Are Stocks Near Their Top?

Source: Adrian Day 04/03/2024

Global Analyst Adrian Day looks at the overvalued U.S. stock market, and indications that he believes it may be about to break. He also looks at year-end financials from another royalty company.

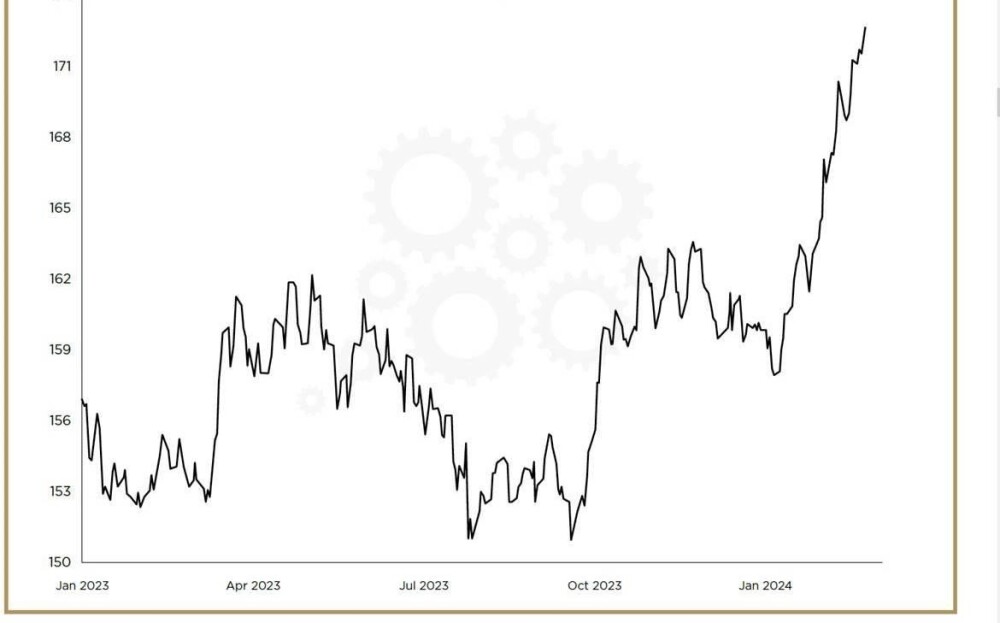

There is no denying that the U.S. stock market is trading at valuation extremes. By most metrics, it is trading today at its highest valuation since the dot-com mania at the end of the 1990s and at levels considerably above average. The only exception was following the Covid pandemic, when earnings collapsed faster than stock prices, sending the p/e ratios spiking.

Stocks today have the lowest dividend yield since 1999 and the highest price-to-sales ratio ever (except for that Covid anomaly). Valuations are meaningfully higher than historical numbers: the index’s P/E ratio, standing at over 25 times today, has been less than 20x for most of the past 20 years and averaged around 17x; the price-to-sales ratio, at over 2.9 times, is significantly above the previous peak of 2.25 in 1999, and twice the longer-term average.

Signs of a Top Abound

With profits also at near-record levels, there is a double risk to stock prices from both a slide in profits and multiple contractions. With the economy slowing and costs stubbornly high, are profits likely to increase from here?

Unlikely.

Companies cannot continue to pass on all of their cost increases during a longer period of even moderate inflation. Are stock multiples likely to go even higher? They can always move higher, but not much and not for long. Starting from high valuations means that stocks are likely to have modest five-and-10-year returns from here. Many technical indicators are also near extremes.

Only five stocks account for over 25% of the S&P market cap, the highest since 1964. Market breadth is particularly narrow relative to stock prices and narrowing even as the market continues to move higher. Extreme concentration in this market is a negative sign.

Meanwhile, investor sentiment continues at extremes, with a 45-point spread between bulls and bears (just 15%), according to Investor Intelligence. Looking at valuations and market internals, John Hussman writes, “We can’t say with any certainty at all that stocks are at a market peak. We can also say with complete certainty that present conditions mirror what a market peak looks like.”

And that mirrors something I have said many times: an investment advisor is not in the business of making predictions but rather assessing risk. Nor should we expect lower interest rates to keep the stock market party going. Lower rates will be a reflection of a recession, which is negative for corporate profits and stocks. The last three rate-cutting cycles — in 2000 to 2003, 2007 to 2008, and 2019 to 2020 — saw stocks decline.

