Zimbabwe Gets Gold-Backed Currency But It Won't Solve the Fundamental Problem

By Mike Maharrey, Money Metals Exchange

On Friday, Zimbabwe officials introduced a gold-backed currency in an effort to stabilize the economy. But the root of the country’s problem remains – the government.

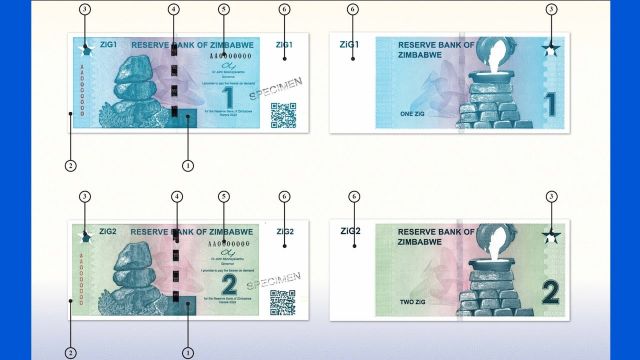

The ZiG (Zimbabwe gold) will replace the Zimbabwean dollar (RTGS) over the next month. The currency will be a “structured currency” backed primarily by gold but also by other forex reserves including dollars. Central bank governor John Mushayavanhu said the ZiG would be set at “a market-determined exchange rate.”

The ZiG currency will reportedly be introduced at a rate of 13.56 per dollar.

The currency will be available in denominations of 1, 2, 5, 10, 50, 100, and 200 ZiG. The country will also mint coins.

Currently, most transactions in Zimbabwe use U.S. dollars. The greenback will remain legal tender in the country. Due to a major coin shortage, Zimbabweans have resorted to using candy and pins as change.

The rollout of the ZiG will happen quickly.

According to a statement released Saturday, “The banking sector and Payment Systems Providers (PSP) have made satisfactory progress in converting the ZW$ balances into Zimbabwe Gold (ZiG).”

“The conversion process will continue for other economic sectors until Friday, 12 April 2024. Thereafter, the Reserve Bank expects that all the online payment platforms will be operating smoothly for all transactions in the economy.”

Zimbabweans will have 21 days to exchange RTGS for ZiG.

Zimbabwe reportedly holds about 1.1 tons of gold in the country, with another 1.5 tons abroad. The central bank also has $100 million in cash along with diamonds and other precious minerals. Mushayavanhu said the reserves total $285 million, “more than three times cover for the ZiG currency being issued”.

Zimbabwe’s History of Monetary Malfeasance

Zimbabwe is hoping the gold-backed currency will stabilize the country’s financial system. It is currently straining under rampant inflation.

The RTGS has lost about 800 percent of its value against the dollar in 2023 alone.

Hyperinflation wiped out the value of the Zimbabwe dollar in the early 2000s. In 2009, the government abandoned its own currency and adopted foreign currencies – primarily the U.S. dollar (or, more accurately, the Federal Reserve Note).

The African nation reintroduced the Zimbabwe dollar also known as the bond note in 2016. It was to be backed by the U.S. dollar loan facility. Then-central bank governor John Mangudya swore the new Zimbabwe dollar would remain on par with the greenback. But the bond note crashed when the government once again began printing excess money. By mid-July 2019, price inflation had increased to 175 percent.

As Business Insider Africa put it, “Zimbabwe continues to bear the scars of hyperinflation endured during the extended leadership of Robert Mugabe.”

New Currency Same Problem

Backing the Zimbabwe currency with gold is a great idea, but the ZiG will collapse just like previous Zimbabwean currencies if the government doesn’t change its ways.

Putting the Zimbabwe dollar on a gold standard would theoretically slam the door on the Zimbabwe government’s inflationary policies. Backing currency with a hard asset limits money creation. The government can’t create more dollars unless it gets more gold. A gold standard puts a natural brake on monetary expansion.

This would benefit Zimbabweans who would enjoy a stable currency and could maintain their purchasing power over time.

But this isn’t the same as owning physical gold and using it as money. A gold-backed paper currency is still fiat. The limitation on monetary expansion imposed by backing a currency with gold or silver is only as good as the discipline of those who control it.

In other words, the success of the ZiG with require fiscal discipline on the part of the government. It can’t rely on money printing to support its spending. Therein lies the rub. Government people tend to quickly abandon any pretense of linking the currency to gold when they discover it puts the kibosh on expanding their power.

Economist Godfrey Kanyenze made this very point in an interview with the BBC:

“We now end up in the same place where we started – where assurances are being given to the market that the government will live within its means. The political culture has not changed – the critical point is discipline on the part of the authorities.”

The bottom line is if the government continues to print money to pay its bills, nothing will fundamentally change in Zimbabwe – gold or no gold.

The problem is there is nothing to stop the government from changing the “market-determined exchange rate.”

This is exactly what President Franklin D. Roosevelt did in the U.S. In 1934, he increased the government’s fixed price for gold from $20.67 to $35 per ounce. This effectively increased the value of gold on the Federal Reserve’s balance sheet by 69 percent and allowed the government to print more money within the law that was intended to prevent excessive money creation.

Simply put, pegging the currency to gold won’t prevent debasement if the government constantly raises the peg.

As economist Milton Friedman once said, “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

In other words, if a country is experiencing price inflation and currency devaluation, it is ultimately the government’s fault. Price inflation is a symptom of monetary inflation – government creating more and more currency to prop up spending.

During Zimbabwe’s first round of hyperinflation, the government was printing money to finance Mugabe’s military involvement in the Congo. It was also allegedly creating currency to pay for government corruption and to fill the pockets of politicians and their buddies.

More recently, Al Jazeera reported, “The printing of new money by the central bank has also worsened the situation, reversing gains made in the past two years that saw inflation decrease from a peak of 800 percent in 2020 to 60 percent in January [2023].”

The rollout of the ZiG could indicate that Zimbabwe officials have finally learned their lesson and are making a sincere effort to reform the country’s financial system. But given history – not just in Zimbabwe but all over the world – I’m skeptical. Only time will tell if the government has truly changed its ways.

Originally Published on Money Metals Exchange.

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).