Expert Says Exploration Co. Will Reverse to the Upside Soon

Source: Clive Maund 06/27/2024

Technical Analyst Clive Maund takes a look at Abitibi Metals Corp. (AMQ:CSE ; AMQFF:OTC; 4KG:FR4) to explain why he believes it is a Buy.

Abitibi Metals Corp. (AMQ:CSE ; AMQFF:OTC; 4KG:FR4) is looking very attractive here for several important reasons. The first is that last Fall, it moved to acquire an 80% interest in the B26 Polymetallic deposit in Quebec that holds 400 million pounds of copper, and that’s a 2018 estimate plus significant quantities of other metals. The next related reason is that, with a massive copper supply shortfall bearing down on the market that cannot easily be fixed, copper prices are set to accelerate higher in a powerful bull market, and lastly, the reaction in the stock price of recent months has cut the share price in half from its late February peak.

Before turning our attention to the stock charts, we will overview the fundamentals of the company in a succinct manner with reference to its latest investor deck.

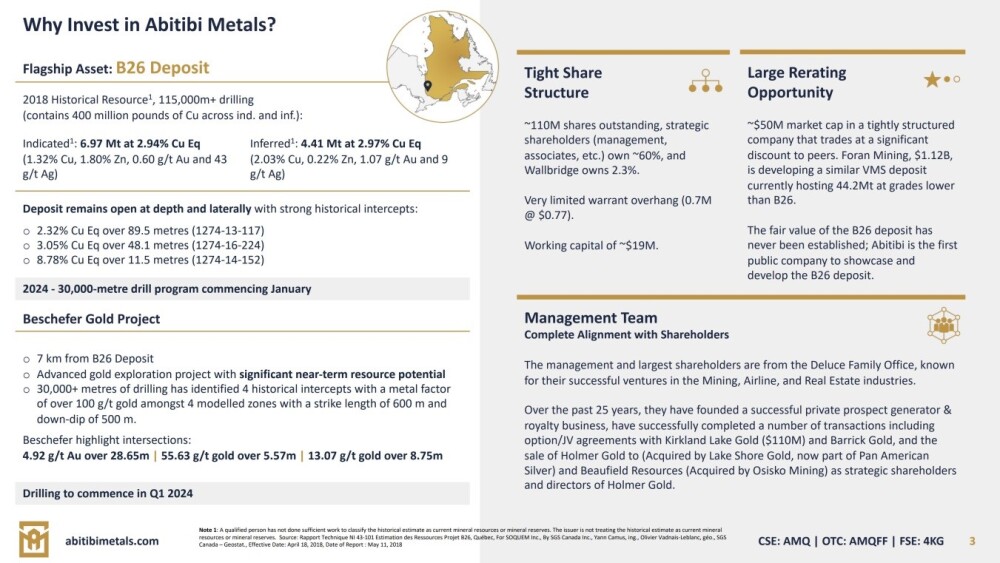

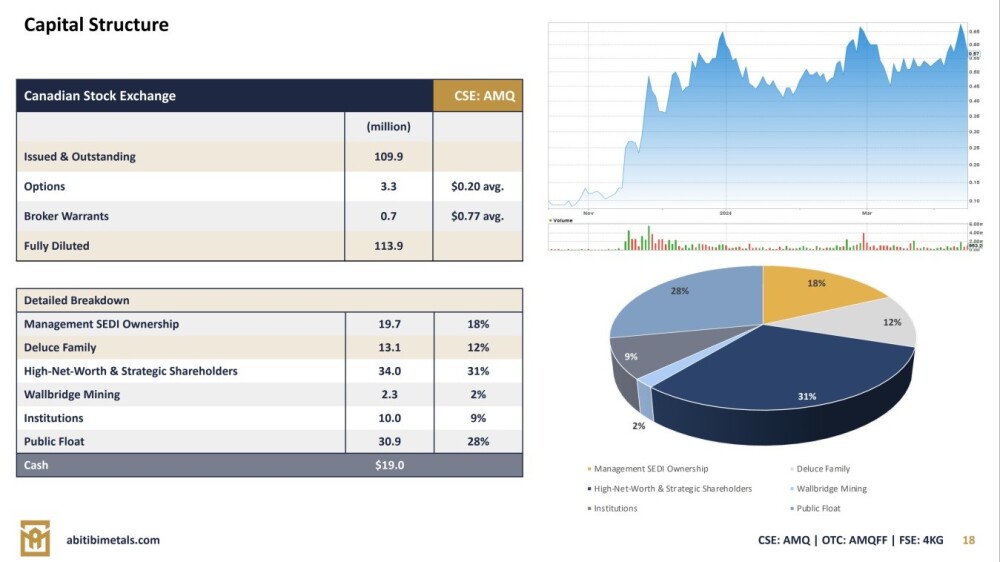

Our first slide gives some important general information about the company. Note in particular that less than only 31% of the company’s stock is in the float and that it trades at a significant discount to peers with a lot of scope for revaluation of the company’s projects.