There Are Indications of Smart Money Moving Out

But now there are signs that the party may be coming to an end. Many astute investors are moving towards more defensive postures. Warren Buffett’s Berkshire Hathaway famously has record levels of cash due to the lack of things to buy. Insiders, particularly in the tech sector, are ramping up their stock sales dramatically. This quarter, the ratio of sales to buys in tech has been almost twice what it was in the prior quarter.

The “Magnificent Seven” tech stocks that have driven the market’s rally — each rose at least 49% last year — are beginning to lose steam as they go their separate ways. Only four of the seven have outperformed the index so far this year, while two have declined, Apple and Tesla (the latter with the largest decline among the S&P 500 stocks).

Keen market commentator Stephanie Pomboy of MacroMavens writes, “You wouldn’t know it to look at the broad market action, but (the) break for the exit looks to be starting already.”

She points to the “sudden and dramatic” outperformance of companies with strong balance sheets, adding, “somebody’s getting nervous.”

Due to the extreme divergence in the market, while the market as a whole is at record valuations, the least expensive are actually undervalued on a relative basis, surprising given the long period of market strength, with the S&P up five-fold in ten years.

According to Jeremy Grantham, the 20% most expensive stocks are in their 10% highest range relative to the market, while the 20% lowest valuation stocks are in their 7% lowest range. In many cases, of course, these stocks are still reasonably valued but very undervalued relative to the market.

We have suggested before that when these leaders stumble, investors will rotate into the stocks that have been left behind, value stocks and high dividend payers, and commodity stocks (including gold stocks). And globally, they will move from the U.S. to global markets, particularly to the laggards such as Japan and smaller markets, where valuations are generally reasonable.

Our list of “Current Positions” includes exposure to these groups, not only commodities and gold, of course, but also to the other areas: global blue chip Nestlé SA (NESN:VX; NSRGY:OTC), high-yielders Ares Capital Corp. (ARCC:NASDAQ), Gladstone Capital Corp.(GLAD:NASDAQ) and Hutchison Port Holdings Trust (HPHT:Singapore) (with yields ranging from 7% to 15%); and global value stock Kingsmen Creatives Ltd. (KMEN:SI).

Metalla Sees Royalty Revenue Jump, With More Ahead

Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American) reported its year-end financials, with attributable gold received up nearly 50% in 2022 and exceeding its guidance. Nonetheless, the company recorded a loss of $5.8 million for the year, down from over $10 million the previous year. The decline in the loss was largely due to a one-time gain from the sale of some mineral claims. As of the end of the year, Metalla had cash of just over $14 million.

It was a transformative year for Metalla, most notably the merger with Nova Royalty, and a new strategic plan, including the cancellation of its “At-the-Market” equity issuance plan, a doubling of the Beedie convertible loan facility to CA$50 million, plans to reduce debt; and plans to pay dividends.

New Royalties To Come on This Year

Three mines on which Metalla holds royalties are scheduled to begin production this year: Tocantinzinho in Brazil and Cȏté and Amalgamated Kirkland, both in Ontario, Canada. Each royalty will see relatively little revenue this year as mines ramp up or move towards royalty ground, but it will increase in the coming years.

This is particularly true of Cȏté, where Metalla’s royalty covers only a small part of that deposit, but all of the adjacent Gosselin deposit, which currently has a resource of 7.4 million ounces (indicated and inferred) and is currently undergoing an aggressive drill program. Operator IAMGOLD Corp. (IMG:TSX; IAG:NYSE) has not yet announced plans for when Gosselin will be mined.

The company also announced that Drew Clark, vice president of corporate development, is leaving the company. This follows the retirement from the board of E.B. Tucker in December. Both gentlemen had been instrumental in the company’s growth for many years.

Hold, but look to buy.

TOP BUYS this week: due to the strong moves in many stocks over the past month, we are buying little. Buys include Lara Exploration Ltd. (LRA:TSX.V), Hutchison Port Holdings Trust (HPHT:Singapore), and Orogen Royalties Inc. (OGN:TSX.V).

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Iamgold Corp., Metalla Royalty & Streaming, Lara Exploration Ltd., and Orogen Royalties Inc..

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

( Companies Mentioned: MTA:TSX.V; MTA:NYSE American, )

Source: https://www.streetwisereports.com/article/2024/04/03/are-stocks-near-their-top.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).