Great Depression vs Silent Depression

Source: https://www.askaprepper.com/

Source: https://www.askaprepper.com/

Economic gurus have been predicting an economic collapse for years, especially since the Great Recession of 2008/2009.

They don’t necessarily agree on how soon it is coming or just what will be the trigger to set it off; but more and more of them are getting on the bandwagon, striking the same drumbeat.

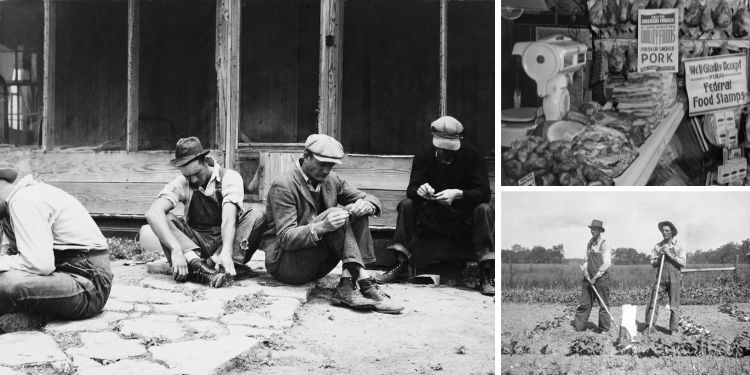

By and large, the forecasts of these economic experts make it appear that the coming financial collapse will far outpace the problems of the depression that started in 1929. But is it possible that they’re ignoring the silent depression that is already happening today?

By definition, an economic depression is a “steep and sustained drop in economic activity featuring high unemployment and negative GDP growth.”

Based on that, the only thing that kept the COVID-19 pandemic from being considered an economic depression is that the drop in our GDP didn’t last long enough to technically qualify.

So, the economists only call it a recession, at least those who recognize what COVID did to the economy do. There are others who don’t.

But these terms, depression and recession deal with the “macro-economy,” what’s happening to the economy as a whole, either nationally or even globally. Yet that can often ignore the realities of the economy, as they relate to real people trying to live out their lives.

That causes both economists and the public at large to see “the economy” as referencing what they refer to as “corporate greed” and “the rich getting richer.” But in reality, the economy is more about people having jobs and being able to afford the goods and services they need.

Roughly 25% of the US population lost their jobs during the Great Depression, making it so that they couldn’t afford the goods and services they needed.

Roughly 25% of the US population lost their jobs during the Great Depression, making it so that they couldn’t afford the goods and services they needed.

That affected the personal economy of others, in a snowball effect, until all but the very richest were affected. Everyone lost something and some lost all.

The question we have to ask ourselves is if it is possible for there to be another depression, without the signs that the economists look for. If the end result of any depression is people losing their ability to buy goods and services, then we are going through a depression right now.

Related: Money Saving Tips From Real Survivors Of The Great Depression

Rather than following the model of the Great Depression of the past, this Silent Depression is being ignored by politicians and publicans, while the common family has to find a way to deal with it.

All it takes is a quick look at a few common costs, some of the ones that everyone deals with, for us to see the truth of this Silent Depression.

Specifically, we need to compare what those things cost during the time of the Great Depression, to what they cost today, not only in hard numbers, but as a percentage of the average family’s income.

Housing

Let’s start with housing costs, as that is one of the average family’s monthly costs. If you had bought a house back in 1930, the average cost would have been $3,900. Today, the average cost of a house is $410,200. (Source)

Renting, for those who couldn’t afford to buy a house, was $18 per month in 1930, which worked out to $216 per year. Today, the average rent is $2,000 per month or $24,000 per year. Keep in mind that the rent in our major cities is considerably higher than this, affecting a large portion of the population.

Money can be saved by renting an apartment, rather than a home, accepting a smaller living space. Even then, the average apartment rent for a two-bedroom apartment is $1,588 per month. (Source)

Transportation

Probably the second biggest family purchase is a vehicle. Back in 1930, the average cost of purchasing a car was $600, compared to today’s average of $47,000. (Source)

Probably the second biggest family purchase is a vehicle. Back in 1930, the average cost of purchasing a car was $600, compared to today’s average of $47,000. (Source)

Considering the push to switch over to EVs, we will soon be able to add another $10,000 to that figure.

That means that cars have gone up roughly 78 times in price since 1930.