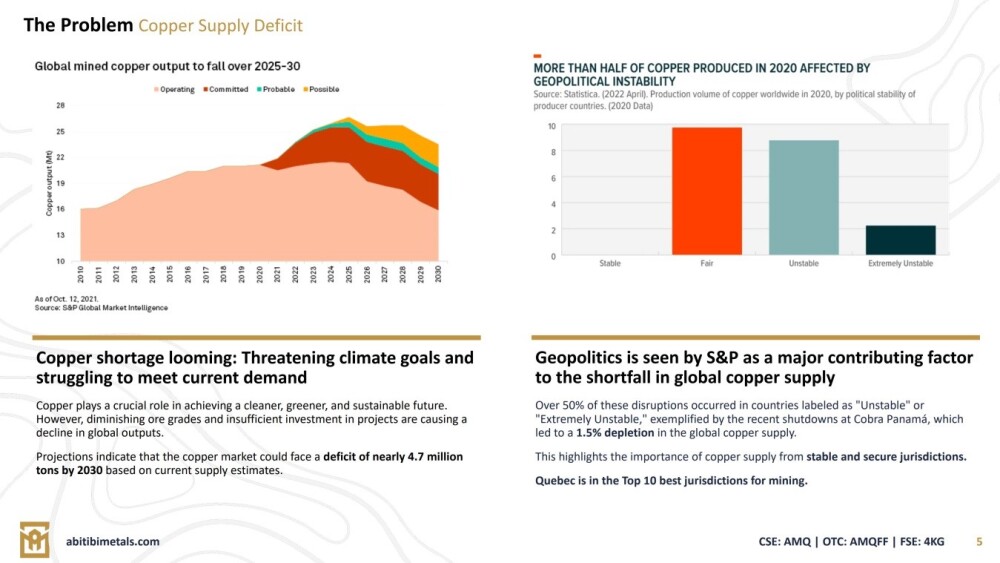

The following slide sets out the reasons for the looming severe copper supply deficit and the importance of producers having their operations in stable and secure jurisdictions, such as Quebec.

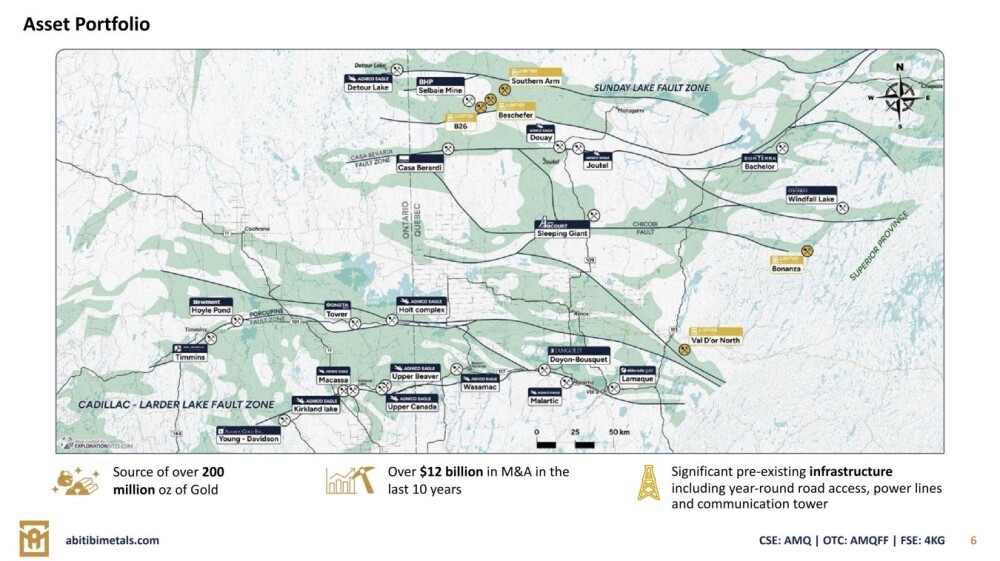

The following map shows the locations of the company’s properties not just in relation to each other but also with respect to other significant companies and their mines and prospects in the district.

