Irrational Exuberance

Source: Michael Ballanger 05/28/2024

Michael Ballanger of GGM Advisory Inc. opines about the current buzz around AI stocks in relation to the dot-com book, touching on Nvidia Corp. He also writes about the current state of gold.

If there is one pastime that I find accompanies the aging process with accelerating frequency, it is the propensity to tell stories — long, rambling sagas about the various pit stops on the way to a much-deserved and fully celebrated septuagenarian status. Such status, it should be known, arrives with a number of heretofore unheralded rights of passage, such as wearing sweaters sporting gaping holes, unmatching socks or shoes, or food-stained track pants.

However, the ability to tell stories seems to age like a fine Madeira, the passage of time creating a rolling ambiance and mystical bouquet. Because the knowledge of history is a particularly important tool in the navigation of the roiling oceans of finance, I find that the idiosyncrasies of today’s market and its leadership often trigger not-so-distant memories of prior regimes. Thanks largely to a still-acute recall facility otherwise known as “long memory,” I am able to recall in near-perfect vividness market events that carry added significance and, in many cases, an uncanny resemblance to current events.

That is not to be confused with “short memory,” which involves recalling items of importance such as car keys, wallets, and wives’ birthdays. As one can imagine, having a functioning “short memory” is far more crucial to avoiding pratfalls such as accidents, missed appointments, and revenge-filled rolling pins than “long memory,” where recalling one’s third-grade music teacher carries a different sense of urgency.

The reason I felt a need to share this magical experience with you all lies in an event this week that eerily resembled a couple of events from the last real market bubble that I can remember. You see, the last time I attempted to circumnavigate a market bubble was in 1990, a period in which the term “irrational exuberance” was popularized by then-Fed-Chairman Alan Greenspan in an effort to describe the outsized bullish sentiment of the dot-com era. I recall commentators like Larry Kudlow praising the Wall Street version of “free market capitalism” every time a new issue of internet content went public.

Companies like “pets.com,” purporting to have a virtual application for pet owners that could be accessed via this new technology called “the internet,” went public in February 2000 at $11/share, raising $82.5 million. Within a year, operations were terminated, with the stock at $0.11 per share and the money gone.

In the past year, the near-vertical ascent of “artificial intelligence” leader Nvidia (NVDA:NASDAQ) has created a pile-on furor scarily similar to the dot-com effect of the late 1990s. Founded in 1993, the company has surpassed Microsoft and Amazon in market cap and replaced Apple as the darling of the current bull market in “story stocks.”

The best example of just how pervasive this has been NVidia mania was the recent stick-save engineered by Elon Musk of his failing EV manufacturer Tesla Inc. (TSLA:NASDAQ) after the company reported plans to slash their global workforce by 10%, after which the U.S. DoJ announced an investigation into allegations of false advertising of their “driver-less auto” technology. Musk told the world not to worry because TSLA was metamorphosing into an “AI” developer rather than an “EV” producer, after which the stock rocketed from $140 to $200 in less than a NY moment.

NVDA reported earnings last Wednesday evening, and they were unquestionably “blow-out,” but to put the icing on the promotional cake, they announced a 10-1 stock split, rendering it infinitely buyable for the smaller retail investor. it reminded me of the last major development for Cisco Systems in the late 1990s when they announced a major stock split after being the technology (and market) leader for an entire decade. That event for CSCO marked the absolute top, after which it experienced a 90% crash as the entire dot-com sector imploded.

Here in 2024, the morning after the blockbuster earnings news, it was as if NVDA sucked all of the bullish air out of the room as the Dow proceeded to lose over 600 points while NVDA hit all-time highs approaching $1,050 per share.

I remember a conversation I had with a technology junkie in late 1998 who was telling me with breathless excitement how he had heard a rumor that internet poster child America Online was going to be taken over by a large U.S. blue-chip and how it was “guaranteed” to take the NASDAQ to 10,000 on the news. I wagered $500 with him that such an event would result in being “THE TOP” upon which the screams could be heard in Bangladesh. Several sessions later, AOL announced that they would be merging with venerable Hollywood media giant Time-Warner, which, to this very day, was the worst merger in U.S. financial history and one that became the symbolic end to the dotcom bubble.

Just as they said back in 2001 that the internet would change the way the world did business as a rationalization for maintaining one’s bullish stance on dotcom stocks, the “AI” bulls today are making the same claims. Insofar as markets never repeat but often rhyme, my septuagenarian “long memory” has a warning bell clanging loudly in the background because the number of “AI” stories being spread around these days is like nitrogen in the Spring in the Kansas cornfields — plentiful.

My septuagenarian olfactory glands are acutely sensitized to the presence of a bubble, but unlike the disinflationary 1990s, this one is a bubble of inflationary proportions. It is what happens when the world loses all respect (and need for) savings. By savings, I refer, of course, to a loss of respect for the sanctity of a currency’s purchasing power because when fear of losing supplants anticipation of winning, that describes an environment where money is scarce, and savings are cherished.