Gasoline has actually done better, considering that the average cost of gasoline was 10 cents per gallon in 1930 and it has been hovering between $3.30 and $4.00, depending on the part of the country you live in.

That’s still at least 33 times what you would have spent back in 1930 and you probably wouldn’t have driven as far.

What’s Happened to Salaries in This Time?

These figures give us a pretty good idea of what inflation has done to prices through the years that have passed since the Great Depression.

But for them to mean anything to us today, we need to be able to compare them to the average household income in 1930, compared to today.

Back in 1930, the average household income was $1,368, with an unemployment rate of 18.26 percent. Today, the average household income is $59,429. (Source) That’s an increase of 4,344 percent.

Looking at the cost of those few basic items I’ve listed above, we find the following, looking at them as a percentage of the average household income:

| 1930 | 2023 | |

| Buying a house | 3 times annual income | 7 times annual income |

| Renting a house (yearly) | 16% of annual income | 40% of annual income |

| Buying a car | 40% of annual income | 79% of annual income |

Granted, most of us don’t buy homes or new cars, paying cash for them, we buy them on time, making payments for years. Nonetheless, the more we spend on housing and buying cars, the less we have available to buy other things.

But There’s More

In addition to what inflation has done to us, the cost of living has increased in many other ways. Many of our modern conveniences, which use electricity, didn’t exist.

In addition to what inflation has done to us, the cost of living has increased in many other ways. Many of our modern conveniences, which use electricity, didn’t exist.

Refrigerators became common in homes, but air conditioning only gained widespread use in the 1940s.

For those of us who live in the southern part of the country, paying to cool our homes is much more expensive than paying to heat them.

Related: How To Cool Your Home When The Power Goes Out

The rotary dial home telephone first became common in homes in the 1930s; but the cost of those phones and the cost of phone service was nothing compared to the cost of our smartphones today.

Televisions were just starting to come out and weren’t in homes yet. In 1947, only a few thousand privately owned televisions were in existence. Without televisions, there was no need to pay for streaming service; for that matter, there were no streaming services or satellite TV to pay for.

We could go on and on with things that are commonplace today, but did not exist back then. The idea of paying seven dollars for a cup of coffee didn’t exist. Coffee was coffee, not some designer drink. Buying an ice cream meant getting a cone, not a custom-made creation at Cold Stone or Marble Slab.

As living became more expensive, more and more women entered the workforce, full time, rather than staying at home. This brought added costs, such as needing a second car, a “work” wardrobe for her, and child care for the children.

Food costs will go up, as the family will be eating prepared food or eating out more often. Then there’s the increase in taxes that has to be paid. With all the additional costs added together, the actual increase in available income is less than ¼ that second salary.

While this may not seem to be part of the Silent Depression, it is. While we are all spending more, we are not spending it on things that we want to. Rather than improving our life, we’re mostly just trying to maintain it.

Your Only Solution

We must realize that the government isn’t going to do anything to solve this Silent Depression. Any action to do so would require that they admit there’s a problem and there’s no way they’re going to do that.

We must realize that the government isn’t going to do anything to solve this Silent Depression. Any action to do so would require that they admit there’s a problem and there’s no way they’re going to do that.

Related: 4 Things The Government Doesn’t Want Preppers To Know

Not only that, but as we’ve all seen for more than half a century, the government’s solution is handing out money to the poor. That just makes more and more people dependent on the government, which is busy taking money from those who have it and giving it to those who don’t.

If you think that means taking it from the rich to give to the poor, think again. Every time they talk about taking money from the “one percenters” they also take it from the middle class.

There are only solutions you and I have available to us. The first is to become so wealthy, that we whatever happens to the economy won’t affect us. I can’t help you with that, as I have no idea how to accomplish it. That leaves us with the second option, which is to focus on becoming as self-sufficient as possible.

In today’s world, self-sufficiency is an invaluable skill, as history has shown us during the Great Depression. People who could provide for themselves, like small-time farmers and homesteaders, were more resilient during challenging times.

The other big thing that helped people get through that depression was not being in debt. When banks are struggling (and they were definitely struggling back then), one way they make up for it is to call in their loans.

When we can’t pay those loans back, they take our homes, our cars, and whatever else we used to secure the loan. So, we need to get out of debt, as part of our strategy to becoming self-sufficient. If we have to have debt, let’s make sure that it is for things that we can afford to lose, not for things we have to have.

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).