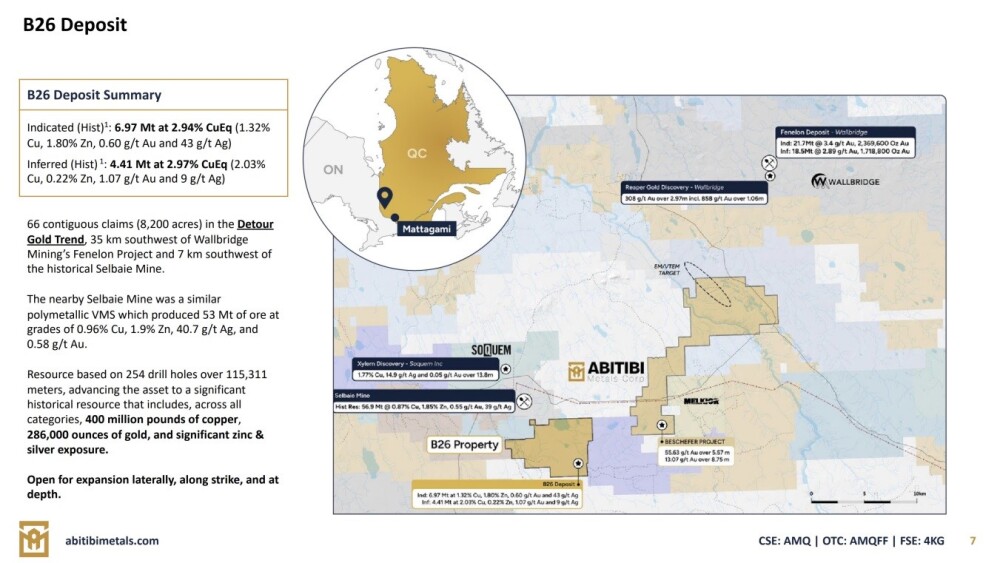

This slide gives the location and extent of the B26 Deposit and also sets out some important details of the deposit.

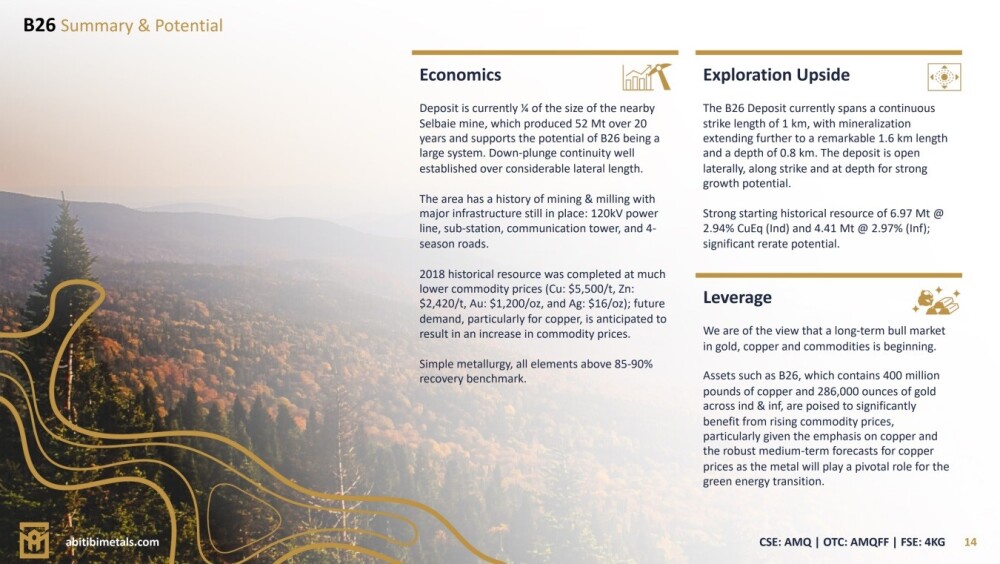

This one summarizes the economics and potential of the B26 Deposit and its capacity to leverage the impending major metals bull market.

