Caveat Emptor

Source: Michael Ballanger 07/07/2025

Michael Ballanger of GGM Advisory Inc. shares his thoughts on his newsletter writing ambitions, gold, silver, and copper.

I am often asked why I elected to embark upon a career as a newsletter writer rather than a fund manager or investment advisor. The answer lies in two entities. The first newsletter to which I ever subscribed was Richard Russell’s “Dow Theory Letters,” which I loved because of his stories involving his military career as a bombardier in WWII in Italy.

My father was in the RCAF and served as a navigator during the food airlift into post-V-Day Berlin, which was an experience he was at once both proud of which, to admit yet loathe of which to speak.

The second entity was the singular best newsletter writer EVER in the field of junior mining and exploration and that was my friend, Robert “Bob” Bishop who toiled for years as the editor and publisher of “The Gold Stock Mining Report” that covered junior exploration and development deals during an era where the preferred area of speculation was not Bitcoin or “artificial intelligence” or “Donald Trump’s next tweet” but rather the success or failure of the junior resource sector with particular focus on the Canadian markets which included the legendary (or infamous) Vancouver Stock Exchange.

Richard Russell was vastly different than Bob Bishop in term of “style” as he delved into personal life experiences far more than Bob did but Bob’s degree in journalism, which showed up in the manner in which he footnoted every piece of information regarding drill results or possible drill results, produced an investment commentary second to none.

Both of these investment letters produced outsized returns for subscribers over their terms, with Russell calling the bottom of the bear markets in both 1969 and 1974, but no one has had the track record for outsized gains like Bob Bishop in the 1990s.

He wrote the now-legendary “Diamonds in North America” in 1991, which featured the Dia Met Lac de Gras discovery, which launched an entire industry in Canada in which his subscribers made fortunes by the time BHP Minerals launched the takeover in 2001 for USD $687 million. During that phase, Bob handed his subscribers early entries into Diamondfields Resources Ltd., the Friedland deal that launched him into history with his $4.63 billion sale of Voisey’s Bay to Inco in 1997. That newsletter also had Arequipa Resources on its “favored status” list, which resulted in a takeover by Barrick Gold in 1996 for in excess of US$800 million.

As a result of my admiration for these two newsletter giants, I decided to launch the GGM Advisory in January 2000 with a view to combining Russell’s storytelling genius with Bishop’s stock-picking genius. Now, the jury is out on whether or not I have been able to replicate Russell’s forte, but there is no one even close to replicating Bishop’s track record in the 1990s — and that includes this author.

Bob handed off his service to the very talented Coffin brothers in 2009, with Eric Coffin now running the show after his brother David passed shortly thereafter. When I look back over the many years I have spent pounding the keyboard in an effort to keep subscribers not only interested but also engaged, I have to shake my head when trying to find something of interest about which to speak.

The junior resource sector has been left in the proverbial dust by the technology sector in recent years, and while I am certain that the commodities arena will be filled to the brim in coming months, it has been a difficult grind when trying to market buggy whips in an era when automobiles have taken over. I have many stories left to tell about my time spent in the junior resource arena, just as I have any more stories about hockey arenas from Quebec City to Sioux City, Iowa.

I will endeavor to provide them with my usual flair for the magnificent, but what I am trying to convey is that I have created a very high bar for myself in the excellence of my two mentors, Richard Russell and Robert Bishop.

Gold

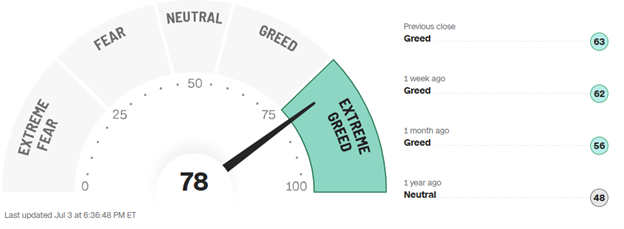

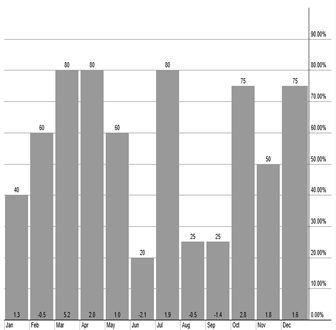

The gold market has been struggling under the weight of summer doldrums in what was typically the weakest month of the year for gold (June) and is now in one of the three strongest months — July.

However, the months of August and September are seasonally the worst two months for gold, falling just ahead of June.

While this summer may be different, I still look for a swoon between now and Labor Day that will take gold back below $3k that will take the HUI back below the 400 level.

GDX:US and GDXJ:US , which took out their respective August 2000 tops at $42.80 and $62.92 in June, could quite easily check back to $35 and $55 before resuming their uptrends.

GLD:US is going to need to build a base before launching a test of the April highs at $317.63. On the downside, support is at $305.95 (50-dma) and then not until $292.42 (200-dma).

Summer Hours

There is not much about which to write during the months of July-August in any year, but I will endeavor to deliver items of interest as best I can. Ergo, this is a truncated version because of the shortened U.S. trading week, but you all know where I stand. U.S. stocks are drastically overpriced, over-promoted, and over-valued.

Upside potential is severely limited; downside vulnerability is substantial. Gold is treading water; silver is trying to make up its mind; while copper is coiling against an upside explosion. Bonds are teetering on the edge of a death-defying precipice.

The Western banking system is broke, and government treasuries are barren. It is all about the D-E-B-T and anyone who fails that comprehensive leap is doomed to the scrap-heap of financial failure. I own only companies with under-recognized assets. You know their names.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Source: https://www.streetwisereports.com/article/2025/07/07/caveat-emptor-1.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.