: Scale, Loyalty, and a Long-Term Tailwind

There’s no question—this is a retail moat built to last.

Its massive buying power gives it pricing advantages across the board. Its relationships with Pro customers create sticky, recurring business. And its mix of in-store and digital infrastructure makes it an omnichannel powerhouse.

Even in a slower housing market, Home Depot still benefits from:

-

Aging housing stock (which needs repairs)

-

High home prices (which push people to renovate vs. relocate)

-

Supply chain strength (which supports cost control and rapid fulfillment)

Plus, it’s expanding its maintenance, repair, and operations (MRO) segment, opening the door to steady, institutional demand beyond retail.

You may not see fireworks every quarter—but this is a business you can own through any market cycle, and get paid the whole way.

Bear Case: Consumer Sensitivity and Margin Pressures

Of course, even the best operators face challenges—and this one isn’t immune.

Home Depot is highly tied to consumer sentiment. When homeowners pause big projects due to high mortgage rates or job market concerns, spending slows. That’s especially true for discretionary categories like kitchens, bathrooms, and outdoor remodels.

It also faces growing pressure in the PRO segment, where Lowe’s, Tractor Supply, and even Amazon are expanding their reach.

Meanwhile, the average ticket size is flat, meaning more customers are shopping, but they’re spending less per visit. That hints at a shift toward smaller projects, which may not carry the same margin benefits.

Finally, costs are rising—from wages to materials to tech investments—which may continue to pinch profits.

Like Stocks that Compound?

Check out our Dividend Rock Star List—a monthly snapshot of high-quality dividend growers like this one.

It’s packed with reliable, repeat-paying names that don’t need headlines to deliver results.

Get the updated list here and see who made the cut this month.

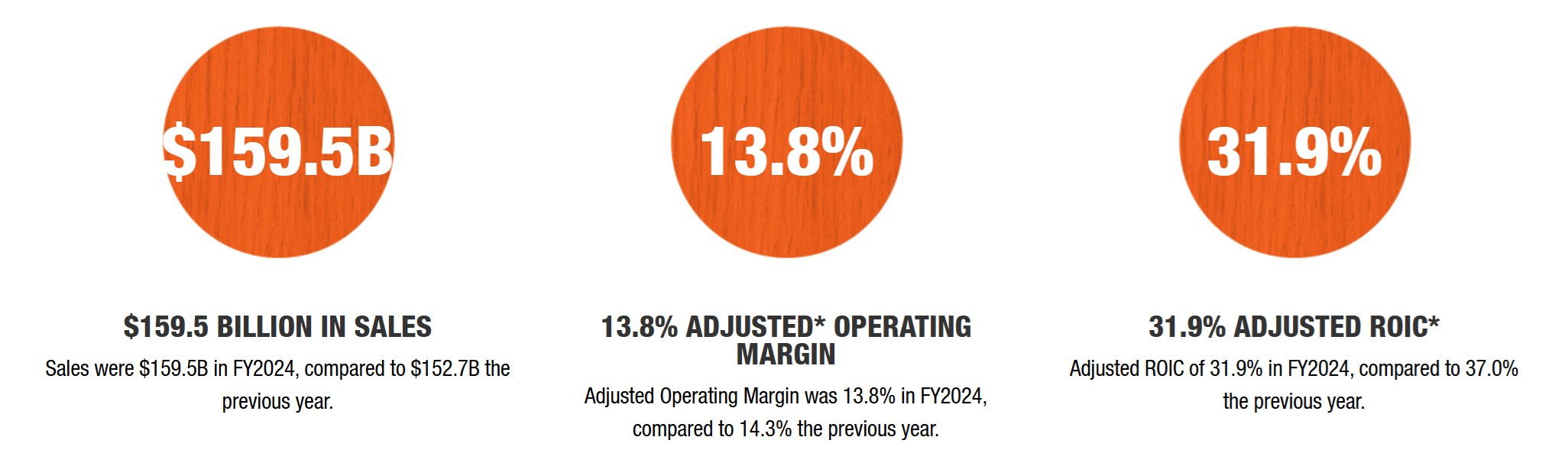

What’s New? Smaller Projects, Slower Profits: But Still Growing

On May 29, Home Depot reported mixed Q1 results:

-

Revenue up 9%

-

EPS down 2%

-

U.S. comparable sales up just 0.2%

The top-line boost came from a 2.1% increase in transactions, but average ticket size stayed flat. That suggests people are shopping more—but sticking to small, manageable upgrades.

The bottom line? Consumers are cautious, especially on big renovations. But the company’s broad base and contractor loyalty are still keeping the register ringing.

Dividend Triangle in Action: Still Holding Up

Let’s break it down across our Dividend Triangle:

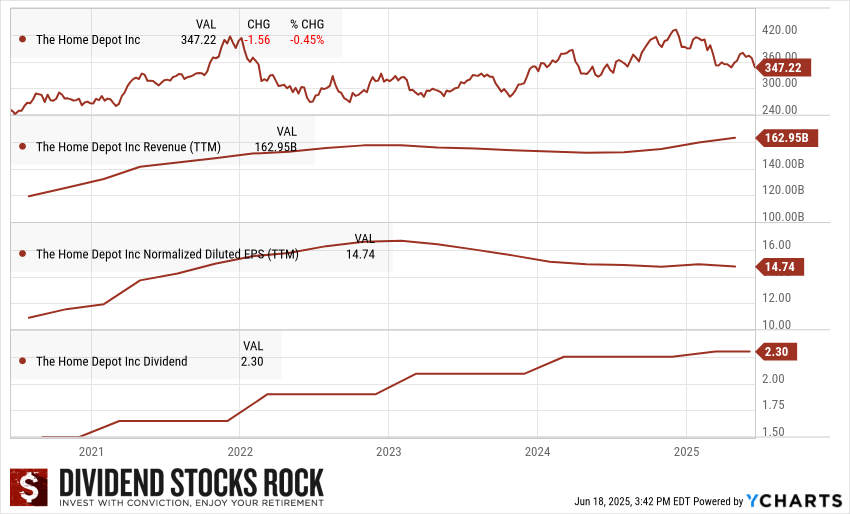

- Revenue: Now at $162.95B (TTM). Growth has leveled off slightly but remains historically strong, even with home improvement headwinds.

- EPS: EPS is at $14.74 (TTM)—off recent highs, but still robust. Profitability remains solid despite shifts in consumer behavior.

- Dividend: The dividend stands at $2.30/share. With decades of increases, a conservative payout ratio, and tons of free cash flow, this payout isn’t going anywhere.

Final Word: Built to Outlast the Cycles

In short, this stock is trustworthy.

It has scale, brand power, and a business model that makes sense in every kind of housing market. Whether you’re painting a guest room or rewiring a 12-unit rental, this company is in the mix—and getting paid.

The dividend keeps growing. The customer base keeps expanding. And when the renovation cycle picks back up? This business will already be there, fully stocked and ready to roll.

For dividend investors who like moats, margin, and staying power, this name belongs in the toolbox.

The Best Dividend Growers, Updated Monthly

Home Depot is just one example of what we look for: reliable, resilient dividend growers with pricing power, staying power, and a long runway.

The Dividend Rock Star List is your shortcut to finding more of them.

- Updated monthly

- Focused on growth and stability

- Includes names that keep paying through every cycle

Download the latest list now and build your portfolio with businesses that don’t just pay—but perform.

The post Big Stores, Bigger Brand—and a Dividend That Gets the Job Done appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/home-depot-hd-analysis/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.