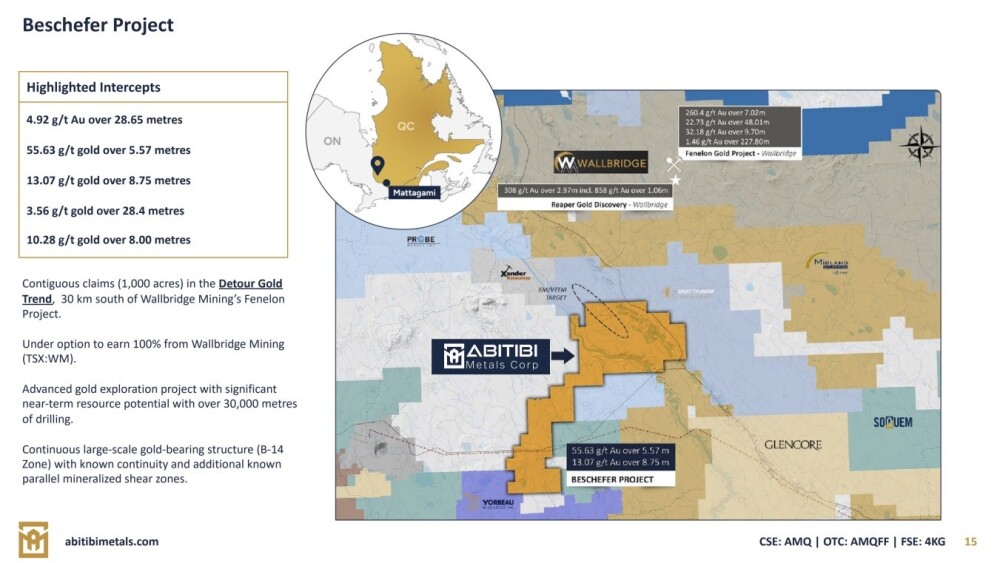

Details of the nearby Beschefer Project, which is currently in the exploration phase, are set out on this slide.

The last slide details the capital structure and the most important takeaway from this is that only 31% of the almost 110 million shares in issue are in the float.

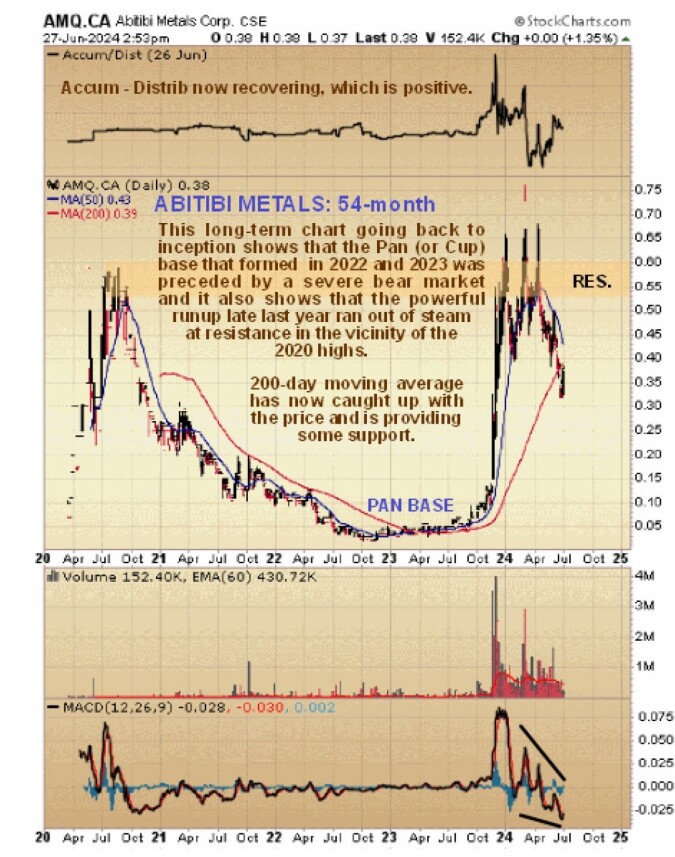

Turning our attention now to the charts for the company’s stock, we will start with the long-term chart to obtain a big picture perspective.

Starting with the 54-month (4-year, 6-month) chart, which shows the stock from its inception in 2020, we see that it has made several massive swings. After coming to market, we saw that it ran swiftly from about CA$0.07 to peak at about CA$0.58 just a few months later.

After topping out, it then went into a severe bear market that lasted well over two years, with it hitting bottom late in 2022. A low Pan (or Cup) base then formed, which completed late in 2023 with an explosive high-volume rally on the news that (after a name change) the company was moving to acquire an 80% interest in the big B26 deposit, as mentioned above. The last point to observe on this chart before moving on to shorter-term ones is that the powerful rally ran out of steam once the price had gotten up to the vicinity of the 2020 highs, where there is resistance.