Since the GFC in 2008, the Fed and the Treasury have encouraged the collective disrespect for risk by way of excessive liquidity injections that have chastened investor reverence for saving money. Sadly, when the legions of citizens of any country are exposed to serial debasement the scope and size of what we have witnessed since the 1980s, they become trained in the art of ridding themselves of cash as fast as humanly possible which is exactly what citizens experienced in Weimar Germany 1921-1923, Zimbabwe in the 1980s and Venezuela since 1998.

As I have written about for what seems like an eternity, what we are experiencing today with booming markets and rising asset prices is not productivity-driven prosperity; it is inflationary growth driven by credit creation.

It is a time for caution. It is a time to own gold.

Gold

Before I proceed, let it be crystal clear: with the breakout to new highs in March, gold entered into the next phase of a massive bull run that actually began in 2001 and, to a lesser degree, in December 2015 at $1,045. It took four long agonizing years of price suppression before it would be allowed to breach old highs from 2020 at $2,087. Driven not in any way by Western demand, buyers from China, the Middle East, and, to a lesser degree, Japan were responsible for the move to new high ground, and if and when the Western generalist portfolio managers elect to join the party, the upside excursion will accelerate with NVidian vigor.

However, over the near term, gold has this week entered into a corrective pause with technical signals registering a collective “sell”. It pains me to say that there is a good chance of a re-test of the breakout point at $2,150, but nothing surprises me when the Fed Chairman tells the world that stagflation is not a concern because, in his words, “I see no “stag” and I see no “flation,” then it reeks of anti-gold rhetoric that all too familiar to those of us that have waged war in the trading pits of the Crimex exchange for decades.

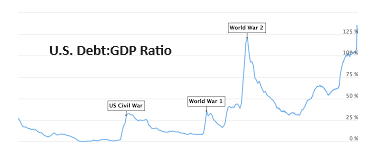

“Stagflation” is a breeding ground for the gold bugs because that is what we had during the 1970s but 2024 is not 1976 because the U.S. has been transformed from being the world’s largest creditor nation to the world’s largest debtor nation. There is technically no room for reflating away the debt when you start from a debt-GDP ratio approaching 130.

I see a move down to the $2,270-2,275 range as the bullish extremes in sentiment moderate and FOMO subsides. However, in a bull market, especially a GOLD bull market, one must learn to expect upside resiliency, the likes of which one rarely sees in other markets.

This old expression — “there ain’t no fever like gold fever” — really does sum up why seasoned traders are wary of shorting gold once it enters a bull phase. I am long gold by way of millions of shares of several gold and copper-gold developers, but I am flat in all trading positions.

I stepped aside my cherished positions in mighty Freeport-McMoRan Inc. (FCX:NYSE) this week (which troubled me greatly), but large declines in both copper and gold had very little impact on sentiment as the bulls showed little concern for what was a massive red candle on the weekly chart for copper.

I would have been far less concerned if the Twitterverse had all of the late arrivals issuing “sell signals” for gold and copper, but there was no such nonsense. Everybody was still chirping out the same “stagflation” narrative along with the notion that “eastern control” of gold makes it immune to the shenanigans of the bullion banks. Only old-timers like me possessing that critical “long memory” are able to retain a relentless distrust of the bullion banks regardless of “Eastern Power.”

Resource Stocks

A few months back, I was asked what it would take to trigger a bona fide rally in the juniors. I responded that a big rally in commodity prices would drive speculative capital into the juniors. To my astonishment, a 40% rally in copper prices and a 45% move in silver failed, for the most part, to do the deed. In fact, not only did the juniors fail to respond, but the senior gold stocks, as represented by the VanEck Gold Miners ETF (GDX:NYSEARCA), only moved to within 14% of the 2020 high when gold touched $2,087. So gold moves 17.5% higher than the 2020 peak, and GDX falls 14% short, implying a 31.5% move required to allow GDX to play “catch-up.”

Unbelievable.

My only explanation for this brutal underperformance lies in the tremendous performance of the NASDAQ and S&P. In the 1970s, the stock market was locked in a 16-year period of underperformance from 1966 to 1982. In fact, in late 1978, the famous headline of BusinessWeek Magazine entitled “The Death of Equities” capsulized the entire decade, where investment capital found its best returns in hard assets such as gold, oil, and lumber rather than financial assets. In 2024, investors are doing just fine investing in technology companies like NVidia that carry market caps of $2.6 trillion, which is approximately equal to the entire combined market caps of all companies listed on Canadian stock exchanges.

What the resource stocks desperately need is less competition from U.S. stocks. A prolonged bear market brought on by a debt-triggered economic downturn will force generalist portfolio managers to seek out better returns on resources. Until that happens, money will stay where it has been treated best, and thus far, the Mag Six, led by the “emotional exuberance” generated by the “IA” megalodon called NVidia, have treated the global investment community wonderfully — exactly how the powers-that-be would like to remain, at least through November.

Until then. . .

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: NVDA:NASDAQ, )

Source: https://www.streetwisereports.com/article/2024/05/28/irrational-exuberance.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.