Sternlicht’s Starwood REIT Running Low On Cash As Redemptions Soar Amid CRE Storm

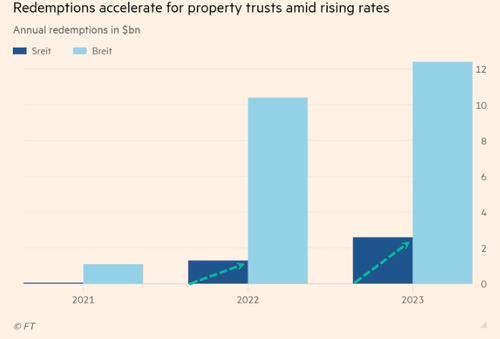

Starwood Real Estate Income Trust (SREIT), a $10 billion non-traded REIT ranked second-largest behind Blackstone’s struggling BREIT, faces a severe liquidity crunch as investor redemptions soar amid concerns ‘higher for longer’ interest rates will worsen the commercial real estate storm.

The Financial Times reported at the end of last week that SREIT is “running low on liquidity as investors demand their money back” and tapped $1.3 billion of its $1.55 billion credit facility since the start of 2023.

Redemptions have jumped among concerned investors. In the first quarter, SREIT investors requested $1.3 billion of their cash back. However, the fund only returned $500 million of the requests in the quarter because of a 5% redemption cap.

Now, Barry Sternlicht’s SREIT is in dire straits. The current pace of redemptions suggests the fund will run out of cash in the second half of the year unless it disposes of properties or expands its credit facility. The filing from last week shows the fund has $225 million left to draw down.

The outflows are similar to what happened to Blackstone’s BREIT over the last few years. At least now, BREIT has been able to meet 100% of its redemption requests for the first time since 2022, according to a notice issued by Blackstone to investors on March 1.

“Liquidity isn’t something that people think about on the way up, but it can become a concern suddenly,” Phil Bak, chief executive of Armada Investors, which invests in listed REITs.

Bak said, “When it comes to private REITs, liquidity concerns have been dismissed, and they will become paramount again.”

FT spoke with an individual close to SREIT who said ‘greater liquidity’ is expected soon after asset sales. They said, “Starwood could sell other assets to raise cash.”

The REIT industry has been under severe pressure since Fed chair Powell began raising interest rates in early 2022. Tighter monetary conditions and higher interest rates for the medium term as inflation remains elevated have pressured CRE values of office towers. This has led to a 16% decline in SREIT’s declared net asset value from its peak in September 2022 at nearly $10 billion.

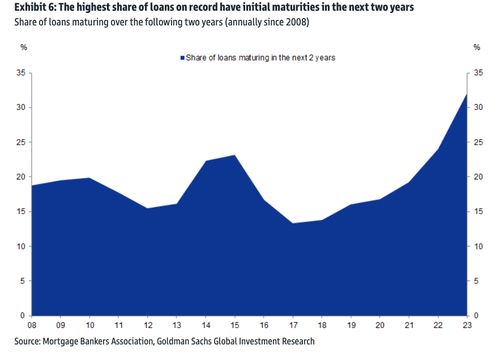

For the CRE industry, Goldman’s Lotfi Karoui outlined days ago that the highest share of CRE loans on record will hit maturity walls in the next two years.

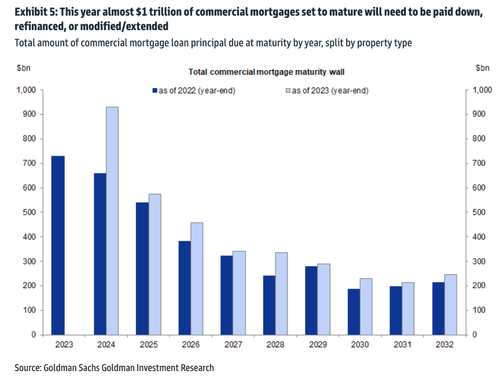

Almost a trillion of CRE mortgages must be paid down, refinanced, or extended by the end of 2024.

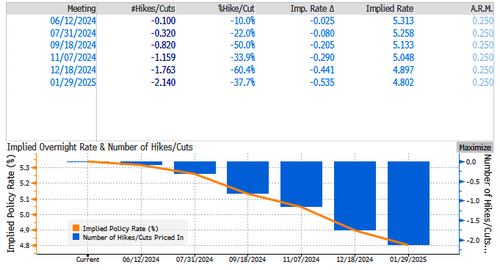

The problem is that the Fed’s rate cut cycle has been pushed out to at least the fall. Interest-rate swaps on Friday showed traders pricing about two quarter-point rate cuts by year-end, with about an 80% chance the first one will come in September.

Between SREIT and BREIT, the smart money has been panic-running for the exit door. Redemption caps have saved these non-traded REITs from totally imploding.

Tyler Durden Sat, 05/18/2024 – 18:05

Source: https://freedombunker.com/2024/05/18/sternlichts-starwood-reit-running-low-on-cash-as-redemptions-soar-amid-cre-storm/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.