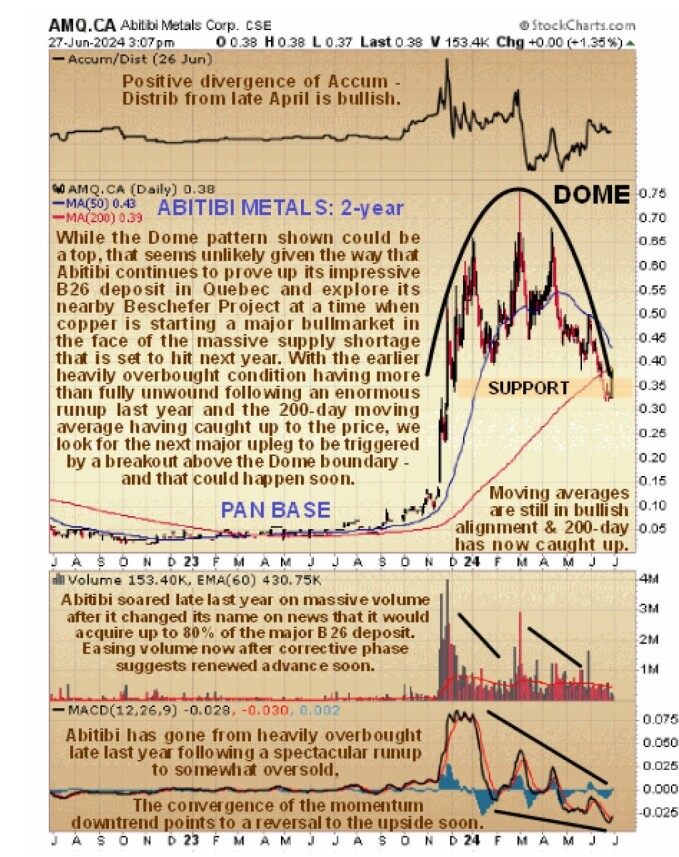

Zooming in now via the 2-year chart enables us to see the large Cup base and the powerful rally that it led to in somewhat more detail. The first important point to observe on this chart is that the spectacular rally late last year resulted in the stock becoming massively overbought, calling for a long period of consolidation / reaction, which is exactly what we have seen since.

The second important point to take note of is that the persistent, very heavy volume driving the big runup had — and has — major bullish implications, which is hardly surprising considering what the company achieved at that time. For this reason, the consolidation / reaction that we have seen since the February peak is expected to lead to a breakout into another major upleg.

We can also see on the chart that the price has rounded over beneath a large so-called “Distribution Dome” that has formed since late last year, which is, of course, due to investors who bought at much lower levels in the past taking profits. These Dome patterns can sometimes mark major tops with the price breaking down and heading back towards where it came from, but that is considered highly unlikely in this case, not just because of the huge volume driving the prior advance but fundamentally because the company has acquired a major stake in a huge copper resource (and other metals) at a time when copper is starting a major bull market in the face of the impending severe shortfall, and here it is worth mentioning that the significant correction in copper of the past month looks like it has about run its course.

So, with the earlier heavily overbought condition of many months ago having more than fully unwound, as shown by the MACD indicator and the rising 200-day moving average having now caught with the price so that it is providing support, the chances of the price breaking to the upside are rapidly improving.

Lastly, on the 6-month chart, we can see recent action in much more detail and, in particular, how, as the price has dropped back over the past several weeks to a support level below the rising 200-day moving average and support at the short-term trendline shown, the Accumulation line has been showing a marked positive divergence and advancing.

These are signs that it is likely to reverse to the upside soon, and as we can see on this chart, it won’t take much of a move for the price to break clear above the restraining Dome boundary, and once it does, it will trigger an abrupt change of sentiment that will cause sellers to back off which should lead to a strong rally.

With a reversal to the upside looking likely soon, Abitibi Metals is rated an Immediate Strong Buy for all time horizons.

Abitibi Metals’ website.

Abitibi Metals Corp. (AMQ:CSE ; AMQFF:OTC; 4KG:FR4) closed for trading at CA$0.37, US$0.2614 on June 26, 2024.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- For this article, Abitibi Metals Corp. has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Abitibi Metals Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

( Companies Mentioned: AMQ:CSE ; AMQFF:OTC; 4KG:FR4, )

Source: https://www.streetwisereports.com/article/2024/06/27/expert-says-exploration-co-will-reverse-to-the-upside-soon.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.