Large Structural Short Will Drive Yen Much Higher

Authored by Simon White, Bloomberg macro strategist,

Focus has been on the growing short position in the yen. But the total size is likely to be small in the scheme of things. The real story is the lack of domestic hedging leading to a large structural short in the yen which will drive the currency much higher when it is covered.

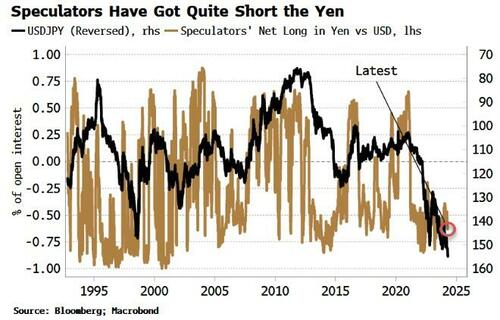

There has been some back and forward internally about the extent of the yen short position. FX positioning is hard to get good visibility on unless you are in the flow. The go-to for most people that aren’t is the CFTC data. This certainly shows that yen short-positioning versus the dollar has risen in recent months.

The chart measures the net short versus open interest. Although the short is high, we can see it has been higher, especially in the late 1990s when USD/JPY rose to ~150.

But COT data is based on flows of FX futures, which are low compared to spot and other flows. The net short for the speculator category – which aims to catch hot flows that are more likely to be price moving on a shorter-term basis, and will mainly be CTA flows – is only about $13.4 billion, not earth shattering.

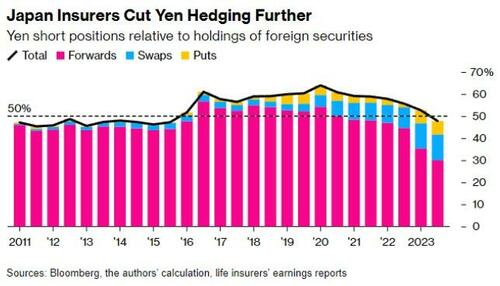

More important for the longer-term outlook is how the yen’s steadily weakening path is leading to domestic investors to allow their foreign asset positions to become underhedged. As a proxy, we can look at the behavior of life insurers, who are among the largest hedgers of their overseas positions. Their hedging ratios have slipped to under 50%.

Japan is the world’s largest net creditor, with over $3 trillion of assets held abroad. Domestic investors’ flows dominate flows of foreigners buying Japanese assets.

Thus, the large and building structural yen short of Japanese investors will be what ultimately sets the path for the currency.

When the wind changes, the yen is primed to change direction with vigor.

Tyler Durden Tue, 04/23/2024 – 09:15

Source: https://freedombunker.com/2024/04/23/large-structural-short-will-drive-yen-much-higher/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).