Amazon Swings Wildly After Reporting Blowout AWS Results But Revenue Guidance Disappoints

Heading into Amazon’s Q1 earnings, we said earlier that the investment thesis is driven by i) ecommerce share, ii) margin expansion and iii) the potential for AWS growth recovery through the year. We also noted that the key bogeys for this extremely popular – among hedge funds – position were the following:

- Q1 Total Sales: high end of guide $138-$143.5 bn

- Q2 Total Sales: $150 bn high end

- Q1 AWS Growth: 15%-16%+

- Q1 EBIT: $13 bn

- Q2 EBIT: $14 bn high end

So with that in mind here is what Amazon – whose stock furst tumbled then spiked after hours, reported moments ago:

- EPS 98c vs $1 q/q, and beating estimates of 83c

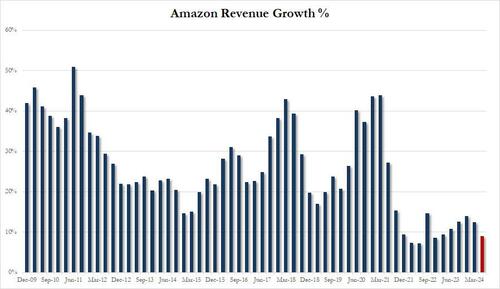

- Net sales $143.31 billion, +13% y/y, beating estimate of $142.59 billion

- Online stores net sales $54.7 billion, +7% y/y, in line with estimates of $54.77 billion

- Physical Stores net sales $5.20 billion, +6.3% y/y, beating estimate $5.08 billion

- Third-Party Seller Services net sales $34.60 billion, +16% y/y, missing estimate $34.63 billion

- AWS net sales $25.04 billion, +17% y/y, blowing away estimate $24.11 billion

- North America net sales $86.34 billion, +12% y/y, beating estimates $85.55 billion

- International net sales $31.94 billion, +9.7% y/y, missing estimates $32.47 billion

- Amazon Web Services net sales excluding F/X +17% vs. +16% y/y, beating estimate +14.5%

- Third-party seller services net sales excluding F/X +16% vs. +20% y/y, beating estimate +15.8%

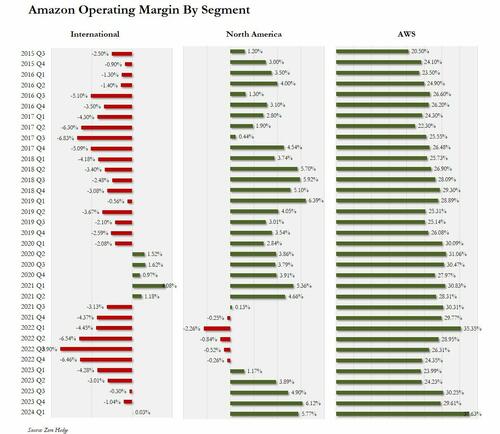

Turning to operating results we get an even stronger tally:

- Operating income $15.31 billion vs. $4.77 billion y/y, smashing estimates of $10.95 billion

- Operating margin 10.7% vs. 3.7% y/y, beating estimates of 7.63%

- North America operating margin +5.8% vs. +1.2% y/y, beating estimates of +4.92%

- International operating margin 2.8% vs. -4.3% y/y, beating estimates of -1.85%

Expenses were generally in line with estimates:

- Fulfillment expense $22.32 billion, +6.8% y/y, below estimate $22.4 billion

- Seller unit mix 61% vs. 59% y/y, beating estimates of 59.5%

Of the above, the most notable highlight was AWS which not only grew revenue by a whopping 17% (ex. FX) and 16% including FX, both of which handily beat estimates of 14.5%, and were the strongest growth in a a year, but whose Q1 operating income of $9.42BN on revenue of $25.04BN, meant that margin surged to 37.6%, which was the highest AWS margin in history!

Sales growth at the cloud unit slowed to a record low last year as businesses cut back on technology spending and sought to curb computing bills that ballooned during the pandemic. Investors have been banking on a rebound this year, particularly after strong results last week from Microsoft and Google, Amazon’s two main rivals in the business of renting computing power and data storage. And, in the case od AMZN, they were right to do so.

The results are the first since Amazon introduced video advertising to the Prime Video streaming service, creating a new revenue source. Advertising revenue rose 24% to $11.8 billion.

Looking ahead, the company’s guidance which was soft on the top line but disappointed on earnings:

- Revenues expected to be between $144.0 billion and $149.0 billion, or grow between 7% and 11% YoY, below the consensus estimate of $150 billion.

- Operating income is expected to be between $10.0 billion and $14.0 billion, vs $7.7 billion in Q2 2023 and in line with estimates of $12.56 billion.

If accurate, that would mean Q2 revenue will grow at the slowest pace sine Dec 2022.

So turning the abovementioned bogeys, this is how AMZN did:

- Q1 Total Sales: $143.3 billion, just below the upper end of the guide $138-$143.5 bn

- Q2 Total Sales: $147 billion range midline, below the $150bn high end estimate

- Q1 AWS Growth: 17%, well above the 15%-16% bogey

- Q1 EBIT: $15.31BN, blowing away the $13 bn bogey

- Q2 EBIT: range of $10-$14BN, matching the $14 bn high end

CEO Andy Jassy has been cutting costs in recent years as he refocused on profitability in Amazon’s central retail business, laying off thousands of people and touting a more efficient warehouse network. At the same time, he’s backed big investments in artificial intelligence services that Amazon expects to generate tens of billions in revenue in the coming years.

“The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate (now at a $100 billion annual revenue run rate),” Jassy said in the statement.

The results are also the first since Amazon introduced video advertising to the Prime Video streaming service, creating a new revenue source. Advertising revenue rose 24% to $11.8 billion.

The stock initially tumbled, only to rebound sharply and then fade, closing roughly unchanged with where it was for much of the day around $180.

Tyler Durden Tue, 04/30/2024 – 16:37

Source: https://freedombunker.com/2024/04/30/amazon-swings-wildly-after-reporting-blowout-aws-results-but-revenue-guidance-disappoints/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).