Deja Vu All Over Again: Biden Administration Charts Another Massive Budget Deficit in March

It was deja vu all over again.

The Biden administration ran yet another massive budget deficit in March.

Tax receipts were up last month compared to February, but so was spending. That led to a $236.46 billion budget shortfall, according to the latest Monthly Treasury Statement.

With another huge monthly deficit on the books, the budget shortfall for fiscal 2024 eclipsed $1 trillion ($1.06 trillion) just halfway through the fiscal year.

Federal tax receipts were healthy in March at $332.09 billion. That was a 6 percent increase over March 2023.

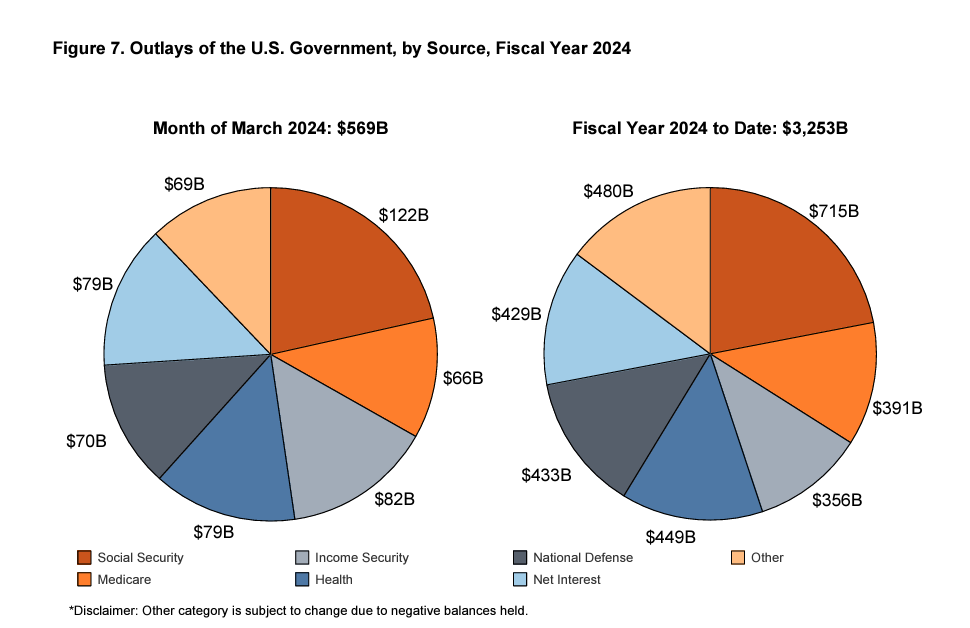

But President Biden and his minions blew through $568.55 billion last month. That was the highest spending total so far this year and inflated total spending for fiscal 2024 to $3.25 trillion.

Spending is up 3.3 percent compared to the half of fiscal 2023. This despite the [pretend] spending cuts and promises from the Biden administration that it would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act.)

This reveals the ugly truth in Washington D.C. No matter what you hear about spending cuts, the federal government always finds new reasons to spend more and more money.

I should note that this problem isn’t specific to Biden or Democrats in general. The Trump administration was running $1 trillion deficits before the pandemic. In other words, Trump was generating Obamaesque deficits despite having what he claimed was the strongest economy in history.

Borrowing and spending is a bipartisan sport.

These massive monthly budget shortfalls are pushing the national debt higher at a dizzying pace. On December 29, the national debt eclipsed $34 trillion for the first time. When Congress effectively eliminated the debt ceiling on June 5, the national debt stood at a “mere” $31.46 trillion. As of April 16, the national debt stood at nearly $34.6 trillion.

According to the CBO, debt held by the public is projected to balloon from $26.2 trillion to $48.3 trillion by the end of 2034. That would represent 116 percent of GDP and would be the highest level on record.

The Interest Problem

Higher interest rates are creating an even bigger problem for Uncle Sam. With price inflation still running hot, it appears likely the Federal Reserve will put off interest rate cuts until later this year. But the federal government desperately needs interest rate cuts.

The ugly truth is the federal government is going to have a hard time maintaining the pace of borrowing with rates this high. (And from a historical perspective, they aren’t even all that high.)

The U.S. government spent $88.65 billion on interest expenses alone in March. This was more than the amount spent on national defense ($70 billion) and more than Medicare ($66 billion). The only spending category higher than interest expense was Social Security.

The government has shelled out $522.02 billion on interest payments so far in fiscal 2024. That’s a 35.9 percent increase over the same period in fiscal 2023. Again, the only category with higher spending was Social Security.

Net interest expense, excluding intragovernmental transfers to trust funds, was $429 billion through the six months of the fiscal year, still nearly as much as the government spent on national defense ($433 billion).

To put this into a different perspective, the federal government is spending over 1/3 of its tax receipts on interest expense alone.

And interest expenses will only continue to climb.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates.

The weighted average interest rate on the government’s outstanding Treasury securities rose to 3.28 percent as of the end of March. That compares with a weighted average rate of 2.58 percent in February 2023.

The only way out of this fiscal death spiral is significant spending cuts and/or major tax hikes. If you think that will happen, I have some beachfront property in New Mexico to sell you.

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).